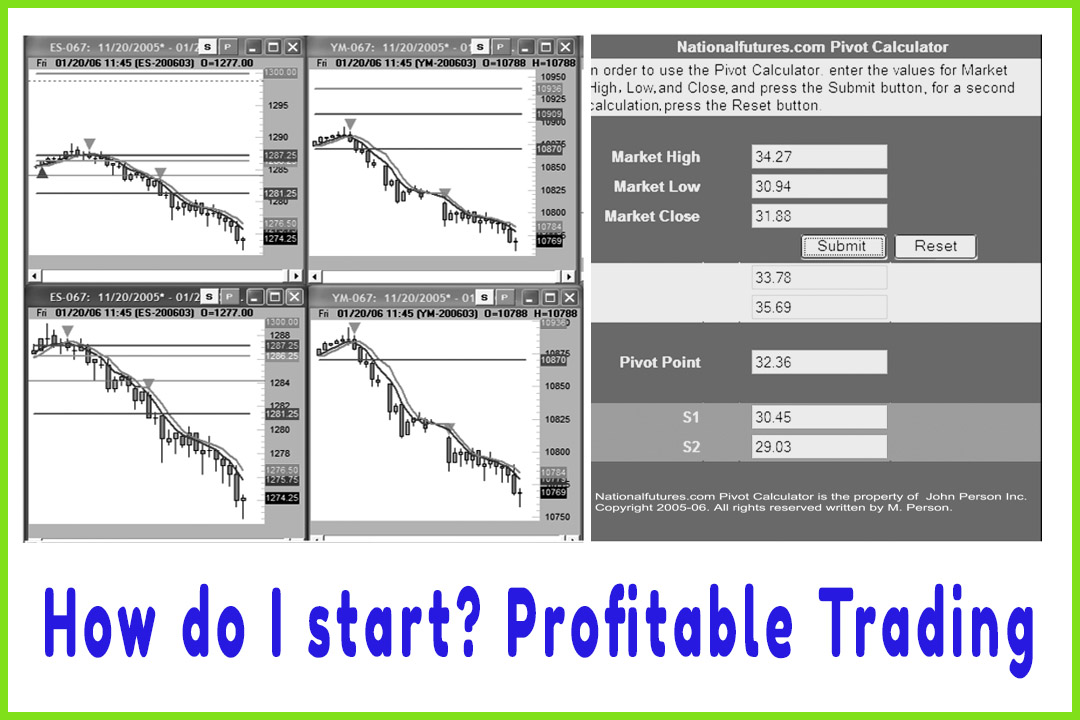

Pivot Point Moving Average System - Introduction

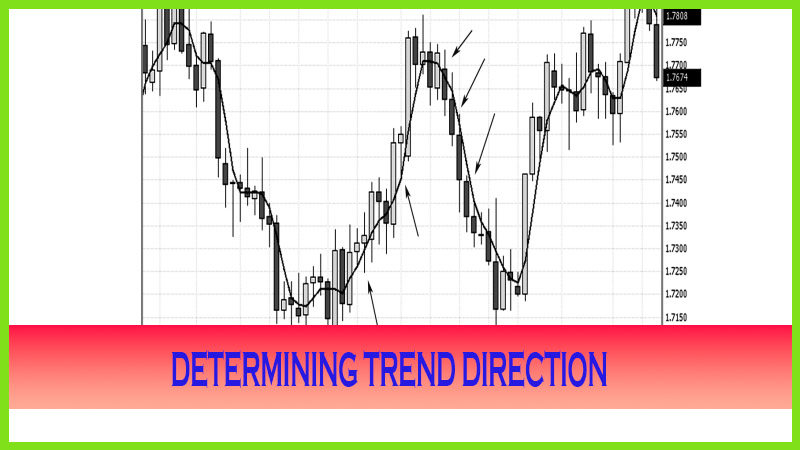

pivot point moving average, moving average, Trend direction

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 6. Pivot Point Moving Average System ]

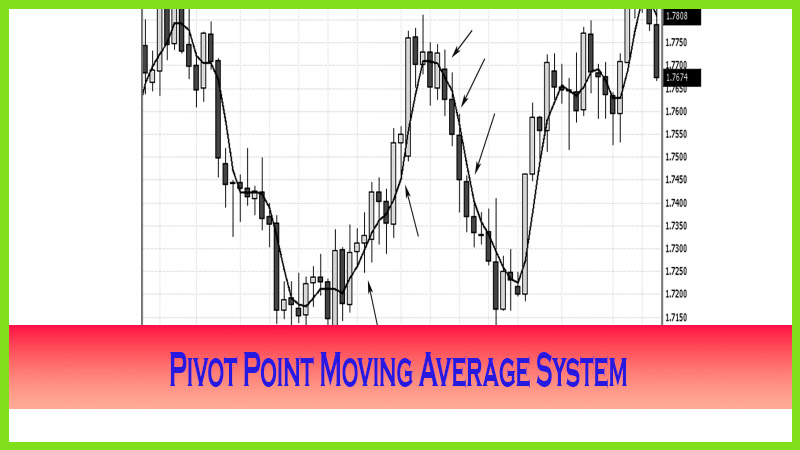

The moving average is one of the most widely utilized indicators in technical analysis because the moving average is easily identifiable and easy to back-test.

Pivot Point Moving Average System

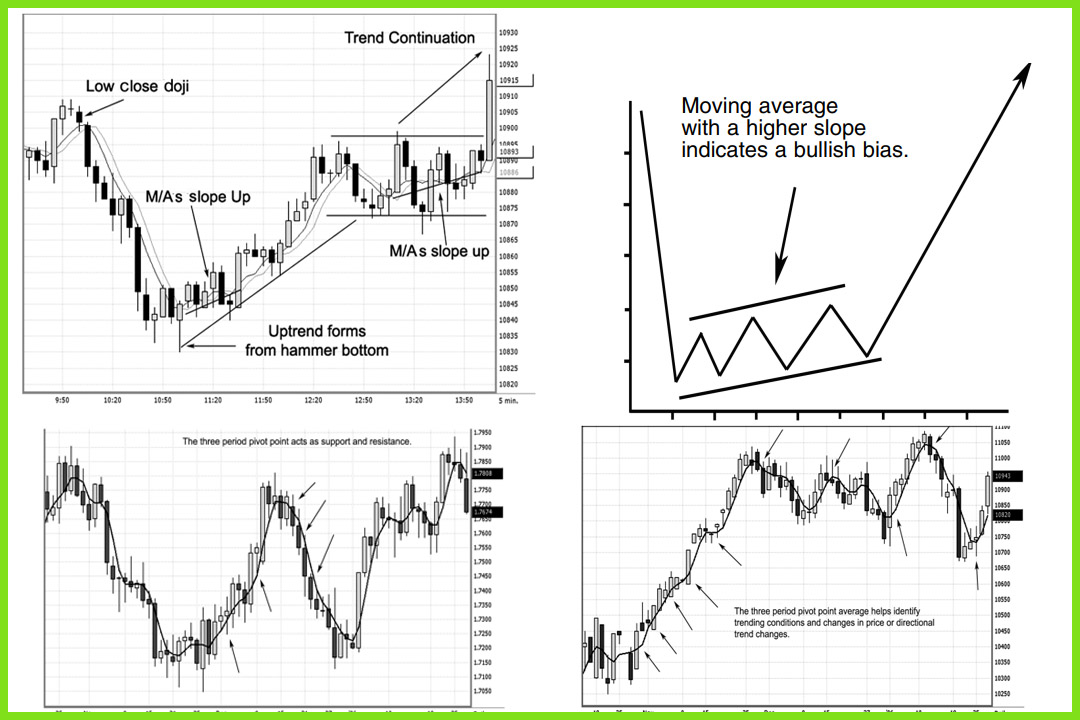

The

moving average is one of the most widely utilized indicators in technical

analysis because the moving average is easily identifiable and easy to

back-test. Many automated trading systems use moving averages or some

derivative of a moving average to generate buy and sell signals. Moving averages

are considered classic indicators and are very popular with traders today. Most

technicians view the moving average as a way to signal a change in the

direction of the trend, as well as a way to smooth out the volatility of the

market. In Chapter 2, we covered a key component in understanding the concept

of trend, which in essence gives you the ability to understand the concept of

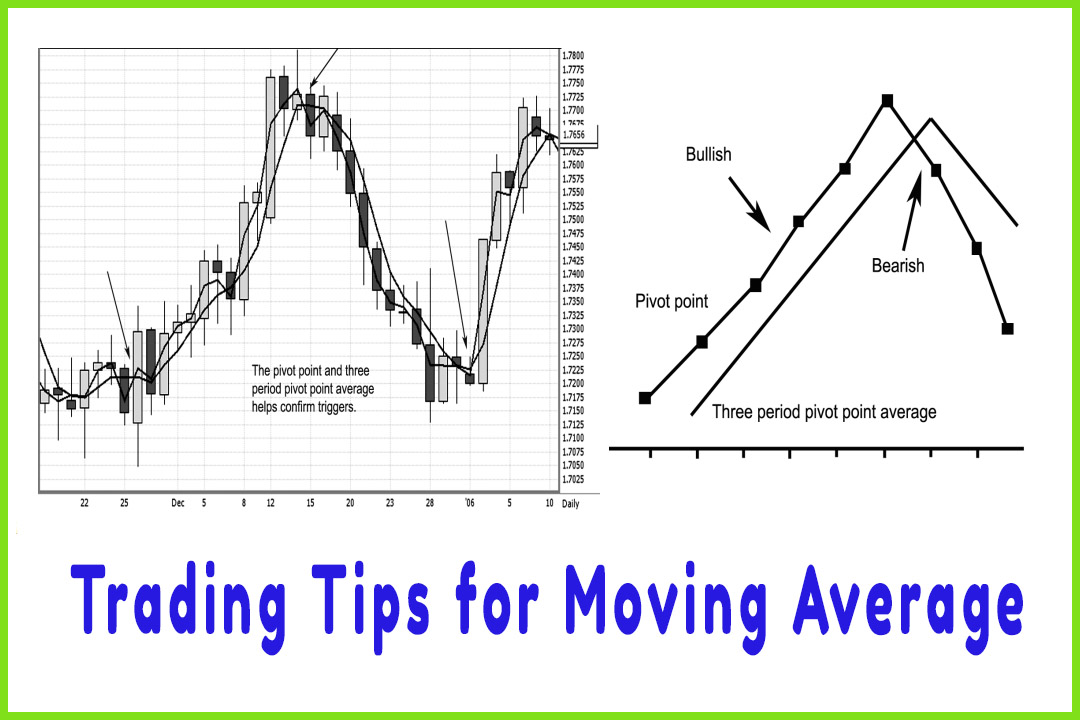

momentum. Remember this: “In a bullish environment, buying begets buying.” Higher

closing highs bring higher highs as momentum and assigned values (the closes)

are justified. The law of physics that states that “a body in motion tends to stay in motion

until a force or obstacle stops or changes that motion” applies in this scenario because higher assigned

values can induce more buying from existing buyers and can attract new buyers.

Once again, the opposite is true of a bearish market: Lower closing lows bring

lower lows as momentum and assigned values are justified. The lower assigned

values induce more selling by existing sellers and can attract new sellers into

the market.

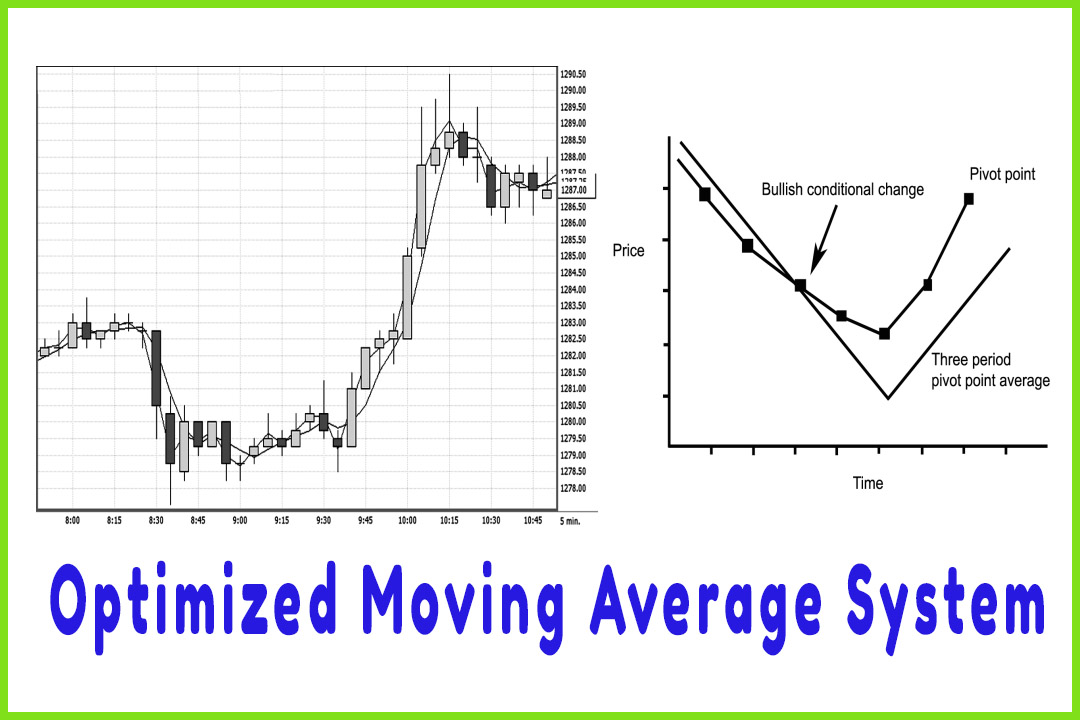

When

prices have appreciated and all buyers have exhausted their resources to add

more long positions in a bull market, prices have reached what is known as

absolute value. Prices will more than likely consolidate for a period of time

before they change direction and reverse lower in value. The opposite is true

in a down-trending market. An important component to remember is that price

action typically moves from trend phase to congestion and can either continue

with the original trend or reverse the trend. Momentum and the psychology of

the perception of the value of a given market in a given time period are what

will move prices from a consolidation, or congestion phase, back to a trending

condition.

The Candlestick and Pivot Point Trading Triggers : Chapter 6. Pivot Point Moving Average System : Tag: Candlestick Pattern Trading, Forex, Pivot Point : pivot point moving average, moving average, Trend direction - Pivot Point Moving Average System - Introduction