Simple Moving Average Trading Strategy - Pivot Method

technical analysis, moving average, Market Direction, Pivot Point Calculation, Support and resistance Level, reversal candle pattern

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 6. Pivot Point Moving Average System ]

The simple moving average (the arithmetic mean) is the most popular moving average used in technical analysis. The simple moving average is the sum of the closing prices over a period of sessions divided by the number of sessions.

THE SIMPLE MOVING AVERAGE

The

simple moving average (the arithmetic mean) is the most popular moving average

used in technical analysis. The simple moving average is the sum of the closing

prices over a period of sessions divided by the number of sessions. For

example, a 10-day moving average would be the sum of the past 10 days’ closing

prices divided by 10. Each new day would drop the first day’s closing price and

add the new day’s closing price. As new data is added to the calculation, old

data is removed. By averaging the price data, a smoother line is produced, and

the trend is much easier to recognize. The disadvantage of the simple moving

average is that it only takes into account the time period of the sessions

covered in the calculation and that it gives equal weight to each day’s price.

In

Chapters 4 and 5, we covered the pivot point formulas and the significance of

pivot points as support and resistance. As you will recall, the pivot point

calculation provides the mean (average) for the session’s trading range, or

high, low, and close: (H + L + C)/3.

This

moving average section discusses how the moving average helps clarify the market’s

price flow by extending price analysis over a certain period of time. In this

manner, moving averages can accentuate when a market enters an extreme

condition by how far it departs from the mean. Price action either will move

toward the moving average or will return to the moving average to retest that

level.

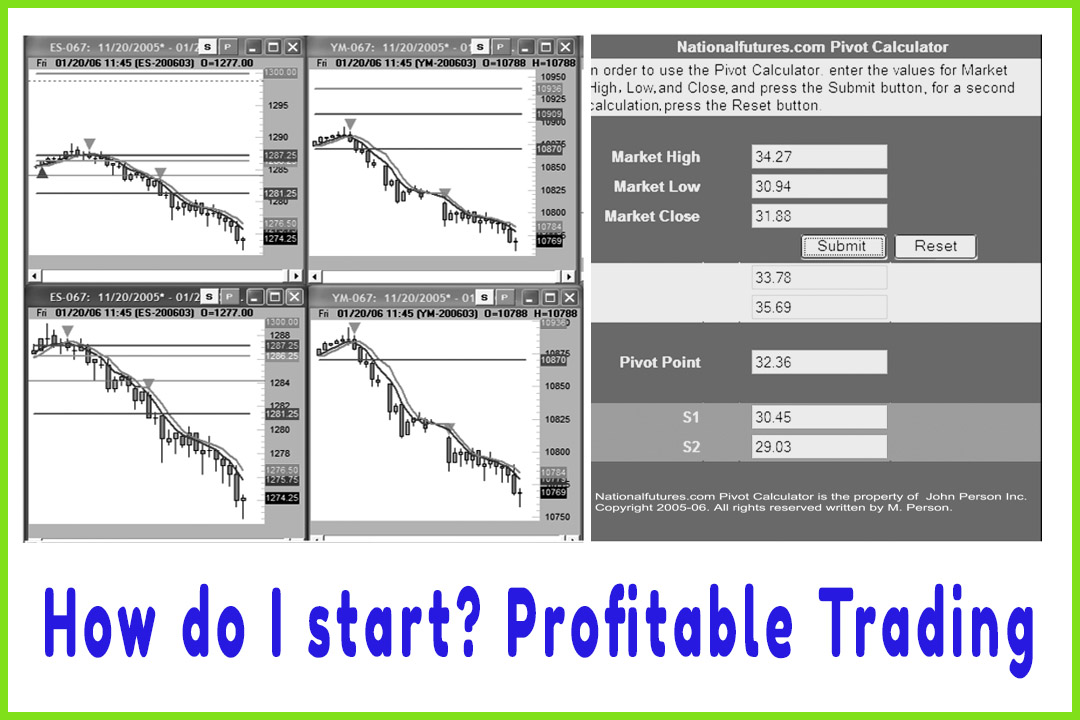

The “Market

Direction” number that was shown

in the Excel sheet in Figure 5.8 is a combination of the use of price session

information (pivot point number) over a period of time (moving average). The

market direction number utilizes cumulative data from the high, the low, and

the close for a session. This information provides a clear picture of the “average true

price” for that time period. The

market direction number is then calculated by taking the average pivot number

from the past three periods. Any time frame can be utilized to calculate the

number. However, the longer the time frame, the more significance the number

will hold. To calculate the market direction number, add three pivot points from

the same session, and divide the sum by three. The purpose of using the pivot

point in the moving average calculation is that the pivot point will show the

continuance of the trend.

Market Direction =Pivot + Pivot + Pivot/3

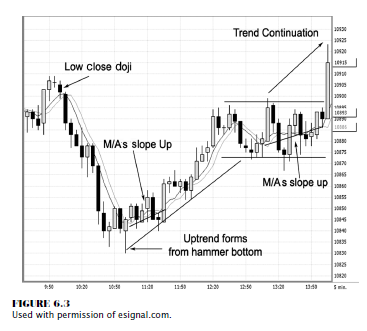

As stated

previously, the market direction number, which is a three period pivot point

moving average, can act as a support number in bullish conditions and has a

high degree of importance when one of the pivot point calculations for the

current session coincides with or is near that number. The market direction

number holds true as a resistance number in a bear market condition. If another

number coincides with the market direction number, such as the actual pivot

point or an R-1 (resistance level one) number, then it would serve as the

target high number for that specific time period. Another way of using the

three-period pivot point moving average is as a point of reference or fair

value. For example, when the market price departs, or deviates, too far from

the mean, then you can use the extreme resistance or support number, such as

R-2 or S-2 (support level two), or the farthest target number of that

direction, as a potential turning point. When various time frames are

incorporated into the analysis (daily, weekly, and monthly), there is more

certainty that the target price level can generate the anticipated reaction. If

the market gaps too far from the daily pivot point moving average, use the

monthly and/or weekly target support and resistance numbers to help identify a

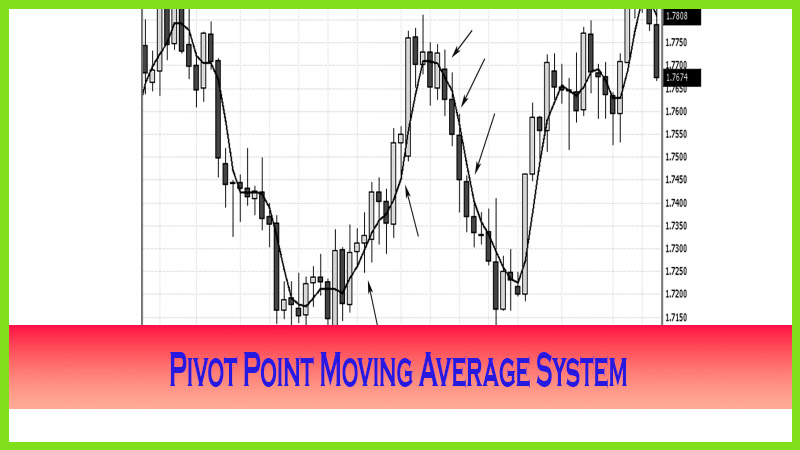

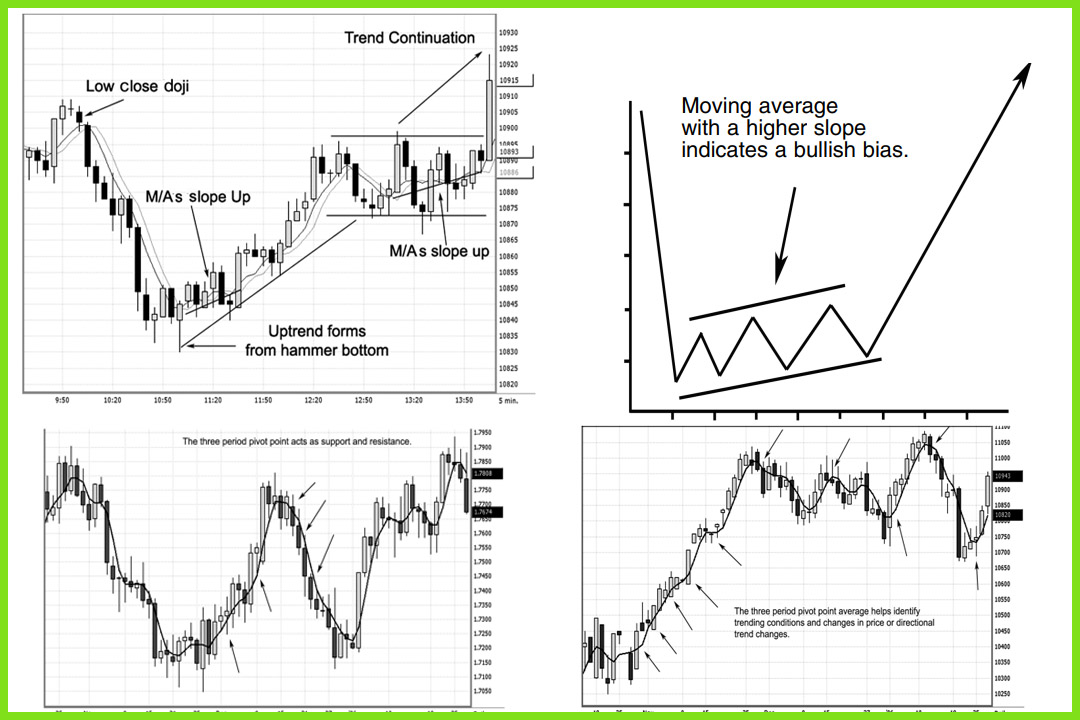

targeted reversal support or resistance point. Figure 6.1 shows a spot foreign

exchange (forex) British pound daily chart with the three-period pivot point

moving average overlaid on top of prices. Notice that as the market changes

conditions from bearish (downtrend) to bullish (uptrend), prices bounce off the

moving average as a support line and then trade off the moving average as it

acts as a ceiling of resistance. If you notice the price action from November

15 to November 25, you will see that the market entered a consolidating phase

as prices moved above and below the moving average. The moving average went

virtually in a flat line with a bias to an upside slope. This was hinting that

prices were getting ready to change direction. When you watch the moving average

in relation to the underlying price action, sometimes you can get clues as to

the true market price direction using the pivot point moving average. Due to

the weighting of the high, low, and close combined, the moving average factors

in the typical price of that time period, thus giving a better gauge of market

value. If the close is closer to the high, the average will be at a higher

assigned value. Using the three-period pivot point will help you filter out

much of the market noise and will give you a truer sense of the market’s fair

value within the price range of the past three trading periods.

At times,

the slope, or angle, of the moving average can give you a clue as to the

market’s true strength or weakness, especially when combined with candlestick

charting.

The slope helps filter out the noise, and you

can see if the market’s value is progressively appreciating or depreciating.

When a market goes from the trending phase into the consolidation phase, it is

the slope of the pivot point moving average that can help you identify the

potential price direction the market makes next from the consolidating phase,

such as if the market will make a continuation or a trend reversal move. For

added clarity, when combined with identifying a high probability bottom or

top-forming candle, you have added confirmation of a potential move.

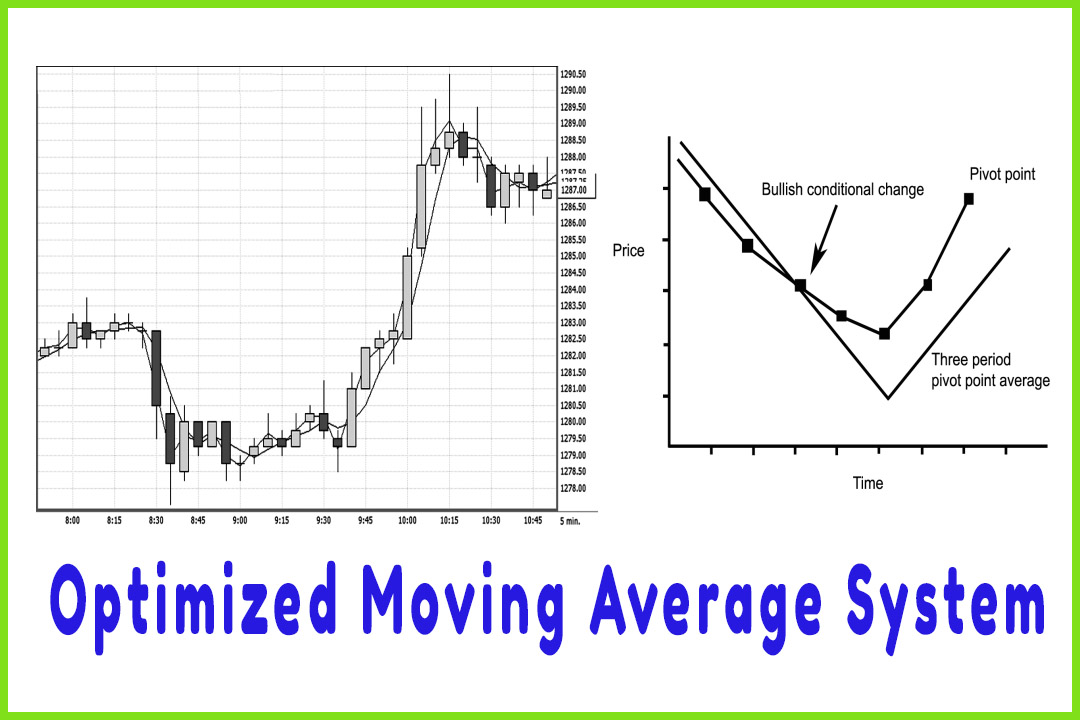

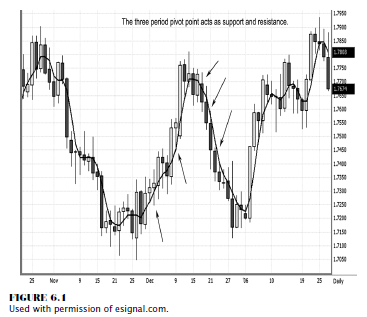

In Figure

6.2, the graph shows a representation of a pivot point moving average in a

declining trend phase. Then as prices consolidate as the pivot point average

measures the typical price rather than the close, we can determine what the

true market value is and which way prices tend to be moving. Markets sometimes

demonstrate extreme volatility at turning points, and the moving average

approach can help filter out the noise inflicted by wide price swings. These

swings often lead to confusion or worse—traders getting whipsawed, causing loss

in trading equity.

As the

moving average slopes up, it indicates that the market values are also tending

to trade higher. Eventually, we see a trend reversal, which is what the

direction of the moving average indicated.

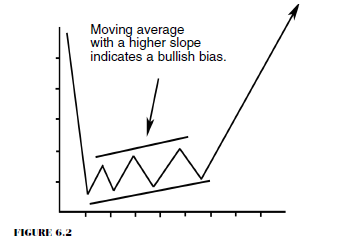

In Figure

6.3, let’s look at a five-minute chart on the Chicago Board of Trade (CBOT)

mini-Dow contract. Just to clarify, the minimum tick fluctuation is a one-point

move, and every point is worth $5. So the overall contract value is $5 times

the index. If the Dow is at 10500, the contract value is $52,500. This may not

make sense now, but as you read the book further, you will understand what the low

close doji sell signal is about and what the specific rules are for entering on

this pattern. For purposes of illustrating what phase a market goes in and how

the pivot point moving average can help you follow a market, let’s look at the

sequence of events:

- The market develops into a downtrend.

- At the bottom, a bullish reversal candle pattern forms.

- Prices start trading wildly, but the moving averages (M/As) are sloping higher.

- The market reverses and then goes into a sideways channel or consolidating phase. (If you examine the pivot point moving averages, you will see they were pointing higher while prices were in the congestion phase.)

- Prices finally break out and continue the uptrend.

This

chart was from 2/10/2006; prices went on to trade that day as high as 10963.

The moving averages did alert you to the internal strength, and the price

direction did continue higher—a pretty good method for getting a clue to the

market’s next move.

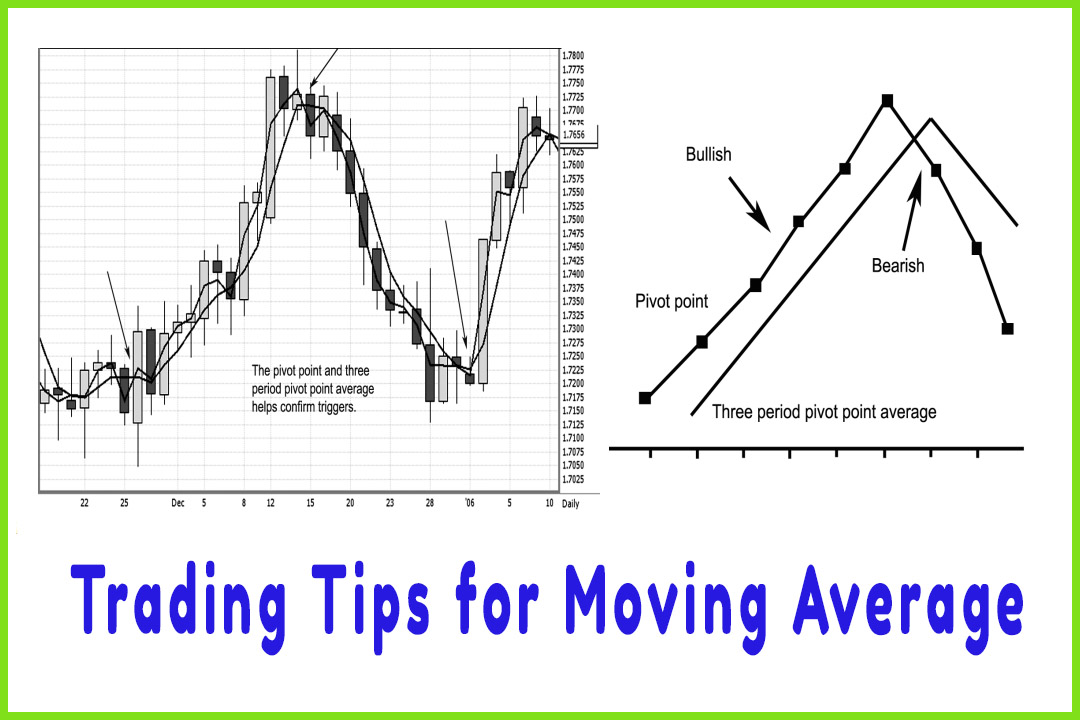

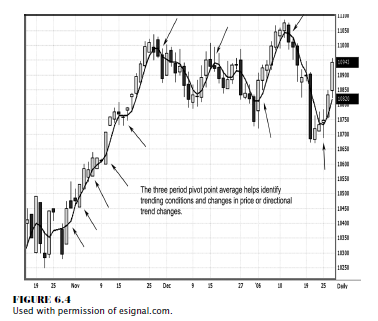

In Figure

6.4, we have the CBOT mini-Dow contract, which shows that the market was coming

out of the congestion, or consolidation, period in late October. The

three-period pivot point moving average was also flat-lining with an upward

slope in the direction of the moving average. Once the market made a break for

it by establishing the uptrend, the average helped identify the trending

condition. As the chart illustrates, the pivot point moving average actually

hugs the market’s lows when in an uptrend and the highs in a downtrend. It also

helps to identify the conditional changes when the market makes reversals.

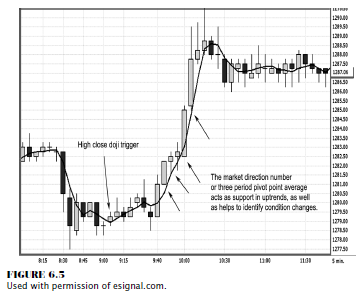

This

moving average approach works just as well for active day trading markets, such

as the e-mini-Standard & Poor’s (S&P) shown in the 5- minute chart in

Figure 6.5, as it does for swing or position traders.

This

method can help active day traders to see and to confirm changes in price

conditions, such as when the market is in a consolidating period to trending

mode. Notice how the moving average acts as a support once the market starts

the breakout in the uptrend.

The

three-period pivot point moving average works as a tool to confirm triggers and

exits by price action closing above or below the moving average pivot line. In

Figure 6.6, we have a 15-minute chart on the spot forex Japanese yen currency.

As the market forms a bottom at 9:00 A.M., notice how the moving average shows

a cup formation and that the price of the market closes above the moving

average. This gives us a clue that the market is starting to change from a

bearish trend condition to a consolidating phase and that the market is

starting to move into a reversal of the current trending condition. As the

market starts to establish higher highs and higher lows, it also is closing

above prior highs and, most important, closing above the three-period pivot

point moving average. Now the average starts to act as a support target until

prices reach the top, and the moving average starts to flat-line again as

prices go into another consolidating phase. The Japanese yen chart provides a

good example of a high close hammer trigger, confirmed by the price closing

above the moving average pivot line.

The Candlestick and Pivot Point Trading Triggers : Chapter 6. Pivot Point Moving Average System : Tag: Candlestick Pattern Trading, Forex, Pivot Point : technical analysis, moving average, Market Direction, Pivot Point Calculation, Support and resistance Level, reversal candle pattern - Simple Moving Average Trading Strategy - Pivot Method