Advanced Supply and Demand Trading Strategy

How to trade Supply and Demand Zone, How to draw Supply and Demand Zone, Multiple time frame analysis

Course: [ Supply and Demand - Trade Like a Pro : Chapter 2. Executing the Strategy ]

A consistent Forex trading strategy provides advantageous entry signals, but it is also vital to consider: position sizing, risk management and when and where to exit a trade.

Trading Strategy

A

consistent Forex trading strategy provides advantageous entry signals, but it

is also vital to consider: position sizing, risk management and when and where

to exit a trade.

This

strategy is not exclusive to a specific trading style, and it does use two key

concepts:

·

multiple time frame analysis.

These

concepts give you two important things:

·

follow the bigger move,

·

better entry and exit points for

your trades.

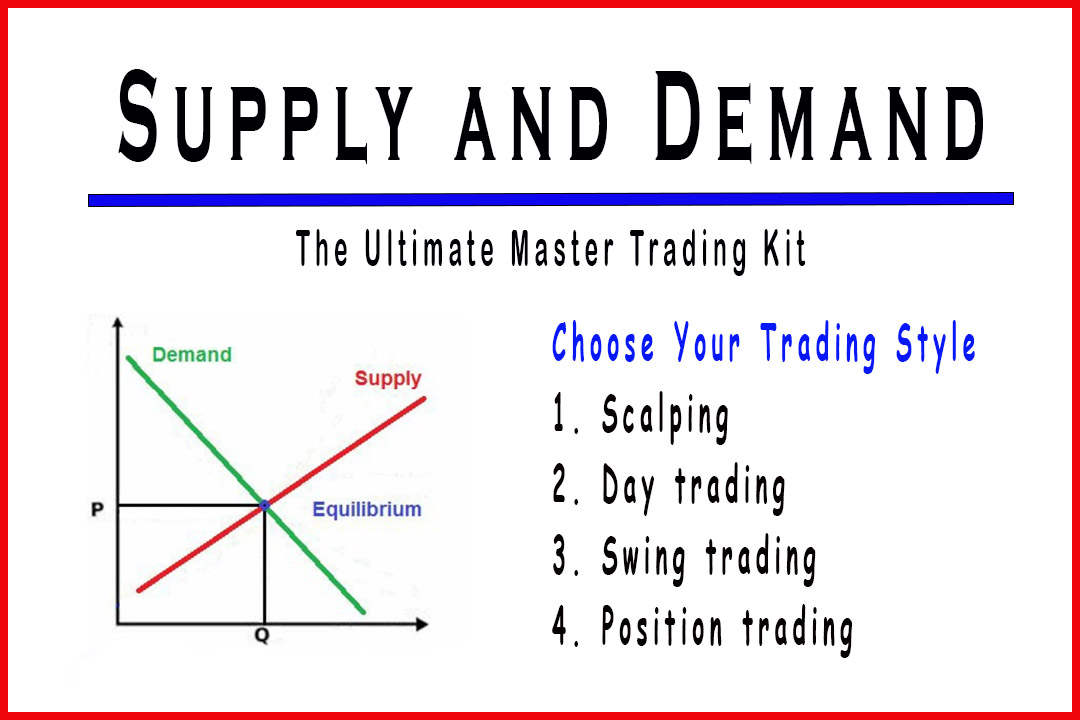

These are

a selection of multiple time frames you can use in your trading analysis based

on your trading style:

·

Scalping trading: 15min/ 5min/

1min,

·

Day trading: 1h/ 15min/ 5min, or 4h/ 1h/ 15min,

·

Swing trading: Daily/ 4h/ 1h, or Weekly/Daily/ 4h,

·

Position trading: Monthly/

Weekly/ Daily,

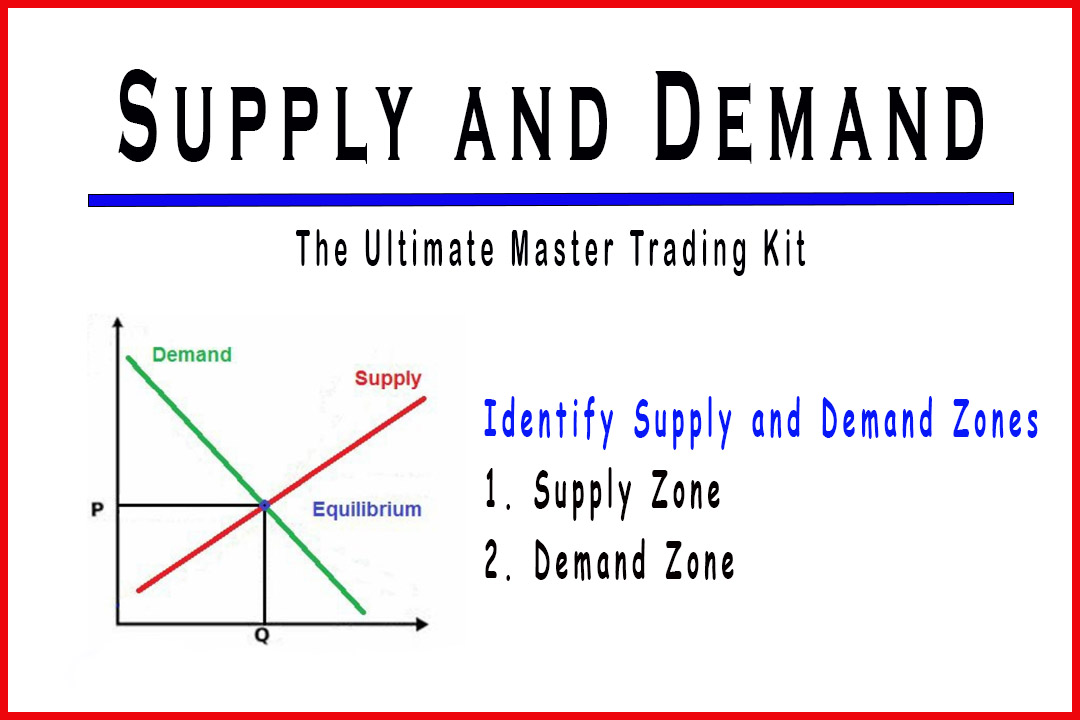

Step one: “Where is the price in the curve?”

The first

thing we need to do is to choose our multiple time frame selection. We are

going to use Monthly/Weekly/Daily selection to explain the strategy. Once we

choose the right selection that best suits our trading style, we start with the

higher time frame because it provides sufficient overview of the past price

action to help us:

1.

Identify whether the market is

trending (uptrend or downtrend), reversing or ranging,

2.

Locate major supply and demand

zones,

3.

Identify the big picture of the

market to see where the price is in the curve:

·

cup-like shape in case of a

supply zone (figure 35),

·

hat-like shape in case of demand

zone (figure 36),

In this

time frame we will assess how high or how low the price is in the curve. It

will tell us if we are too high to buy or too low to sell in the market. As a

general rule, if the price is near supply zone and high in the curve, we only

sell in the market. If the price is near demand zone and low in curve, we only

buy in the market. If the price is at equilibrium (in the middle of the curve),

we wait for either bullish evidence to go long or bearish evidence to go short

in the market. Otherwise, we do nothing and we wait for the price to be either

high or low in the curve.

Let’s go

over some examples to better understand these concepts. In the next chart

(figure 37):

·

Higher Time Frame: Monthly Chart,

·

Big Picture: Cup-like shape

structure,

·

Price in the curve: Price is low

in the curve,

·

Trend: Uptrend.

As we can

see, the price is low in the curve which means we only buy in this market. We

have enough room to go long because the price is still far enough from the

supply zone.

The next

chart (figure 38):

·

Higher Time Frame: Monthly Chart,

·

Big Picture: Hat-like shape

structure,

·

Price in the curve: Price is high

in the curve,

·

Trend: Downtrend.

As we can

see, the price is high in the curve which means we only sell in this market. We

have enough room to go short because price is still far enough from the demand

zone.

Step two: “The trend time frame”

Finding

the trend is one of the trickiest things a trader will have to deal with,

because every timeframe has its own trend. You may find an uptrend on H4, but

the daily timeframe is in a downtrend, and the weekly timeframe in an uptrend,

which is quite confusing for novice traders.

This is

why in this strategy we are using multiple time frame analysis to assign

specific task to each time frame so the trader won’t get lost.

We use

the intermediate time frame to find the trend. Since we have chosen the monthly

time frame to find the curve, now we are using the weekly time frame to find

the trend.

Step three: “The entry time frame”

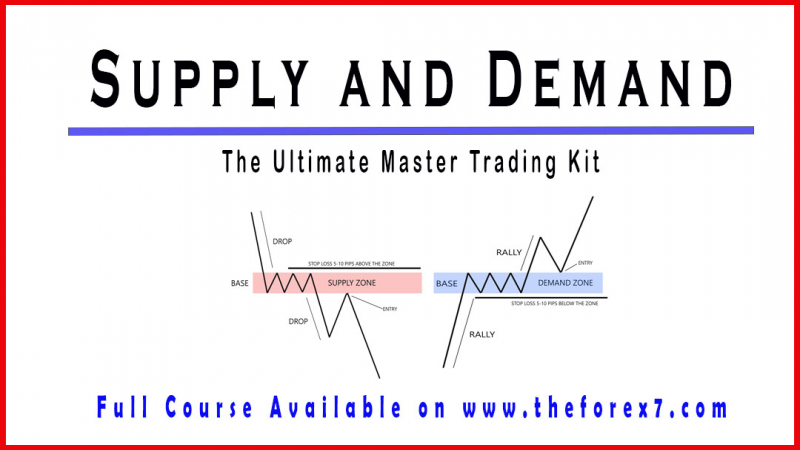

This is

where we choose the entry where we will be drawing our entry supply and demand

levels.

·

Lower Time Frame: Daily

timeframe,

This is where we draw the supply and demand zones,

execute and manage our trades. If the daily timeframe is too wide, we can drill

it down by using H4 or H1 to fine tune our entry.

·

Stop loss and exit point: we

place our stop loss order below/above the supply or demand zones, and for the

exit point we could either use the reward-risk ration (3:1) to calculate your

exit point or use the opposite supply (when we enter a buy order) or demand

(when we enter a sell order) zone as an exit point.

Conclusion

·

Don’t Buy when price is high in

curve or near supply zone,

·

Don’t Sell when price is low in

curve or near demand zone,

·

If you missed a trade do not jump

into the market, instead wait for another chance to come,

Now let’s

take an example to understand how the strategy works:

Step one: “Where is the price in the curve?”

·

Multiple Time Frame Selection:

Daily/H4/H1,

·

Higher Time Frame: Daily Chart

(figure 39),

·

Big Picture: Cup-like shape

structure,

·

Price in the curve: Price is high

in the curve,

·

Trend: Uptrend.

Created

with

Step two: “The trend Time Frame”

·

Trend Time Frame: H4 Chart

(figure 40),

·

Trend: Uptrend.

Step Three: “The entry time frame”

·

Lower Time Frame: H1 Chart to

draw our supply zone (figure 41),

·

We place our pending order at the

lower line of the supply zone,

·

Price will continue up and hit

our order,

·

We use the opposing demand zone

as an exit point to close the trade.

Another

example:

Step one: “Where is the price in the curve?”

·

Multiple Time Frame Selection:

Weekly/Daily/H4 or H1,

·

Higher Time Frame: Weekly Chart

(figure 42),

·

Big Picture: Hat-like shape

structure,

·

Price in the curve: Price is low

in the curve,

·

Trend: Uptrend.

In this

example we have a previous demand zone that we have found by scrolling left of

the weekly chart (figure 43). We are going to use this demand level, because

the price has tested it as we can see, and in case the price retest it again we

will go long.

Step two: “The trend Time Frame”

·

Trend Time Frame: Daily Chart

(figure 44),

·

Trend: Uptrend.

Step Three: “The entry time frame”

This is

an interesting example because we have two trades to execute. Let’s begin with

the demand zone we identified, on daily timeframe we noticed that the price has

tested the zone, so we will place a limit order at this level in case the price

re-test this zone again.

On the

next chart (figure 45) we draw our demand zone on H4 timeframe and place our

limit order. The price pulled back and hit our buy order.

So part 1 of the step three is:

·

Lower Time Frame: H4 Chart to

draw our demand zone (figure 45),

·

We place our buy limit order at

the top line of the demand zone,

·

We place our stop loss order at

the bottom line of the demand zone,

·

We use the opposing supply zones

as the exit points to close the trade progressively as the market moves up

(figure 46),

Now that

the price is in an uptrend, let us locate a supply zone on H4 and find an

opportunity to short the market.

So part 2 of the step three is:

·

Lower Time Frame: H4 Chart to

draw our supply zone (figure 47),

·

We place our sell limit order at

the bottom line of the supply zone,

·

We place our stop loss order at

the top line of the supply zone,

·

We use the opposing demand zones

as the exit points to close the trade progressively as the market moves down,

Supply and Demand - Trade Like a Pro : Chapter 2. Executing the Strategy : Tag: Supply and Demand Trading, Forex : How to trade Supply and Demand Zone, How to draw Supply and Demand Zone, Multiple time frame analysis - Advanced Supply and Demand Trading Strategy