Be on Guard for Changes

chart patterns, trending market conditions, price changes, learn how to exit the trade

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 2. Determining Market Condition ]

I must reiterate that no one, no matter what, can foresee the future. Therefore, you must be aware that changes can and do occur.

BE ON GUARD FOR CHANGES

I must

reiterate that no one, no matter what, can foresee the future. Therefore, you

must be aware that changes can and do occur. You must understand what drives

these changes as reflected on the chart patterns. Once you can master

identifying what drives price changes or trending market conditions, then you

need to learn how and when to execute a trade based on those signals. Then the

next phase is to manage the risks of the trade and to learn how to exit the

trade to harness the profits accrued in the trade.

I will

teach you how to spot these changes and what you can do to protect yourself

from giving back profits by scaling out of trades, which will be covered in

Chapter 10. First, you need to be aware of the process that markets go through.

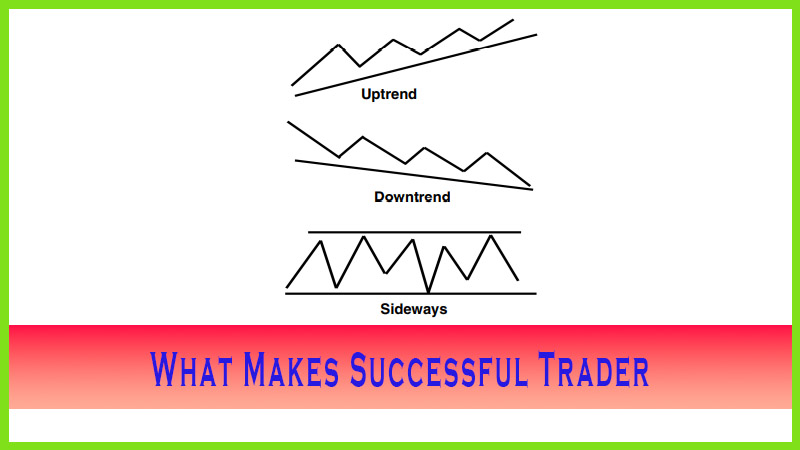

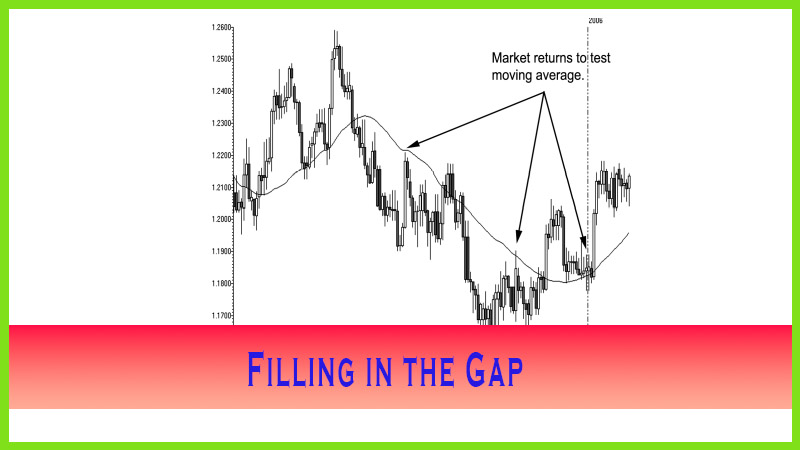

Prices do go in trend mode as we have covered so far. From a technical

standpoint, there are certain clues that candle charts illustrate to show you

the true condition of the market. Pivot point analysis will also help guide you

as to price targets, either the high or the low or both of a given session. If

you have the understanding that markets can either continue the original trend

or reverse it on a dime, then you will be able to filter out preconceived

emotional opinions rather than “fight the tape,” as it is called. You will read

that the mind can, will, and does play tricks on you when you are trading. So

you need to focus on what the market is showing you at the current moment.

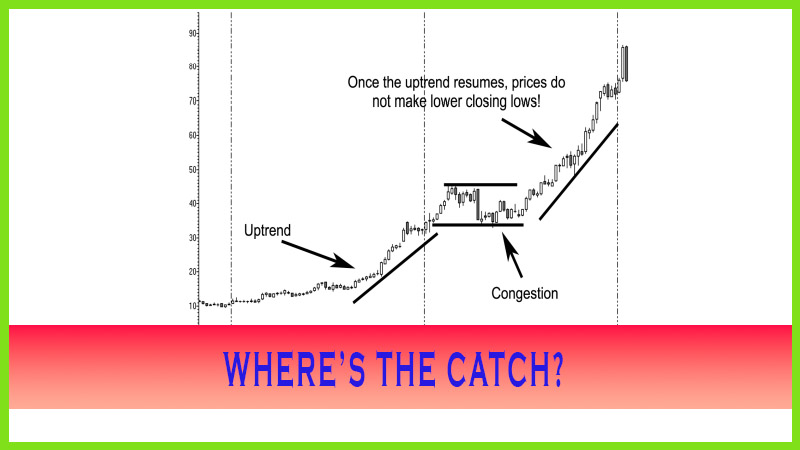

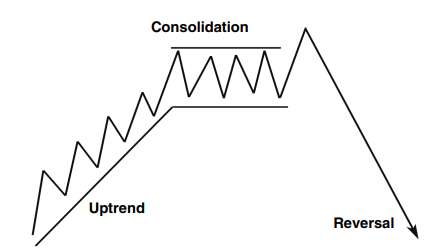

The graph

in Figure 2.7 seems a bit harsh that a market condition could be so bullish and

yet completely fall apart at the seam after a consolidation period.

What can and usually does happen is that a

trader gets a preconceived notion that the value of a given market should

continue to move in one direction. Most traders will continuously buy breaks

after a consolidation period. Granted, that might be a correct notion; but it

might not be the correct move, especially when proven wrong by the markets’

conditional changes as highlighted by specific candle patterns.

As you

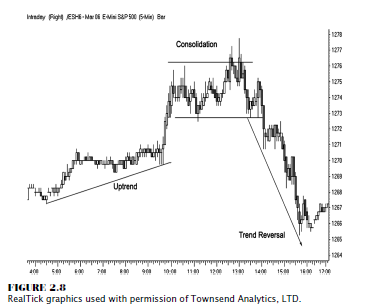

can see in Figure 2.8, the 5-minute e-mini-Standard & Poor’s (S&P)

chart shows how a market moves from bullish (or an uptrend) to the

consolidation phase to a complete trend reversal. Drawing a simple trend line

would help you identify a breakdown of the support; but the one most important

element that signaled a trend reversal was the fact that once the market traded

below the consolidation sideways channel support more specifically, closed

below that level and remained below the channel support level you had

sufficient evidence to identify that the market’s bullish condition had

changed.

The Candlestick and Pivot Point Trading Triggers : Chapter 2. Determining Market Condition : Tag: Candlestick Trading, Stock Markets, Pivot Point : chart patterns, trending market conditions, price changes, learn how to exit the trade - Be on Guard for Changes