Forex Markets Fall Prey to Reversals

countertrend trade, trend reversal, manipulate prices, forex market’s liquidity, pivot point method

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 2. Determining Market Condition ]

Let’s examine a market that is not correlated to stocks, such as the euro currency, to see how this market phenomenon known as a trend reversal occurs.

FOREX MARKETS FALL PREY TO REVERSALS

Let’s

examine a market that is not correlated to stocks, such as the euro currency,

to see how this market phenomenon known as a trend reversal occurs. Keep in

mind that the markets are a reflection of the cumulative total (or sum) of

market participants’ perceived value of a given product at a given time. We

went over the fact of how massive the spot forex market’s liquidity is; not a

single entity can manipulate prices. Something or some event must drive

traders’ opinions of the markets. One such event is a news or economic report,

which can change people’s opinions on a given market’s value.

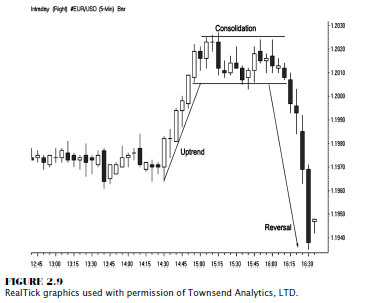

As we

look at the euro currency chart in Figure 2.9, we see the market develop into

an uptrend, then consolidate, and then, bang, on the drop of a dime, drastically

reverse. This is the kind of trading environment in which traders can and do

make lots and lots of money. If you know what to look for and if you understand

once a market goes from trend to consolidation, you should be aware that the

next possible outcome might not be a trend continuation but rather a complete

trend reversal. Then you have a better chance of not fighting against the

current of the market, otherwise known as the tape.

MOVING AVERAGES HELP!

The next

method for identifying whether the market is bullish, bearish, or in a

consolidation phase is utilizing moving averages. The most familiar one is the

benchmark 200-day moving average. Most technicians and short term traders feel

this is a worthless time period, with which I agree for short to

intermediate-term trading.

Remember

that the idea in using moving averages is to help determine the true direction

of the market. The longer the time period used in a moving average, the less

effective it is for shorter-term trading. Keep in mind that a 200-day moving

average is over 28 weeks, more than half a year. The Federal Reserve raised

rates four times in 2005 in that same time period. That leaves way too much

time and, more important, distance between prices and the moving average to

generate buy or sell signals.

When using moving averages the general guideline is simple:

- If prices are above the moving average, look to buy pullbacks or to take buy signals, as the market is in a bullish mode or in an uptrend.

- If prices are trading below the moving average, look to sell rallies or to take sell signals, as the market is bearish or in a downtrend.

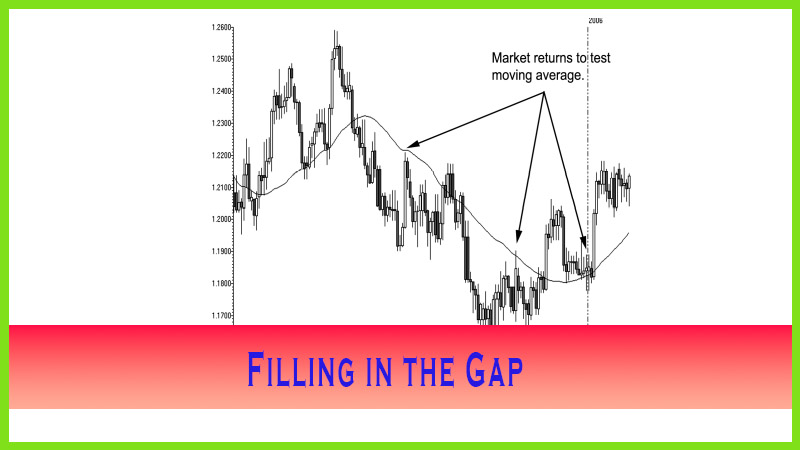

Another

instance in which traders use moving averages in helping their trading is

determining what is called “regression to the mean.” This is a term many

traders hear but really do not understand. It refers to the condition when

prices deviate too far from the mean or average. At that time, prices will

regress, or return, to the average; or the market will pause or consolidate until

the average catches up to the price. You will notice what I call a “gap band”

signal. This is what will occur when the prices gap too far away from the

moving averages or bands and give a trader an opportunity for a countertrend

trade. Another way to describe this is that when a market deviates, or departs,

too far from the moving average, it gives an opportunity for a speculator to

take advantage of this condition, which generally ends up with prices reaching

an unsustainable extreme and then returning back toward the moving averages for

a short term price swing. The question is at what distance or price level do

prices deviate, or move too far away, from the moving average before market

prices return to the moving average or the market pauses in order for the

moving average to catch up to the prices.

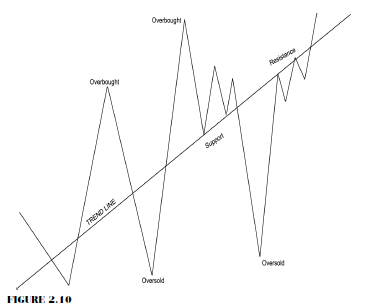

As you

can see in Figure 2.10, the market trends higher; but at times we see reactions

that shift values from one extreme to another. How do we use moving averages

effectively? More important, which time frames and which set of conditional

settings should we employ to give us a true sense or value of the market? We

will cover a different concept using a pivot point method later in the book.

Right

now, I want to set the foundation behind the principle of why we use moving averages

to help determine bullish, bearish, or neutral market conditions and how to

trade these conditions. I try to figure out not why a market moved, but rather

where the market is now in relation to specific points of interest, such as

past opens highs, lows, and closes.

The Candlestick and Pivot Point Trading Triggers : Chapter 2. Determining Market Condition : Tag: Candlestick Trading, Stock Markets, Pivot Point : countertrend trade, trend reversal, manipulate prices, forex market’s liquidity, pivot point method - Forex Markets Fall Prey to Reversals