What Makes Successful Trader

what makes a good trader, what makes a successful forex trader, how much do successful traders make, how much money do successful day traders make

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 2. Determining Market Condition ]

The key elements to making money are this: Successful traders interpret correctly and act swiftly! Successful traders have the courage to act and act promptly.

WHAT MAKES A SUCCESSFUL TRADER?

The key

elements to making money are this: Successful traders interpret correctly and

act swiftly! Successful traders have the courage to act and act promptly. I

often ask what are the differences between successful traders and not so

successful traders are. I get all kinds of relatively good answers of why

traders fail, mainly due to the fact that folks share their own bad experiences

with me. The reason I give for success is very simple: Generally, a successful

trader does not make a habit of consistently buying the high of a given time

period and riding the loss out until it “turns around.” Inversely, successful

traders do not make a habit of consistently selling the low of a session and

riding that loser out. Successful traders have a plan; they follow the market

and go with the flow. After all, that is where the saying, “The trend is your

friend,” came from. So we need to determine the trend. That is where charts

come in handy.

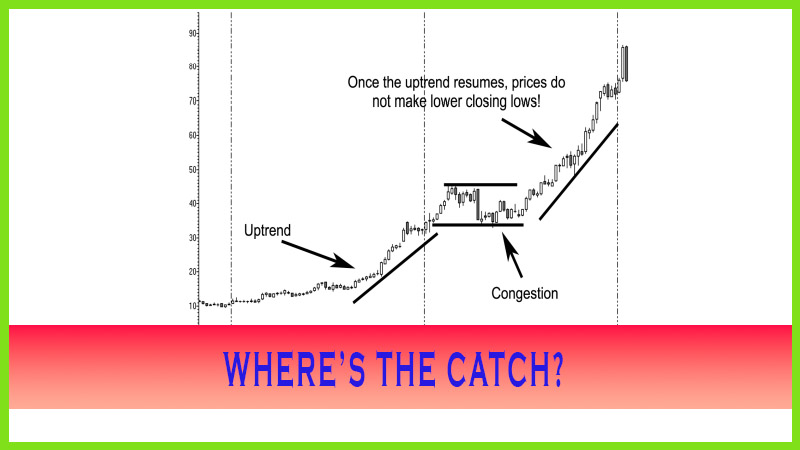

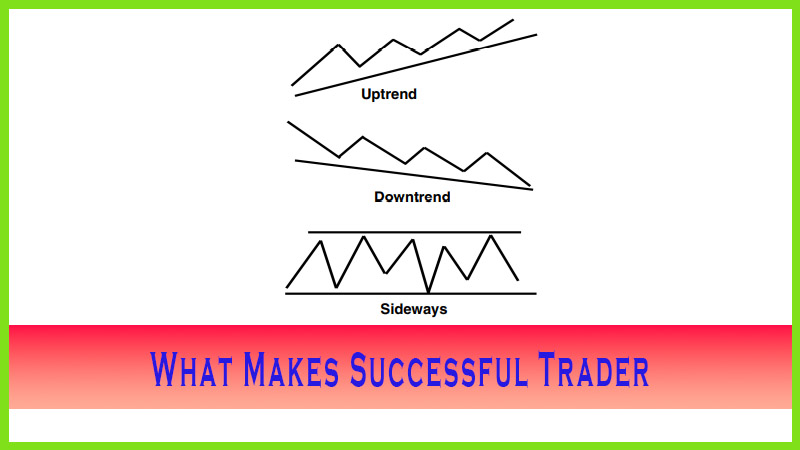

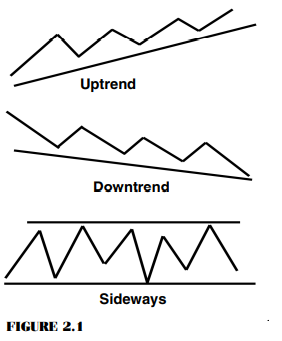

As Figure

2.1 shows, there are but three states the market is in: (1) bullish, or

uptrend; (2) bearish, or downtrend; and (3) neutral, sideways, or what is known

as a consolidation phase.

We can see the current trend or conditional

state that the market is in. What we can’t see is when and by how much that

condition will change. That is one reason why many traders lose they anticipate

or guess which direction the market will go; they trade without a plan or set

of rules to enter a trade. If you do believe that the markets are an effective

mechanism for reflecting the perceived value on a given product at a given

time, then you need to learn how to follow the flow of the market. A chart

shows the market in its current condition. Until that condition changes, you

need to go with the flow. So what signals should you look for when conditions

change? When the market is in an uptrend, a simple signal is once the market

ceases to increase its assigned value by establishing not only higher highs and

higher lows but, most important, when a market stops making higher closing

highs.

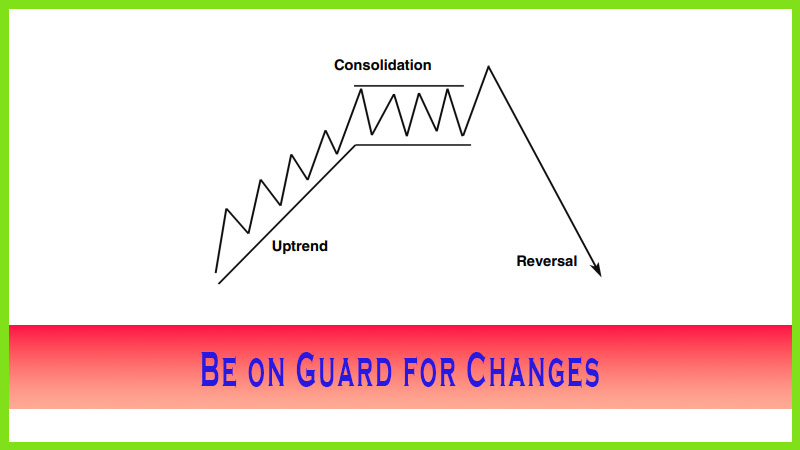

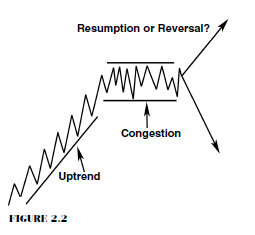

As for a

market that is in a downtrend, when different events occur such as lower

highs, lower lows, or, more important, lower closing lows then it is starting

to change conditions. If a bearish market or a bullish market changes

conditions, it will most likely go into what is called a consolidation or

congestion phase. Figure 2.2 shows the market moving from an uptrend to a

congestion phase, or sideways pattern. What we need to do then is, first, learn

how to anticipate or discover what forecasting tool would help us determine

what the potential top of that uptrend would be and, second, understand what

clues to look for once it establishes the top to help signal us that the trend

may resume or that a reversal of the trend will occur.

The Candlestick and Pivot Point Trading Triggers : Chapter 2. Determining Market Condition : Tag: Candlestick Trading, Stock Markets, Pivot Point : what makes a good trader, what makes a successful forex trader, how much do successful traders make, how much money do successful day traders make - What Makes Successful Trader