Determining Market Condition

Bearish arket, Bullish Market, Side Market, Neutral

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 2. Determining Market Condition ]

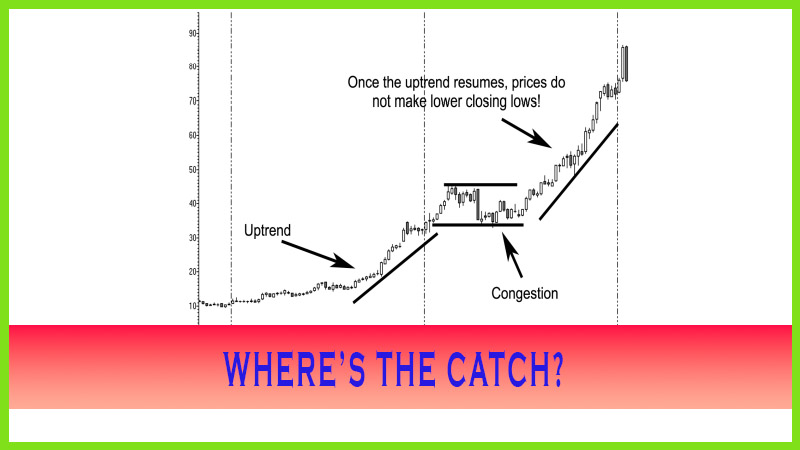

I would say the hardest thing for any trader to do is buy high, especially after seeing a huge run in the market. Buying high is a technique that very successful professional traders use.

Bullish, Bearish, or Neutral

I would

say the hardest thing for any trader to do is buy high, especially after seeing

a huge run in the market. Buying high is a technique that very successful

professional traders use. It is also a contrarian approach. After all, if you

feel that the value cannot go any higher, it probably won’t, right? This market

condition generally tempts traders to sell. That is absolutely the wrong thinking!

In most bull markets, that thinking falls under the category of “picking tops

without cause,” “justification,” and “trading based off a set of rules or

technical reasons”! Do not try to anticipate what the market will do next.

Simply go with what the market tells you it is currently doing. In other words,

try to avoid concerning yourself with why the market is moving; focus on what

is occurring. That is my definition of staying in the now and, most important,

staying with the trend.

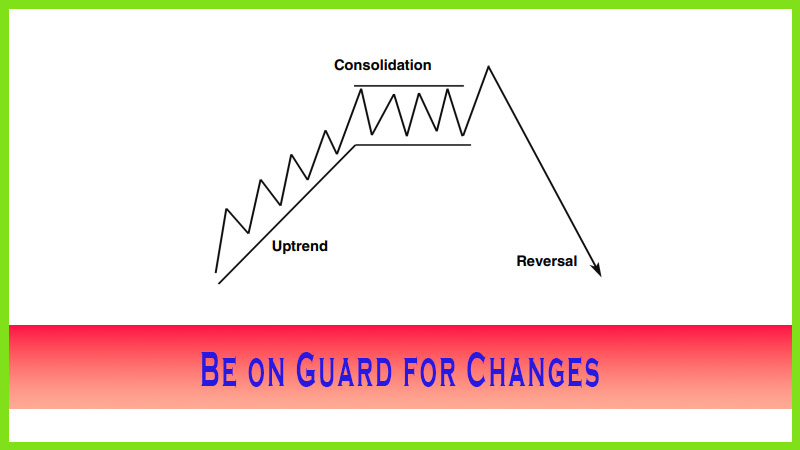

Forget

that last week the market may have taken a nosedive or that yesterday the

market rallied significantly. Concern yourself with what the market is doing

now. Ask yourself where prices are in relation to the current trend. It is up

to you to identify the type of trader you are (day trader, swing trader,

long-term trader) and the time frame in which you trade (minutes, days, weeks,

. . .).

For

example, a day trader in the mini-stock index futures or the foreign exchange

(forex) markets may only be working with a five-minute time frame. In that

case, she could care less what the market did last week or yesterday. A day

trader may also want to focus on a 60-minute trend to decide whether she should

hold the position for two or more periods. A swing trader, who would hold a position

for several days, may want to see what the trend is doing from a weekly time

perspective or from a time interval based on the past several days. Longer-term

position traders may want to view the trend over several weeks or months.

Cracking the code and understanding how to interpret what the market is telling

you is what this book is about and what it will hopefully teach you.

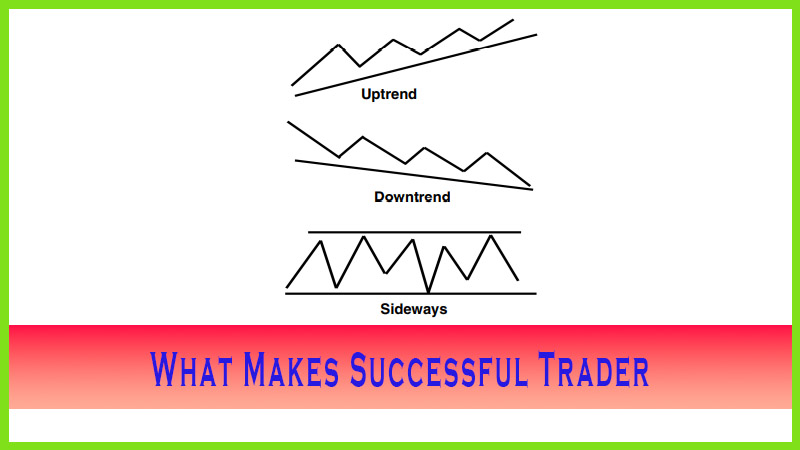

As a

trader, you should recognize the immediate environment or market condition. Is

it up, down, or sideways? After a trend is established, let’s say a bullish

trend, it should consist of higher highs and higher lows. It is usually a more

fruitful situation to buy dips in that environment, as you will you get more

out of the trade in price magnitude than you will in selling the rallies. In a

bullish environment, buying begets buying. Higher closing highs more

importantly bring higher highs as momentum and assigned values are justified.

The Candlestick and Pivot Point Trading Triggers : Chapter 2. Determining Market Condition : Tag: Candlestick Trading, Stock Markets, Pivot Point : Bearish arket, Bullish Market, Side Market, Neutral - Determining Market Condition