Filling in the Gap

trading why do gaps get filled, filling gap in stocks, filling gap in forex

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 2. Determining Market Condition ]

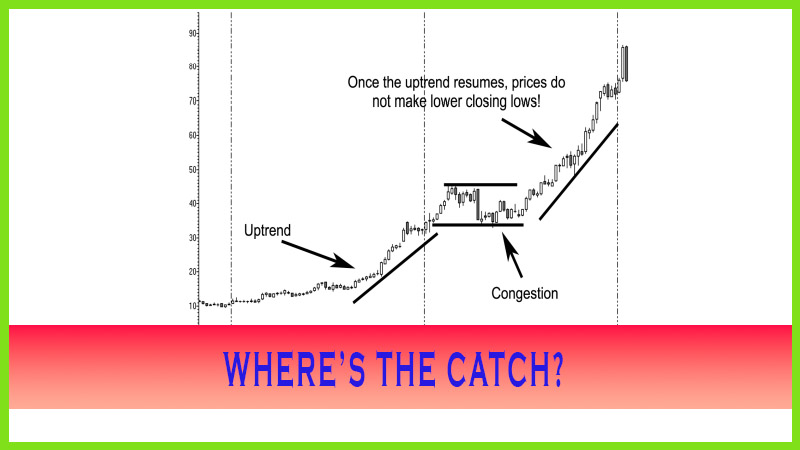

As you can see in Figure 2.10, the gaps that occur show that prices move too far too fast in one direction, which is a condition known as overbought or oversold.

FILLING IN THE GAP

As you

can see in Figure 2.10, the gaps that occur show that prices move too far too

fast in one direction, which is a condition known as overbought or oversold.

Those moves are unsustainable and thus form what we call overvalued or

undervalued in relation to the trend line or moving average. Most market

behavior as reflected by the human emotional state goes into extremes. This is

even the case in trending markets: They move either too fast or too far in any

one direction and then simply pause or correct back above or below the various

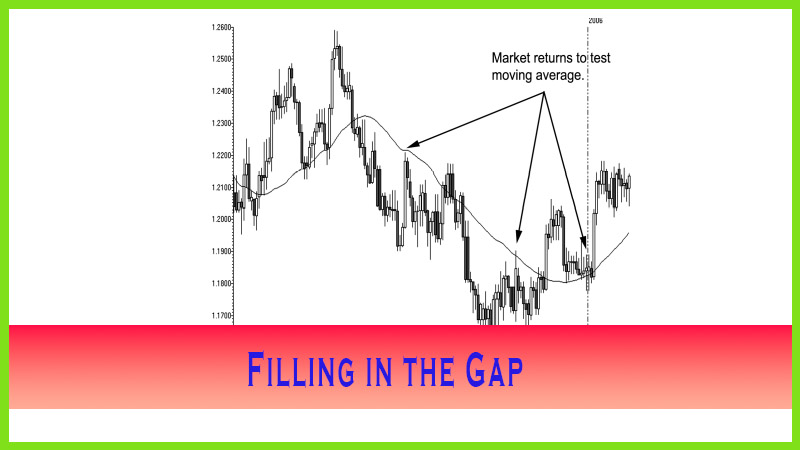

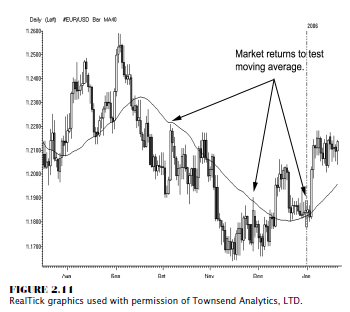

moving averages, as you will see. The chart in

Figure

2.11 is the spot euro currency. This market has an inverse relationship with

the U.S. dollar. As the dollar moved lower, the euro moved higher, and vice

versa. Notice that when it separates too far away from the longer- term moving

average (M/A), it would return back to test the M/A as a support line or fill

the gap, as it is known. Finally, as it breaks below the M/A support in the

middle of September, it declines too far too fast and returns back up to test

the line, which now acts as a resistance trend line.

In

conclusion, trend lines and moving averages help us determine the price

direction of a given market at a given time. They can also help us discover

when a market is overbought or oversold. In simple terms, when we use moving

averages, the more time periods we use, the slower or less sensitive moving

averages are to price changes. Prices will trade and close below a moving

average in a bearish market condition, or a downtrend; and prices will trade

or, more important, close above a moving average in a bullish market condition,

or uptrend. Introducing more than one moving average with two different

calculated values, such as 10-period and 20-period simple moving averages on a

closing basis, will generate buy and sell signals as one value crosses above or

below the other. We can compute and change the variables we use as well, such as

closes and volatility calculations.

Moving averages help in the development of

trading strategies, as we will see in later chapters. There are also variables

other than just a simple moving average based on a closing time period that you

can use. I will introduce to you a pivot point moving average method in Chapter

6.

Forex, or

currency, markets tend to establish longer-term trends, so moving average

studies are very popular with these markets. Also, moving average systems can

be back-tested; therefore, hypothetical results can be produced for those

looking to explore running a hedge fund.

In the next few chapters, we will introduce the pivot point system and incorporate that as one of our moving average values. We will blend this with a series of conditions and introduce various time frames to help us determine:

- Market condition and direction.

- Overbought or oversold conditions.

- Potential turning points or reversal areas.

- A moving average system to determine buy and sell signals.

If you

are looking to improve your skills as a trader, then these next few chapters

will help. I hope I will inspire you to learn how to develop a predetermined

game plan, to act on that plan, and to manage and maintain the profits in the

trade and to learn how and when to cut the trade when the market signals to do

so.

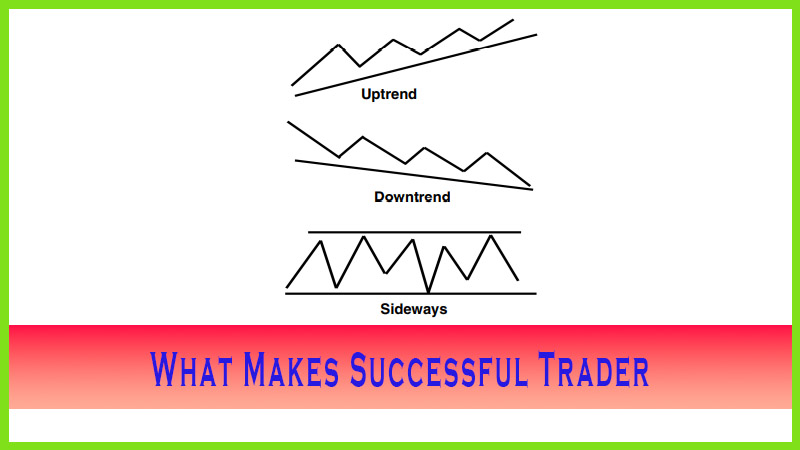

If you

understand the three directions in which a market can go up, down, or

sideways then you will have an edge on learning how to “read the tape,” which

should enable you to cut losses and let your winners ride.

The Candlestick and Pivot Point Trading Triggers : Chapter 2. Determining Market Condition : Tag: Candlestick Trading, Stock Markets, Pivot Point : trading why do gaps get filled, filling gap in stocks, filling gap in forex - Filling in the Gap