Presence of Catch

trend phase, False breakouts and reversals, bullish chart patterns

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 2. Determining Market Condition ]

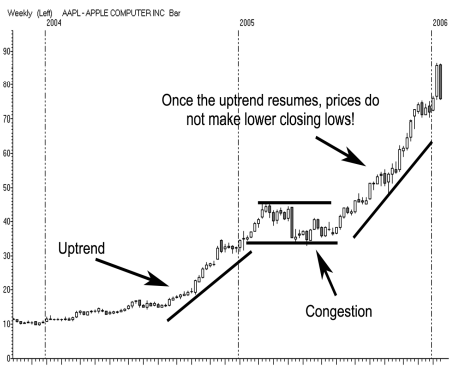

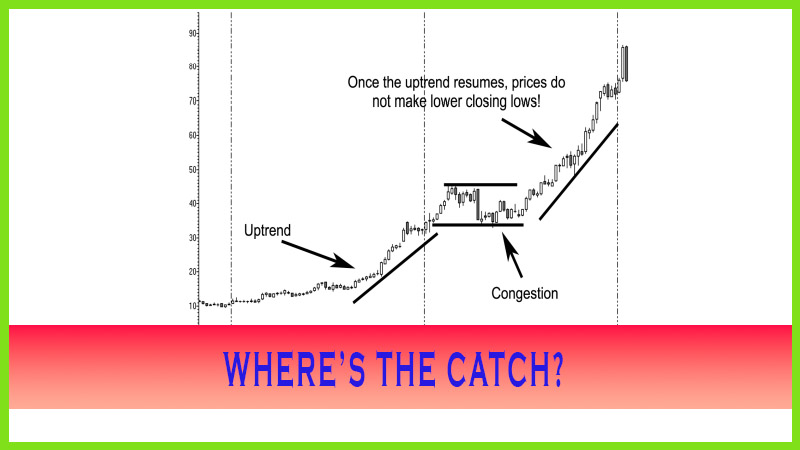

As the market starts to trade higher once, it enters a trend phase. Generally speaking, the market will pause or consolidate before resuming the uptrend.

WHERE’S THE CATCH?

As the

market starts to trade higher once, it enters a trend phase. Generally

speaking, the market will pause or consolidate before resuming the uptrend.

However, there lies the catch and what substantiates the Random Walk theory.

Not at all times do markets resume an uptrend from the consolidation phase.

False breakouts and reversals do occur. Most bullish chart patterns, such as

flags, pennants, rising wedges, and ascending triangles, are just an assortment

of classical technical continuation patterns that exist in trends. These work

in bar charts and candle charts. The larger patterns tend to give a clue to

the next move by forming in the direction of the trend; the smaller corrective

patterns, such as flags and triangles, lean away from the trend. Sideways

channels that form after a bullish trend have a tendency to support off a past

breakout point or an old high.

Figure

2.3 shows weekly chart of Apple Computer; it had an amazing run after it went

out of a period of congestion and blasted off to the upside. Notice that after

the bullish price direction resumed, prices do not make lower closing lows

until the second week in December.

After

that, as you can see, it did move higher at the start of 2006; but the tweezer

top formation (equal and opposite) contained the rally, and prices ended back

where they started.

The Candlestick and Pivot Point Trading Triggers : Chapter 2. Determining Market Condition : Tag: Candlestick Trading, Stock Markets, Pivot Point : trend phase, False breakouts and reversals, bullish chart patterns - Presence of Catch