Definition of Momentum

what is momentum trade, meaning of momentum trader, define momentum trading, what is the best definition of momentum

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 2. Determining Market Condition ]

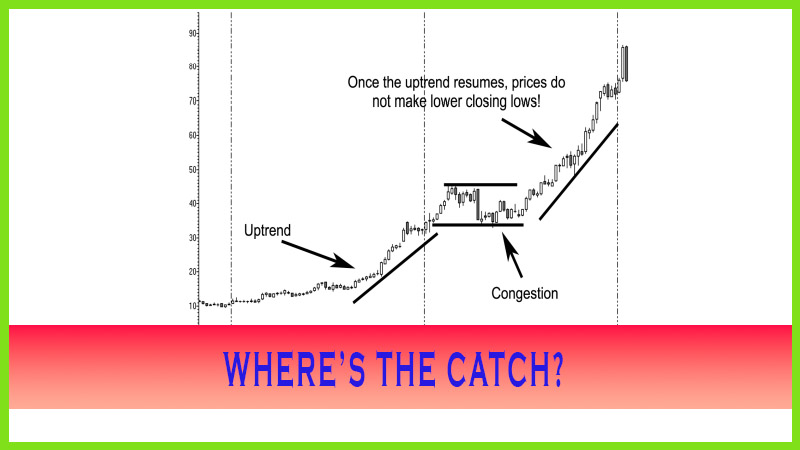

That is what momentum is and why it is the key in trading. Think of what an auction is like. There is excitement. People are furiously bidding up the price of an object.

WHAT DEFINES MOMENTUM?

The close

is the assigned value for any market. The law of physics that states “a body in motion tends to stay in motion until a force

or obstacle stops or changes that motion” really applies to this

concept, because higher assigned values can and do usually attract more buying

and even new buyers. That is what momentum is and why it is the key in trading.

Think of what an auction is like. There is excitement. People are furiously

bidding up the price of an object. It attracts more buyers. Gosh, it even

attracts people to bid on items they don’t even want. Then as value has peaked,

the bidding dries up; and the last person with the highest bid is awarded the

item (or stuck buying the high). Trading is essentially the same if you know

when it’s the right time or price level to enter the market and what signals to

look for to exit a trade.

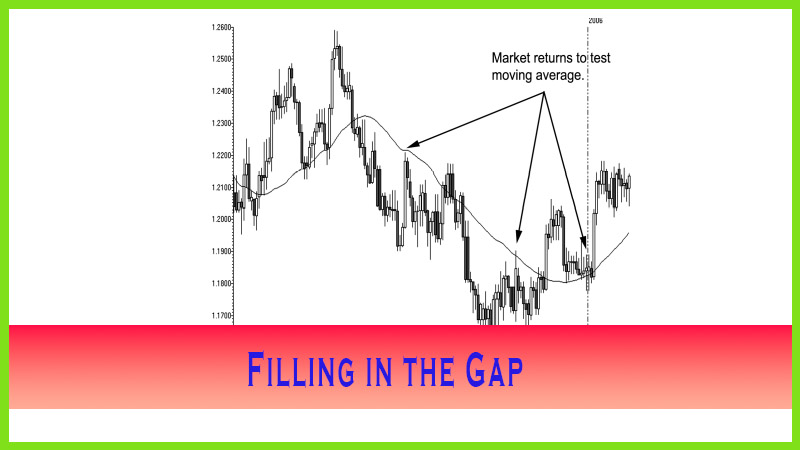

There are

all kinds of traders, and each one uses different forms of analysis. What I

teach short-term stock, forex, and futures traders is that there is immediate

equal access to the four common denominators that each and every trade has to

work with, without prejudice and exclusivity: (1) the open, (2) the high, (3)

the low, and (4) the close. For stock traders, there is a fifth element:

volume. Fugures traders who are longer term or who like to confirm the strength

or the weakness of a trend should also be concerned with volume. In futures,

unlike in stocks, the volume is not given to the investing public in real-time

intraday. Truthfully, that is why the futures and forex markets depend on

technical analysis to speed the analytical process to determine a market move

on pure price action. After all, it is how we analyze, interpret, and act on

the information that makes us different as traders. As for forex, we do not

have a means to measure volume as discussed previously. Therefore, it is wise

for a forex trader to learn how to borrow information from the futures markets.

The Candlestick and Pivot Point Trading Triggers : Chapter 2. Determining Market Condition : Tag: Candlestick Trading, Stock Markets, Pivot Point : what is momentum trade, meaning of momentum trader, define momentum trading, what is the best definition of momentum - Definition of Momentum