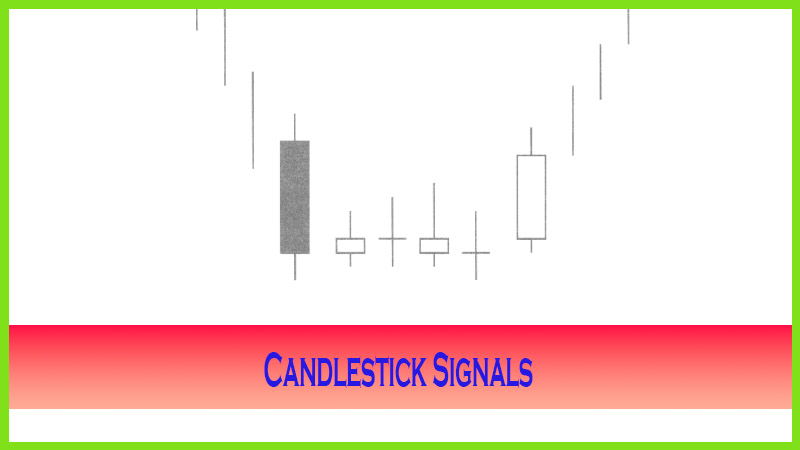

Breakout Trading Strategy

Single candlestick patterns, Types of candlesticks, Powerful candlestick patterns, Types of candlesticks, Candlestick chart analysis, Bearish candlestick patterns, Breakout Trading

Course: [ How To make High Profit In Candlestick Patterns : Chapter 5. Candlestick Signals and Patterns ]

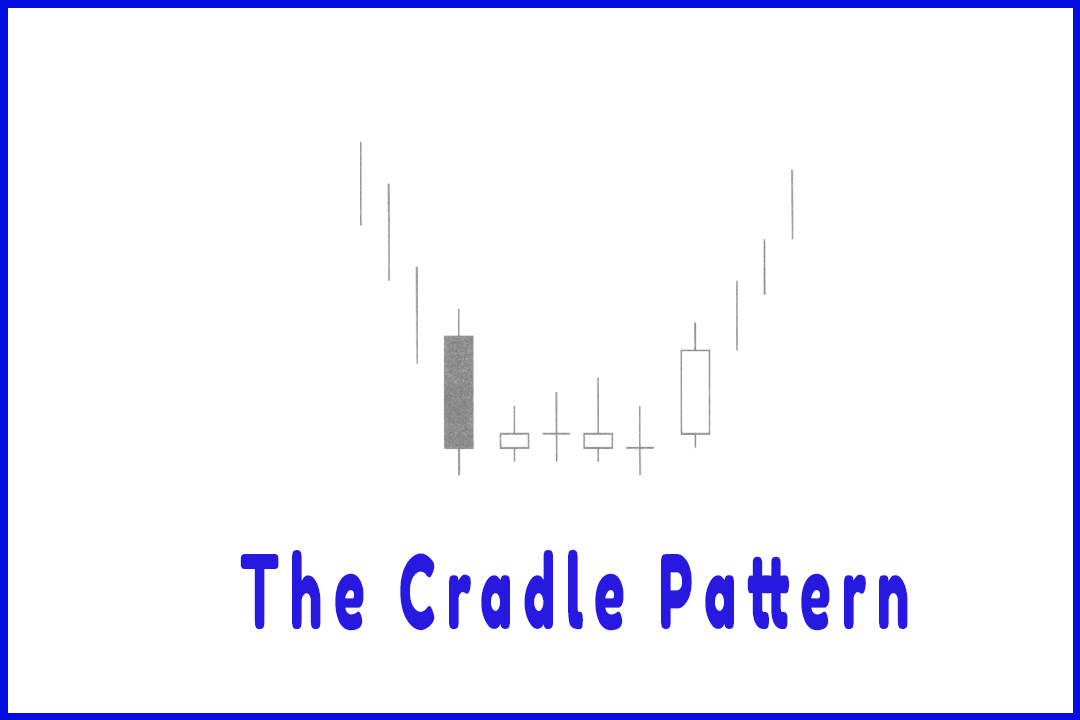

One of the most powerful investment techniques is to exploit the explosive nature of a breakout. The term “breakout” should be relatively self- explanatory. It signifies a price move that is dramatically out of the ordinary for the normal trading pattern of a trading entity.

One of

the most powerful investment techniques is to exploit the explosive nature of a

breakout. The term “breakout” should be relatively self- explanatory. It

signifies a price move that is dramatically out of the ordinary for the normal

trading pattern of a trading entity. How do candlestick signals and formations

benefit in breakout trading? Being able to evaluate what the continuing move

will be after a significant price move becomes very important. Is the price

move a one-day fluke? Did severe short covering affect the price? Will the

trend continue after a significant percentage price move? These are all questions

that can be answered by simple evaluation of the candlestick formation at the

end of a trading day.

There is

a significant difference of a breakout where the price starts low and ends near

the top of the trading range. This creates a large white candle. A price that

opens up significantly higher and closes at the lower end of the trading range

is a completely different scenario. Although the price may be dramatically up

for the day, the type of candlestick formation produced on that day provides

significant investment information.

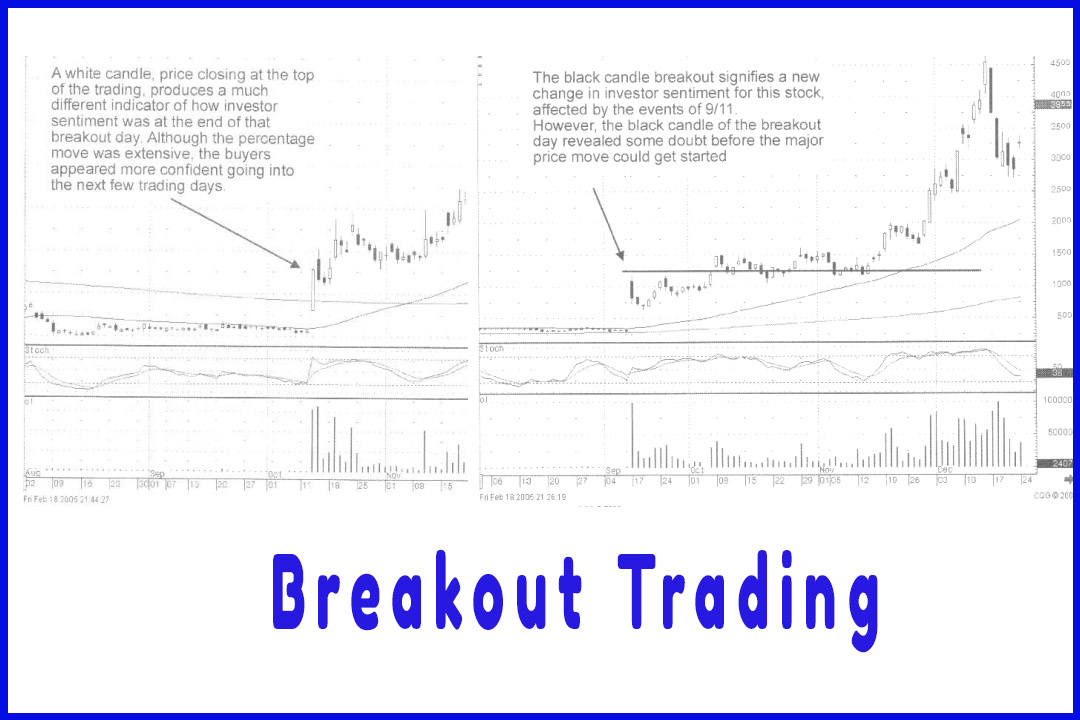

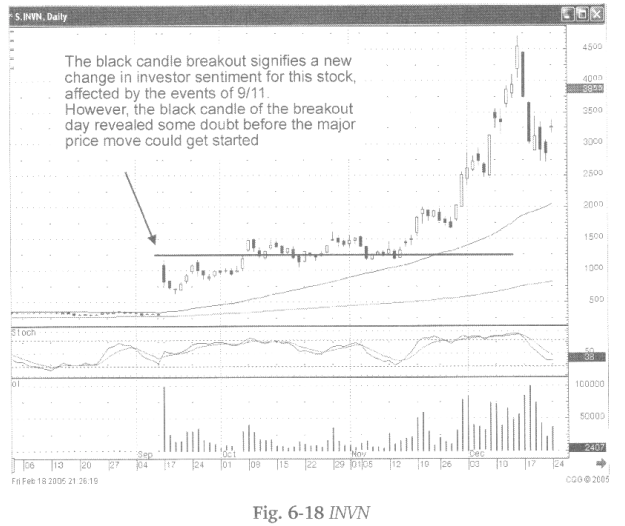

Fig.

6-18, The INVN chart clearly illustrates a change in investor sentiment when

an outside event affects a stock price. Notice how the stock jumped from $2.50

a share to $8.00 a share during the 9/11 attacks on the World Trade Center. The

large volume breakout, although impressive, did not have any major significant

price move for two months after the breakout. The fact that the breakout day

opened at around $11 a share and closed near $8.00 affected the price trend.

The buying started three days later after a small Morning Star signal formed

but overall the price of this stock was almost the same as where it opened on

the breakout day in mid-November

As seen,

the price started moving significantly after the breakout. But the large black

candle on the breakout day indicated there was still some doubt in investor sentiment

at the end of the day. This was reflected in the stock price for a few months.

The fact

that a breakout has occurred in the first place reveals something. That

something may be a new dynamic coming into the stock price. That dynamic may

have been created by internal improvements of a company. The new investor

sentiment may also be caused by an external event that changes the outlook for

a company’s fundamental potential or a commodity supply or demand potential.

Whatever the cause for the breakout, an investor wants to be able to analyze

whether a dramatic price move is a one time shot or if it’s the beginning of a

huge price jump. Candlestick analysis greatly enhances the ability to evaluate

the potential move.

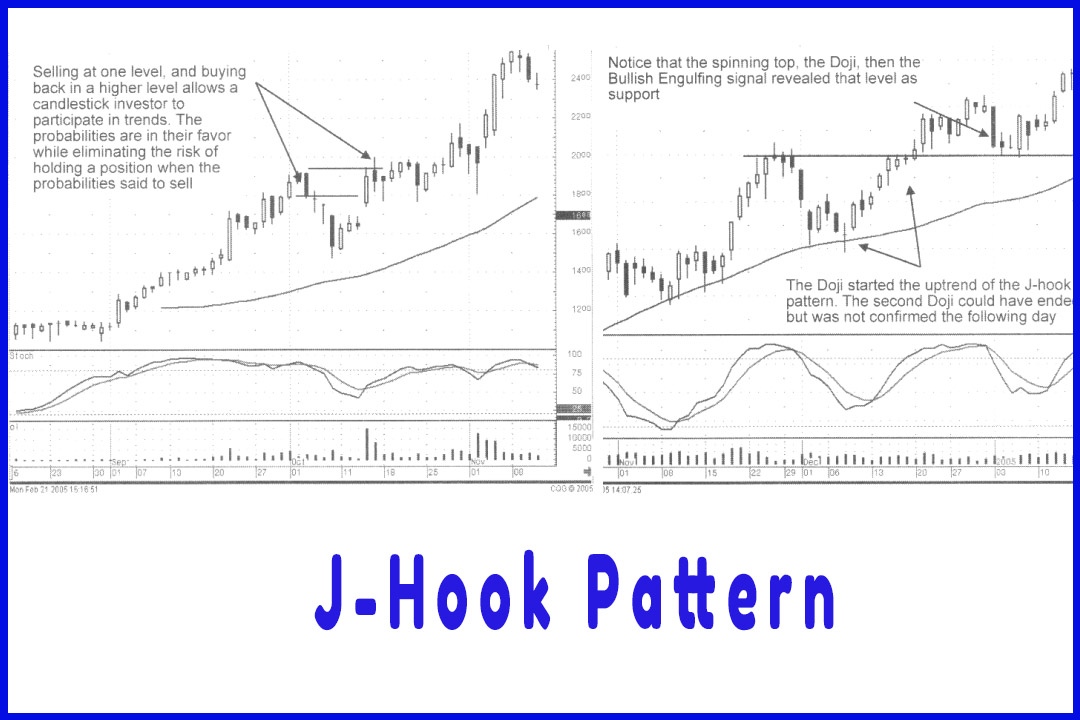

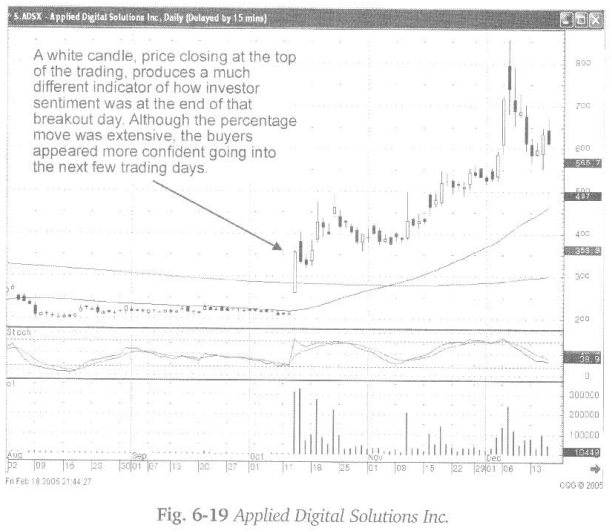

The

common sense that is incorporated into candlestick analysis makes interpreting

a breakout situation relatively easy. The signals are still the important

criteria. The analysis of what the signal represents, in correlation to the

trend, is greatly entranced with simple explanations of what the candlestick

formations are illustrating. Fig. 6-19, The Applied Digital Solutions Inc.

chart revealed important information. The breakout opened and continued to move

up, closing on the high. It moved through the 200-day moving average with no

problems. This becomes a significant message.

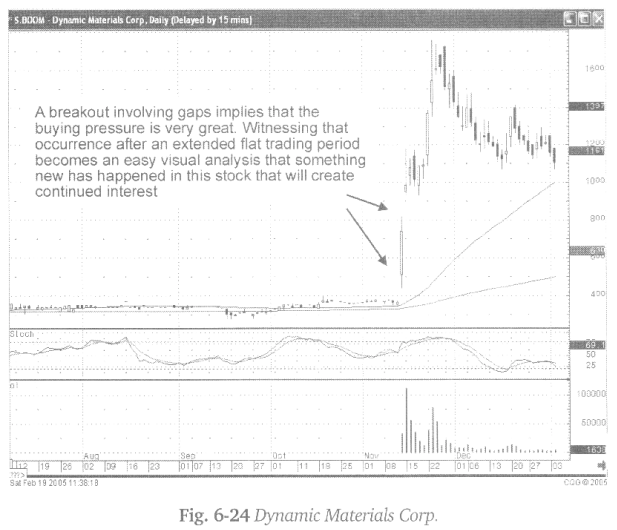

The term

breakout can be applied to stocks that have traded in a flat range for an

extended period of time. A giant move to the upside, based on any news

announcement or world event, becomes an important ‘alert’ system. Simple logic

dictates that if a substantial price move takes effect after a particular

event, the price move becomes a beacon for analyzing what a company’s potential

should be in view of that event.

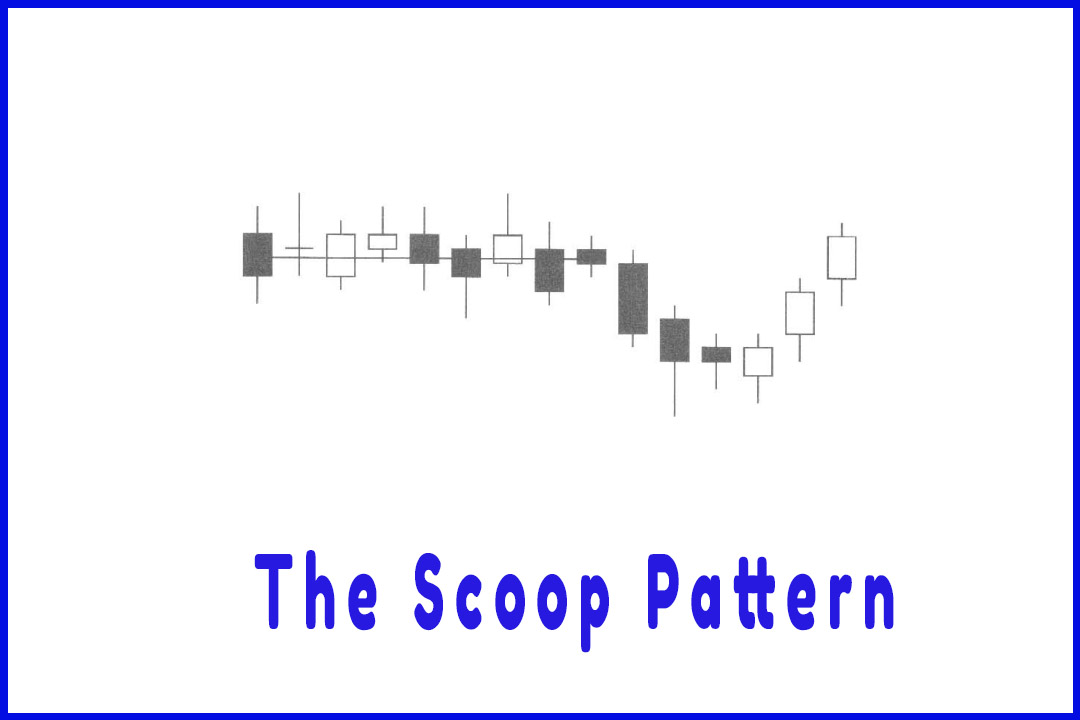

The

development of other formations, after a breakout, becomes very revealing as

far as what the next potential move will be. The evaluation, of what the

reaction should be from investors after an extensive move, is easily analyzed

when understanding candlestick analysis.

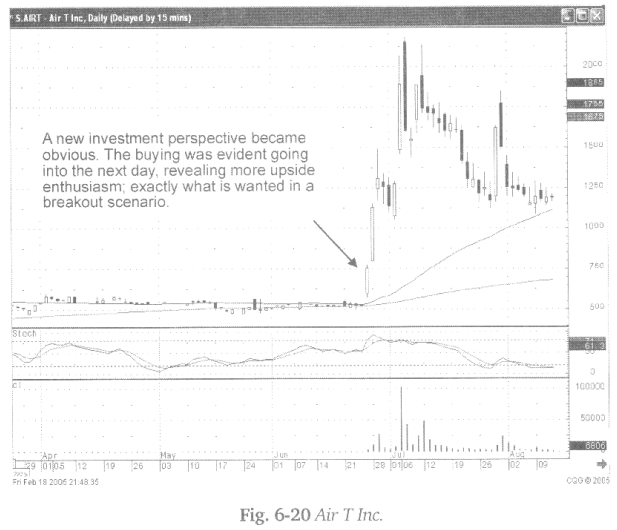

Fig.

6-20, The Air T, Inc. chart illustrates additional buying enthusiasm, even

after a 50% move in the price on the breakout day. The fact that the slight gap

up the following day was followed by continued buying indicated that the buying

pressure had not diminished. This creates a much different evaluation versus

seeing a gap open, followed immediately by selling, or an open that occurred

back down in the previous days trading area.

Having an

immediate visual graphic of what investor sentiment is producing is paramount

when debating whether to hold a position or take profits. When prices increase

dramatically, percentage-wise, in very short period of time, human emotion

factors have to be analyzed very quickly. The greed factor, the fear factor, or

the profit taking aspects have to be accounted for as quickly as possible.

Buying and selling decisions become quicker on the trigger. The fear of not

getting in fast enough or getting out fast enough becomes exaggerated in the

price movement.

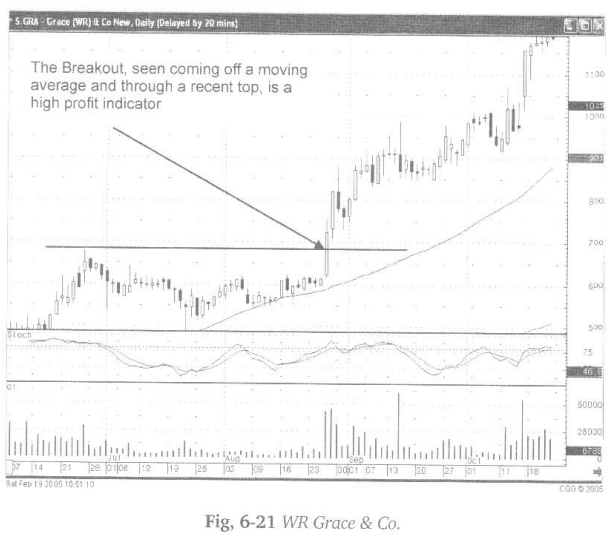

The

elements of a breakout pattern can involve other technical indicators. As seen

in Fig. 6-21, the W R. Grace & Co. chart, the 50-day moving average began

acting as support. Witnessing a big price move becomes the alert.

The fact

that the price move was created on big volume is another indicator. A large

price move, accompanied with high volume trading and breaking through the top

of an established price range, is a significant message. It clearly illustrates

that a new dynamic has entered this stock price.

The

combination of a gap up and a large candlestick body, with expanded volume, and

the price breaking out through a resistance level, is a clear message. The

bullish candle formation left little doubt at the end of the day that the

bullish bias was still present. Had a significant shadow been viewed at the end

of the day, to the upside, then a different analysis would have been applied.

The

question arises as to whether this may not be demonstrating exuberance at the

top. That observation would have been more crucial had this been a day of large

buying at the end of an uptrend. In this case, this was a breakout from a flat

trading area, definitely a different trading mode than witnessed in the prior

month and a half.

Breakouts

can also occur in an established trend. If they can clearly be observed in a

price pattern, such as a trading channel, and a large-volume price movement

breaches that trading area, that breakout now reveals new investor sentiment

coming into the price. How a price moves out of the norm, in a trading pattern,

is illustrated by the candlestick formation. The information revealed in that

formation can be used to great advantage for entering very profitable trades.

Does a

breakout always immediately signify massive gains? Not always! However, a

breakout from an established trading area should at least be the shot across

the bow. Notice in Fig. 6-22, the Catalina Marketing Corp, chart, the breakout

was obvious. Yet the main thrust of the uptrend did not occur until three weeks

to a month later. The gap up from the breakout day now becomes an important

factor. The pullback, after the initial breakout, appeared to stop at the

bottom of the bullish breakout candle. The fact that the 50-day moving average and

the 200-day moving average crossed as the price came back to the bottom of the

breakout candle adds significance.

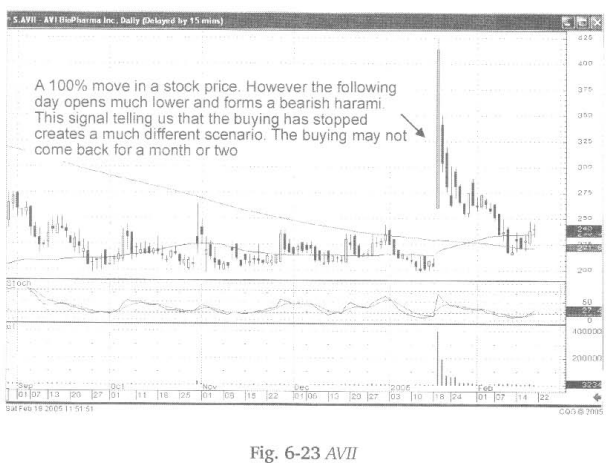

The

candlestick signals provide relevant information in a breakout situation.

Notice in Fig. 6-23, the AVII chart how a breakout, that more than doubled the

price of the stock, was followed the next day by a Bearish Harami. That

information provides a completely different scenario than if the buying was

still present the day after the breakout. This is nothing more than utilizing

what the Japanese Rice traders have observed for centuries.

Will the

price of this stock eventually recover to the high of the breakout? More than

likely. That provides the candlestick investor with an alert system to watch

for new activity in this stock. Keep in mind, the basic element of a breakout

situation is that a new dynamic has entered into the stock. The probabilities

indicate that the new dynamic will not disappear after one day of trading.

Whatever news or event that affects the price greatly is probably going to be

revisited within a reasonable amount of time.

A huge

move? What do the candlestick formations tell you is happening at the end of

the trading day? This information is valuable. The proper evaluation of a

breakout candle can produce very large profits.

How do

you find a breakout situation? This is a very simple scan. It involves finding

the stocks that have the biggest percent move during a given timeframe.

Breakouts are usually news-driven. They can be found in all-priced stocks.

Volume will have a great important also. Volume should be significantly greater

than a normal trading day. Some common sense still needs to be applied when

evaluating volume. A stock that normally trades 3200 shares a day that has a

big moves on 40,000 shares a day should not have as much relevance as a stock

that normally trades 200,000 shares a day and moves up to 4 million shares in

one day. Logic dictates that a low-volume stock can be moved around by one

purchaser.

Breakouts

are the result of something significantly different happening for the future

potential of a company (or any other trading entity). That result can be

visually analyzed in the candlestick bodies following the breakout move. Simple

analysis wants to identify whether the buyers are still involved. The presence

of more ‘buy’ signals, such as gaps up, acts as an efficient analytical tool.

The strength of an up move will be predicated upon the candlestick formations

appearing during or very soon after a breakout candle appears. As with all

analysis of candlestick signals, a black candle following a breakout does not

necessarily reveal a reversal if that black candle does not portray a

candlestick ‘sell’ signal.

The same

rules for analyzing candlestick signals in a normal trend should be applied in

a fast-moving breakout situation. A Shooting Star on a second day of a breakout

still requires confirmation the following day. A Bearish Harami reveals a

different scenario.

The

elements that form a breakout situation can produce extremely large profits for

the investor that takes the time to analyze what the candlestick formations are

revealing. Is it worth chasing a stock that is already up 40% on the day? If

you can interpret what the chart pattern is revealing, using candlestick

formations, the fear of chasing can be eliminated. The confidence that comes

with understanding what that chart formation can produce allows the candlestick

investor to participate in analyzed and calculated trades.

How To make High Profit In Candlestick Patterns : Chapter 5. Candlestick Signals and Patterns : Tag: Candlestick Pattern Trading, Forex : Single candlestick patterns, Types of candlesticks, Powerful candlestick patterns, Types of candlesticks, Candlestick chart analysis, Bearish candlestick patterns, Breakout Trading - Breakout Trading Strategy