The Scoop Pattern

Single candlestick patterns, Types of candlesticks, Powerful candlestick patterns, Types of candlesticks, Candlestick chart analysis, Bearish candlestick patterns

Course: [ How To make High Profit In Candlestick Patterns : Chapter 5. Candlestick Signals and Patterns ]

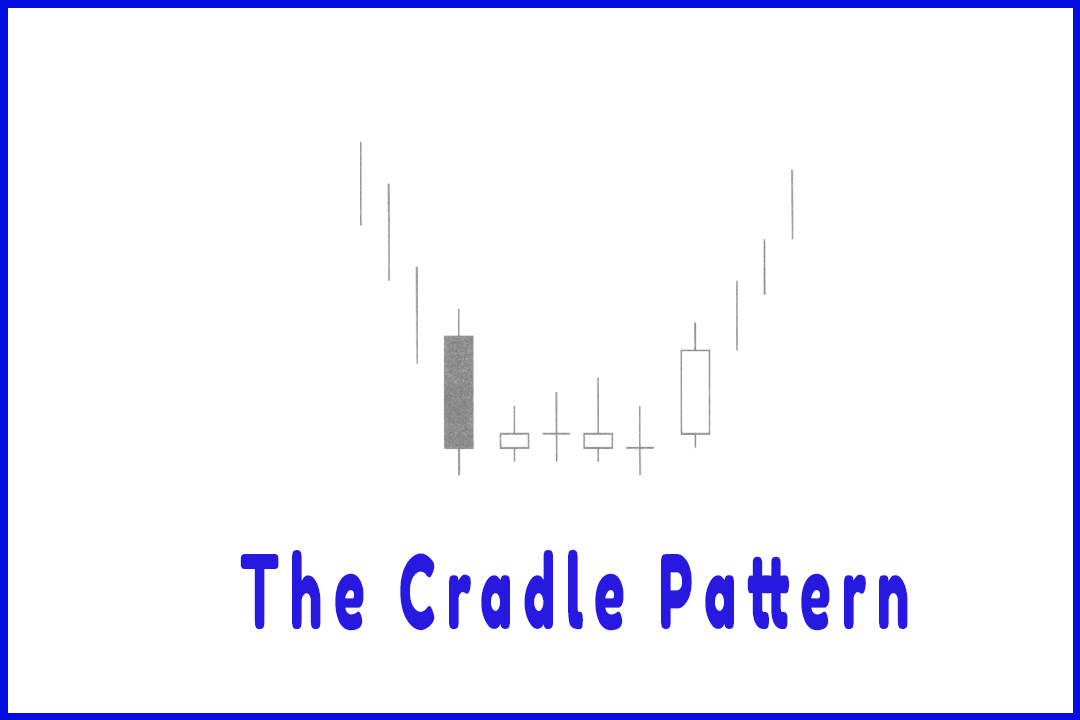

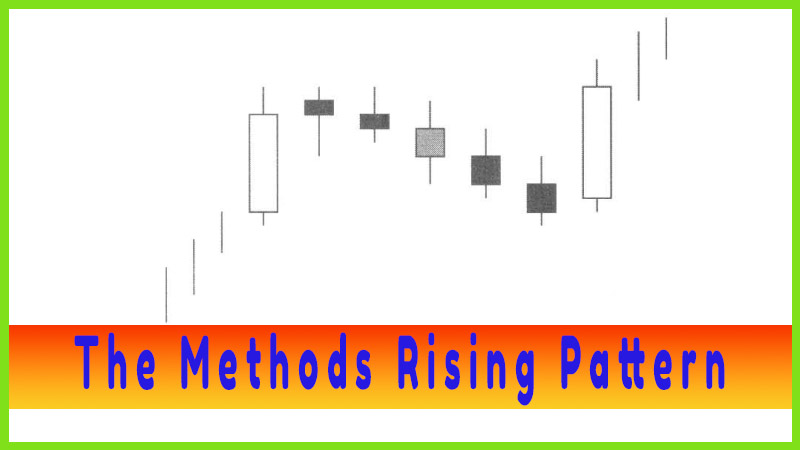

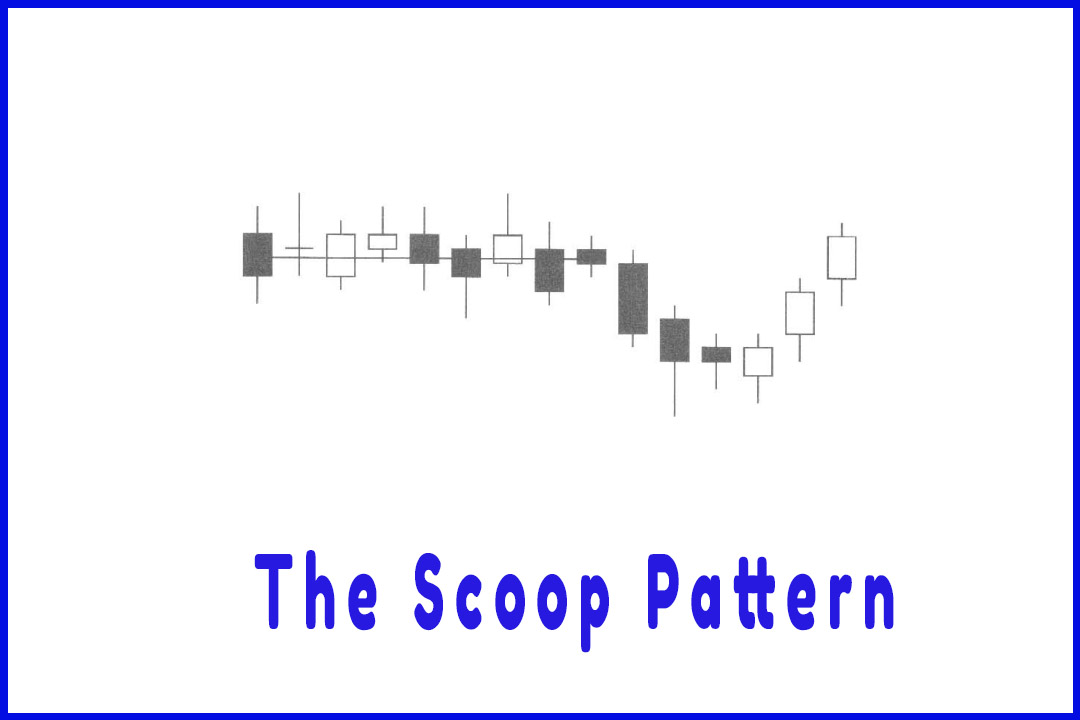

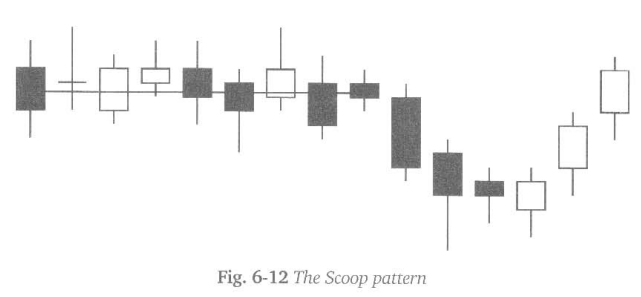

The Scoop pattern works effectively and can be easily recognized. The candlestick signals allow an investor to exploit it properly. The explanation of how and why it works is subjective. The pattern is formed after a lengthy period of flat trading, known as the ‘handle.’ The handle is usually comprised of small, indecisive trading days.

The Scoop Pattern

The Scoop

pattern works effectively and can be easily recognized. The candlestick signals

allow an investor to exploit it properly. The explanation of how and why it

works is subjective. The pattern is formed after a lengthy period of flat

trading, known as the ‘handle.’ The handle is usually comprised of small,

indecisive trading days. After a recognized flat trading timeframe, the price

starts to back down. The term “recognized” is visually determining a flat trading

area. That flat trading will usually maintain for a longer length of time than

what is usually seen in the price movement of that trading entity. It becomes

obviously lengthy, to the point where it becomes boring to be in that position.

It may be

the boredom that finally makes the price move down. Investors get tired of

waiting for it to do something. However, after a few days the small buying

signals start showing up. The price starts moving back up toward the flat area

creating the scoop. An inordinate percentage of the time when the price comes

back up to the flat trading area, the trend continues in a strong upward direction.

This may be the result of everybody that was bored with the trading sees it is

finally moving and start adding to their positions again.

The

visual recognition of the handle, being followed by the pullback should be the

‘alert.’ Upon seeing new buying, after a few days a pullback is a set up for a

low risk trade. Buying near the bottom of the scoop allows the stop-loss area

to be at the low of the scoop. The first test from there should be the flat

trading area. A breakout through that area indicates that a good trend is in

the making.

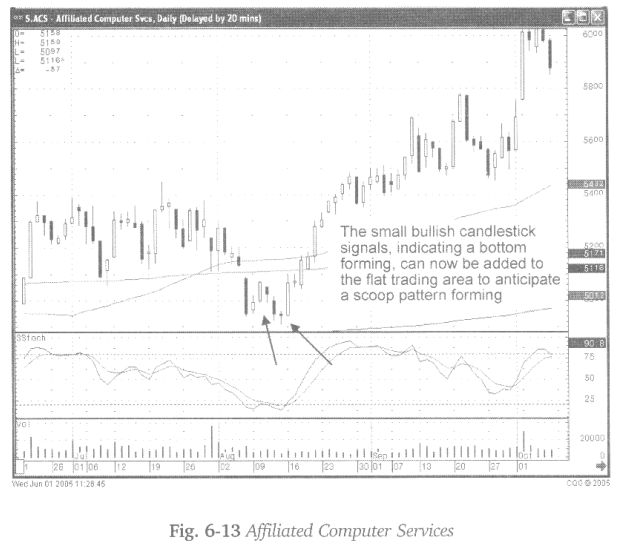

Fig.

6-13, The Affiliated Computer Services chart reveals a flat trading period,

followed by the price breaking down. After just a few days of pullback, bullish

candlestick signals start to appear. Being able to visualize the handle,

followed by a pullback, then witnessing candlestick buy signals should alert

the candlestick investor to the potential of a scoop pattern forming.

Additional

technical indicators such as moving averages can help anticipate a support

level. The trading support at that level after a relatively long flat trading

area adds more visual credibility to the scoop pattern development.

As seen

in Fig. 6-14, the WCI Communications chart, the 5O-day moving average is a

logical support level.

“Half of being smart is knowing what you’re dumb at.”

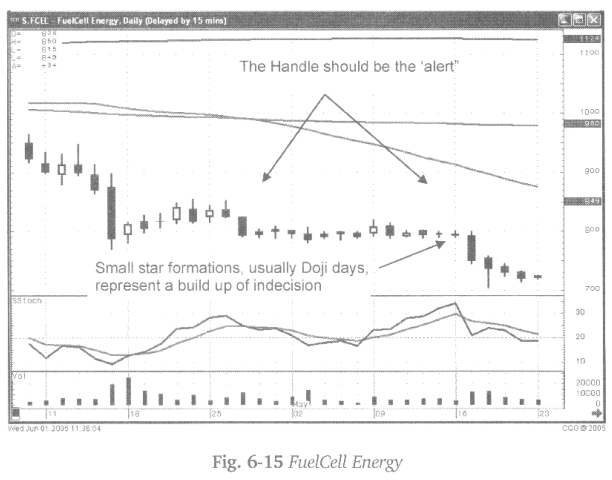

What is

the key element forewarning a Scoop pattern? As can be seen in Fig. 6- 15, the

FuelCell Energy chart, the long flat trading area, the handle, followed by a

pullback has the makings for a Scoop pattern. Notice how the force of the

selling is depicted by the smaller candlestick bothes until a little star

formation appears. That should suggest watching for new buying.

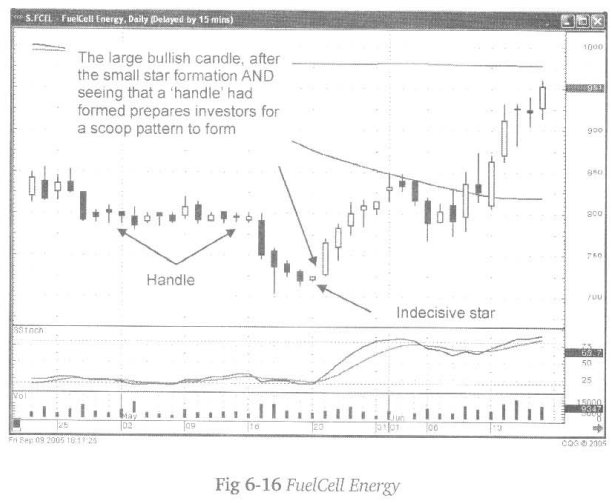

The

trajectory of the downtrend, created by small trading days, is an alert to

expect bottoming action. Once buying is witnessed at this level anticipate the

first price test to be back at the ‘handle’ level. The appearance of a large

bullish candle after the Star/Doji provides a better visual confirmation that a

Scoop Pattern is about to form. The analysis from that point is anticipating a

test of the recent flat trading area. A successful scoop pattern will be the

stimulus for a long and steady uptrend.

The

uptrend can continue for an extensive period of time, keeping the stochastics

waffling in the overbought area. It is not unusual to see the uptrend coming

out of the scoop pattern last for four to six weeks. This makes identifying the

scoop pattern in its early formation an extremely profitable trade.

Once the

price has tested and then breached the previous flat trading level, upside

targets can be projected. FuelCell Energy hit its first target, the 50- day

moving average. Once an uptrend comes through the handle area, the stochastics

become less of an influence.

The Scoop

pattern, the same as the Fry-Pan Bottom pattern, is going to be more effective

when the stochastics are in the overbought area. Also, developing a scan for a

scoop pattern is going to be difficult. The only recognition of the pattern

comes from reviewing the chart once a buy signal occurs at the end of a

pullback. Recognizing the flat trading period prior to the pullback prepares

the investor for a high profit trade.

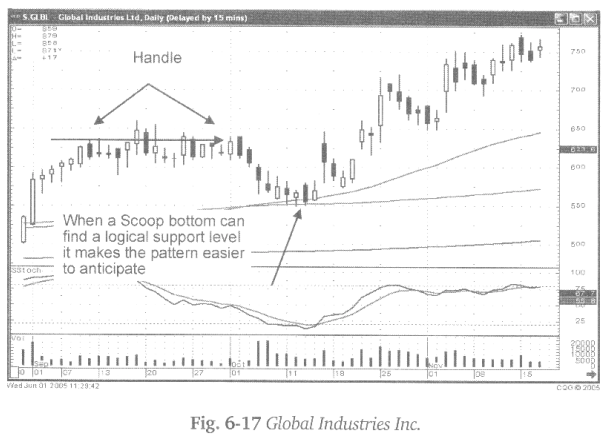

As seen

in Fig. 6-17, the Global Industries, Inc. chart, the buy signals forming in an

oversold condition was the first alert. Those signals forming right on the

moving averages added more credibility to the trade. Was this a worthwhile

trade? That becomes an easier evaluation when understanding that a Scoop

pattern possibility should at least test the ‘handle’ area. If the handle area

was breached, then the likelihood of a strong trend after that was good.

The Scoop

pattern can produce big profits. Buying at the bottom of the potential scoop

makes for a small stop-loss set-up. The first test is the handle. The upside

potential if breaching the handle will provide good profits.

How To make High Profit In Candlestick Patterns : Chapter 5. Candlestick Signals and Patterns : Tag: Candlestick Pattern Trading, Forex : Single candlestick patterns, Types of candlesticks, Powerful candlestick patterns, Types of candlesticks, Candlestick chart analysis, Bearish candlestick patterns - The Scoop Pattern