High Profit Patterns Enhanced with Candlestick Signals

candlestick signals, candlestick reversal patterns, High Profit candlestick Patterns, High Profit trading Patterns

Course: [ How To make High Profit In Candlestick Patterns : Chapter 5. Candlestick Signals and Patterns ]

The effectiveness of candlestick signals stem from one basic factor. Human emotions! When applied to investment decisions, human emotions produce signals. Technical analysis, in general, is the result of price patterns forming recurring patterns.

High Profit Patterns Enhanced with Candlestick Signals

The

effectiveness of candlestick signals stem from one basic factor. Human

emotions! When applied to investment decisions, human emotions produce signals.

Technical analysis, in general, is the result of price patterns forming

recurring patterns. The ebb and flow of investor decision-making processes have

produced a multitude of technical indicators. The utilization of these indicators

is the result of recognizing statistically favorable price movements. Indicators,

such as stochastics, Fibonacci numbers, Elliot Wave, and many other technical

analytical tools exist because they identified recurring price patterns.

Most

technical analysis is the anticipation of price behavior at specific levels.

The Fibonacci investor is expecting something to occur at the 38% retracement,

50% retracement, or the 62% retracement level. The ‘stochastics’ investor will

buy when the slow stochastics and the fast stochastics cross each other in the

oversold condition. An investor, utilizing trend-lines, will buy or sell when a

price confirms a reversal at those levels.

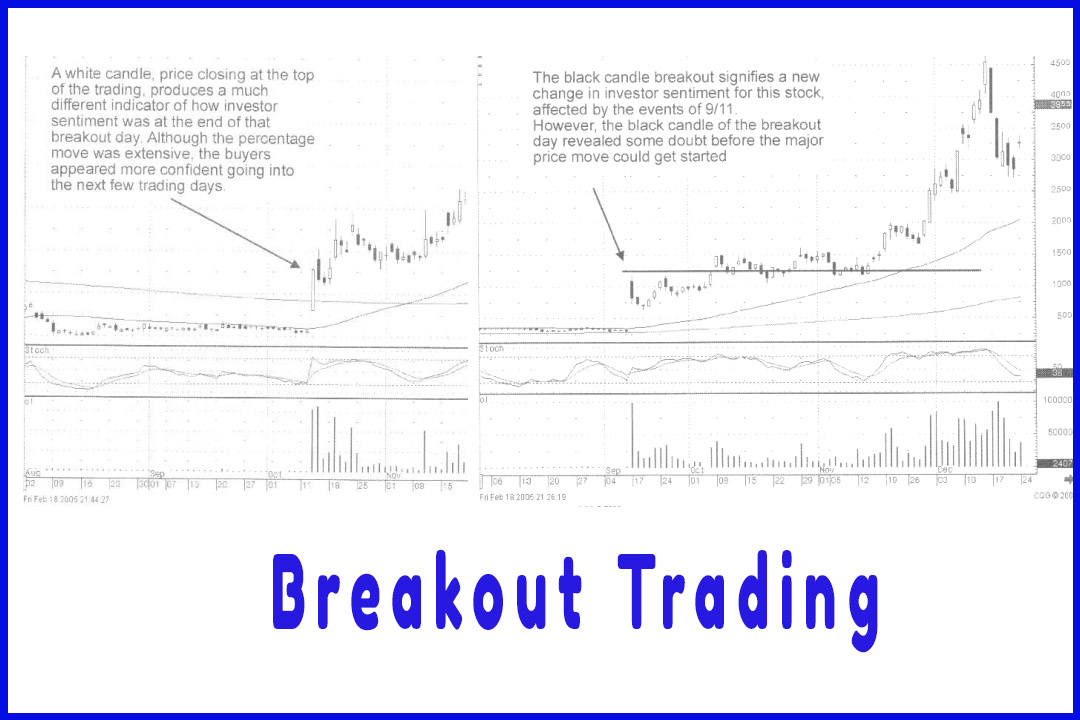

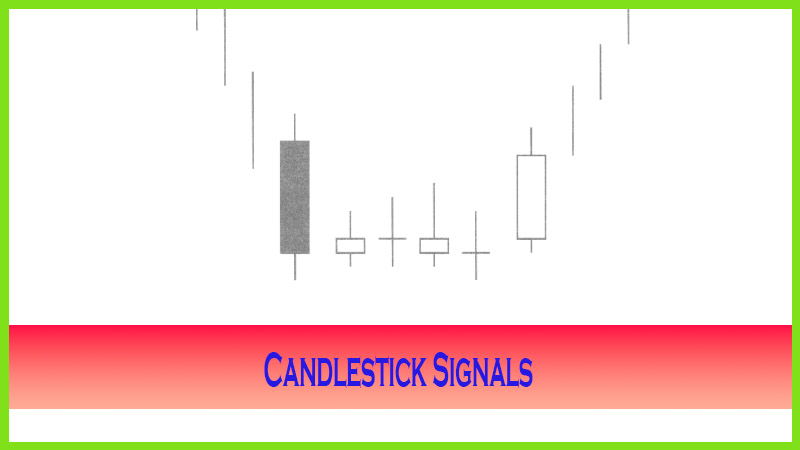

A major

benefit of candlestick signals is the illustration of what investors are doing

right at that time. Applying candlestick signals to other technical methods

dramatically increases the probabilities of being in a correct trade. Instead

of anticipating, then waiting for confirmation of a trend reversal at a major

technical level, an investor can immediately analyze what investor sentiment

is doing right at that level. This allows for entry and exit strategies to be

implemented at opportune times or levels.

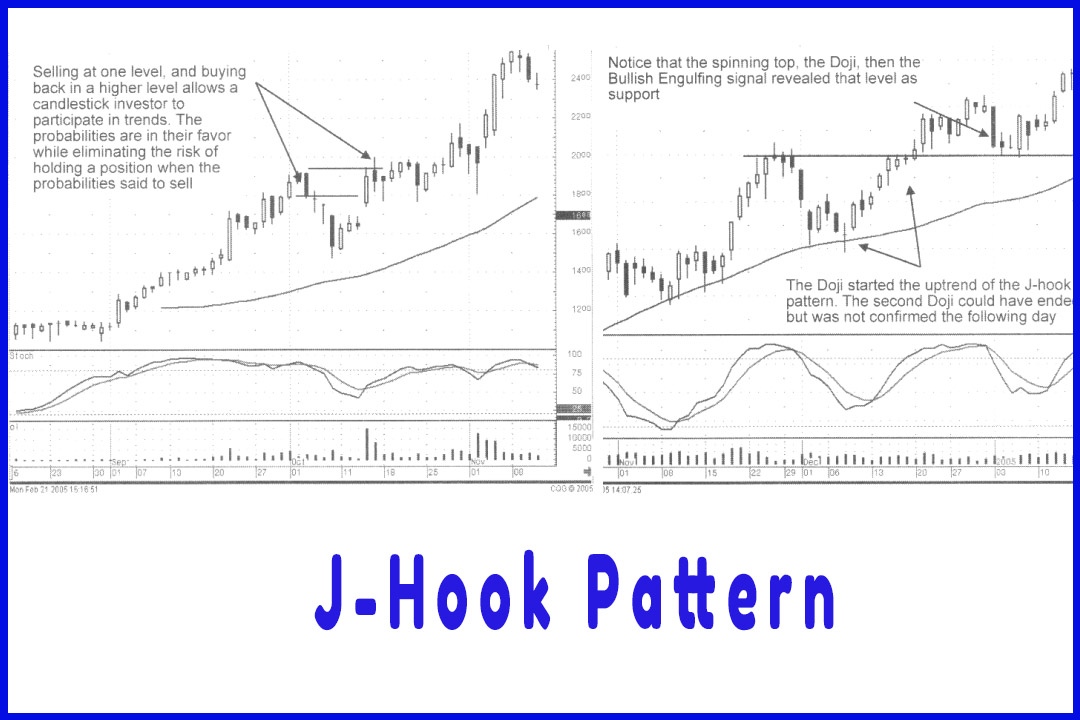

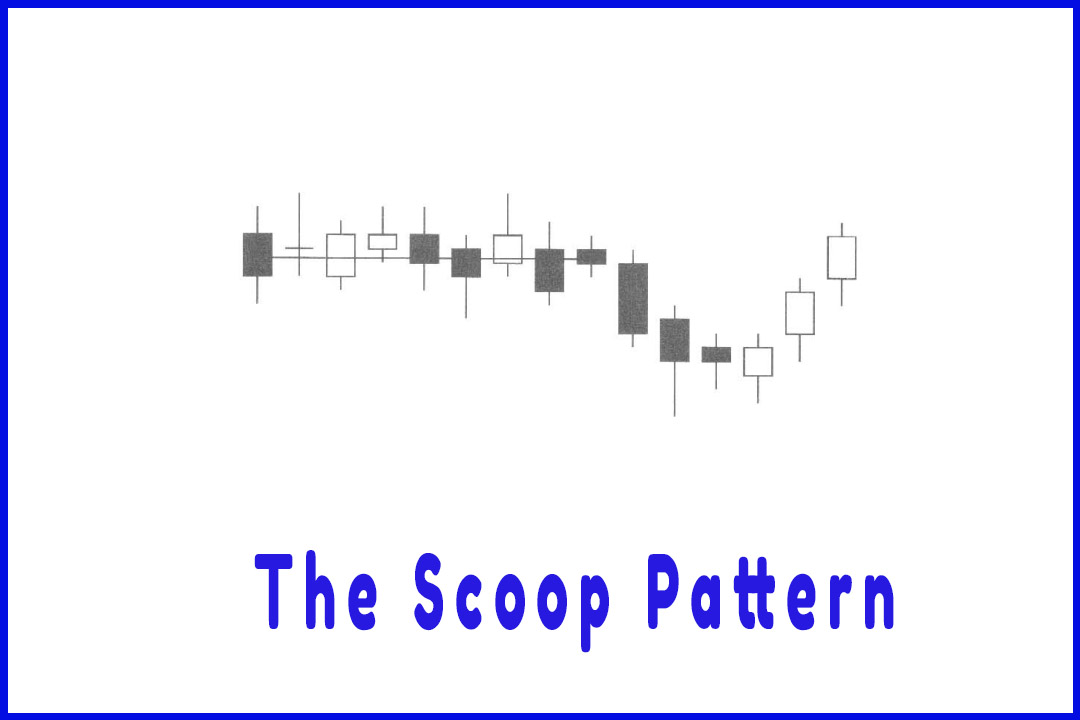

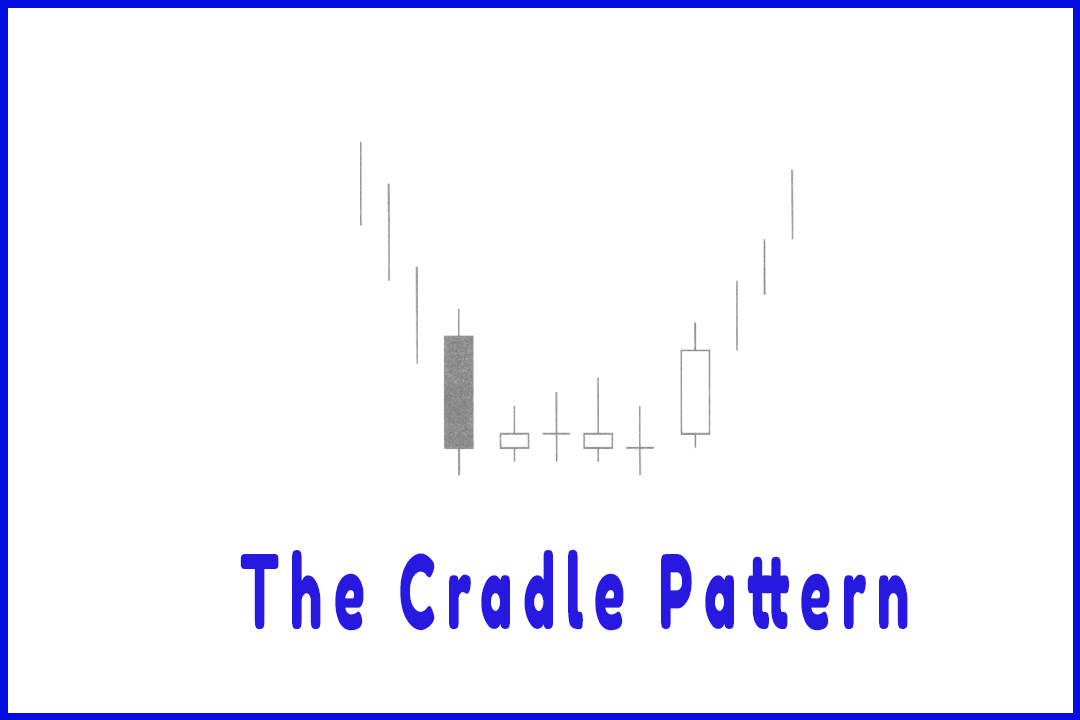

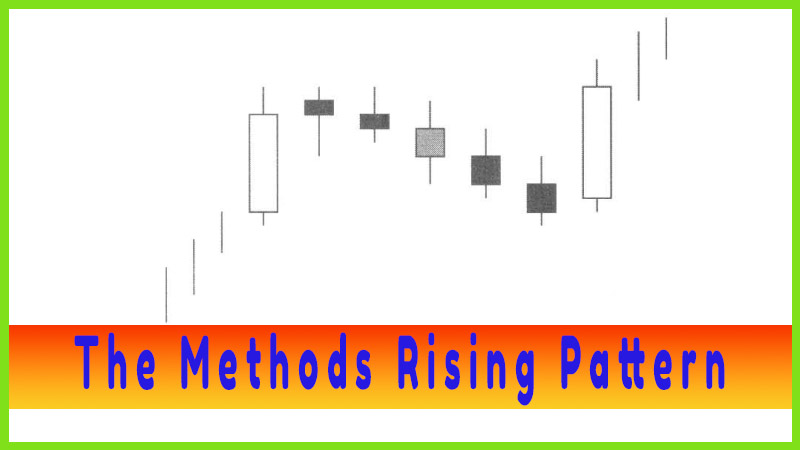

An

additional benefit of the candlestick signals is the ability to recognize a

high-profit pattern in the process of forming. Having the ability to visually

analyze a high-profit pattern formation allows for the preparation of entering

a trade at a low-risk level. Entering a trade in the early stages of a reversal

pattern makes the stop-loss strategy easier to implement. A failure of the

pattern permits an investor to close out a made with minimal losses.

Recognizing

the components of a high-profit pattern allows an investor to take profits when

it is time to take profits. It also allows the investor to re-enter the trade

when the pattern indicates further profitability. This ability greatly reduces

the risk factors.

How To make High Profit In Candlestick Patterns : Chapter 5. Candlestick Signals and Patterns : Tag: Candlestick Pattern Trading, Forex : candlestick signals, candlestick reversal patterns, High Profit candlestick Patterns, High Profit trading Patterns - High Profit Patterns Enhanced with Candlestick Signals