Candlestick Gap up at the Bottom

Profitable Candlestick Trading, Harami signal , bearish candle, Reversal Pattern, Candle Gap analysis

Course: [ How To make High Profit In Candlestick Patterns : Chapter 3. High Profits Using Gaps ]

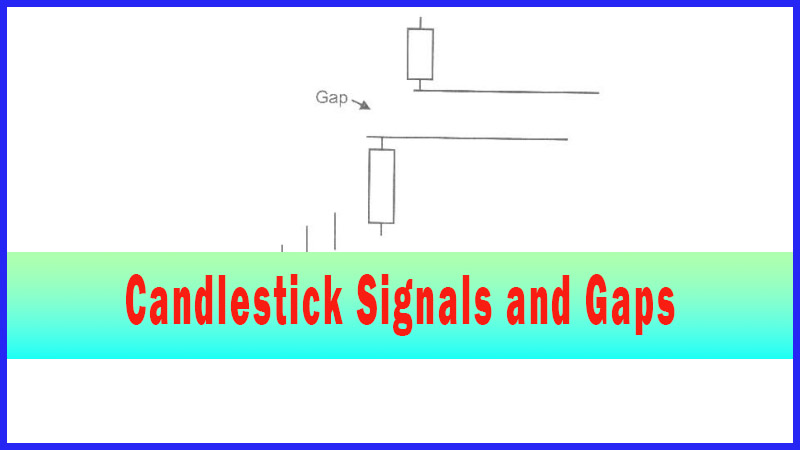

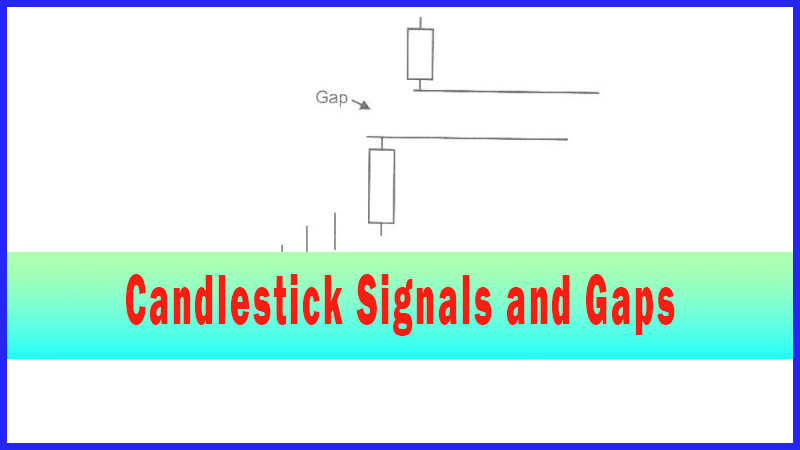

A gap, appearing after a candlestick “buy” signal, has powerful implications. Knowing that a gap represents enthusiasm, getting in or out of a stock position becomes an easy identification process.

A Gap up at the Bottom

A gap, appearing after a candlestick “buy” signal, has powerful

implications. Knowing that a gap represents

enthusiasm, getting in or out of a stock position becomes an easy

identification process. The forewarning that a strong profit potential

situation is about to or has occurred is established. Where is the best place

to see rampant enthusiasm? At the point you are buying, near the bottom.

Obviously, seeing a potential Candlestick “buy” signal, at the bottom of an

extended downtrend is a great place to buy. In keeping with the concepts taught

in Candlestick analysis, we want to be buying stocks that are already oversold,

to reduce the downside risk. Evidence that buyers are very anxious to get into

the stock is all that much better.

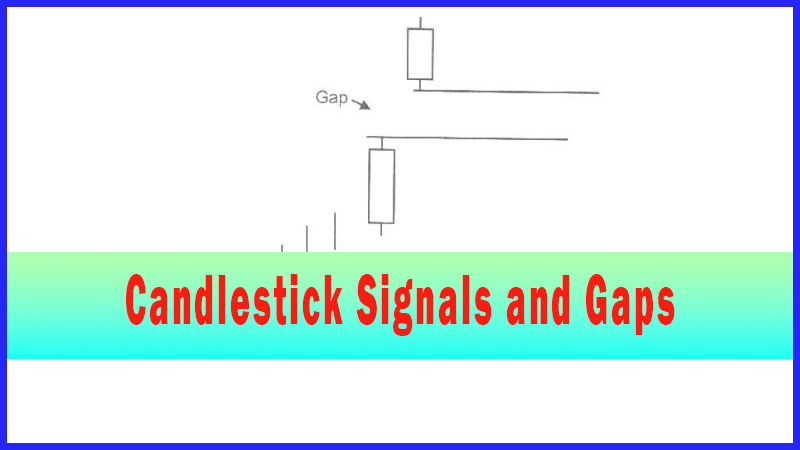

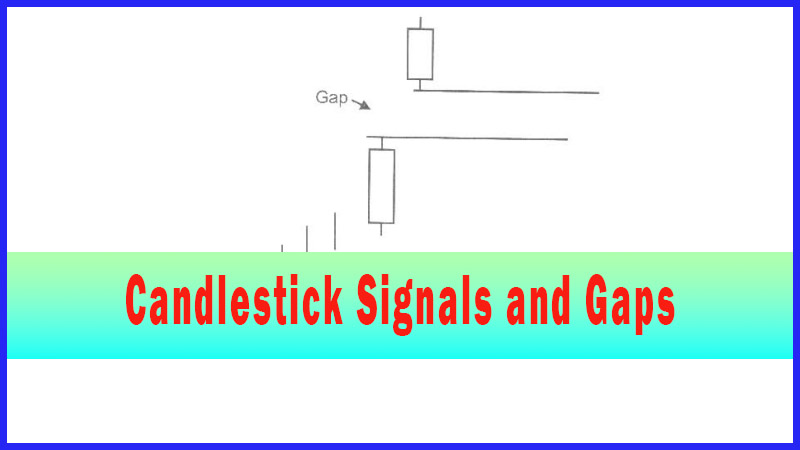

Reiterating

the basics of finding the perfect trades, as found in the Article “How To make High Profit in Candlestick Patterns,”

having all the stars in alignment makes for better probabilities of producing a

profit. The best scenario for a high-profit trade is a candlestick “buy”

signal, in oversold condition, confirmed with a gap up the following day.

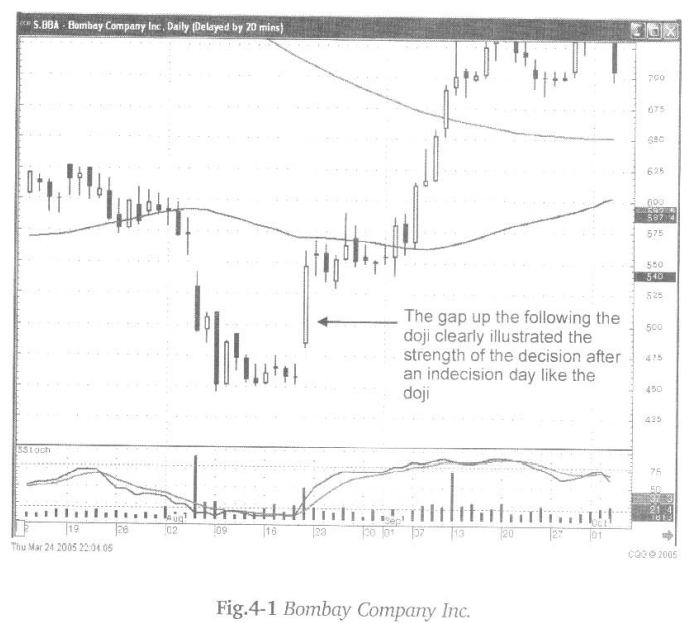

Illustrated in Fig. 4-1, the Bombay Company, Inc. chart, the uptrend was

obviously instigated after a gap up and large bullish candle following a Doji.

The fact that prices gapped up was clear illustration that buyers wanted to get

into this stock with great fervor.

Unofficially,

statistics illustrate an 80% or better probability that a trade will be

successful when stochastics are oversold, a Candlestick “buy” signal appears,

and prices gap up. (The Candlestick Forum will offer our years of statistical

figures as “unofficial.” Even though over fifteen years of observations

and studies have been involved, no formal data gathering programs have been

fully operated. However, currently the Candlestick Forum is involved with two

university studies to quantify signal results. This is an extensive program

endeavor. Results of these studies will be released to Candlestick Forum

subscribers upon completion. This study has been long and difficult, but

results are expected sometime in the near future.)

Having

this statistic as part of an investor’s arsenal of knowledge creates

opportunities to extract large gains out of the markets. The risk factor

remains extremely low when participating in these trade set-ups.

Many

investors are afraid to buy after a gap up. The rationale being that they don’t

like paying up for a stock that may have already moved 3%, 8%, 10%, or 20%

already that day. Witnessing a Candlestick “buy” signal prior to the gap up

provides a basis for aggressively buying the stock. If it is at the bottom of a

trend, the 3%, 8%, 10% or 20% initial gap move may just be the beginning of a

50% move or a major trend that can last for months.

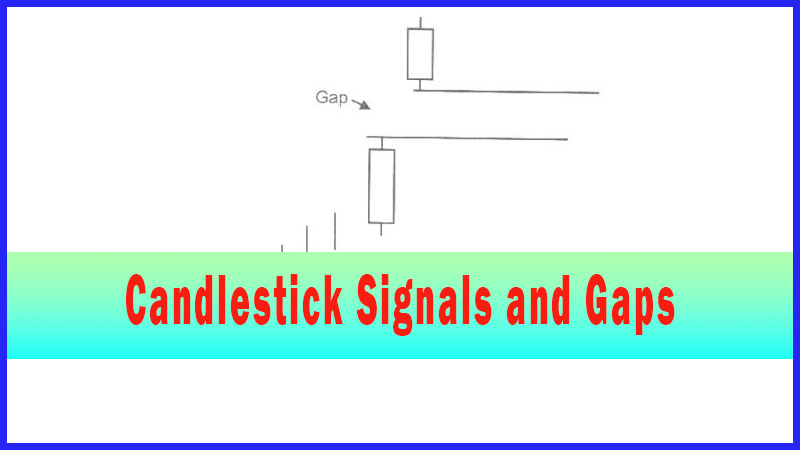

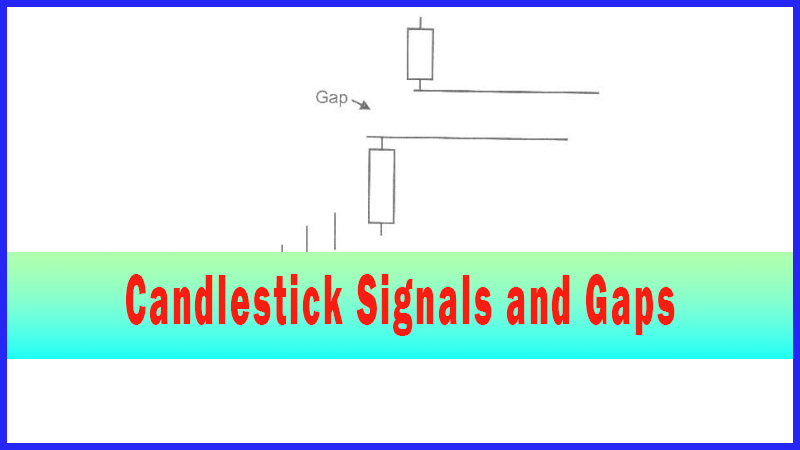

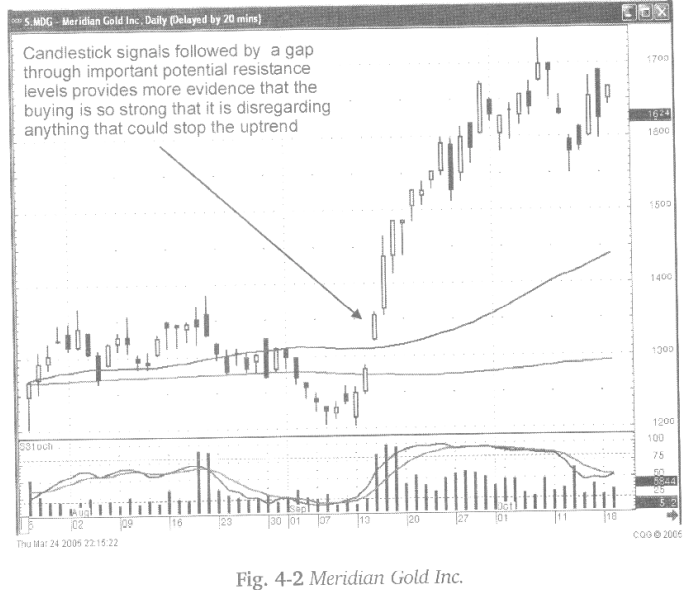

The

strength of an uptrend can be better verified when the gap in price moves up

past potential resistance levels. As illustrated in Fig. 4-2, the Meridian

Gold Inc. chart, the price gapped up over the 50-day moving average, what had

previously been acting as a resistance area. The strength of the buyers is

clearly represented. The fact that the price breached the moving average, while

still forming a bullish candle after the open price, illustrates that the

buying sentiment did not diminish after the dramatic increase in price.

The

more parameters in place, confirming an uptrend, the higher the probability of

being in a correct trade. Add to that the confirmation of excessive buying

strength, a gap up in price, the higher the probabilities that a strong uptrend

is occurring.

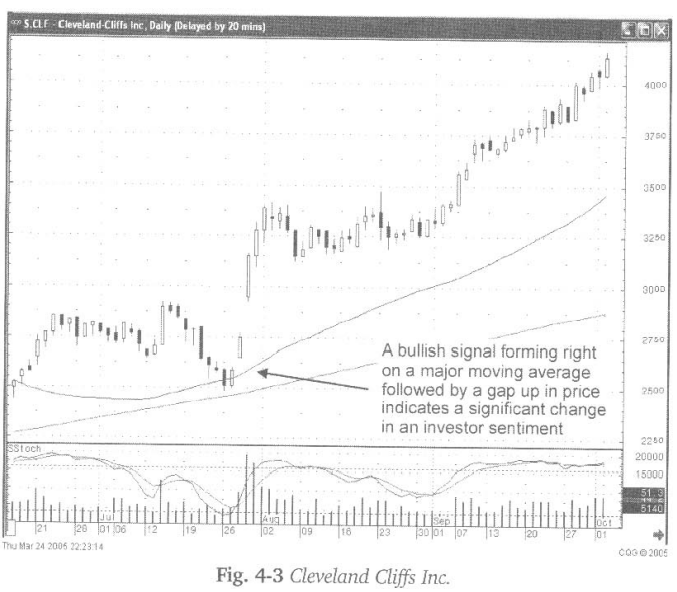

Fig.4-3,

The Cleveland Cliffs Inc. chart reveals a Bullish Harami forming right on the

50-day moving average followed by a gap up in price. First, the Bullish Harami

forming on the 50-day moving average became a good indication that the moving

average was going to act as support. The gap up the following day made it

evident that many buyers felt the same way. If one gap shows enthusiastic

buying, two gaps reveal that much more strength. The trend is your friend, an

often the spoken adage. Gaps, when used correctly, are your best friends.

This

is not a difficult analysis. Witnessing a candlestick buy signal followed by

exuberant buying is exactly the type of trade an investor should be looking

for.

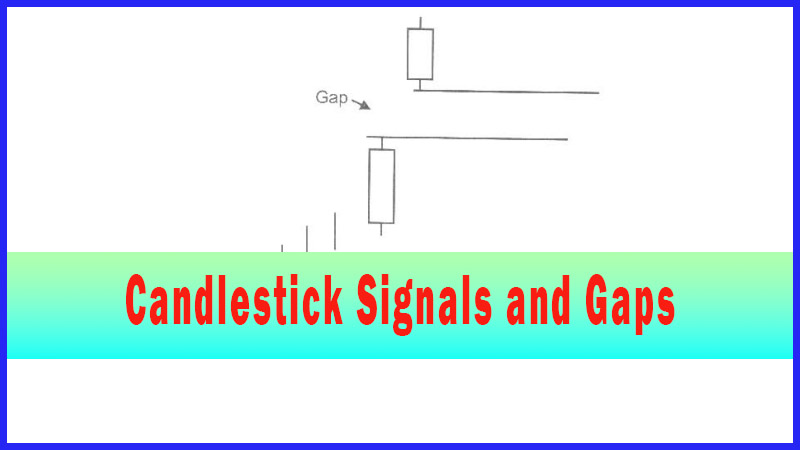

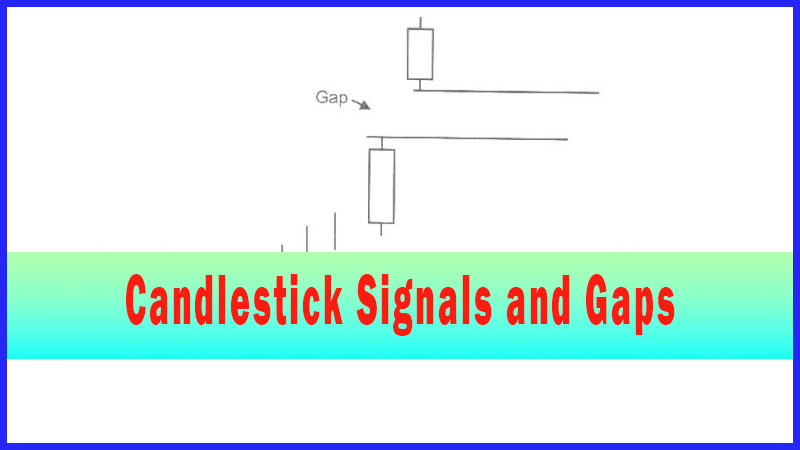

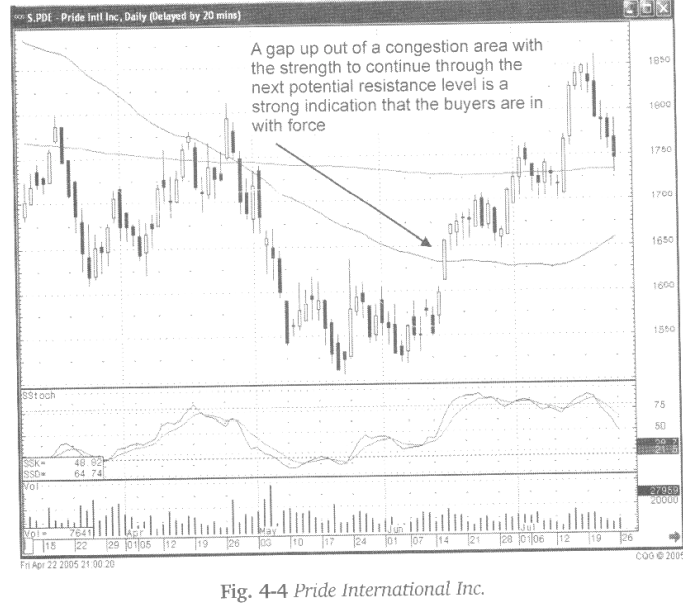

Fig.

4-4, The Pride International Inc. chart illustrates how the enthusiastic buying,

after a candlestick signal, provides the confirmation that a strong uptrend is

in progress. Notice how the Kicker type signal, a strong bullish indication in

itself, precludes the strong uptrend. The next day it gaps up on a strong

bullish candle. The gap up, followed by strong continued buying, reveals a

number of bullish observations.

The

gap occurs at what could be considered a mild resistance level. The price

appeared to have trouble closing above the $16 level. When the price gapped up

through drat area, it revealed that the $16 area was not acting as resistance

any more. Next, the strong bullish candle went through the 50-day moving

average. That average acted as a resistance level earlier. Witnessing price

moving out of a trading range and through potential resistance should indicate

that a new dynamic has come into the price trend.

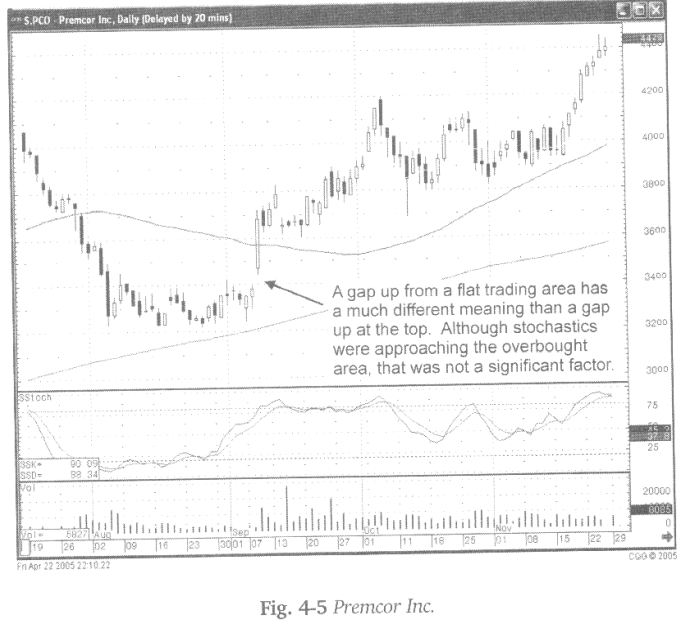

Candlestick

analysis can also be applied to what a price was doing before a significant buy

situation. As seen in Fig. 4-5, the Premcor Inc. chart, August was a period of

indecisive trading. There would not have been anything in the trading, during

that time, that provided any reason to get excited about getting into that

stock position. The gap up, out of the congestion area, now becomes a clear

indication that new investor sentiment has entered this stock trend.

Once

the gap up, followed by a strong bullish candle was observed, candlestick

analysis of the prior month of trading becomes useful. Although the daily trading

ranges were relatively insignificant, they were showing small bullish candlestick

signals. Upon reviewing the trading during that time, it becomes obvious that

it was forming a basing range. That information now becomes useful for

analyzing the gap up.

The

congestion area formed a resistance level at the $34 price. Once the price gapped

up through that level, it became immediately obvious that the $34 level was not

acting as resistance any more. Next, the large bullish candle went straight

through the 50-day moving average without any problems. Obviously, the 50-day

moving average was not going to act as resistance. Being able to analyze what

happened prior to the gap up allows the candlestick investor to better evaluate

what was going on in investor sentiment. Although stochastics was now nearing

the overbought area when the gap up occurred, the strength with which the

buyers started entering into the stock price produces a different scenario. A

breakout from the congestion area meant new enthusiasm was coming into the

stock price.

A

gap up occurring at a top of a trend, with stochastics in the overbought area,

might have a much different conclusion. In this case, the gap up did not occur

at a top of a trend. As observed, the trend was sideways prior to the gap up.

This observation would put a different importance on the location of the

stochastics.

Being

able to analyze what the candlestick signals were doing prior to a gap up

produces valuable information for entering high-profit trades. Preparing one’s

eyes for successful and powerful price-movement setups aids an investor in

being mentally ready to immediately exploit a high profit potential signal.

This is a simple process. Having a mental picture of how a high-profit potential

trade begins helps an investor enter that trade at a very early stage. This not

only benefits the profitability; it also reduces loss potential. Entering a gap

up situation in the very early stages of its development, provides more

effective time and price entry levels to get in and out of the trade if it

doesn’t reach full expectations.

How To make High Profit In Candlestick Patterns : Chapter 3. High Profits Using Gaps : Tag: Candlestick Pattern Trading, Forex : Profitable Candlestick Trading, Harami signal , bearish candle, Reversal Pattern, Candle Gap analysis - Candlestick Gap up at the Bottom