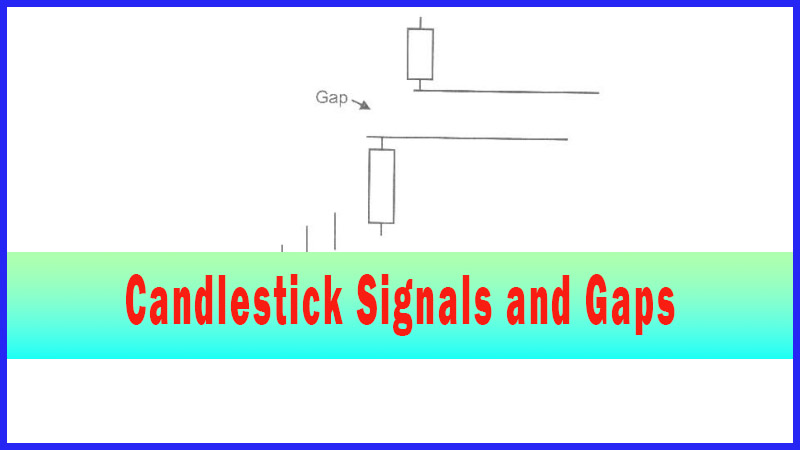

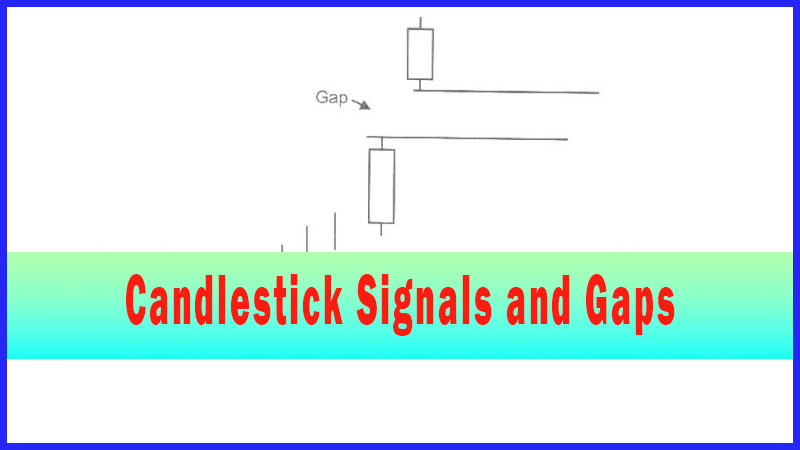

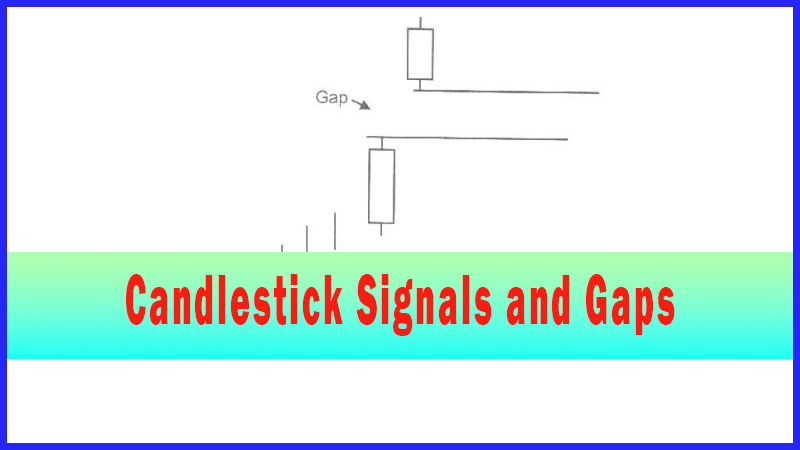

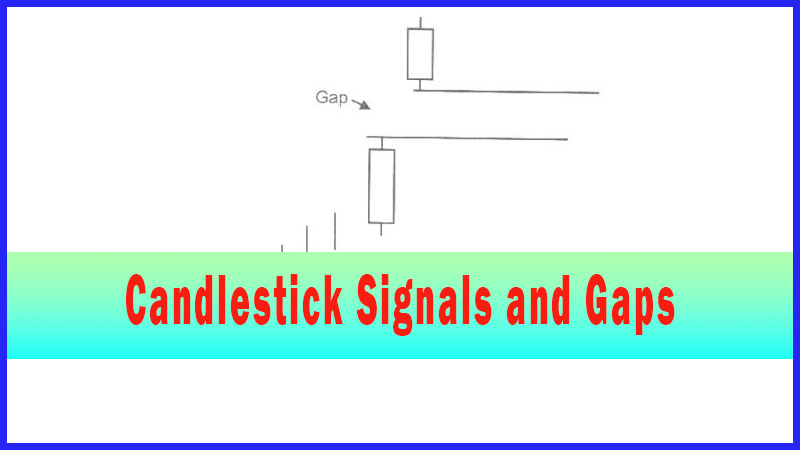

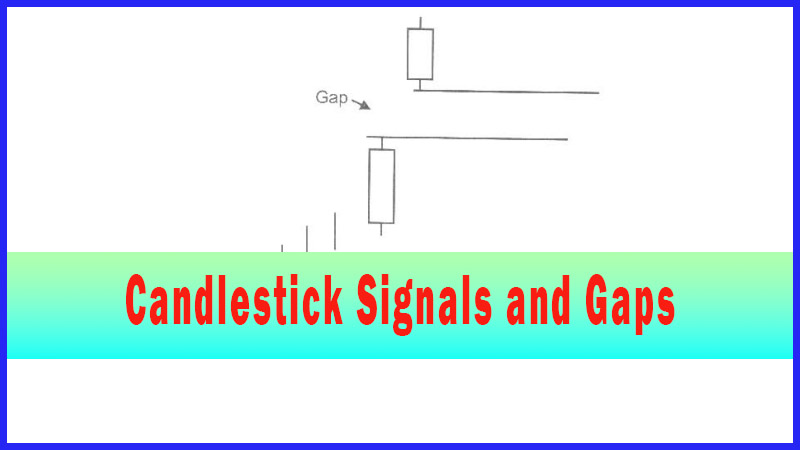

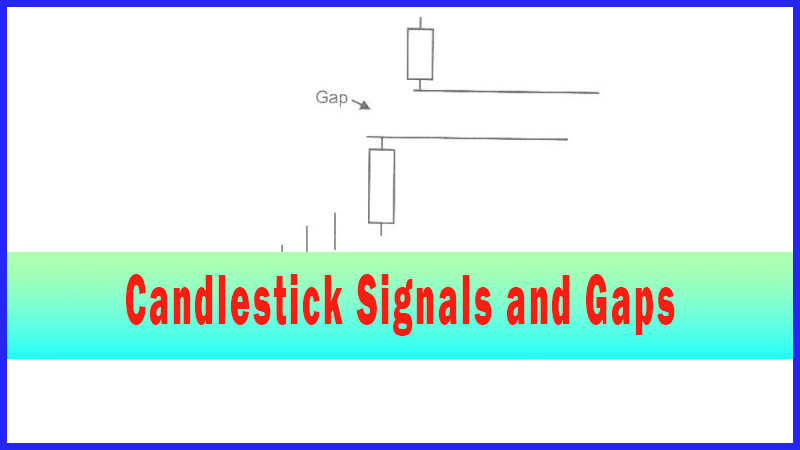

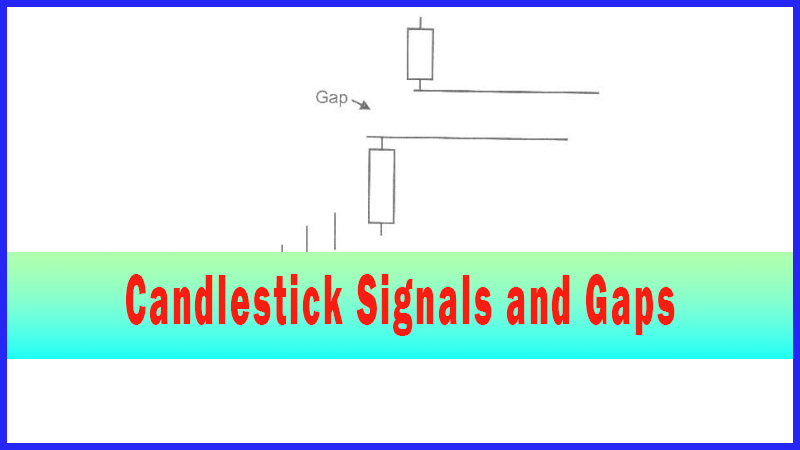

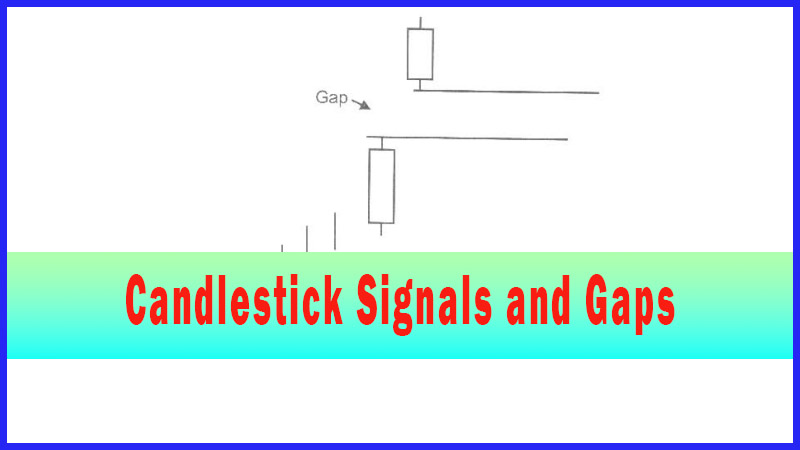

Gaps at the Top Reveal Exuberance

candlestick chart gap top pattern, Gap-up, Gap-down, High Profit pattern

Course: [ How To make High Profit In Candlestick Patterns : Chapter 3. High Profits Using Gaps ]

Exuberance at the top is depicted with the formation of long candles or a gap up. When either or both of these situations occur, be prepared for a candlestick sell signal to soon follow. This becomes a simple visual analysis.

Gaps at the Top Reveal Exuberance

“Each problem that I solved became a rule, which served

afterwards to solve other problems.”

Exuberance

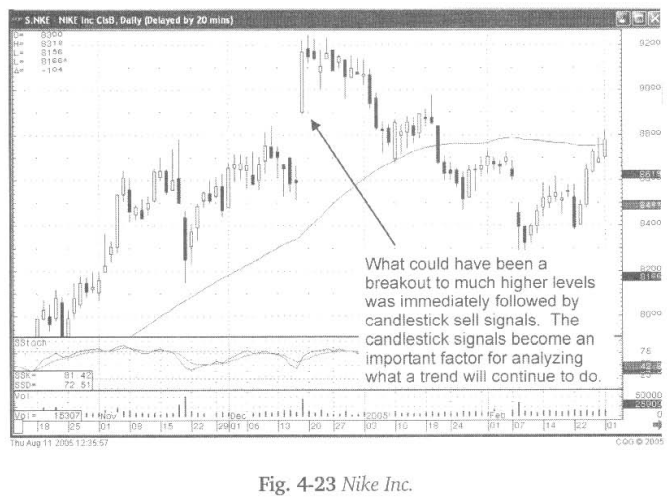

at the top is depicted with the formation of long candles or a gap up. When

either or both of these situations occur, be prepared for a candlestick sell

signal to soon follow. This becomes a simple visual analysis. Being able to

correctly interpret the investor sentiment conveyed in a gap up at the top becomes

an important decision-making factor. Fig. 4-23 (following page), The Nike Inc.

chart reveals a gap up followed by strong buying when stochastics is well in

the overbought area. The following four or five trading days indicate

indecisive movement between the Bulls and the Bears at those high levels. The

big trading day either revealed that something major was happening in the stock

price or it was the final exuberant buying. The fact that the next five days

showed indecisive trading, no bullish follow through, now provides a better

picture of what is happening to investor sentiment.

Described

in the “Stop Loss” chapter later in the book,

effective stops can be placed upon a gap up in overbought condition. Simple

techniques allow for reaping the majority of the potential returns from a

trend.

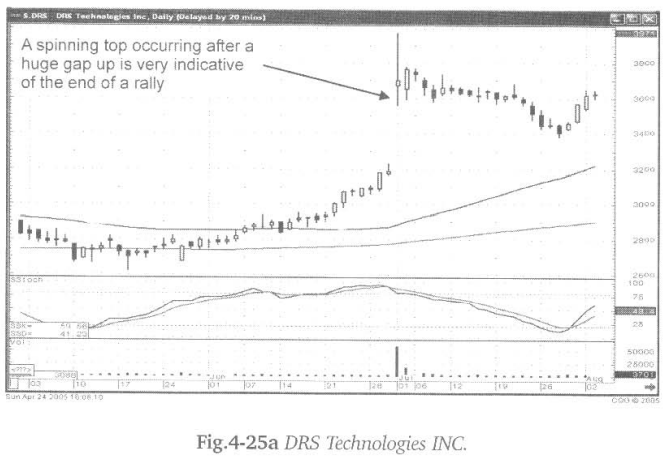

When

prices gap up in overbought conditions the potential for forming a candlestick

‘sell’ signal becomes favorable. Prices backing off from those levels can form

a Dark Cloud or Bearish Engulfing signal if they continue weak for the rest of

the trading day. Even if prices come back up to the top of the trading range, a

signal such as the Hanging Man or a Doji could be formed.

If

prices continue higher, and pull back by the end of the day then a Shooting

Star can be formed. Once a gap up occurs, the only possibility of a candlestick

sell signal not appearing is when prices open higher and then continue to trade

to the higher end of the trading range. If this is the case, the placement of

stop losses, as recommended in the “Stop Loss" chapter, will not be

affected. Profits will continue to be made. However, the point of being

prepared for a gap up at the top is based on probabilities. The “probabilities” a trend is over is much greater than

anticipating the trend going higher.

Fig.

4-24, The XM Satellite Radio Holdings Inc. chart illustrates that the sellers

are ready to take over, after an extended uptrend that is followed by a gap up.

Unless something dramatic is about to occur, such as an announcement of good

news for the company, it is likely that the uptrend is over. This assumption is

based upon the visual observations over the past few centuries. Why invest

against the probabilities?

If

the gap up is substantial, and it continues higher, put the stop at the open

price level. On any of the scenarios described, the price moving back to the

‘stops’ would more than likely create signals that warranted liquidating the

trade, forming Shooting Stars, Dark Clouds, Meeting Lines or Bearish Engulfing

patterns. In any case, sellers were making themselves known. It is time to take

profits in the high-risk area and find low risk ‘buy’ signals at the bottom of

a trend.

The

candlestick investor requires nothing more than the training of the eye to

recognize high probability patterns. A large gap up in an overbought condition

provides a definite decision-making process. As a rule, the appearance of

exuberant buying is the time to be prepared to take profits. The question that

should always be asked, “When

prices are going through the roof, when the accompanying news appears to make

the future look very bright, who is selling?”

How To make High Profit In Candlestick Patterns : Chapter 3. High Profits Using Gaps : Tag: Candlestick Pattern Trading, Forex : candlestick chart gap top pattern, Gap-up, Gap-down, High Profit pattern - Gaps at the Top Reveal Exuberance