High Profits Using Gaps

gap trading strategy, gap trading stocks, candlestick gap patterns, candlestick gap analysis

Course: [ How To make High Profit In Candlestick Patterns : Chapter 3. High Profits Using Gaps ]

Gaps occurring at different locations in a trend have different meanings. Taking advantage of what they reveal becomes highly profitable. Dissecting the implications of a gap/window makes its appearance easy to understand. Where a gap occurs is important.

Combining Candlestick Signals and Gaps

“He who fears something gives it power over him.”

Gaps

occurring at different locations in a trend have different meanings. Taking

advantage of what they reveal becomes highly profitable. Dissecting the

implications of a gap/window makes its appearance easy to understand. Where a

gap occurs is important. The ramification they reveal in a chart pattern is an

important aspect to Japanese Candlestick analysis. Some traders make a living

trading strictly from gap trading.

Gaps

(ku) are called windows (Mado) in Japanese Candlestick analysis. A gap or

window is one of the most misunderstood technical messages. It is usually

advised by a good percentage of investment advisors not to buy after a gap. The

explanation being that it is too dangerous to predict what will happen next.

That advice usually comes from somebody that does not know how to use gaps

successfully. Gaps reveal powerful high profit trades. Candlestick signals,

correlated with the appearance of a gap, provide high-probability profitable

trade set-ups. The unique built-in forces, encompassed in the candlestick signals,

and the strength of a move revealed by the existence of a gap produce powerful

trading factors. The knowledge of what this combination of signals reveal will

produce consistent and strong profits.

These

are not “hidden” secret signals or newly discovered formulas that are just now

being exposed to the investment world. These are a combination of widely known,

but little used, investment techniques. Candlestick signals obviously have a

statistical basis to them or they would not still be in existence after many

centuries. Gaps have very powerful implications. Combining the information of these

two elements produces investment strategies that very few investors take the

time to exploit.

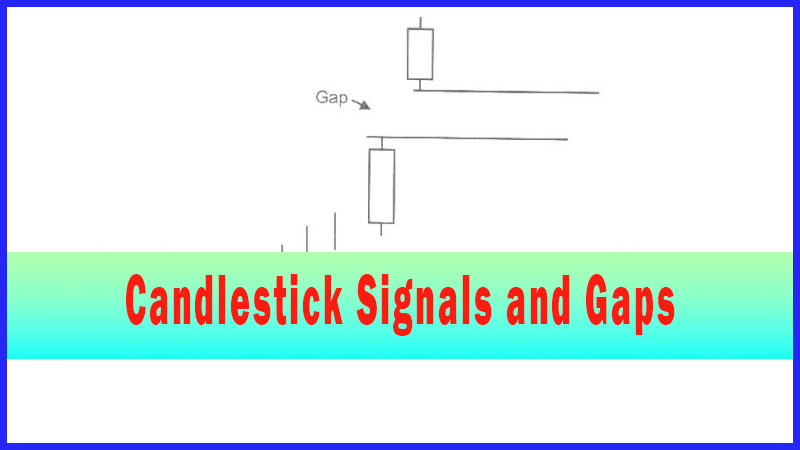

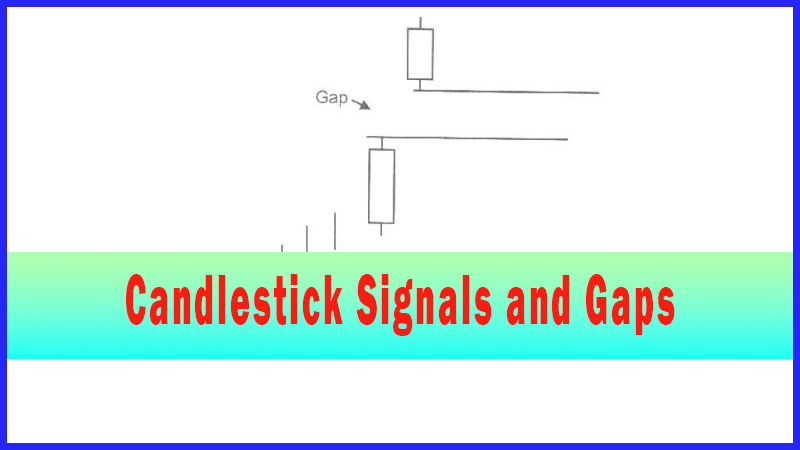

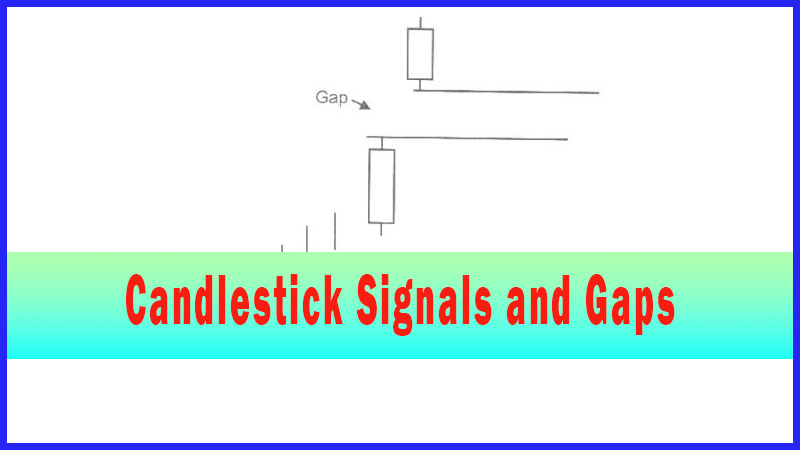

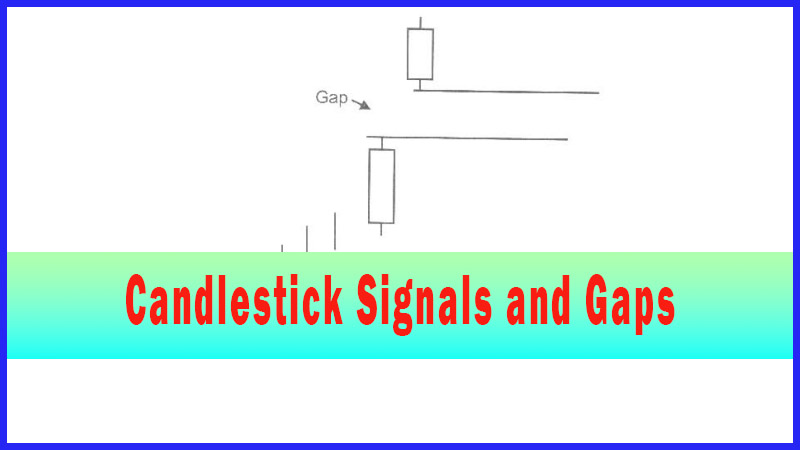

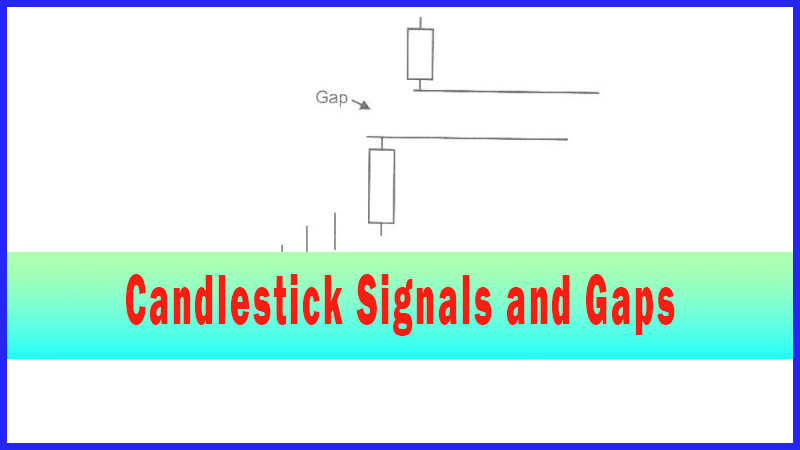

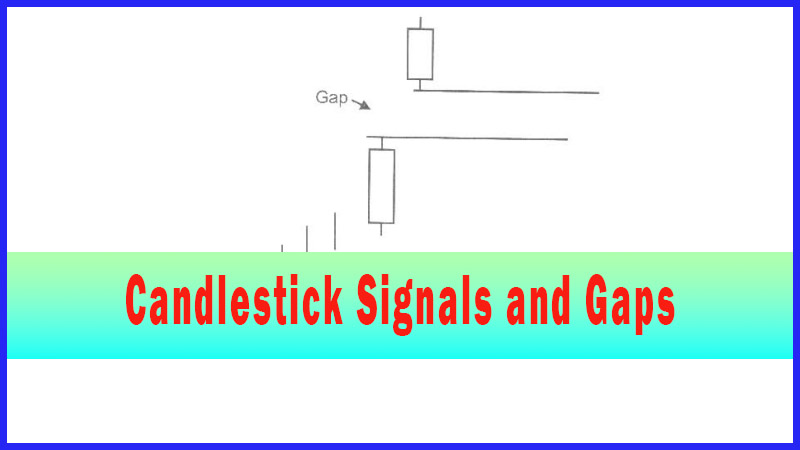

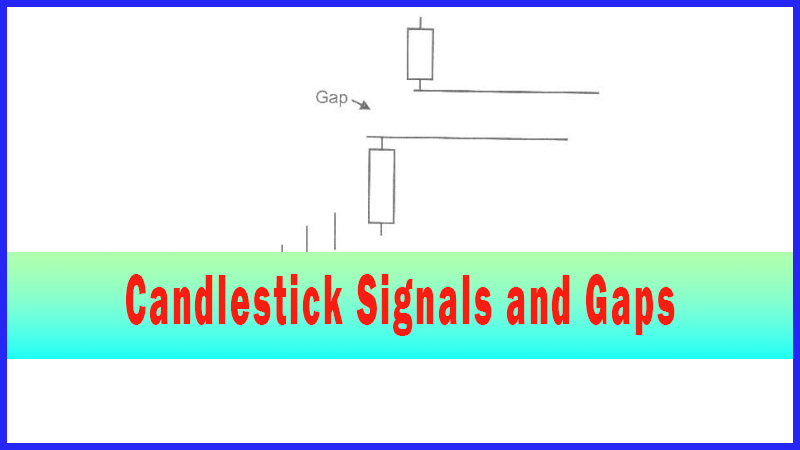

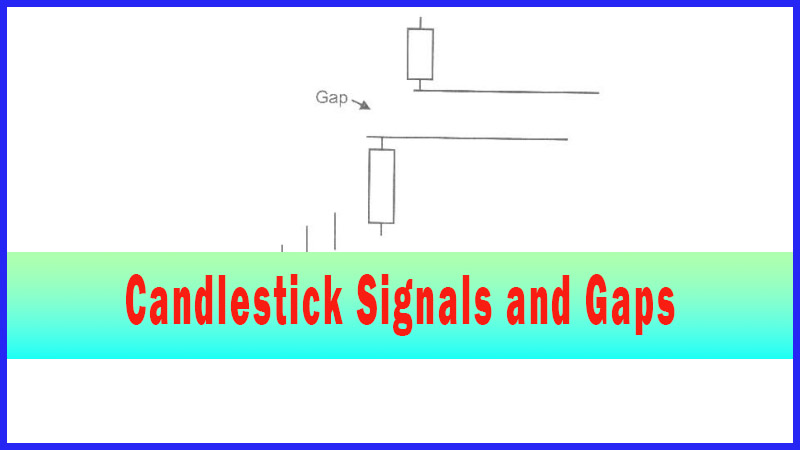

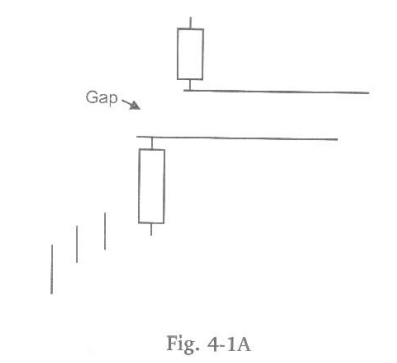

Consider

what a window or gap represents, in a rising market, it illustrates prices

opening higher than any of the previous days trading range. What does this mean

in reality? During the non-market hours, something made owning a stock, or any

other trading entity, tremendously desirable. So desirable that the order

imbalance opens the price well above the prior day’s body as well as the high

of the previous days trading range. As seen in Figure 4-1 A, note the space

between the high of the previous day and the low of the following day.

Witnessing

a gap or window at the beginning of a new trend produces profitable

opportunities. Gaps formed at the beginning of the trend reveal the buyers have

stepped in with a great amount of zeal. A common scenario is witnessing a

prolonged downtrend. A Candlestick signal appears; a Doji, Harami, Hammer, or

any other signal that would indicate that the investor sentiment is changing.

What is required to verify a candlestick reversal signal at the bottom? More

buying the next day! A bullish candle indicates a reversal has occurred. A

“gap up” bullish candle indicates that a reversal has occurred with extraordinary

force.

Many investors are apprehensive about buying a stock that has popped up from the previous days close. A risky situation! The hesitancy is caused by the percentage move. When most investors are happy with a 10% return annually it is hard for an investor to commit funds to a position that has moved 12% in one day. Understanding what that gap up represents eliminates fear.

A

Candlestick investor has been forewarned that the trend is going to change,

viewing the candlestick signal as an alert. A gap up, illustrating buyer

enthusiasm, reveals excessive strength. Use the gap as a strength indicator.

The fact that the initial move is substantial should act as an indication that

the remaining move of this new trend could be more substantial.

Always

keep in mind, the markets do not care what an investors’ fears and perceptions

are. A price that has moved dramatically in one day is usually cause for fear.

Entering a trade for most investors becomes forbidding. They do not have the

knowledge to understand what that strength illustrates for the future.

How To make High Profit In Candlestick Patterns : Chapter 3. High Profits Using Gaps : Tag: Candlestick Pattern Trading, Forex : gap trading strategy, gap trading stocks, candlestick gap patterns, candlestick gap analysis - High Profits Using Gaps