Doji Followed by a Gap Up

Candlestick analysis, Doji after gap down, Doji after downtrend, Doji gap up

Course: [ How To make High Profit In Candlestick Patterns : Chapter 3. High Profits Using Gaps ]

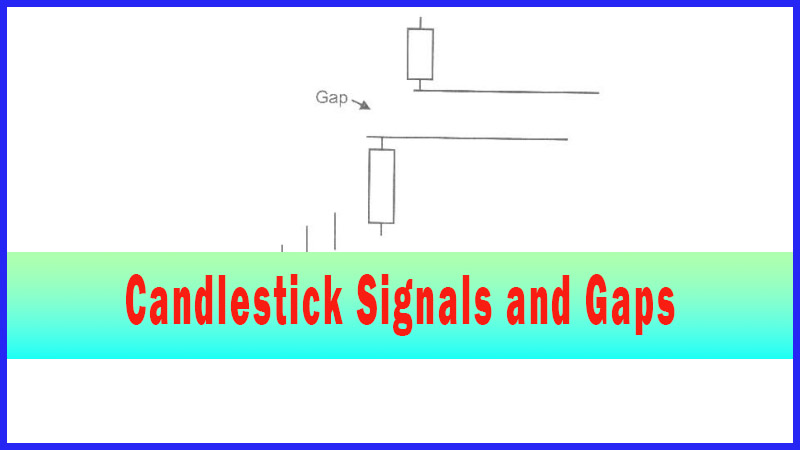

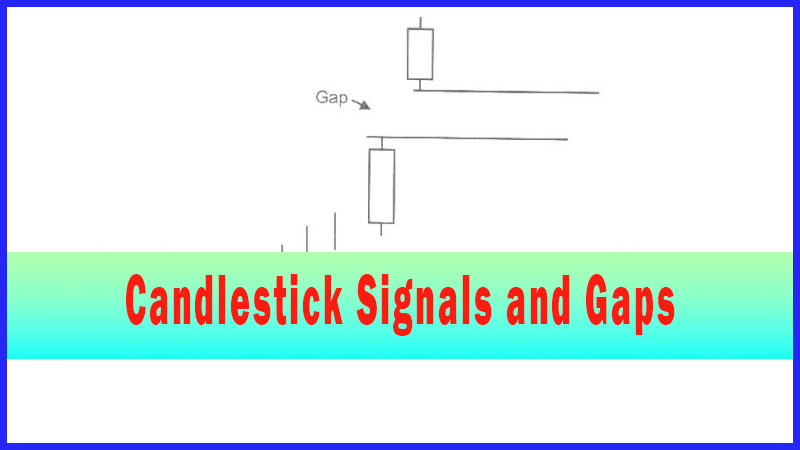

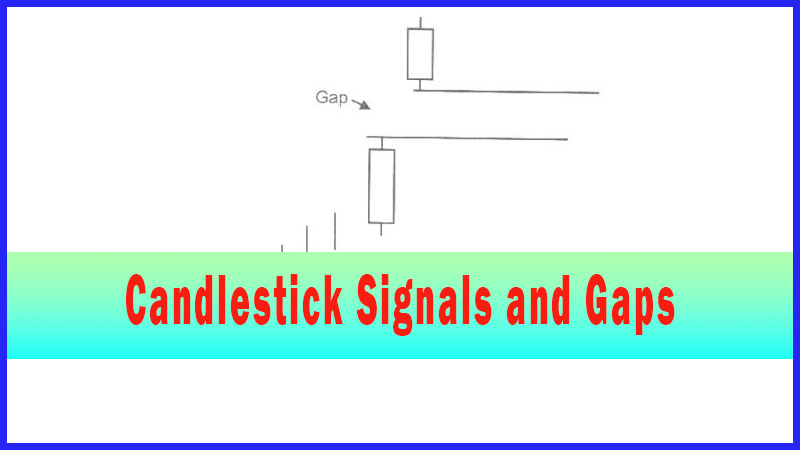

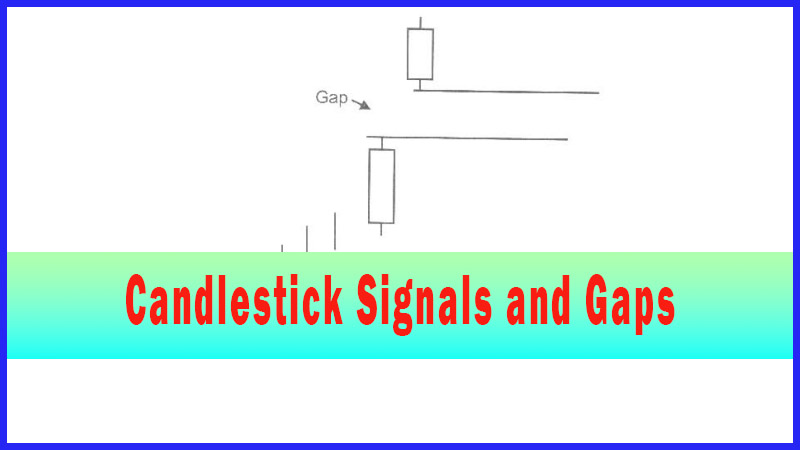

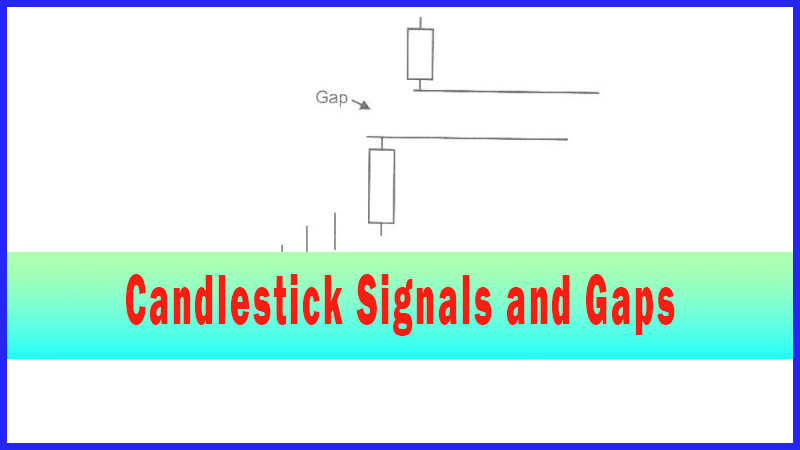

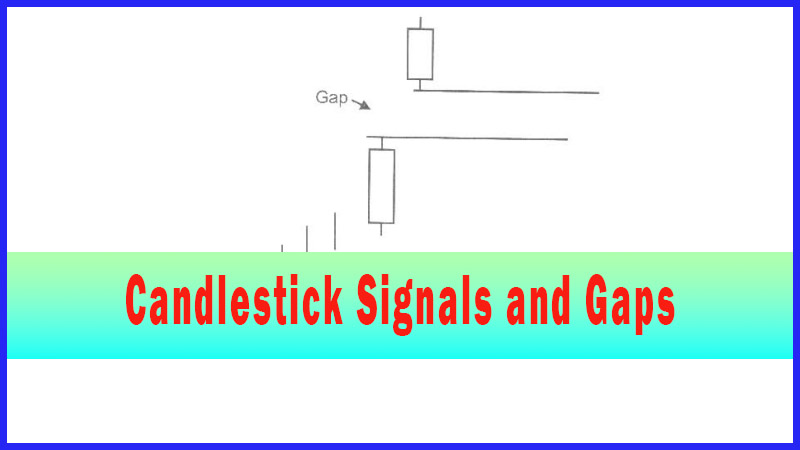

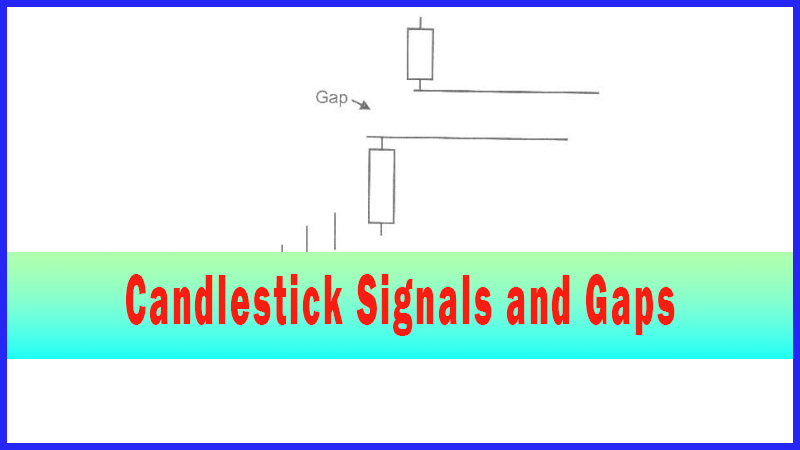

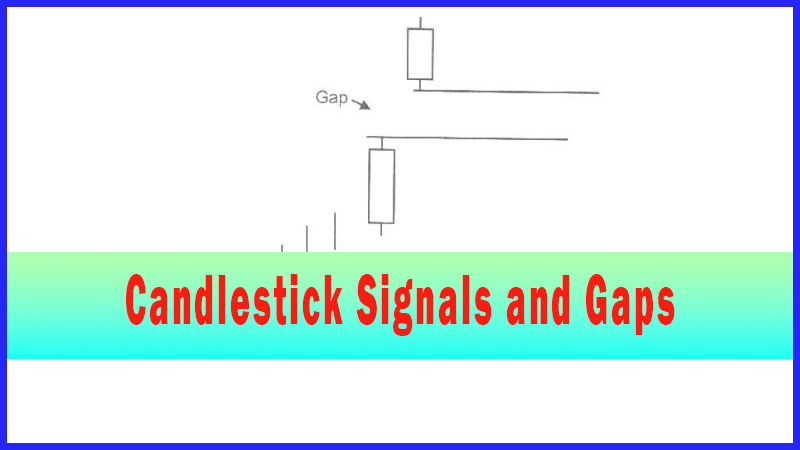

The Doji is one of the most informative signals in candlestick analysis. It appears at many significant points in a trend. In addition to its being a relevant signal at tops or bottoms of trends, it also is an important alert for gap up trade situations.

Doji Pattern Followed by a Gap Up

“He who ignores discipline despises himself, but whoever heeds

correction gains understanding.”

The

Doji is one of the most informative signals in candlestick analysis. It appears

at many significant points in a trend. In addition to its being a relevant

signal at tops or bottoms of trends, it also is an important alert for gap up

trade situations. An inordinate number of times a Doji will be witnessed prior

to a breakout. The gap movements can occur at the top of a trend, bottom of a

trend, or after a flat trading period.

One

of the trading rules for a Doji is, “the trend will usually move in the direction of how prices open

after a Doji.” The

trend strength becomes more enhanced if the open price gaps away from the Doji.

A Doji followed by a gap usually produces a very strong trend.

The

Japanese Rice traders say, “Always

take heed when a Doji appears.” It

is even more important to take heed when prices gap away from a Doji. That

becomes strong evidence that after a day of indecision, a decision has been

made very forcefully.

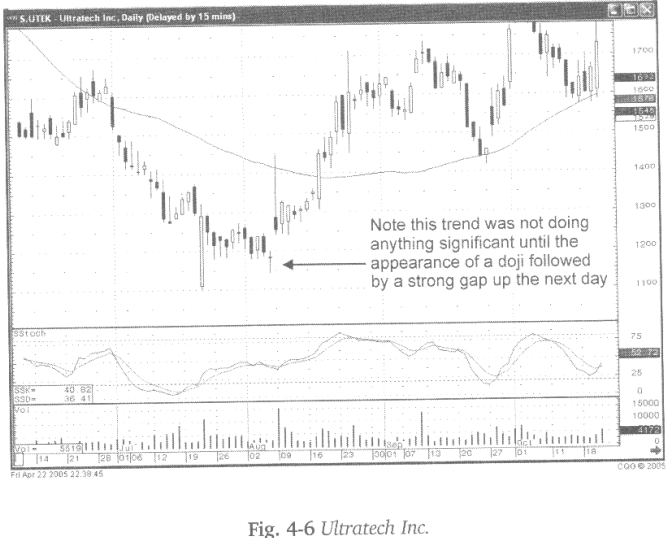

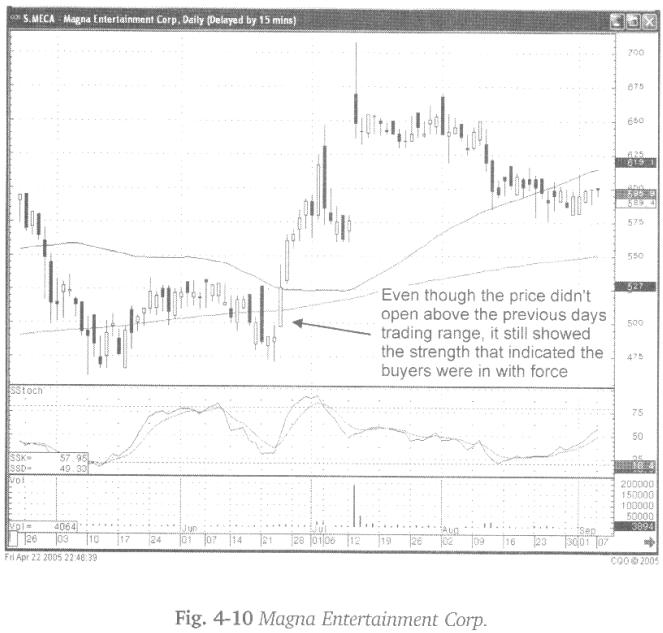

Fig.

4-6, The Ultratech Inc. chart reveals a relatively sloppy trading environment

in late July and early August. Stochastics are in mid-range. Notice the Doji at

the end of that sideways trading is the last signal prior to a definite move to

the upside. Although the gap up trading day did not show strength by the end of

the day, the fact that it gapped up away from the Doji, revealed important

information. For some reason the buyers were coming into the stock with great

strength. They did so the day after an indecision day, the Doji. As observed,

buying pressure continued after that gap up day.

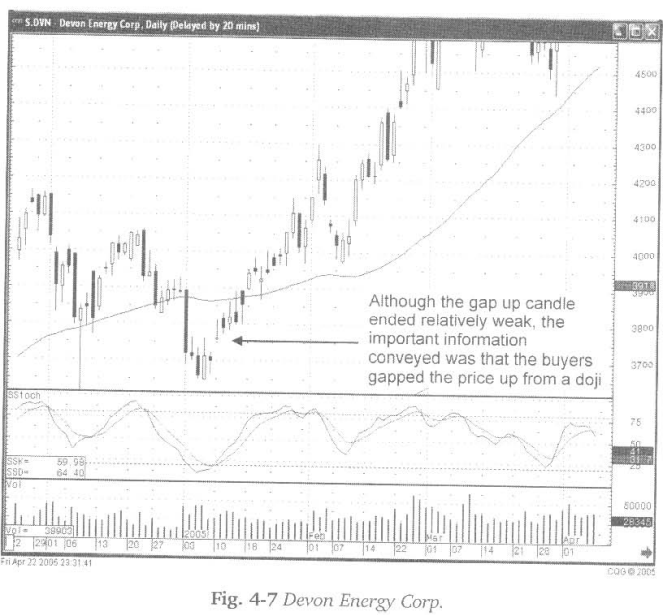

The

gap up day does not necessarily need to show strength after the gap up. As

illustrated in Fig. 4-7, the Devon Energy Corp. chart in January of 2005, the

gap up day finished at the lower end of the trading range. What should be

analyzed is that when the stochastics were in the oversold condition, a

Piercing Pattern appeared. Then a Doji appeared. The gap up in price, after

those signals becomes the relevant parameter for the evaluation. Would it have

been better to see a strong bullish candle after the gap up? Certainly, but the

fact that investors were wanting to buy aggressively the day after the Doji

should be the predominant evaluation.

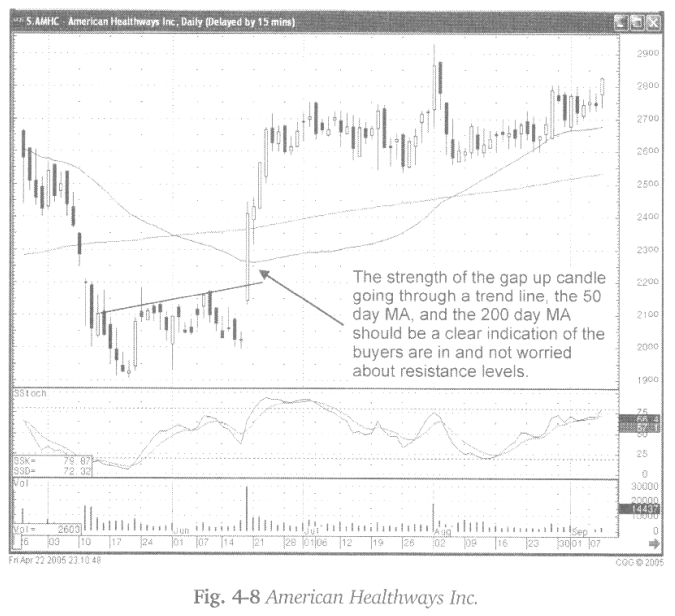

Fig.4-8,

The American Healthways Inc. chart also demonstrates a gap up from a Doji after

a relatively sloppy trading session. The strength of the initial gap up candle,

going through both the 50-day and the 200-day moving average, reveals there

should be more upside potential.

Should

the percent move be a concern? Definitely not! A price-movement, when the

proper signals are present, indicates strength coming into a trend. The message

conveyed by a 5%, 10%, 20%, or greater move may just be the forewarning of a

price movement that can continue up another 30%, 50%, 100%, or greater. Do not

let percentages be a deterring factor. If you’re going to buy with a

candlestick buy signal, then sell when you see a candlestick sell signal.

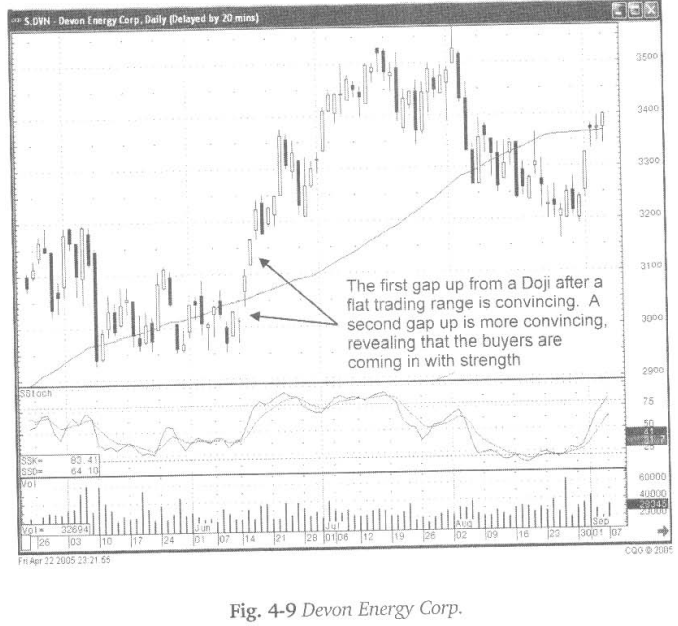

Fig.

4-9, the Devon Energy Corporation chart also illustrates an indecisive trading

period ending with a Doji. The last day of indecision clearly exhibited what

the new decision process was on the following day. The gap up from the Doji,

with trading opening above the 50-day moving average and closing with strength,

provided valuable information. The buyers were stepping in and taking prices

higher. It confirmed that fact again. The following day exhibited another gap

up. If one gap up illustrates strength, two gap ups illustrate that much more

strength.

The ‘rules’ for gapping up, after a Doji, do not have to be to

the letter. The indication that the buyers are coming into a position with

strength, opening the price well above the closing price of the Doji day, does

not require the true gap definition. As seen in Fig.

4-10, the Magna Entertainment Corp. chart, the price gapped up the following

day after a Doji/Spinning Top. Although the price did not quite open above the

top of the trading range of the Doji signal, it still indicated that the buyers

had moved the price significantly. Buying continued from that point.

If

there is evidence of strong buying, gapping the price away from the previous

days close, the message should still be the same. The buyers are coming in

with much more strength than what was being traded the previous day.

The

important factor in this scenario is the day of indecision was followed by a

clear statement of what the investors had decided. Analyzing candlestick signals

should be done with a commonsense evaluation, not a stringent set of rules! If

you understand what each signal represents, the investment actions that follow

can be better interpreted.

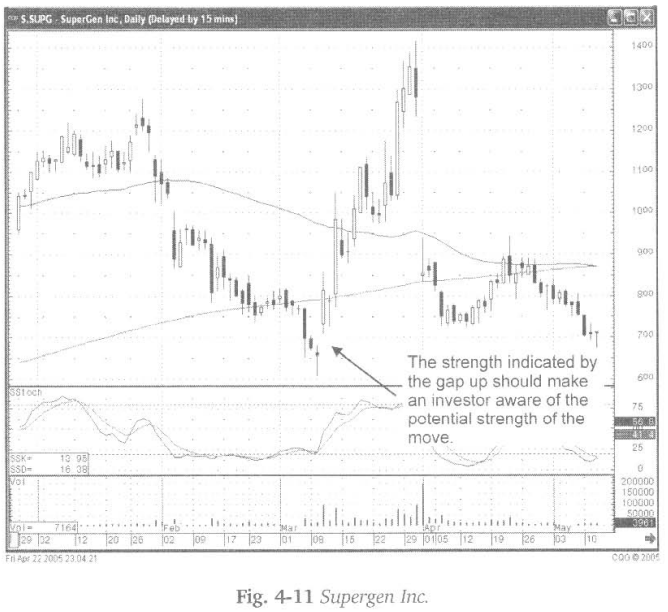

Logically,

interpretation becomes much easier the stronger the indication that the buyers

are coming in with force. As illustrated in Fig.4-11, the SuperGen Inc. chart,

the Doji at the bottom, followed by a large gap up, produces a much easier

evaluation. Stochastics in the oversold area, a gap up from a Doji, and the

price going up through a major moving average, after an extended downtrend,

aligns a number of the stars. These are all parameters for a high probability

trade.

A

strong trading pattern makes sitting through the day after the gap up less

stressful. The strong ‘buy1 signal becomes the predominant investment factor.

Although the selling during the day after a gap up might cause concern, knowing

that a strong buy signal has been created should induce more patience. The

strength of the ‘buy’ signal would allow sitting through the following day without

panicking.

A

large influx of buy orders, after a Doji, should become a clear indicator of

which direction the trend will move. There is an easy method for confirming

this scenario in your own mind. Scan back through charts. As you are going

through the learning process, analyzing the peaks and valleys of price trends

will become highly educational. When you come upon a Doji at the bottom,

followed by a gap up, review what occurred in the trend if prices gapped up the

next day. You’ll discover that an inordinate number of strong rallies were

started with a Doji followed by a gap up.

How To make High Profit In Candlestick Patterns : Chapter 3. High Profits Using Gaps : Tag: Candlestick Pattern Trading, Forex : Candlestick analysis, Doji after gap down, Doji after downtrend, Doji gap up - Doji Followed by a Gap Up