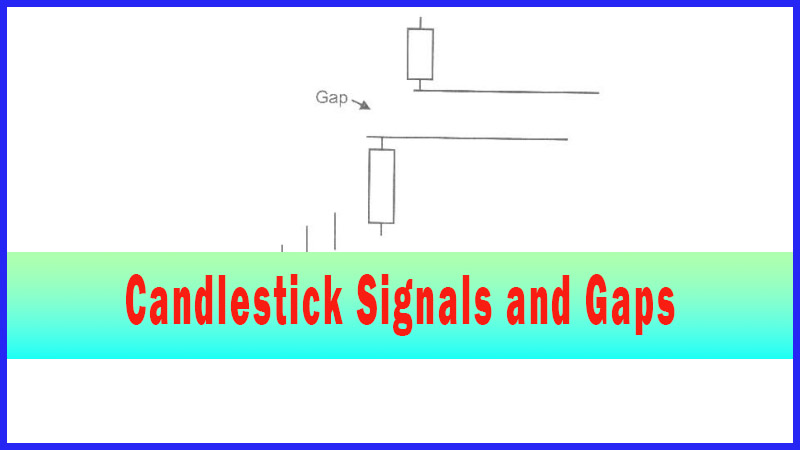

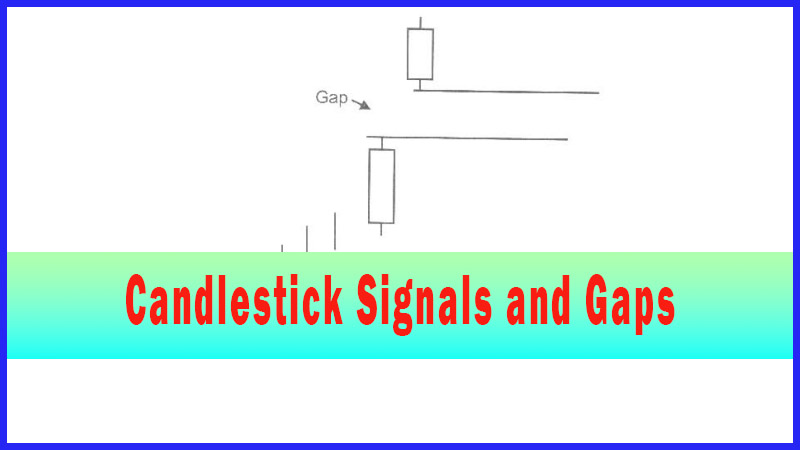

Gaps at the Top

Candlestick analysis, Candlestick chart, Gap down Doji, Hammer signal, Bullish Harami, Gap up bullish candle

Course: [ How To make High Profit In Candlestick Patterns : Chapter 3. High Profits Using Gaps ]

The gap up that appears at the top of an uptrend is the one that provides ominous information. Remembering the mental state of most investors, the enthusiasm builds as the trend continues over a period of time.

Gaps at the Top Candlestick Charts

“New knowledge is the most valuable commodity on earth. The more

truth we have to work with, the richer we become.”

The

gap up that appears at the top of an uptrend is the one that provides ominous

information. Remembering the mental state of most investors, the enthusiasm

builds as the trend continues over a period of time. Each day the price

continues up, the greater investors become convinced the price is going to go

through the roof. The “talking

heads” on

the financial news stations start to show their prowess. They come up with a

multitude of reasons why the price had already moved and will continue to move

into the rosy future. With all this enthusiasm around, the stock price gaps up.

Unfortunately, this is usually the top. Fortunately, Candlestick investors

recognize it. They can put on exit strategies that will capture a good portion

of the price move at the top. Consider the different possibilities that can

happen when witnessing the gap up at the top of a sustained uptrend. Most of

the time, the gap will represent the exhaustion of the trend, thus called an

Exhaustion Gap. Or it could be the start of a Three Rising Windows formation,

or big news such as a buy out or a huge contract announcement about to be

announced.

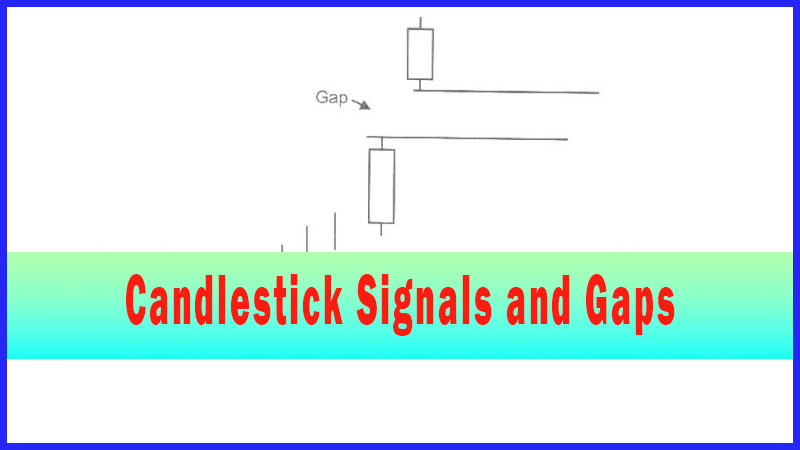

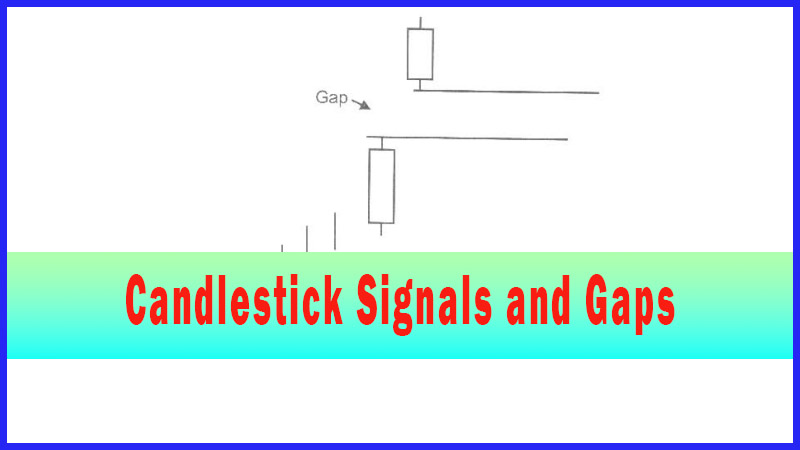

What

are the best ways to participate in any potential of higher prices, at the same

time knowing that the probabilities are that the top is near? A few simple

stop-loss procedures can allow you to comfortably let the price move and

benefit from the maximum potential.

Hopefully,

after a gap up is occurring, (the exuberance of an extended trend), a

substantial gain is already realized in the position. The gap up is adding to

an already big gain. Probabilities dictate that this is the top. However, there

is the possibility of more gains.

Upon

a slight to medium gap up, the Candlestick investor should put their stop at

the close of the previous day. The thinking being that if the price gapped up

in overbought conditions, and prices came back down through the close of the

previous day, the buying was not sustained. If so, the ‘stop’ closed the position

at the level of the highest closing price of that trend. The same rationale

applied to the psychology of a gap down at a bottom of a trend can be applied

equally well to the gap up at the top of a trend. Where do most investors buy?

They buy when the confidence has finally built up, after the price has done

well. When most investors feel safe that a price is doing well, that is usually

the time to look for ‘sell’ signals.

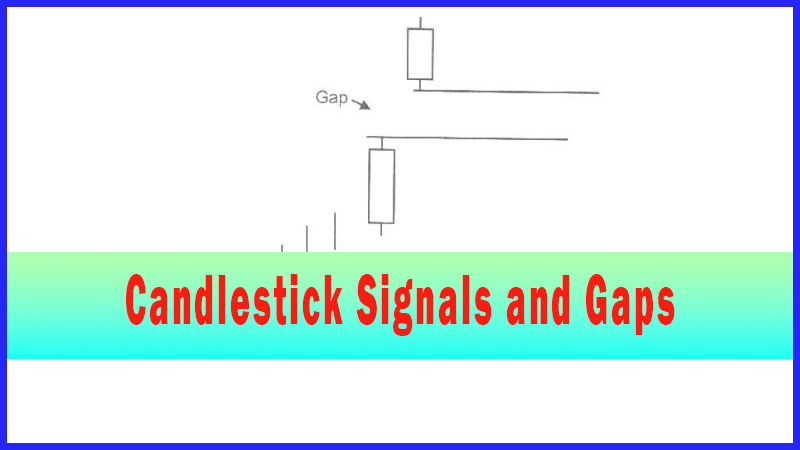

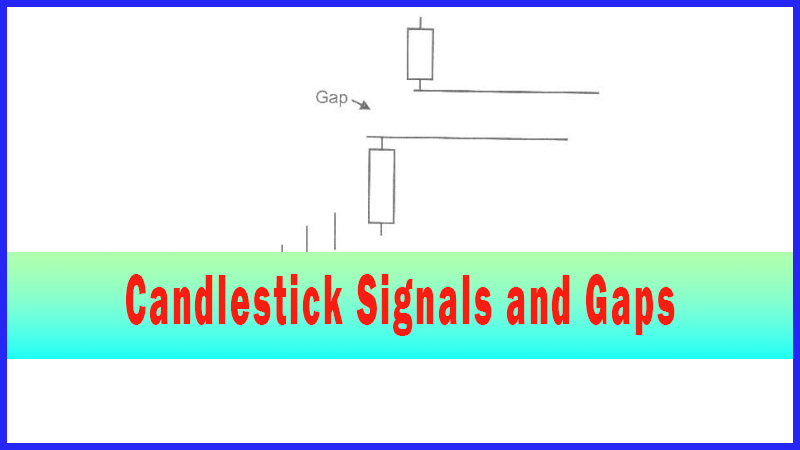

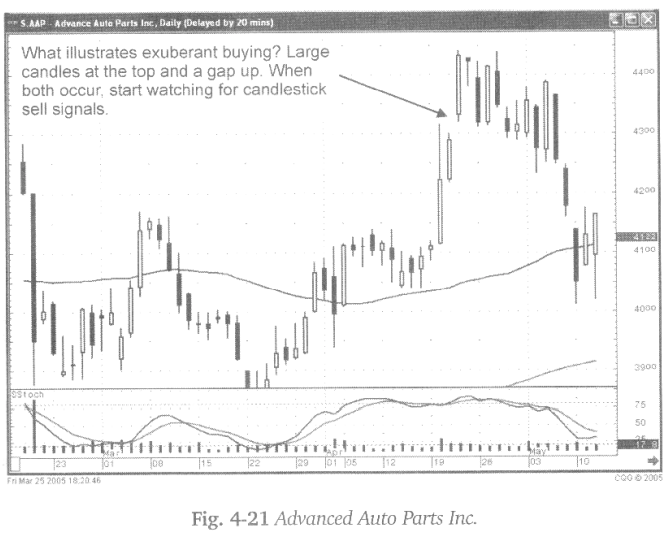

The

gap up after a strong run up is dearly indicative of the exuberant buying. When

buying gets exuberant, the smart-money starts taking profits. Fig, 4-21, The

Advanced Auto Parts Inc. chart, reveals the exuberance. Large candles, in the

overbought stochastics conditions, reveal that investors are piling into the

stock. Finally a gap up becomes the first signal that the top may be near. This

becomes more evident the following day when a Harami/Hanging Man signal

appeared. Now there is the evidence of a gap up followed by a potential

candlestick “sell” signal. The lower open the following day makes it more

convincing that the top is here. Does a gap up at the top necessarily mean the

ultimate top has occurred? Definitely not, however it produces a good

indication that a top may be very near. It provides the investor with an alert

to be ready to take profits and/or start shorting a position on the first signs

of weakness.

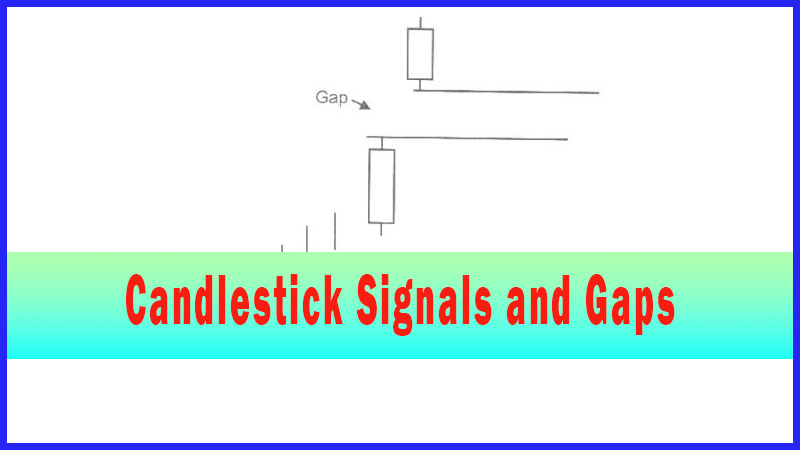

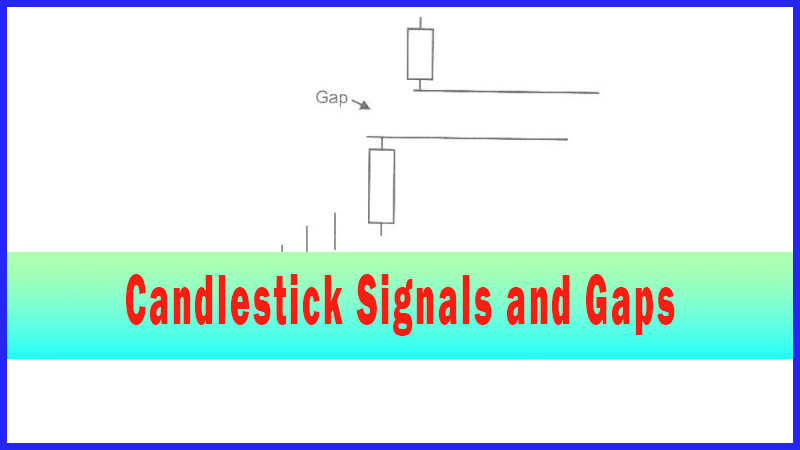

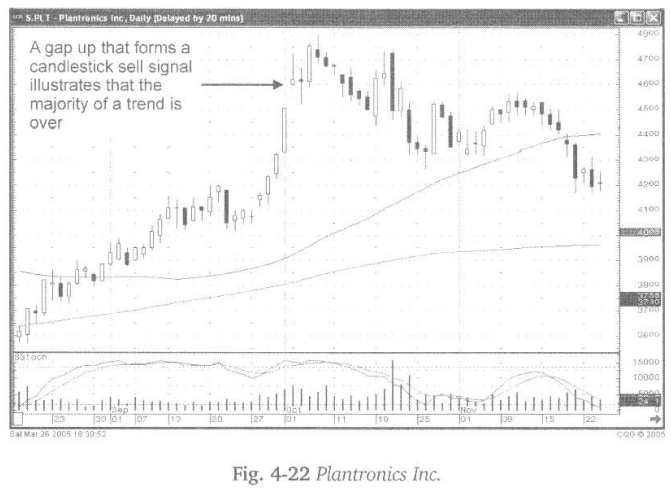

Fig.

4-22, The Plantronics Inc. chart shows a Shooting Star after a gap up. The

Shooting Star at the top of a trend alone would signify that the bears are making

their presence known. The fact that it occurred after a gap up is more

convincing. Exit strategies can be better formulated when knowing the probabilities

indicate a reversal is occurring or about to occur. Each investor can prepare

exit strategies that comfortably fit their investment nature. For example,

upon seeing weakness the following day after the shooting star, half the

position may have been closed out. The other half might have been closed out

two or three days later as more candlestick sell signals appeared. A gap up at

the top has historical indications that the majority of the uptrend is over.

Having that knowledge allows an investor to better analyze and shift funds

from a poor probability situation back into a high probability situation.

How To make High Profit In Candlestick Patterns : Chapter 3. High Profits Using Gaps : Tag: Candlestick Pattern Trading, Forex : Candlestick analysis, Candlestick chart, Gap down Doji, Hammer signal, Bullish Harami, Gap up bullish candle - Gaps at the Top