Hammers, Haramis, and Inverted Hammers with Gaps Up

Hammers, Haramis, Inverted Hammers, Gaps Up, Candlestick signal

Course: [ How To make High Profit In Candlestick Patterns : Chapter 3. High Profits Using Gaps ]

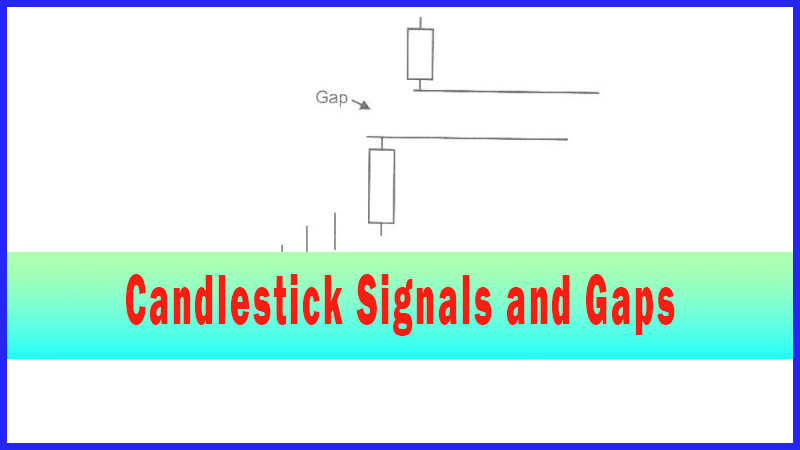

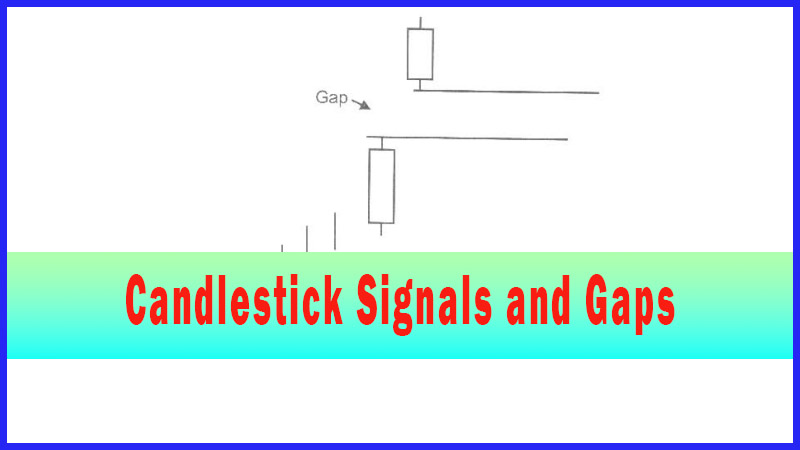

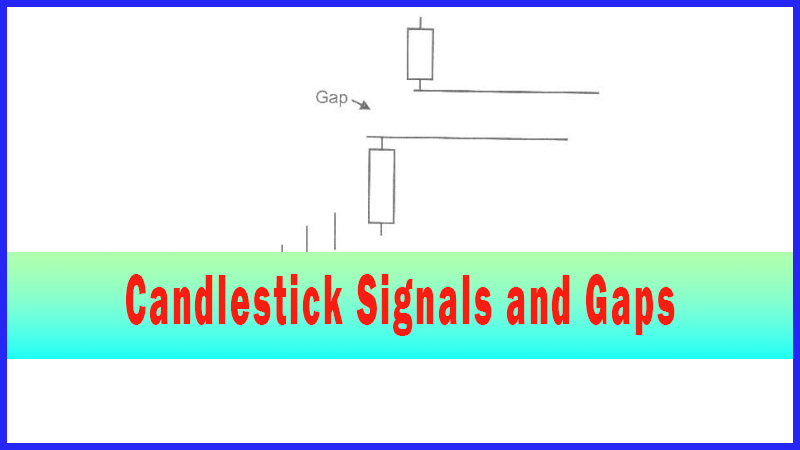

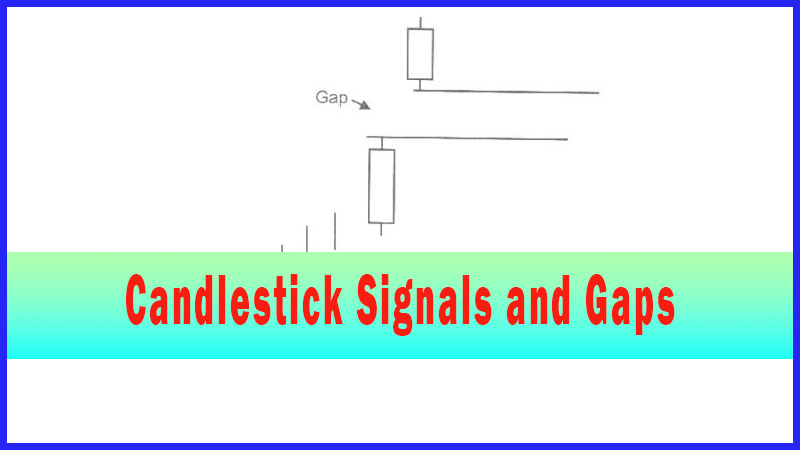

the Doji illustrates indecision and creates a high-powered move followed by a gap up, do not disregard that same effect following the other major candlestick buy signals at the bottom. The Hammer, Harami, and the inverted Hammer signify a potential reversal when seen in the oversold condition.

Hammers,

Haramis, and Inverted Hammers with Gaps Up

“If you are on the right track, if you have this inner

knowledge, then nobody can turn you off no matter what they say.”

Although

the Doji illustrates indecision and creates a high-powered move followed by a

gap up, do not disregard that same effect following the other major candlestick

buy signals at the bottom. The Hammer, Harami, and the inverted Hammer signify

a potential reversal when seen in the oversold condition. Confirmation of a

reversal requires positive trading the following day. As with the Doji,

positive trading represented with a gap up is that much more compelling

evidence that the reversal has occurred. The force with which that new trend

may move is demonstrated by the gap up in price the following day.

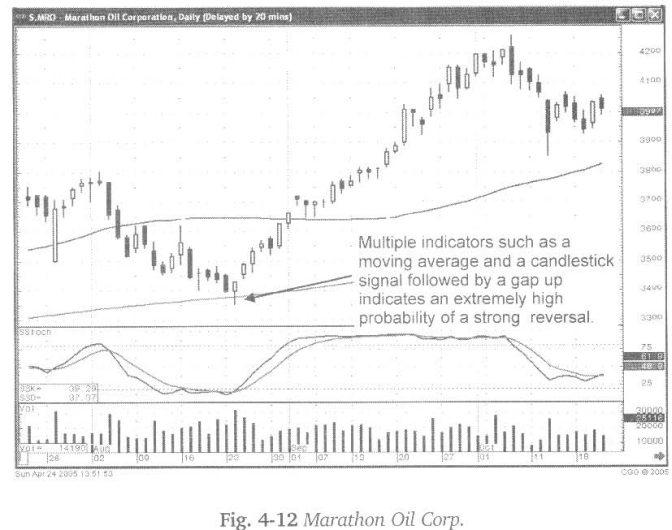

The

candlestick signal is the alert that a potential change of investor sentiment

may be occurring, especially when it occurs in oversold condition. As illustrated

in Fig.4-12, the Marathon Oil Corp. chart, the Hammer/Harami signal gave a good

indication that the 200-day moving average should act as support. This becomes

better confirmed the following day when the price gaps up. It becomes more

obvious that the 200-day moving average acted as the support when buyers showed

great zeal to get into this position, causing the next day’s gap up.

Being

able to use a visual analysis makes interpreting investor sentiment at

important levels very easy. Utilizing the knowledge of what the signal conveys

and what a gap up conveys enhances strong trend identification.

How To make High Profit In Candlestick Patterns : Chapter 3. High Profits Using Gaps : Tag: Candlestick Pattern Trading, Forex : Hammers, Haramis, Inverted Hammers, Gaps Up, Candlestick signal - Hammers, Haramis, and Inverted Hammers with Gaps Up