Gap Down at the Bottom

Candlestick analysis, Candlestick chart, Gap down Doji, Hammer signal, Bullish Harami, Gap up bullish candle

Course: [ How To make High Profit In Candlestick Patterns : Chapter 3. High Profits Using Gaps ]

The basic premise of investing: buying at the bottom. Candlestick analysis provides the tools for exploiting human emotions. The fear that enters most investors investment decisions can usually be seen graphically on a candlestick chart.

A Gap Down at the Bottom

The

basic premise of investing: buying at the bottom. Candlestick analysis provides

the tools for exploiting human emotions. The fear that enters most investors

investment decisions can usually be seen graphically on a candlestick chart.

The evidence is usually illustrated with the candle bodies getting larger as

the price enters into the oversold conditions. This is often seen after an

extended decline. The further the downtrend moves, the more panic selling is

observed.

The

panic selling is usually fueled by the rhetoric put out by the talking heads on

the financial news stations or the financial publications. Most of the time the

financial news agencies are reporting what has already happened. After a stock

or any other trading entity has been in an extended decline, it starts getting

discussed in the news media. The discussion for why that industry/sector is in

such bad condition starts getting publicized, alter it has been in a

three-month downtrend.

Quite

often when a trend, whether positive or negative, becomes recognized by the

financial news repotting media, that is usually time to start watching for

reversal signals. Very rarely will you see reports from the news media stating

why an industry would likely be attractive after a severe decline. They always

seem to report why things are bad after the price decline has occurred. This

becomes a great indicator for watching for a candlestick reversal situation.

When you hear constant doom and gloom predictions for an industry; prepare for

the panic selling. Then start watching for the buy signals.

“An investment in knowledge always pays the best interest.”

What

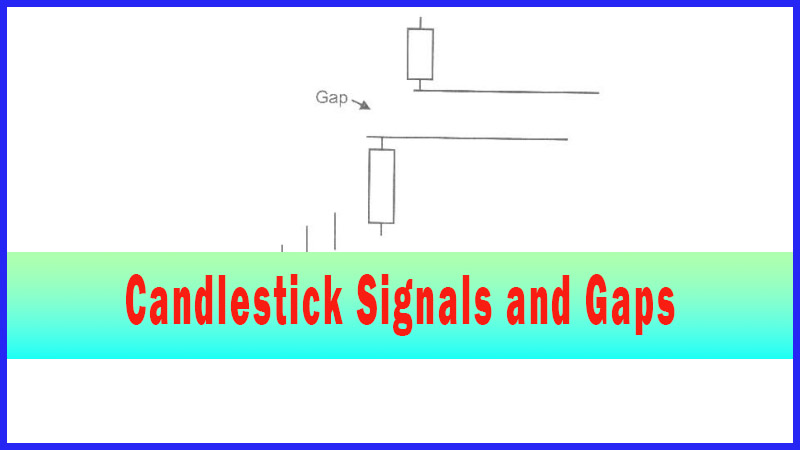

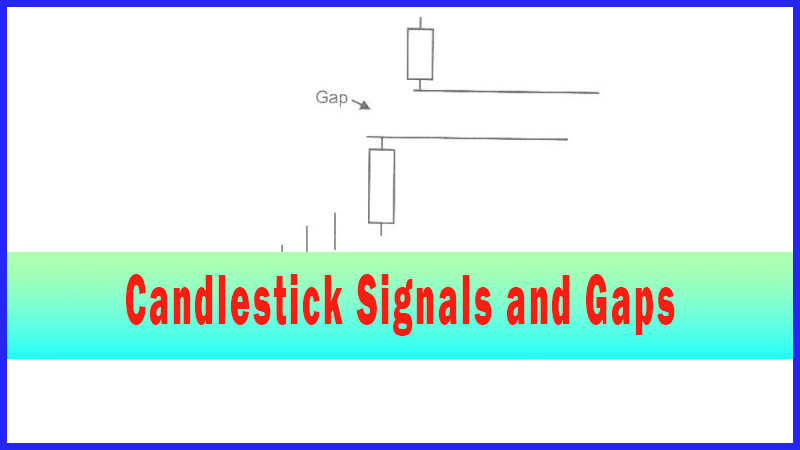

is the ultimate indicator of the panic selling? The gap down at the bottom! A

clear indication, illustrating investors wanting to get out of a position, no

matter what the price! The gap down illustrates the tremendous desire (panic)

to exit from that position. A gap down in oversold conditions becomes the cause

for diligently watching for a candlestick ‘buy” signal to occur. If most

investors panic at the bottom and a gap down represents the panic selling, then

the bottom is usually very nearby. This is purely common sense. Having this

knowledge of investor psychology allows the candlestick investor to be

prepared for the “buy” signal.

Does

that mean a buy signal will show up immediately? Not necessarily. However it

does indicate that the majority of the move in the downtrend is probably over.

This creates two benefits. First, if this position had been shotted, it now

reveals a time to start covering the short position. Second, it alerts in

investor to start watching for a buy signal.

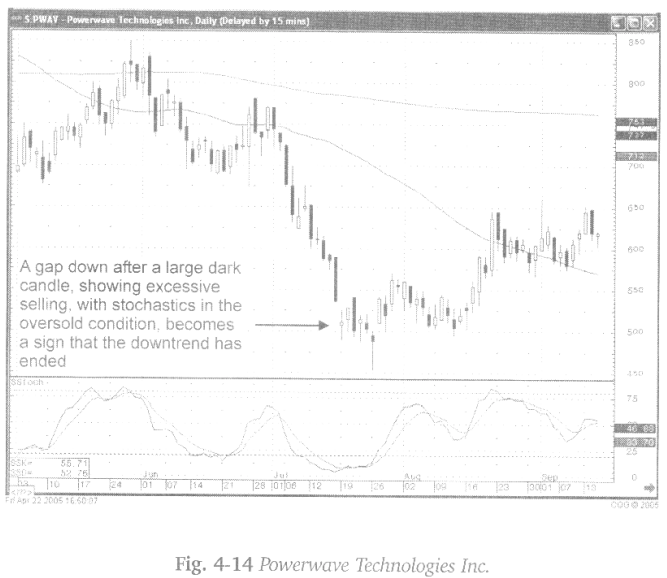

As

illustrated in Fig. 4-14 the Powerwave Technologies Inc. chart, after an extended

downtrend the selling starts escalating. This is identified with a large black

candle followed by a gap down in price. That gap down forms a Doji/ Spinning

Top. With the stochastics well in the oversold condition, the gap down should

have been the first inkling that the bottom was near. In the Powerwave

Technologies Inc. chart, the gap down Doji was the end of the majority of the

downside move. About a week later, a gap up after the Hammer signal indicated

the uptrend may have started.

The

point of this illustration is to show that the gap down at the bottom warranted

closing the short positions and watching to go long.

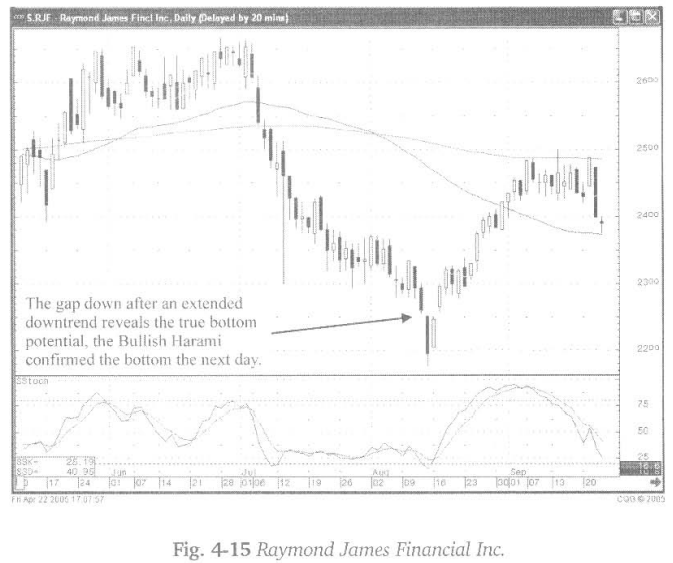

As

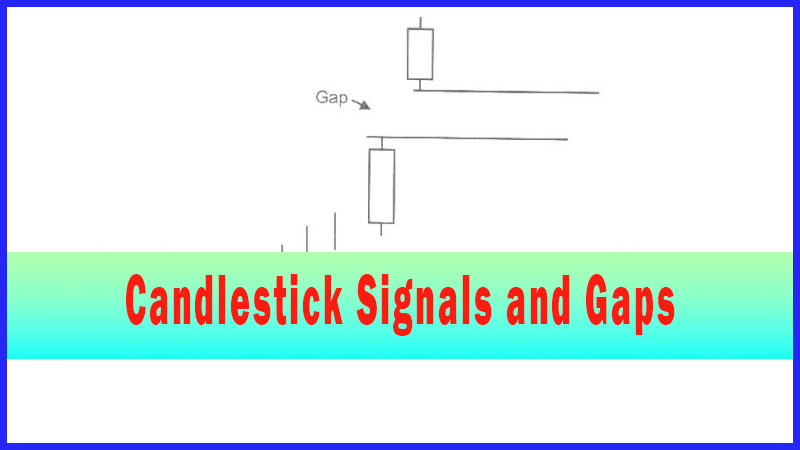

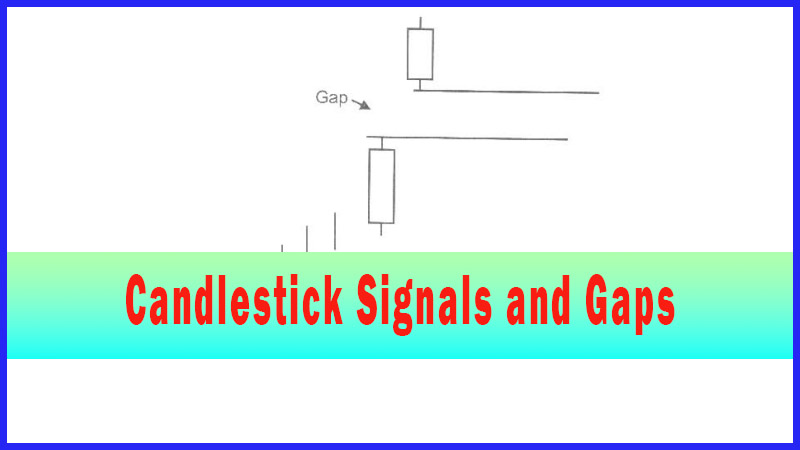

witnessed in Fig. 4-15. the Raymond James Financial Inc. chart, the stochastics

had indicated that the price of the stock was in the oversold condition throughout

early July until early August. During that time there were a number of potential

candlestick buy signals but the signals never got confirmed. Note how the

ultimate bottom occurred after a gap down.

A

big selling day, after a gap down when stochastics have been in the oversold

condition for a lengthy period of time, becomes the alert to start watching for

a candlestick buy signal. The Bullish Harami, the following day becomes a clear

indication that the last gasp selling was over and buying was starting. A gap

up the following day creating an island reversal, becomes a very strong

reversal indicator. This whole sequence would have been put on watch because of

the gap down.

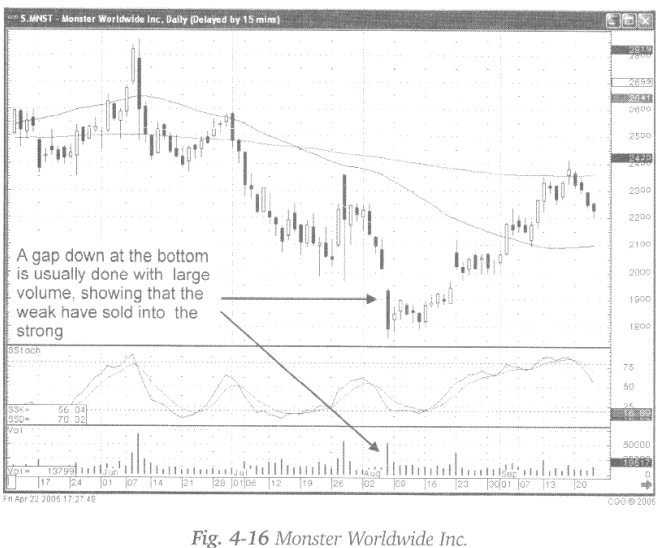

Fig.

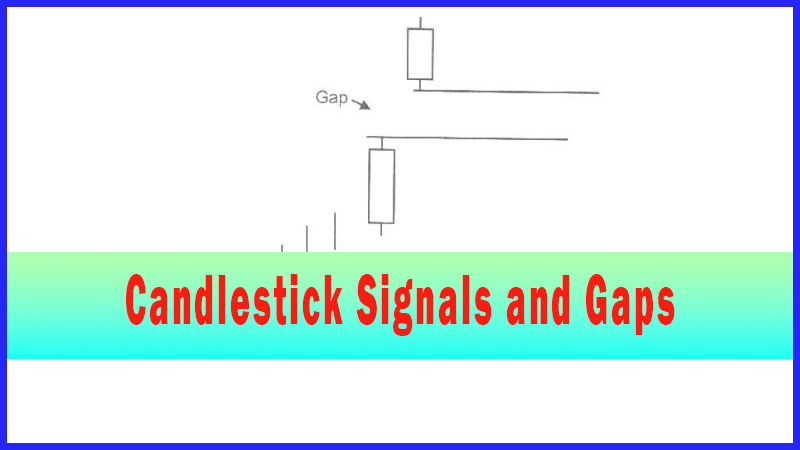

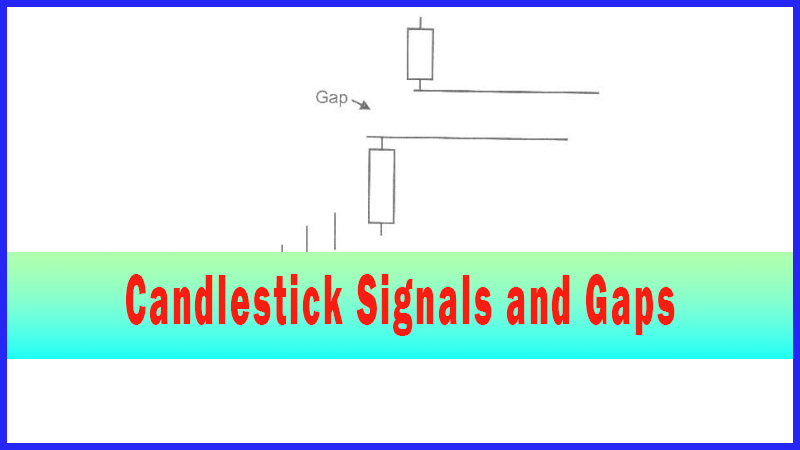

4-16, the Monster Worldwide Inc. chart, also illustrates the final bottom. It

is not unusual to see increased volume coming into trading after a gap down.

This becomes an indication that the weak are selling to the strong. Although

the volume is not a necessity, the presence of a large volume day during the

gap- down day, or a day or two to one side or the other, reveals that there has

been a large change of ownership in a stock. The weak sellers have relinquished

their stock to the strong.

The

Spinning Top/Harami appearing during following day illustrates that the selling

had stopped. The uptrend may not start immediately. There always exists the

possibility of some follow-through selling from the previous downtrend.

However, a gap down signifies that most of the selling occurred that day. After

a few days, the rest of the selling becomes acquired by the buyers. Then the

trend can get started to the upside.

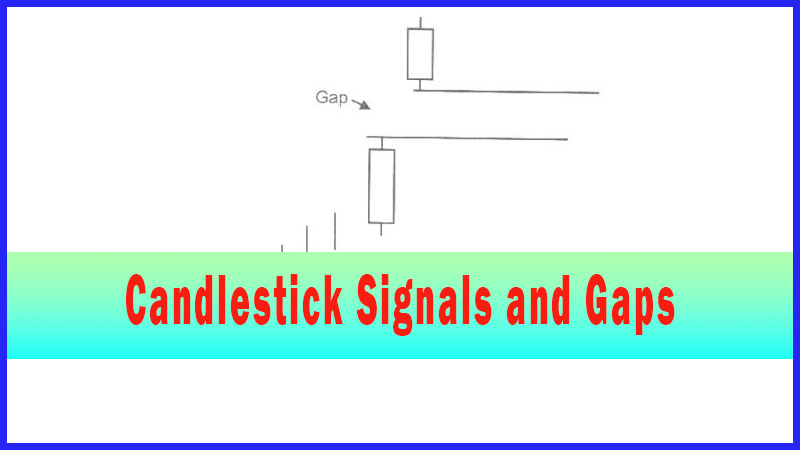

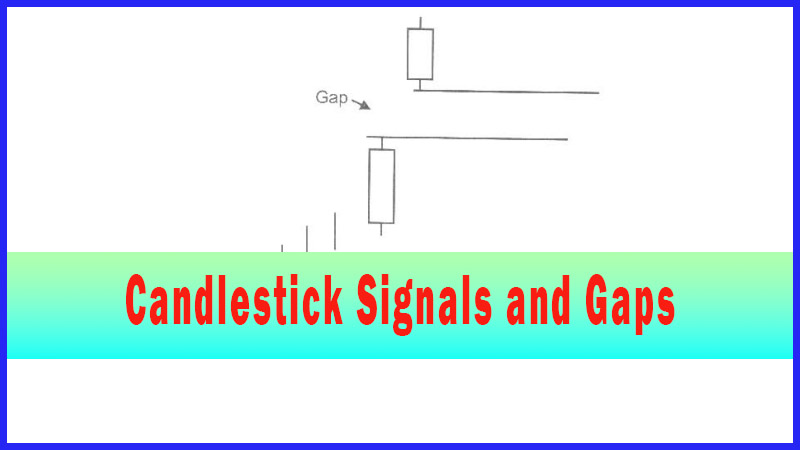

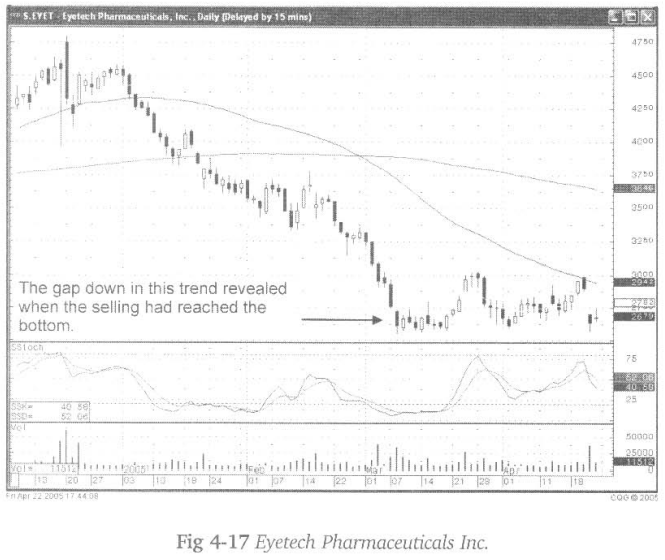

The

gap down at the bottom doesn’t necessarily mean that a strong uptrend will

occur, but it does signify that the downtrend has stopped. Fig. 4-17, The

Eyetech Pharmaceuticals Inc. chart illustrates, after an extended downtrend,

the gap down at the bottom revealed that the downtrend had stopped. At that

point, watching for candlestick ‘buy signals becomes the strategy. Those ‘buy1

signals may not show up for a few weeks, but the probabilities that the bottom

is near becomes extremely great when witnessing the gap down in the oversold

conditions. This may not be the time to buy. However, if an investor had been

short this position, the gap down would have been the signal to take profits.

Keep

in mind, a gap down near the oversold area indicates that a bottom is near.

That is why it becomes important to analyze the candlestick signals that are

forming.

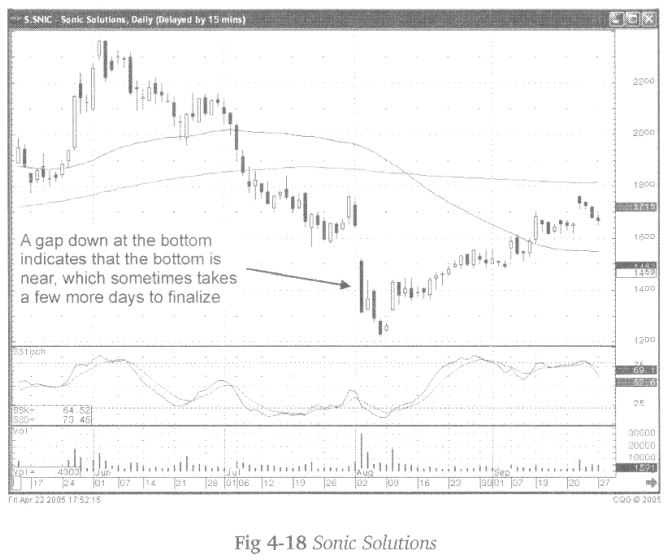

As

in the case of Fig. 4-18, Sonic Solutions Inc., the gap down on large volume

was near the bottom. It took a few more days to wash out all the sellers.

The

Doji/Harami, followed by the gap up bullish candle, became a ‘buy" signal.

After an extended downtrend, all the selling sentiment will not disappear on

one major down day. Likewise, the selling doesn’t always immediately disappear

after a strong bullish candlestick ‘buy’ signal. This knowledge permits a

candlestick investor to sit through a residue selling day or two after seeing a

reversal situation occur.

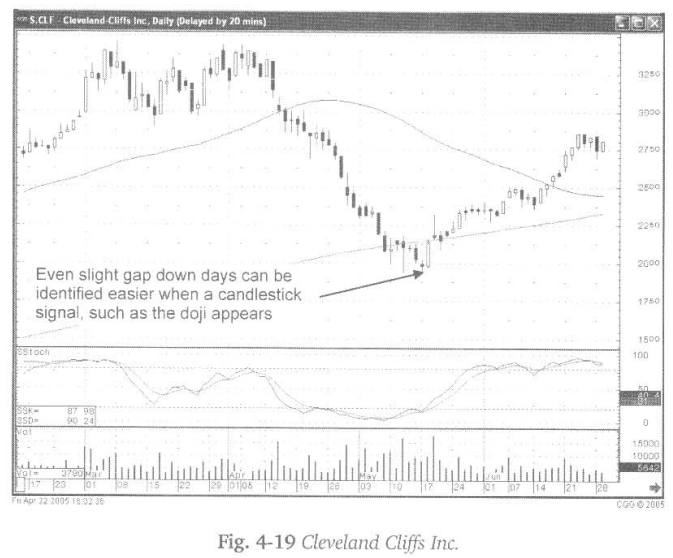

The

subtle gap downs become more apparent when a candlestick signal forms on the

gap down day. Notice in Gig. 4-19, the Cleveland Cliffs Inc. chart how the gap

down may not have been noticed had a Doji not formed that day. Of course, a

Doji at the bottom should always be heeded. When the stochastics have confirmed

the oversold condition, the slight gap down on the open of the Doji signal

becomes more important.

A

gap down on big volume should become a well-recognized sign. It incorporates

all the investor psychology required for identifying when investors are getting

out at the bottom. It usually occurs on bad news. That news probably was known

to the smart investors months before. More titan likely they were selling at

the top. The information was built into the decline of that stock price months

ahead of when the announcement came out.

Fundamental

analysis should be used when exploiting the gap down at the bottom. Whatever

bad news was reported, fundamental analysis assumes that the management of the

company was aware of the problem well before it was announced. It also has to

be assumed that a high percentage of management teams are relatively smart and

effective

This

assumption is made based upon the fact that most management executives rise to

their positions based upon talent. With that in mind, then it can be is assumed

that by the time that a bad news announcement is made, the problem is being

resolved. The management of that company had been working on the solution to

the problem for at least a few months. By the time the news comes out, a

resolution to the problem may already be in place.

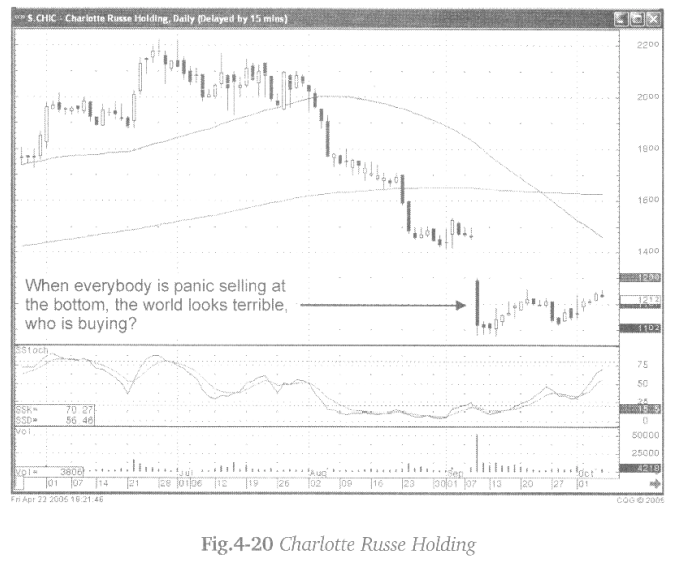

That

leads to one final question. If everybody is panic selling at the bottom, and

the circumstances looks bleak for that stock, then who is buying? If you have

ever found yourself selling at the bottoms because your emotions cannot stand

the stress and the strain, then you should recognize where you sold in the

past. Use that knowledge and the understanding of what a gap down at the bottom

represents. Once you can visually identify indications of bottoming action, an

investor can now establish being mentally prepared to buy when the rest of the

world seems to be selling.

How To make High Profit In Candlestick Patterns : Chapter 3. High Profits Using Gaps : Tag: Candlestick Pattern Trading, Forex : Candlestick analysis, Candlestick chart, Gap down Doji, Hammer signal, Bullish Harami, Gap up bullish candle - Gap Down at the Bottom