Common Wave Characteristics

Extended Waves, Impulsive Wave, Elliott wave structure, ABC Pattern

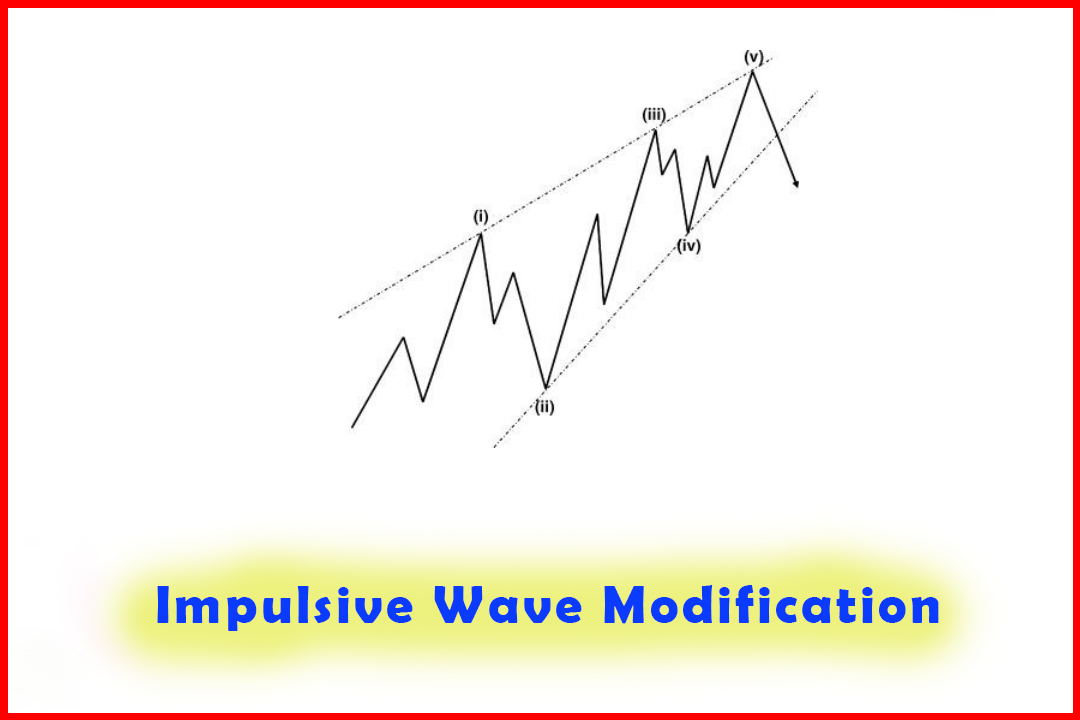

Course: [ Harmonic Elliott Wave : Chapter 3. Impulsive Wave Modification ]

Elliott Wave | Forex |

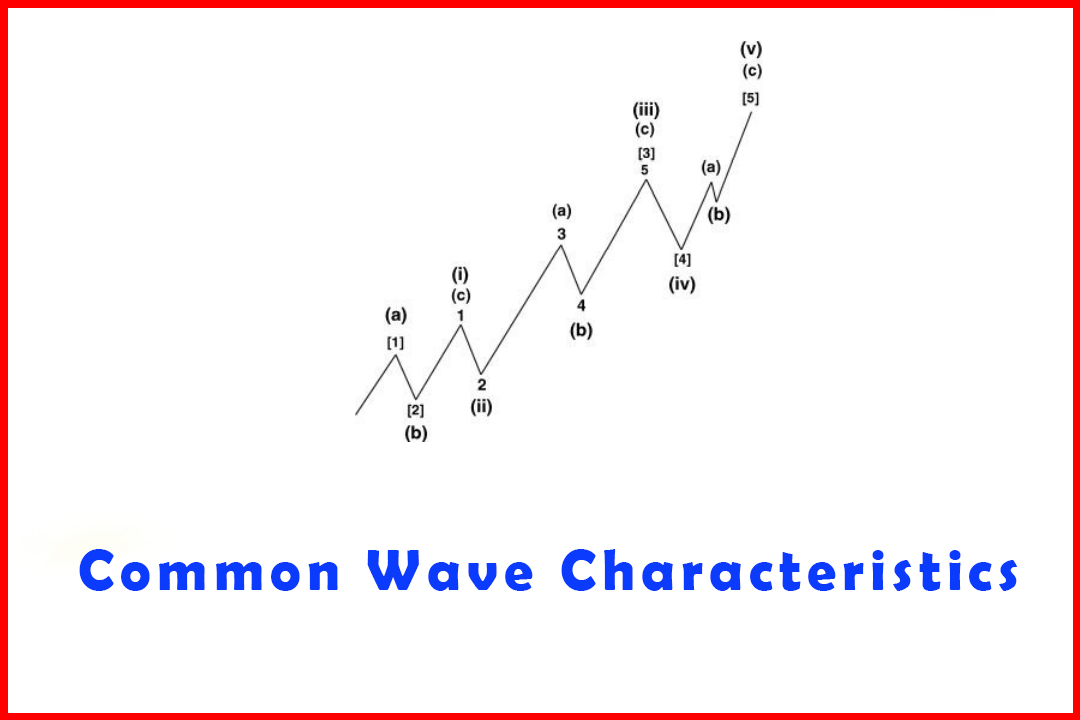

Over the years I have noted several different characteristics that appear in the modified structure. I shall highlight the most common in preparation for the charts that will follow the description of the Fibonacci and harmonic ratios that commonly occur.

Common Wave Characteristics of the Modified Impulsive Wave

Over

the years I have noted several different characteristics that appear in the

modified structure. I shall highlight the most common in preparation for the

charts that will follow the description of the Fibonacci and harmonic ratios

that commonly occur.

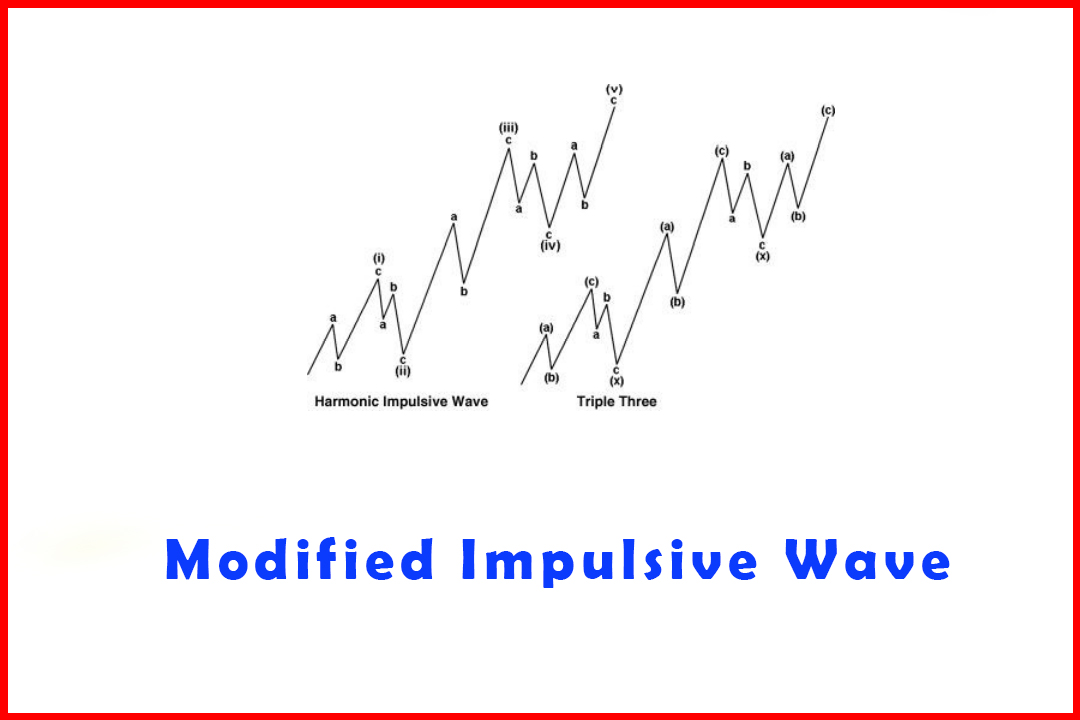

Extended Waves

In

the modified structure, extended waves do not occur in the manner in which

Elliott proposed in his structure. From my extensive observations I have not

seen an equivalent to an extended Wave 1. My opinion is that the concept of

extended waves developed because of the factor I am addressing in this book.

The first Wave (a) and Wave (c) develop in five waves (even though the Waves

(i), (iii), and (v) comprise three waves) and would therefore have looked as if

waves were developing in a (1), (2), 1, 2, 3, so on, manner. Considering Wave

(a) and Wave (c) of Wave (iii) also comprise five waves, that will have

appeared to be a continuation of the extended sequence.

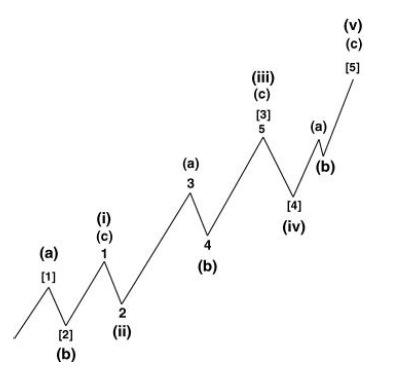

Figure

3.5 is a representation of how I believe R. N. Elliott may have mistaken the

manner in which the impulsive structure develops by classifying the Waves (a)

and (b) as individual five-wave moves. Since each of the Waves (a) and (c)

develop in five waves they could easily be mistaken as separate waves as

described by R. N. Elliott. The key point to the difference between Waves (i)

and (iii) compared to Wave (v) is that invariably Wave (a) of Wave (v) ends

lower than the Wave (iii), whereas in Waves (i) and (iii) the Wave (a) is above

the prior swing (wave) high. Thus it could easily be considered that Wave (v)

was labeled as Wave [5].

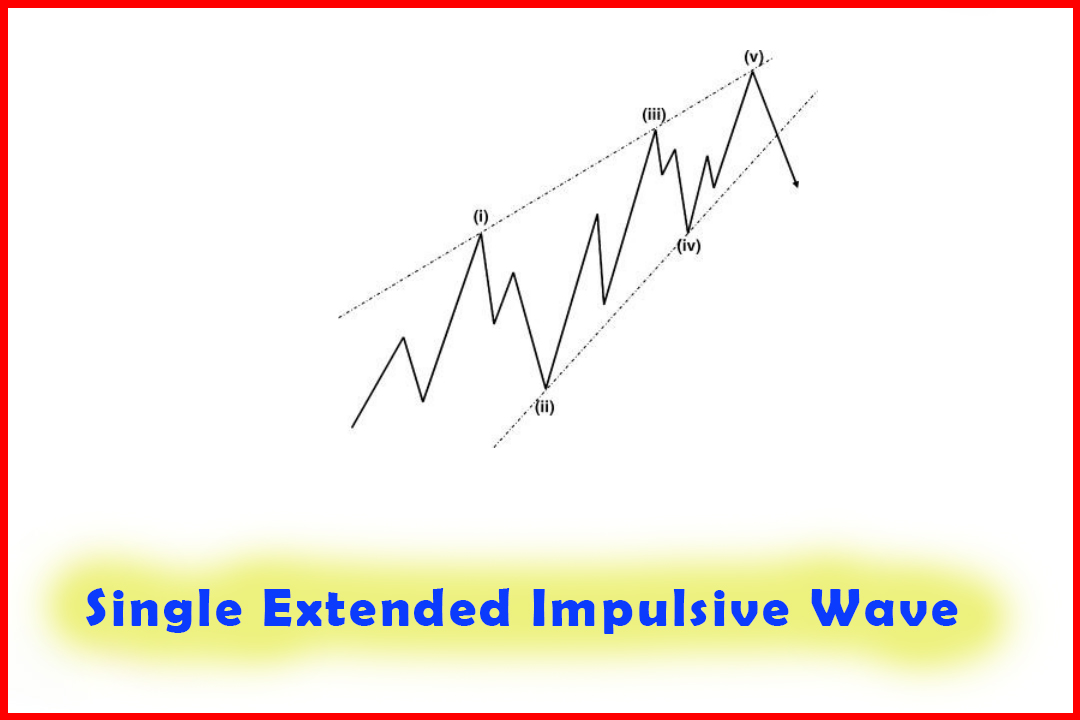

Figure 3.5

Labeling of the Modified Rally versus a Single Extended Elliott Rally

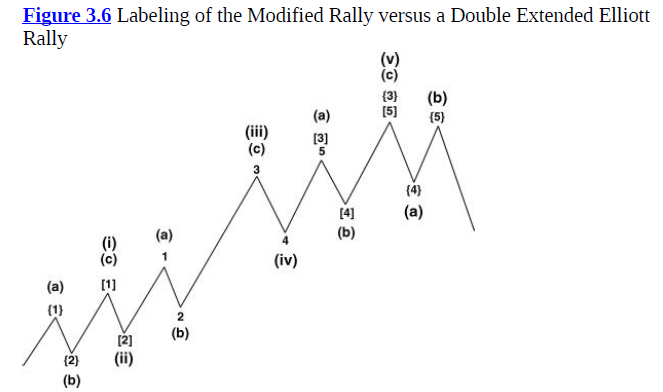

Now consider a double extension in Wave 3 (as shown in Figure 3.6).

Figure

3.6 is one representation of how a double extended wave could be labeled. I

have never noted any occasion where a failed fifth wave has occurred. In this

example the Wave (a) of Wave (v) did end above the prior Wave (iii) and this

has caused what appears to be a double extension of Wave 3. However, Wave {5}

is a failed fifth. In the modified structure Wave {4} is actually Wave (a) of

the new move lower and Wave {5} is Wave (b).

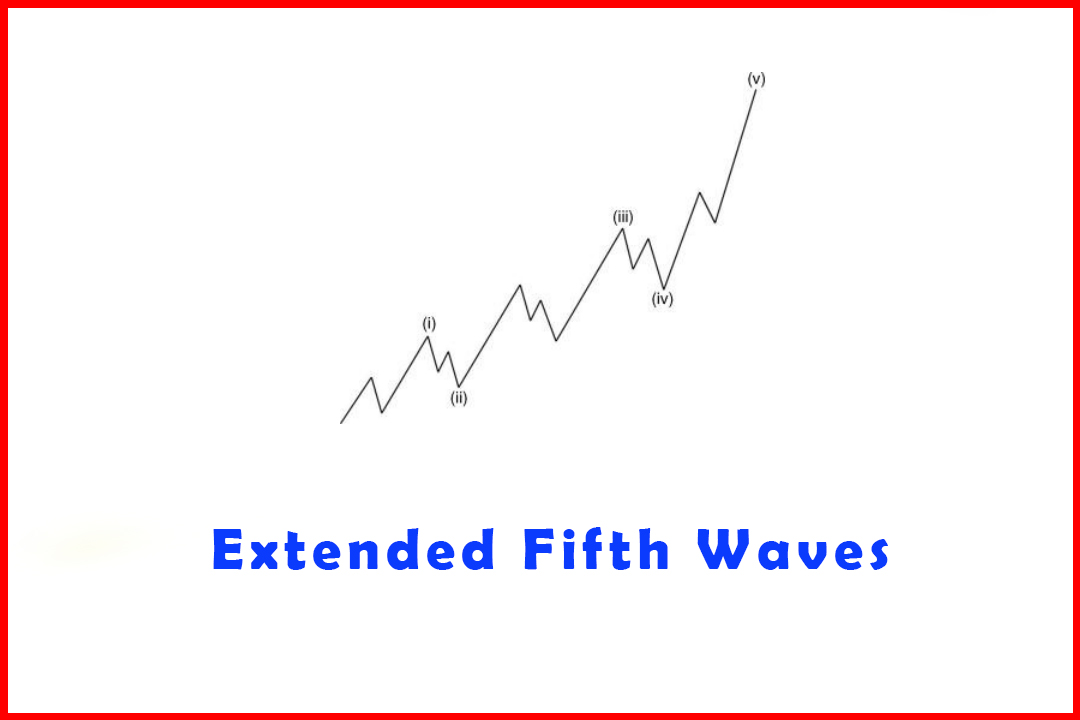

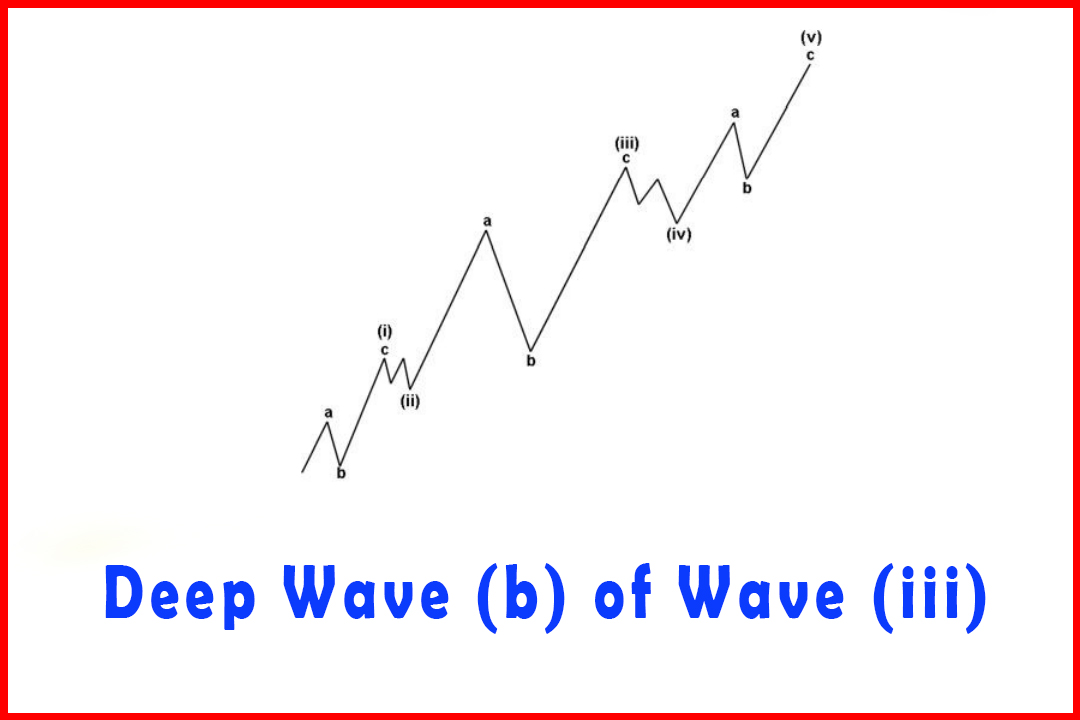

Another

possible confusion that can cause the apparent extended wave structure is the

development of a deep Wave b of Wave iii. For example, in Figure 3.6 the Wave

(c) of Wave (iii) could develop with a deep Wave b of Wave iii. I cover this

situation a little later in this chapter; it will be seen how this appears to

be an additional wave that could have been assumed to be part of an extension.

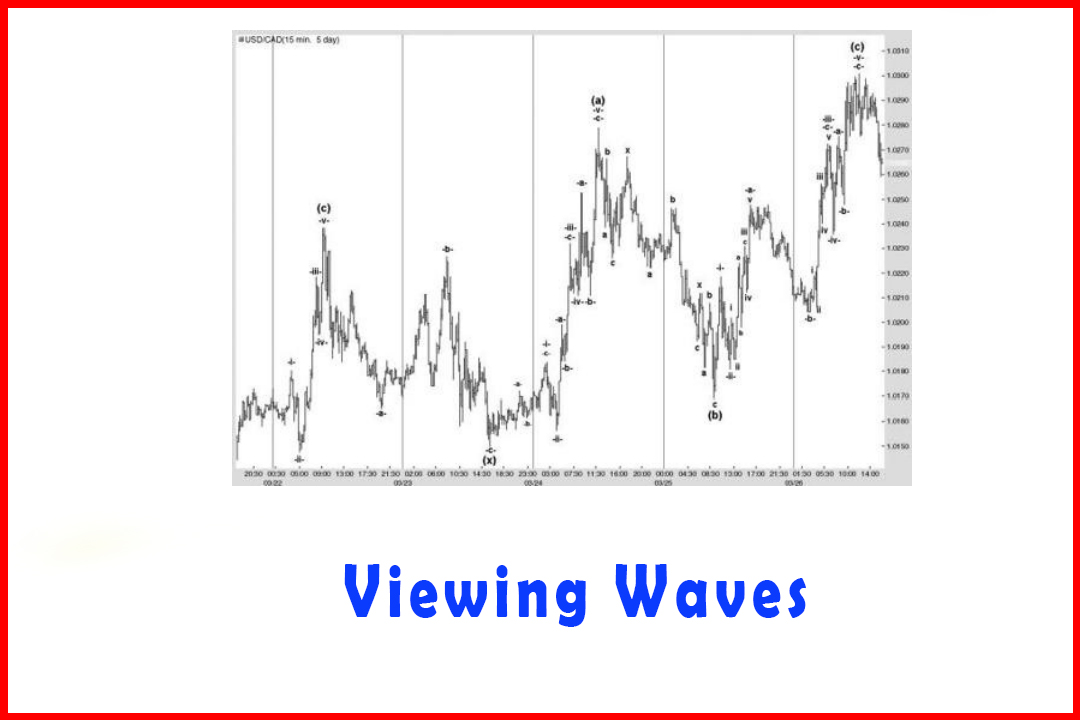

I

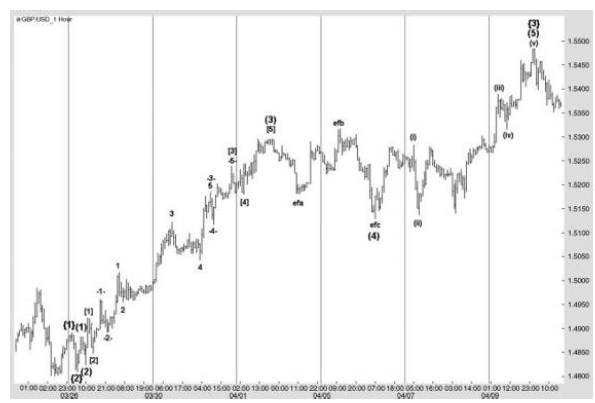

have taken an example of a rally in the hourly chart of the GBPUSD market in

Figure 3.7 and provided a possible wave count in Figure 3.8 that would be used

within a traditional Elliott Wave five-wave structure, although the high at

1.5484 has only been counted as the end of Wave {3}. There are probably other

different counts that could have been employed, the problem being that it is

mostly subjective and there is implied “permission” to arrange the count to

suit the fact that such a rally is obviously a five-wave move which has

extended. No real attention is given to wave relationships at this stage and

more attention is given to fitting in a wave count that suits the

analyst's expectations. I could never quite accept this form of

Elliott Wave as a forecasting tool, as not only does it tend to cause too many

changes in view but it also makes forecasting reversal points more a matter of

chance.

Figure 3.7 An

Example of how a Multiple Extended Rally in GBPUSD may be Labeled

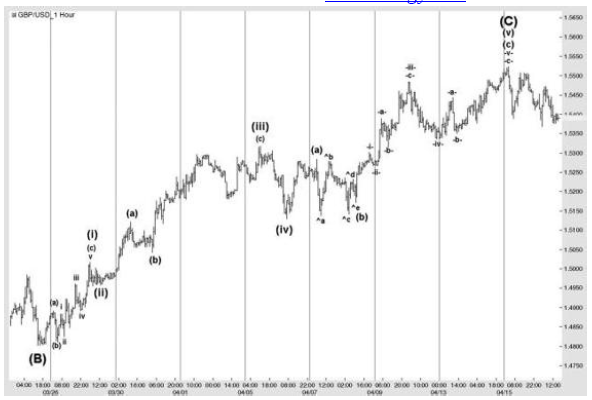

Figure 3.8 The Same Rally as in Figure 3.7 but with a Harmonic Wave Count Applied

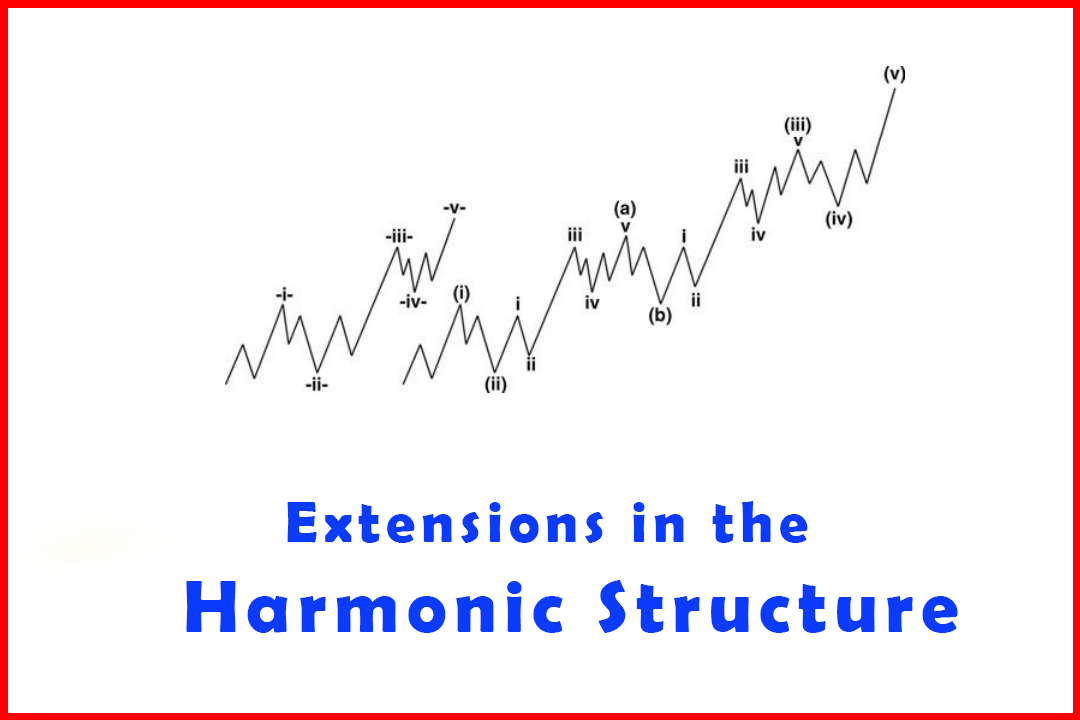

Now

let's look at the harmonic version of this rally.

As

I will demonstrate in Chapter 4, all ratios between Wave (c) and Wave (a) and

their corresponding Waves (i), (iii), and (v) are in harmony, as is the

attention to the alternation of Wave (ii) and Wave (iv). I will not suggest

that at every stage the individual structural development could have been

anticipated, but with due diligence and attention to matching ratios there

would have been plenty of opportunities to identify the waves in retrospect.

While this may sound no different from the original structure Elliott

described, it is in fact quite different. The use of requiring ratios to

develop in harmony across the wave structure brings a higher level of certainty

to the correct structure and therefore greater confidence in understanding what

move is required next to confirm. It will also confirm the structure and

approximate extent of the forthcoming waves.

Harmonic Elliott Wave : Chapter 3. Impulsive Wave Modification : Tag: Elliott Wave, Forex : Extended Waves, Impulsive Wave, Elliott wave structure, ABC Pattern - Common Wave Characteristics

Elliott Wave | Forex |