Rule Concerning the Overlap of Wave 1 and Wave 4

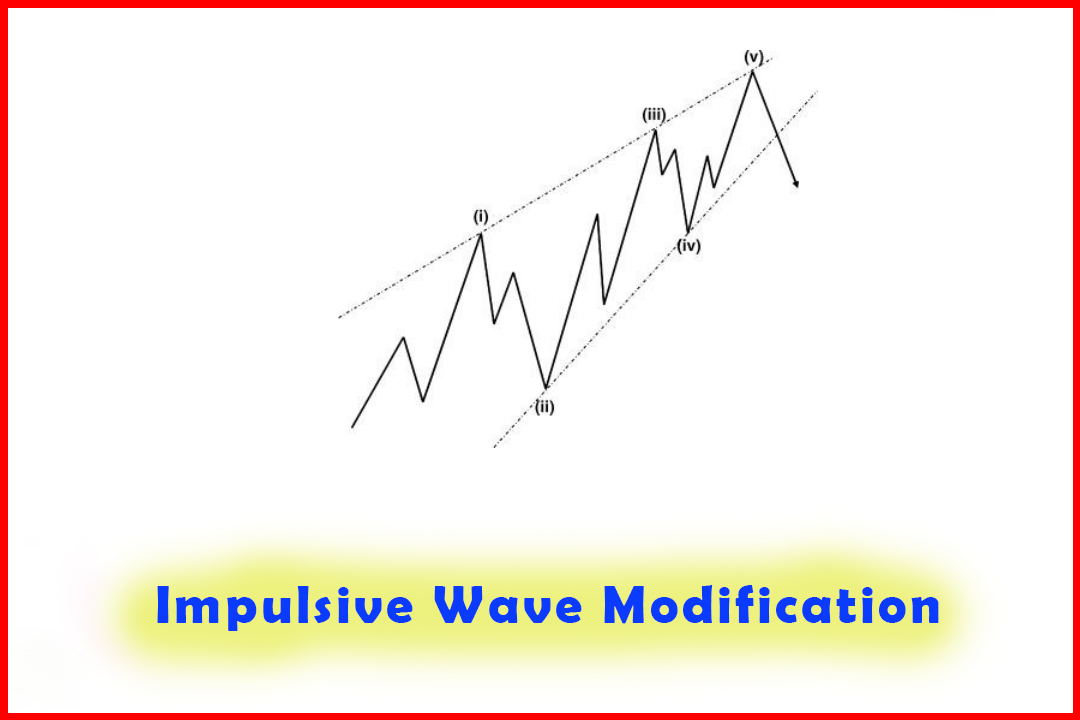

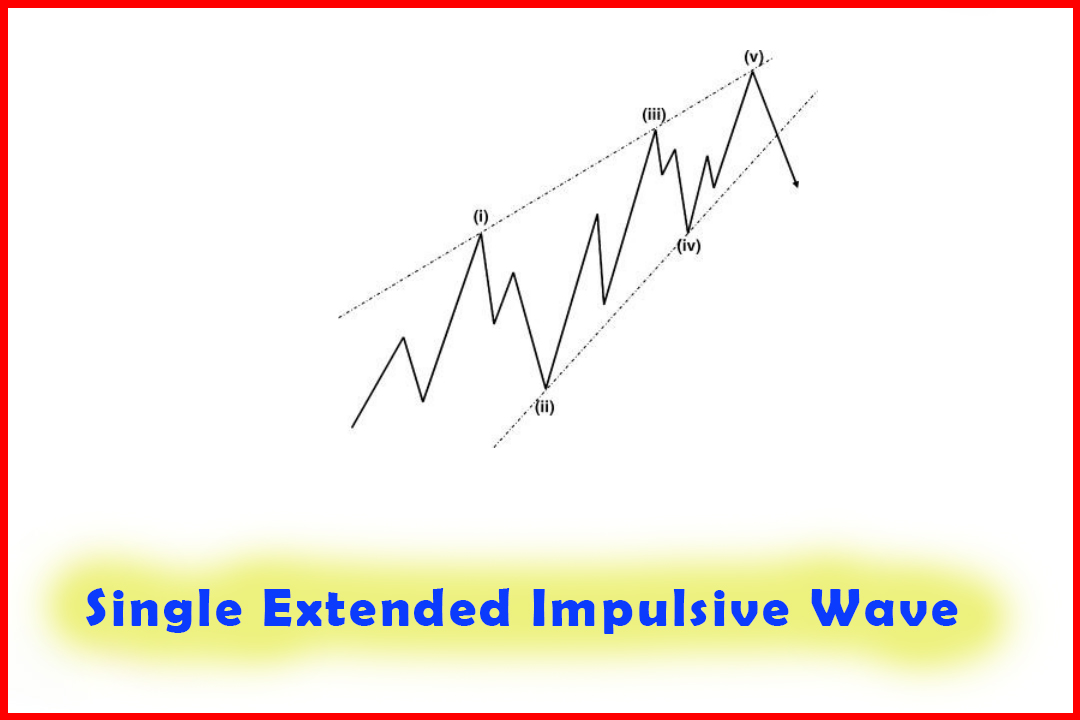

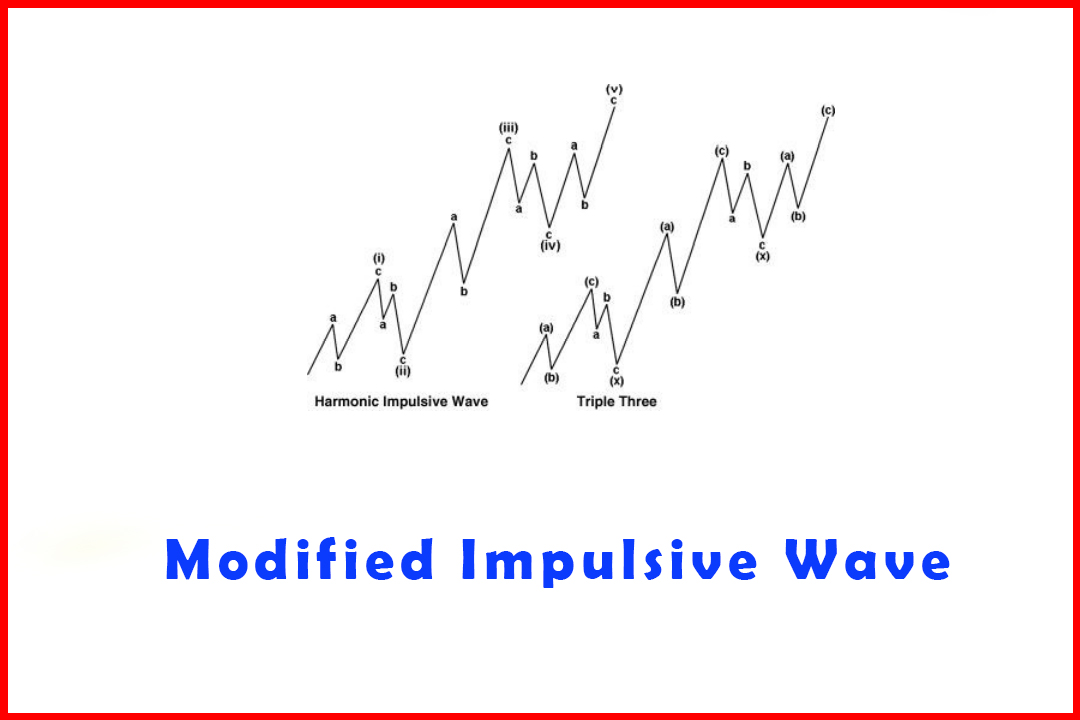

Modified Impulsive Wave, Triple Three Trading Strategy

Course: [ Harmonic Elliott Wave : Chapter 3. Impulsive Wave Modification ]

Elliott Wave | Forex |

As one of Elliott's unbreakable rules he stated that the correction in Wave 4 should never penetrate the extreme of Wave 1. In my findings.

Elliott's Rule Concerning the Overlap of Wave 1 and Wave 4

As

one of Elliott's unbreakable rules he stated that the correction in

Wave 4 should never penetrate the extreme of Wave 1. In my findings. I do not

really see any evidence of this, and whether or not the extremes of Wave (i)

and Wave (iv) overlap really depends on whether the Wave (iii) has been a

normal projection or a strong projection. While I will cover the degrees of

projections in Chapter 4, for now I will merely point to Wave (iii) projections

of between 161.8% and 194.43% as being normal with projections of 223.6% or

higher being strong projections. It is probably fairly obvious that the

stronger the Wave (iii) the less chance there is of the Wave (iv) retracement

being able to reach the extreme of Wave (i).

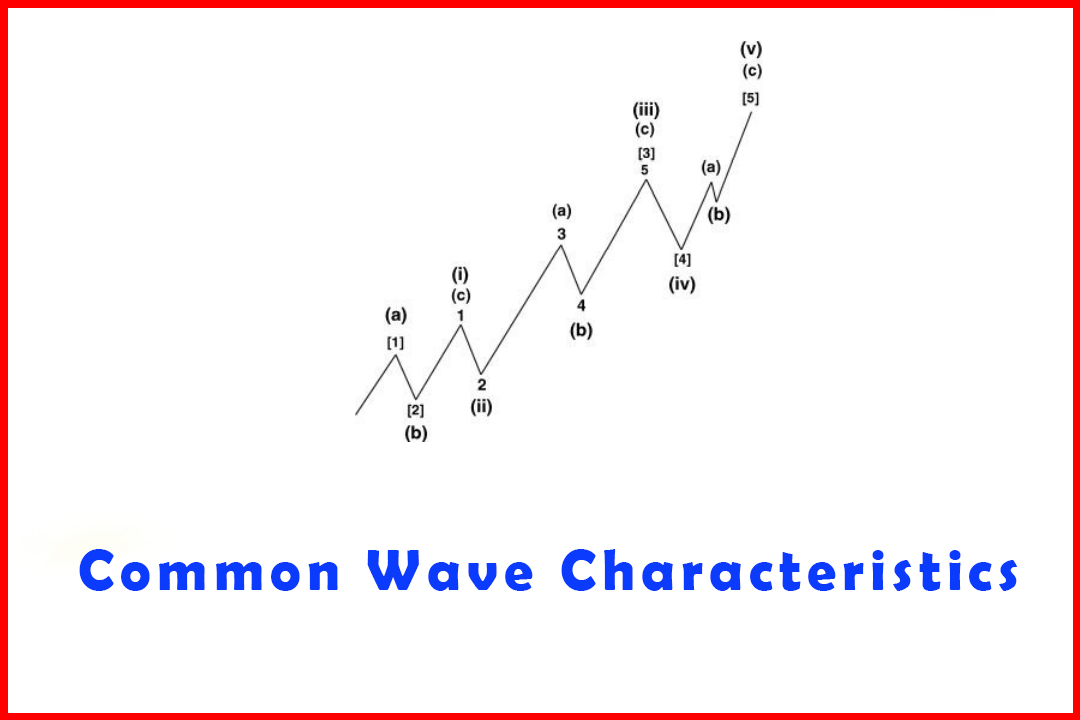

Furthermore,

since instances of Wave (iii) will only occur in a Wave (a) or Wave (c), which

in turn appear in both impulsive five-wave moves as well as corrective

structures, the most common occurrences of overlap are in corrective

structures. Extending this concept, it is also logical that since a Wave (iii)

in an impulsive (trending) move has the greatest occurrence of strong

projections the instances of overlap are least. In Waves (i) and (v), overlaps

are more common.

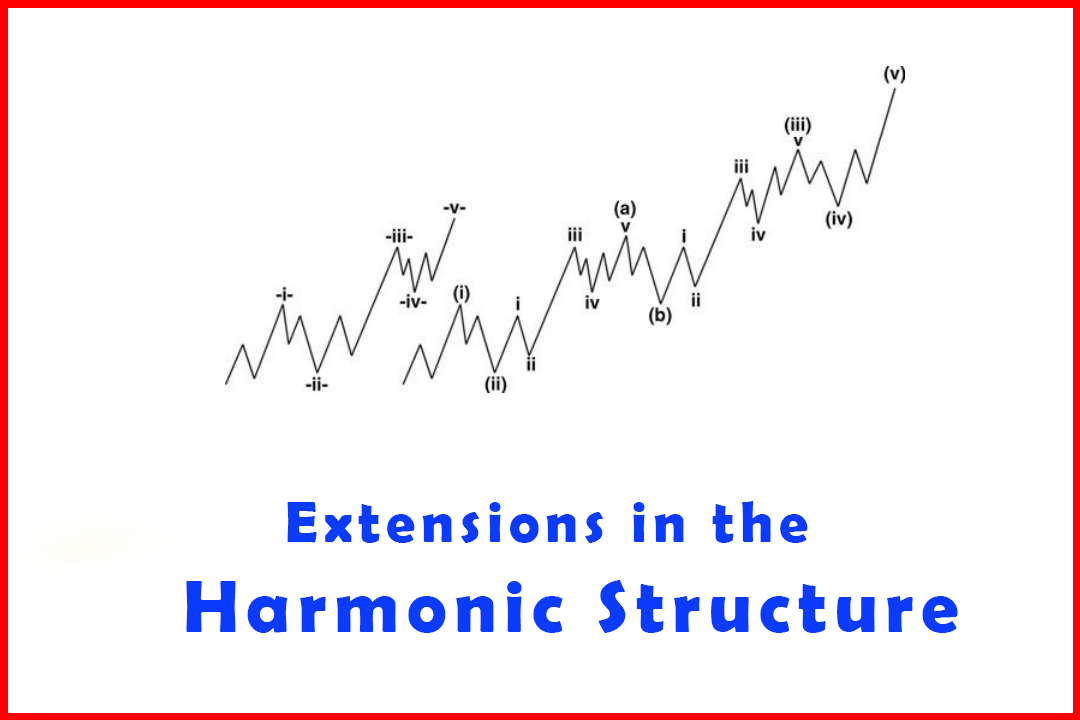

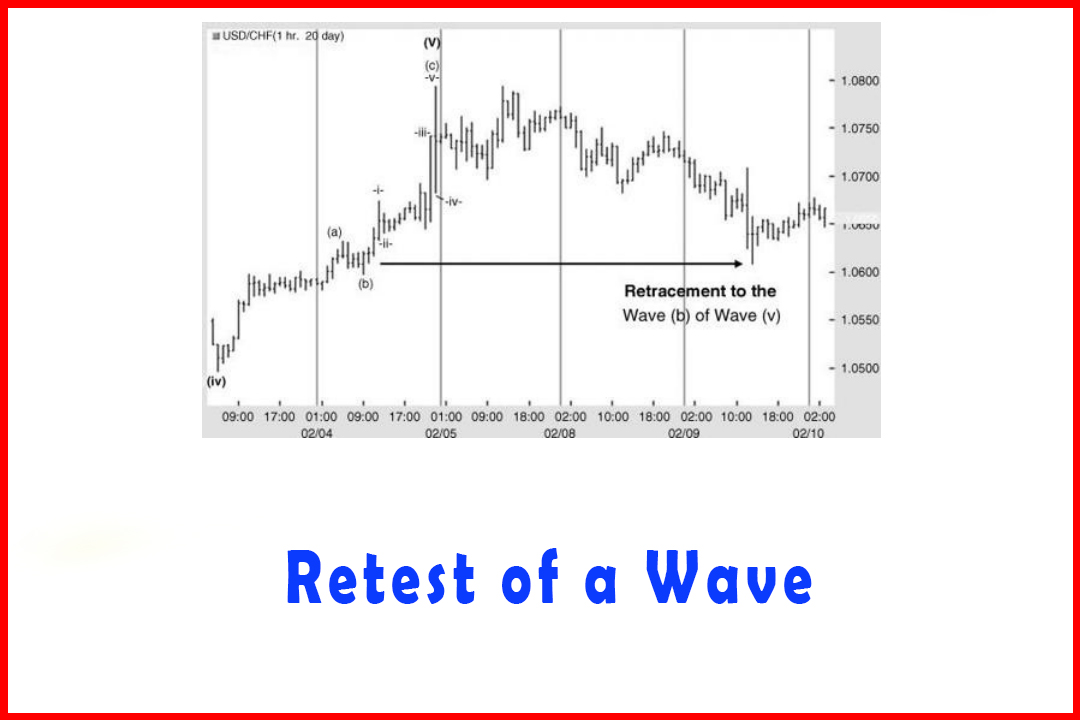

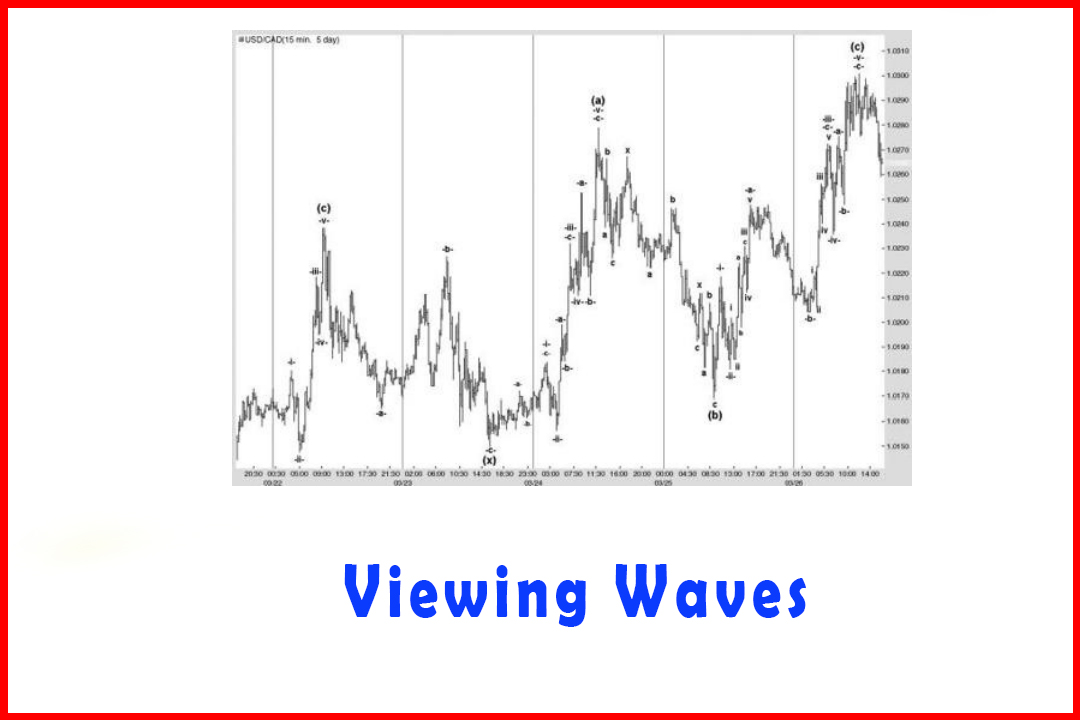

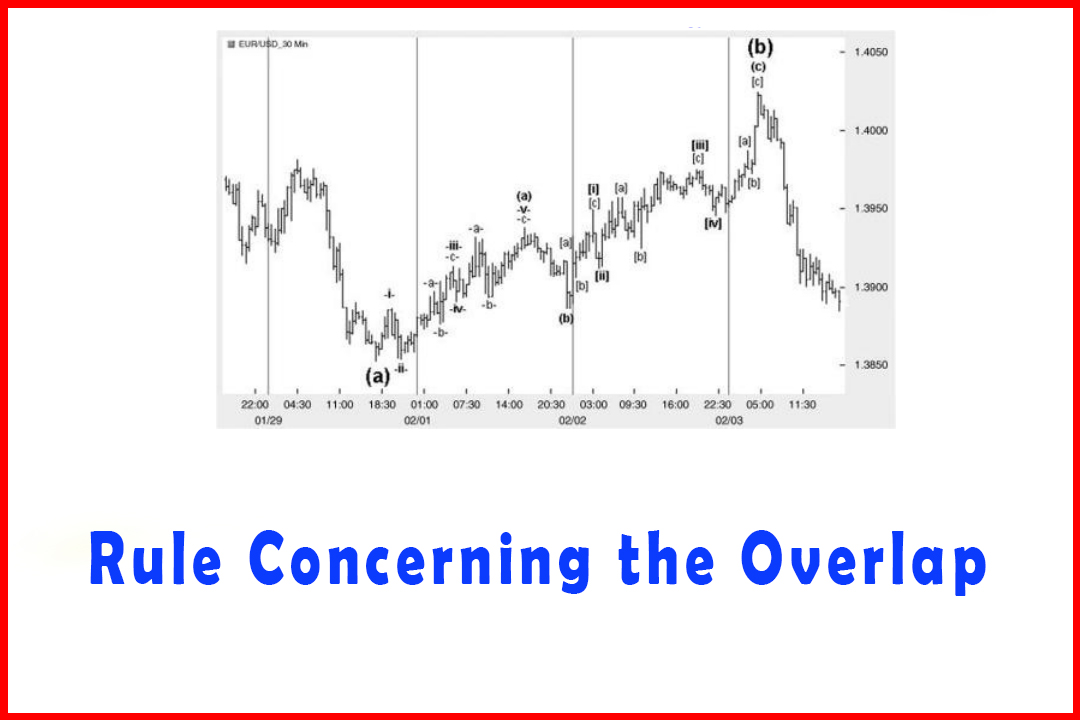

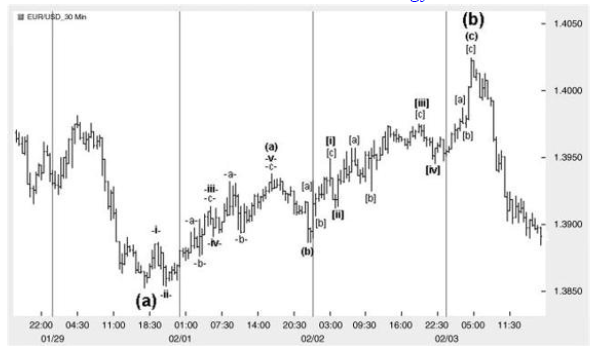

Figure

3.17 displays an (a)(b)(c) rally in a Wave (b) of the next higher degree. Note

in Wave (a) the peak of Wave -i-is not touched by the low of Wave -iv-.

However, in Wave (c) the low in Wave [iv] does overlap the peak in Wave [i].

This does not necessarily mean that overlaps are seen only in Wave (c). They

can happen in either Wave (a) or Wave (c). What is more important to understand

is that the overlap occurred in a corrective structure of the next higher

degree and not a true impulsive, trending move.

Figure 3.17 Zigzag

Higher in 30-Minute EURUSD with Overlap in Wave [i] and Wave [iv]

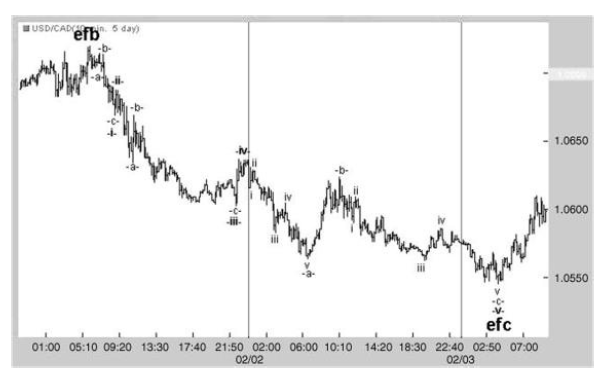

Figure

3.18 displays a decline in Wave efc of an Expanded Flat Wave (iv) in USDCAD. In

this example, the extremes of Wave -i-and Wave -iv-are not close at all.

Figure 3.18 A

Decline in Wave efc in 10-Minute USDCAD to Complete what was a Wave (iv)

Note: The

two examples will be used in Chapter 4 to confirm the remarkably accurate

relationships between all related waves.

Alternation

Elliott's

guideline on the alternation between Wave 2 and Wave 4 holds true in the

modified structure. However, it does raise one additional complication. To

recap on Elliott's guideline, Elliott noticed a strong tendency for

corrective waves within an impulsive structure to alternate in terms of depth

and complexity. If Wave 2 develops in a simple manner (an ABC Zigzag move) then

Wave 4 will tend to be complex (Triangle, Flat, Expanded Flat, or Triple

Three). If Wave 2 develops in a complex manner then Wave 4 tends to be a simple

ABC move.

In

addition, alternation covers the depth of the retracements in Waves 2 and 4. If

Wave 2 was shallow then Wave 4 will be deep, and vice versa.

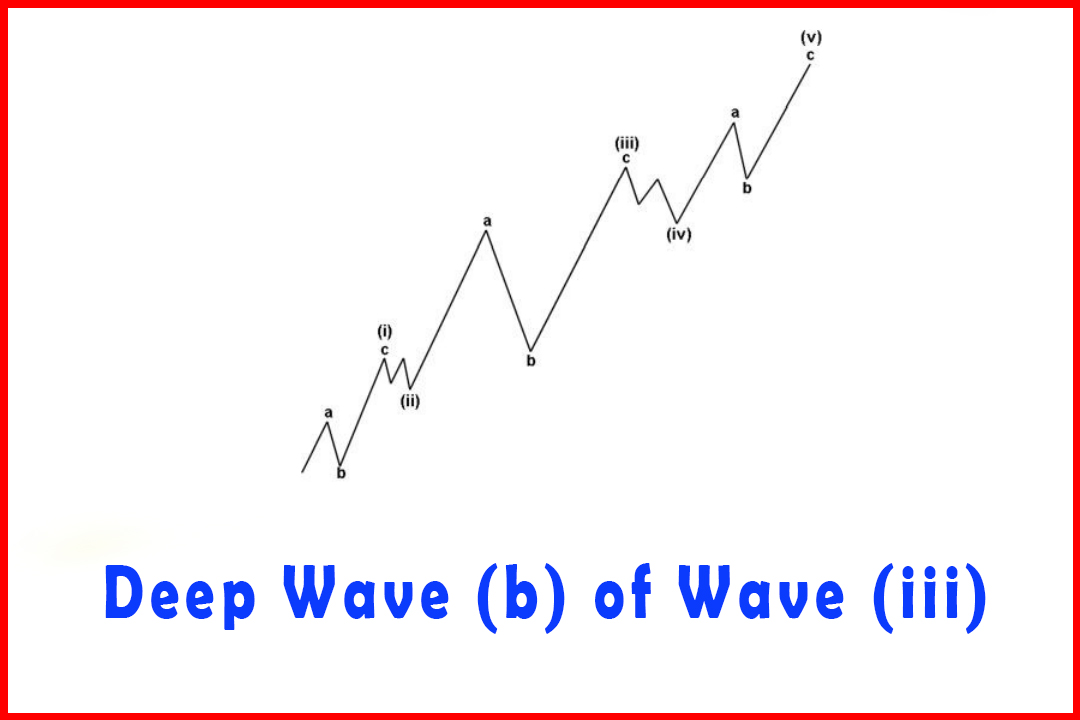

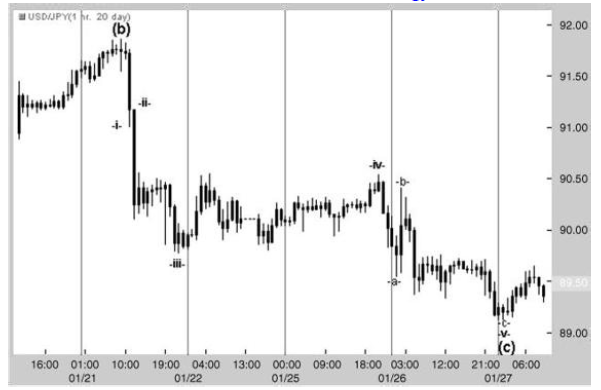

Figure

3.19 displays a five-wave decline in a Wave (c) in the hourly USDJPY. Note how

Wave -ii-was almost non-existent. In fact, the extension in Wave -iii- held a

moderately good relationship with Wave -i-and the correction in Wave - iv-is

clearly a deep and long correction. This also held what is a very common

relationship in a deep Wave -iv-, and will be covered in Chapter 5.

Figure 3.19 A

Five-Wave Decline in Wave (c) in USDJPY which has Wave -i- and Wave

-iv-Alternating

Harmonic Elliott Wave : Chapter 3. Impulsive Wave Modification : Tag: Elliott Wave, Forex : Modified Impulsive Wave, Triple Three Trading Strategy - Rule Concerning the Overlap of Wave 1 and Wave 4

Elliott Wave | Forex |