Guideline on a Retest of a Wave

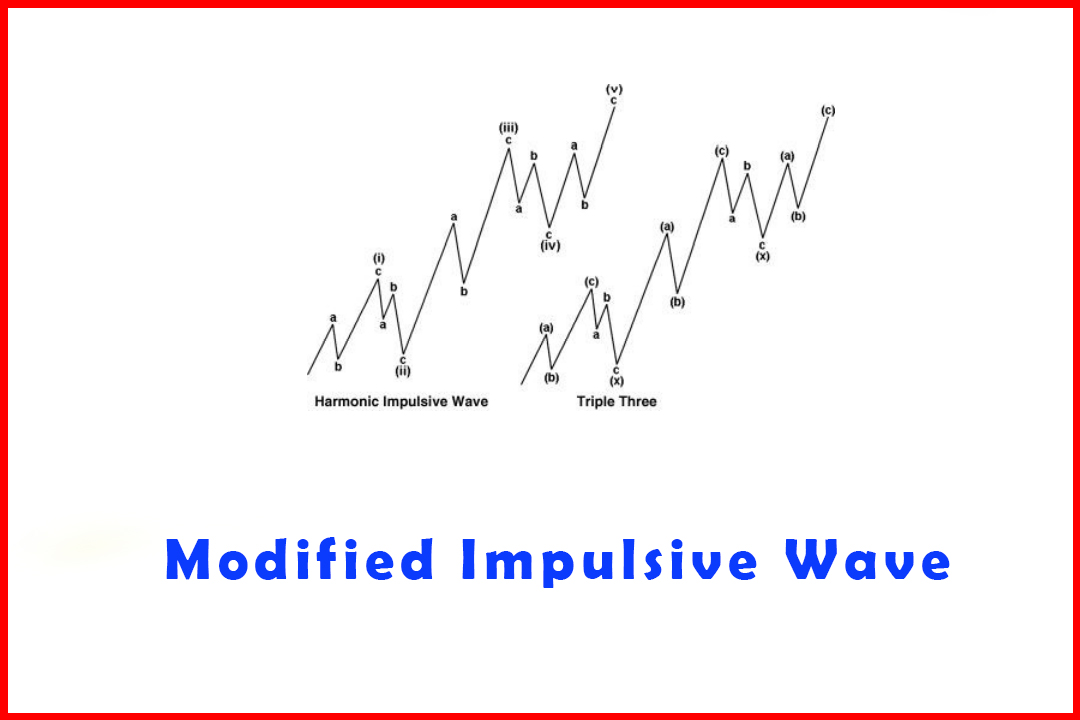

Modified Impulsive Wave, Triple Three Trading Strategy

Course: [ Harmonic Elliott Wave : Chapter 3. Impulsive Wave Modification ]

Elliott Wave | Forex |

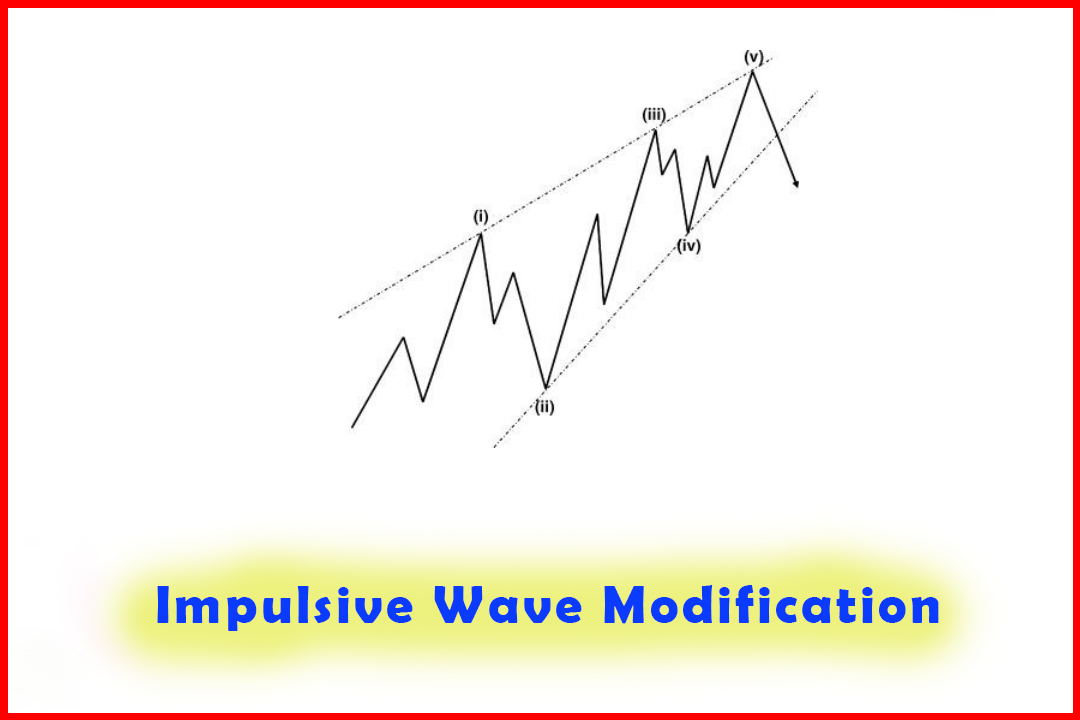

Given that I have discovered that the impulsive waves 1, 3, and 5 actually comprise three waves and not five, this guideline can become a key pivotal forecaster in your analysis.

Guideline on a Retest of a Wave (b) after Completion of a Three-Wave Move

Given

that I have discovered that the impulsive waves 1, 3, and 5 actually comprise

three waves and not five, this guideline can become a key pivotal forecaster in

your analysis. However, I have noticed different reactions after the completion

of each three-wave impulsive wave.

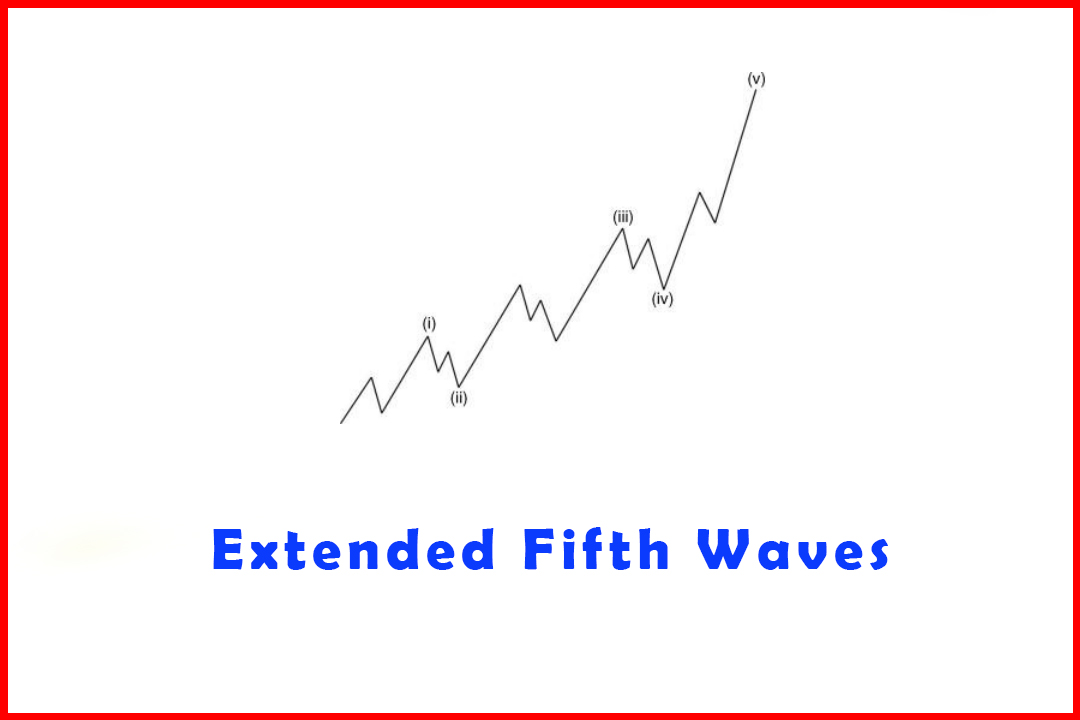

The

retracement after Wave (i) may see the Wave (b) hold and sometimes not. In most

cases it will be retested, but if Wave (ii) is a Triple Three then it will be

quite common for the retracement to be quite deep and beyond the Wave (b).

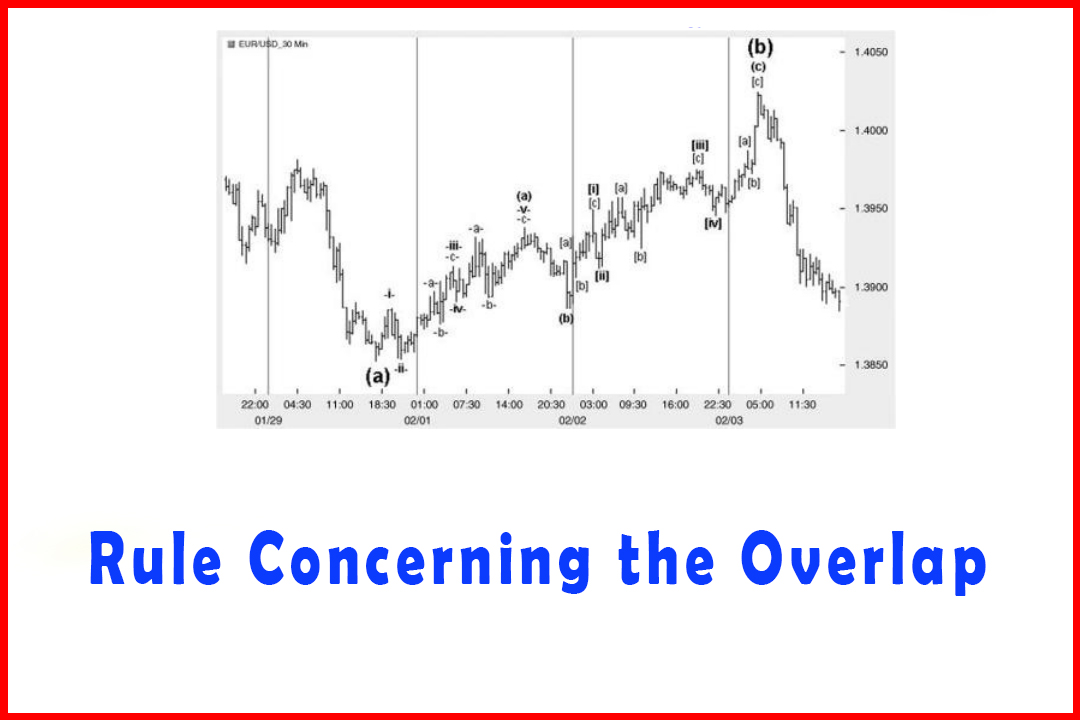

The

retracement after Wave (iii) will never fully test the Wave (b). Occasionally

it comes close, but will not move particularly close to the extreme. Even after

the completion of Wave (v) and there has been a reversal, it is rare for the

extreme of Wave (b) of Wave (iii) to provide any lasting reaction unless it is

clearly a key swing high/low within the trend.

The

retracement after Wave (v) almost always moves directly to the Wave (b). More

than in any other position this can be relied upon in the vast majority of

cases.

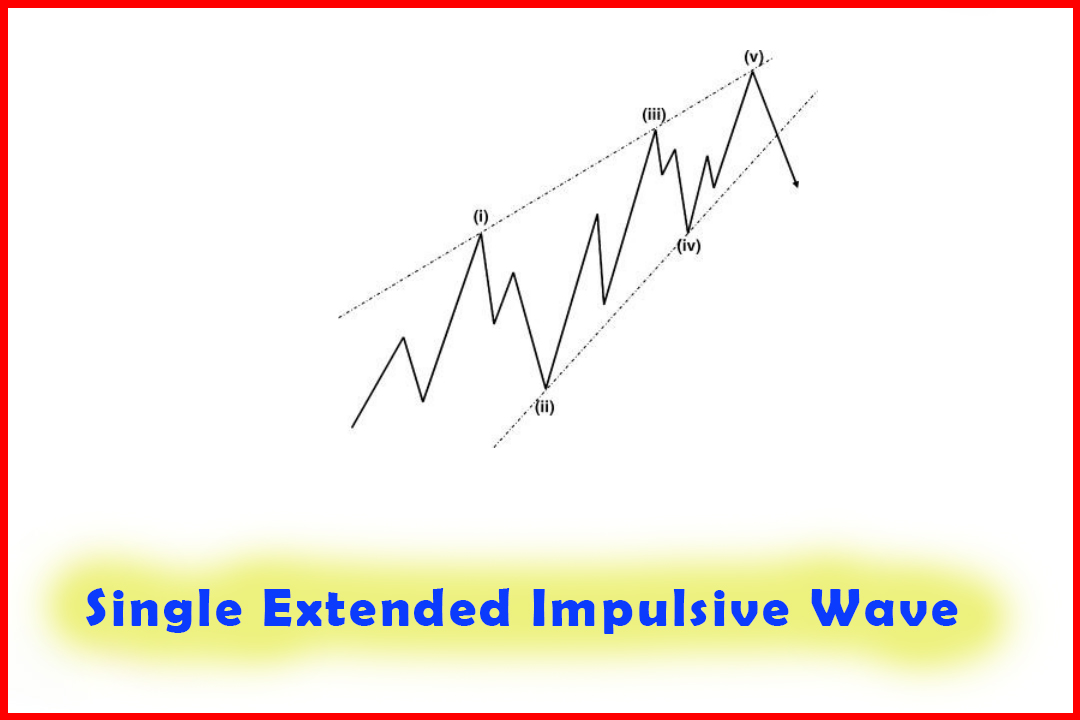

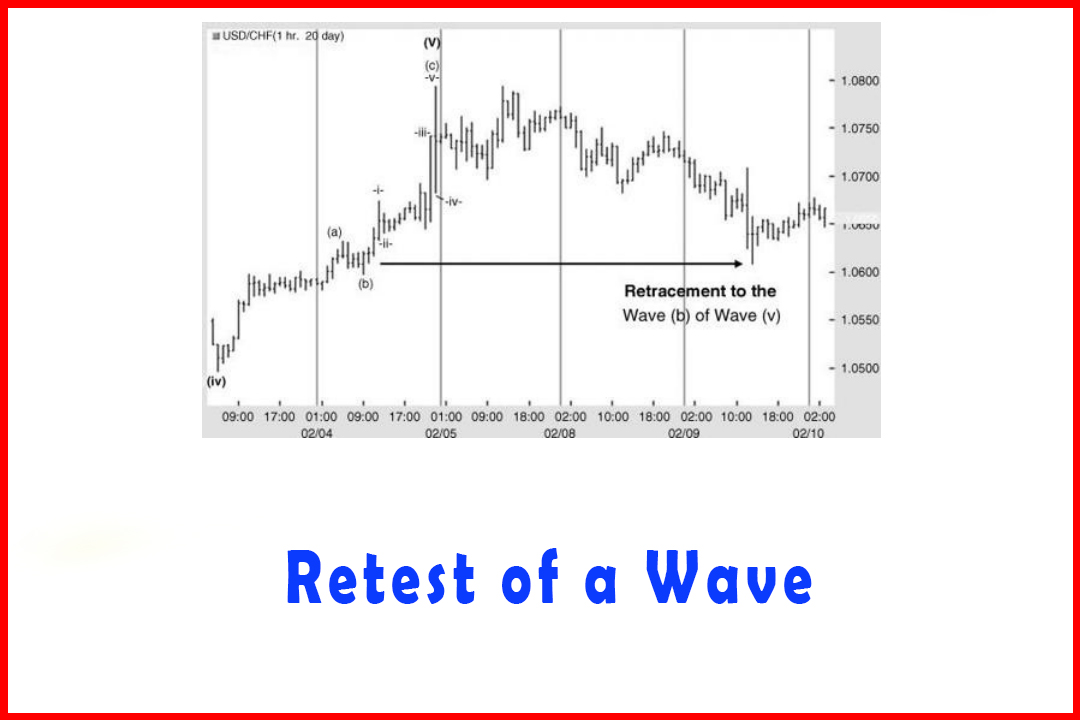

In

the example in Figure 3.25 in the hourly USDCHF market we had a long move

higher that came in three waves, this being the fifth wave of Wave (C). Within

the Wave (v) the rally came in three waves, with Wave (b) just below 1.0600.

After completion of Wave (v), price declined to the span of the Wave (b) and

corrected higher. In fact this pullback reached higher to 1.0719. If we observe

this market in a lower time frame, perhaps the five-minute chart, we should

also be able to spot the Wave -b-of Wave -v-, which should have been the first

target in the retracement.

Figure 3.25 A

Return to the Prior Wave (b) of Wave (v) after the Completion of the Wave (v)

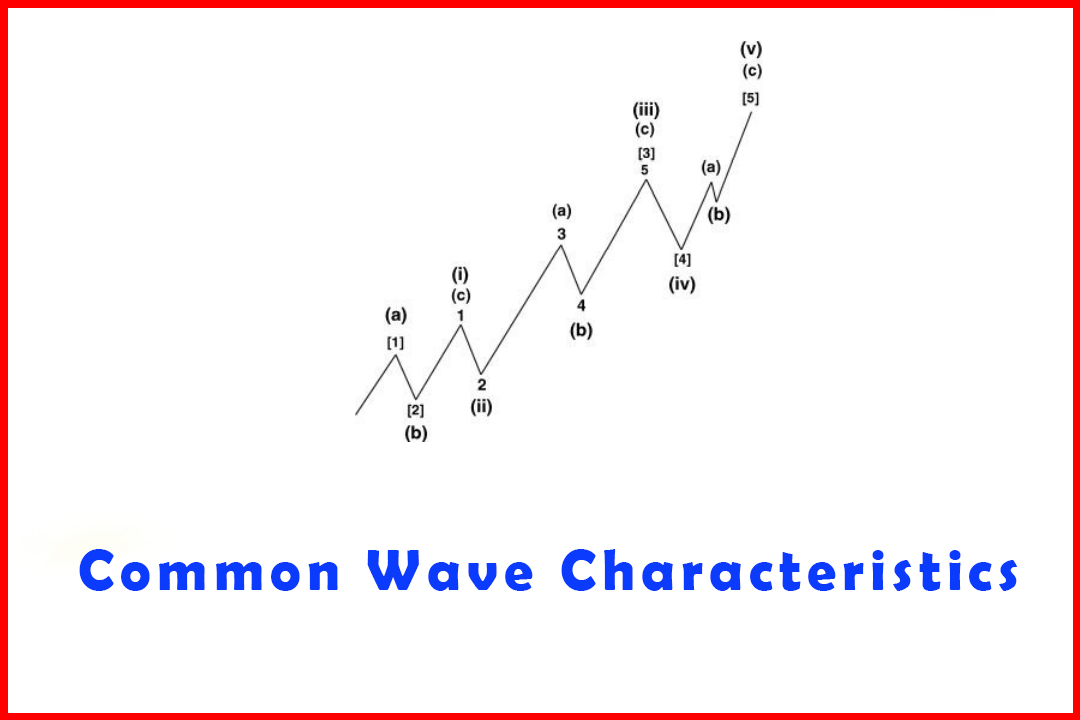

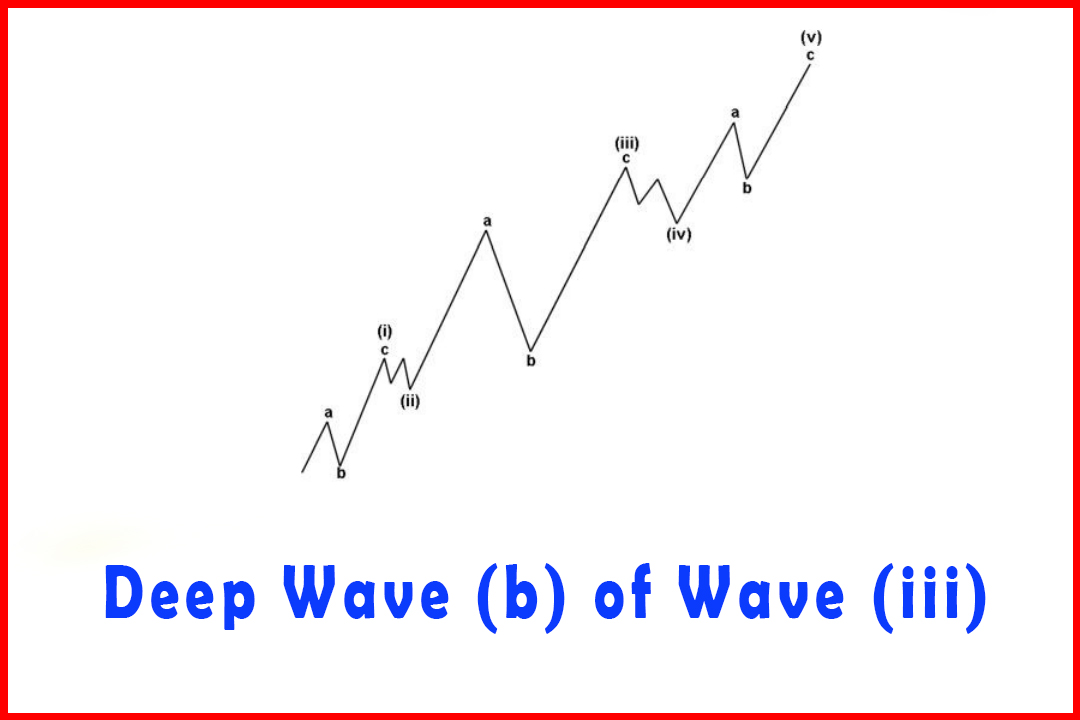

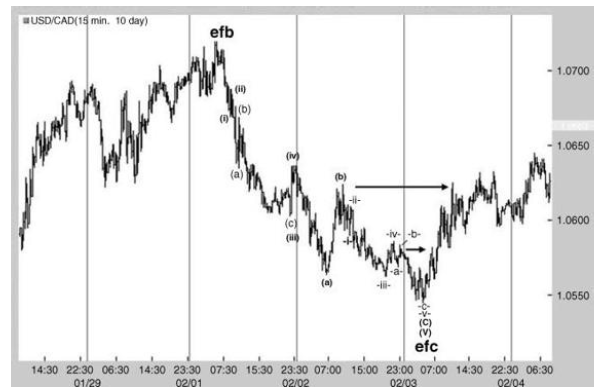

An

example of this type of move is shown in Figure 3.26, which shows the decline

in Wave efc in USDCAD shown in Figure 3.18.

Figure 3.26 A

Return to the Prior Wave -b-and Wave (b) of Wave (v) after the Completion of

the Wave (v)

Following

the perfect move lower in five waves it can be seen that price quickly retraced

to the Wave -b-of Wave -v-, corrected lower, and then rallied toward the peak

of Wave (b) of Wave (v). This type of reaction is extremely powerful and occurs

very regularly, and can set up the reversal structure very well.

Harmonic Elliott Wave : Chapter 3. Impulsive Wave Modification : Tag: Elliott Wave, Forex : Modified Impulsive Wave, Triple Three Trading Strategy - Guideline on a Retest of a Wave

Elliott Wave | Forex |