Development of Extensions in the Harmonic Structure

harmonic structure, How to trade Harmonic Pattern, Impulsive wave trading, best trading strategy

Course: [ Harmonic Elliott Wave : Chapter 3. Impulsive Wave Modification ]

Elliott Wave | Forex |

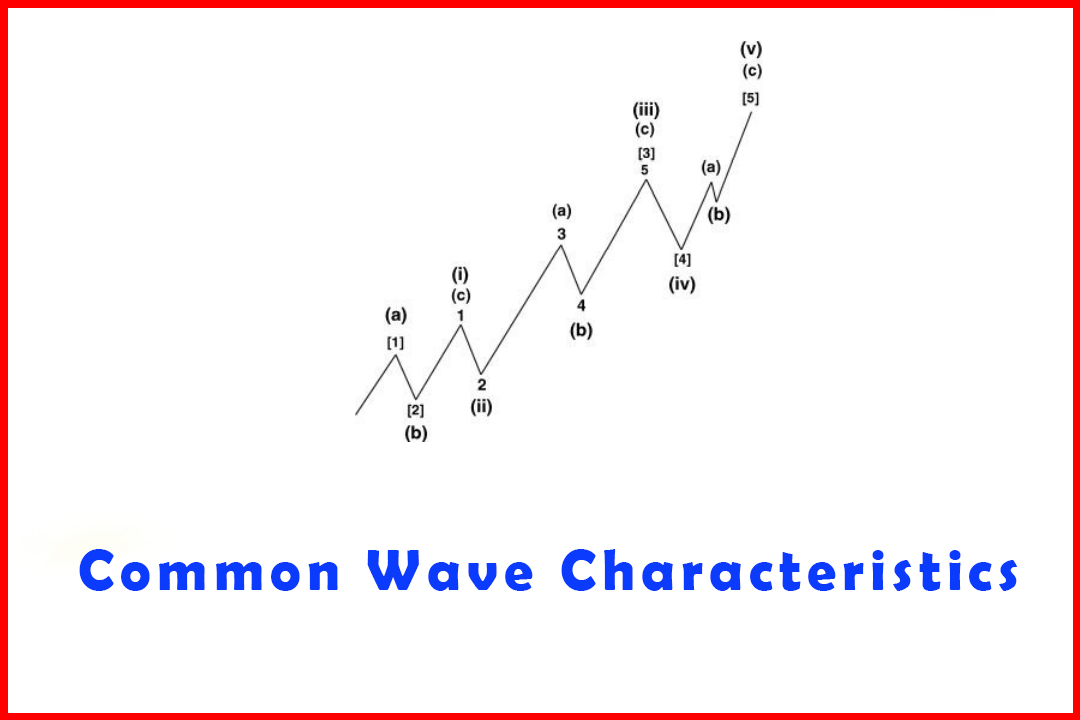

The harmonic structure there is basically little difference in the structure between a standard five-wave move and an extended five-wave move. Both are constructed of five waves, all developing in three waves. However, quite clearly some trends develop more aggressively than others, and it is worth noting the difference.

Development of Extensions in the Harmonic Structure

In

the harmonic structure there is basically little difference in the structure

between a standard five-wave move and an extended five-wave move. Both are

constructed of five waves, all developing in three waves. However, quite

clearly some trends develop more aggressively than others, and it is worth

noting the difference.

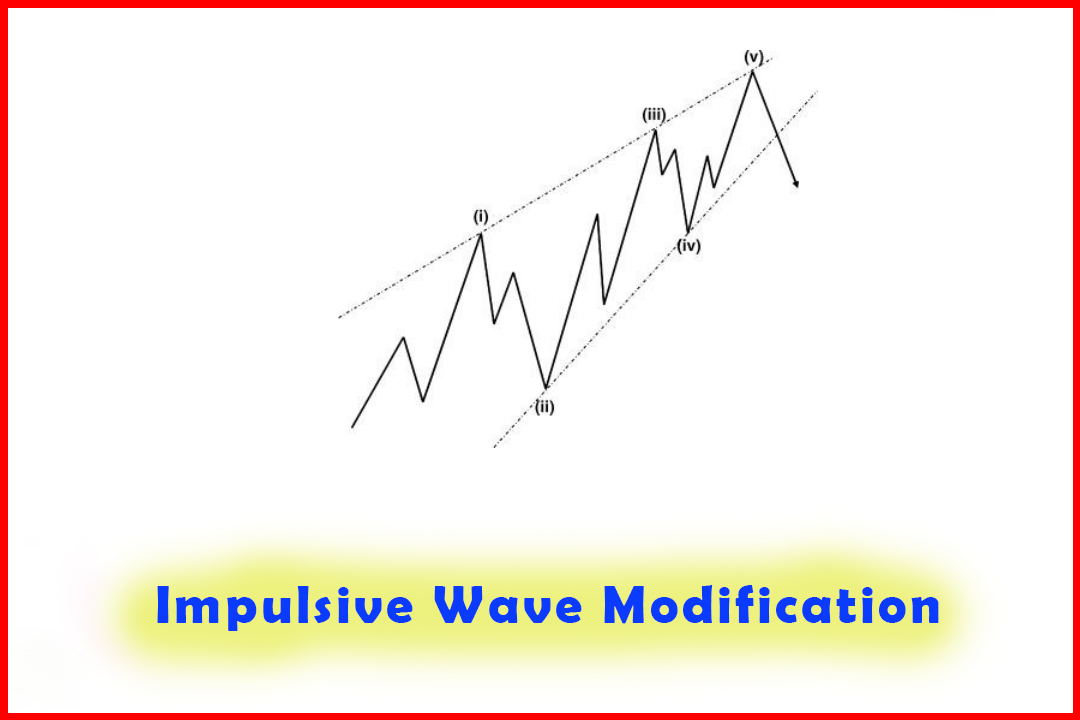

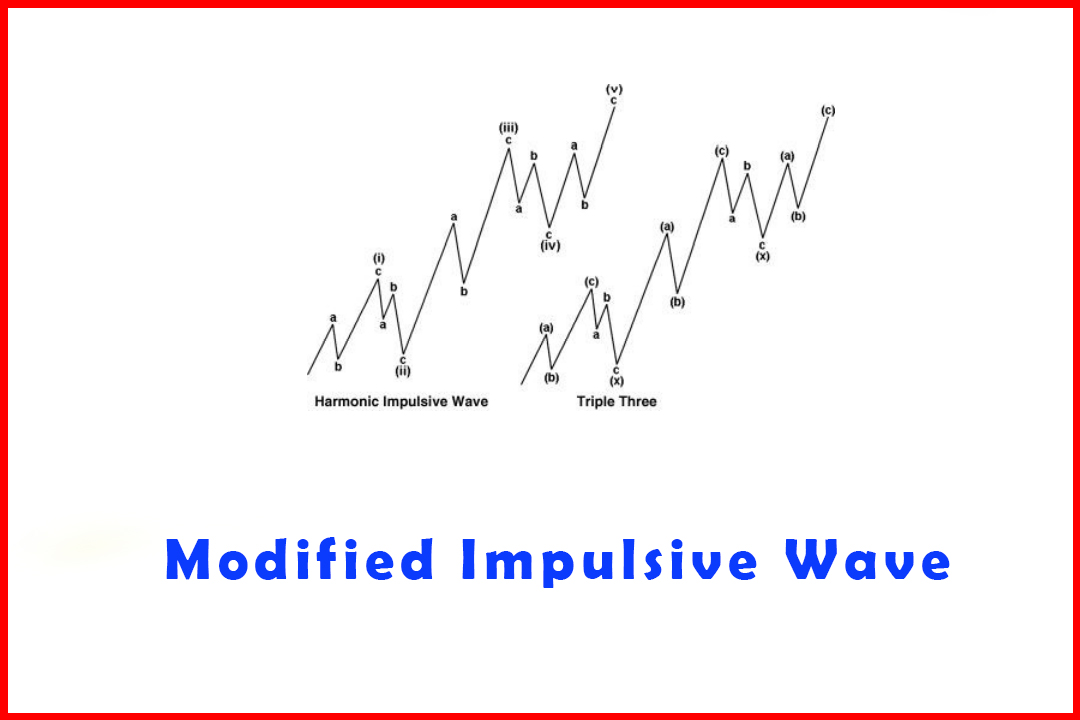

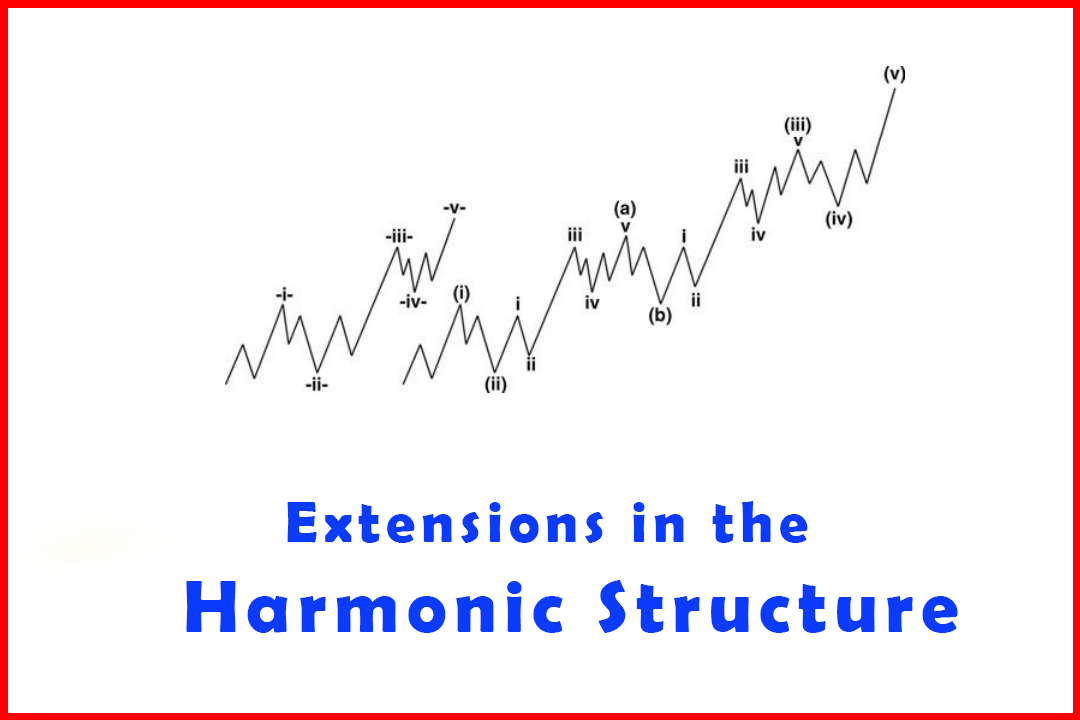

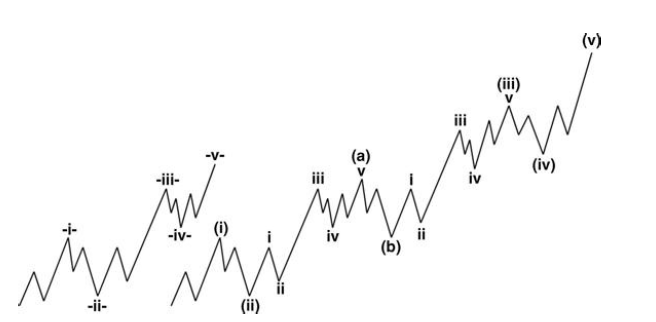

Figure

3.9 displays two five-wave rallies. On the left, labeled as Wave -i-to Wave

-v-, it can be seen that the rally is not really aggressive but develops in the

harmonic manner. On the right the rally begins in a very similar manner.

However, the equivalent to Wave a, Wave b in Wave -iii-plus the Waves abc in

Wave -v-actually develop in their own five waves to form Wave (a) of Wave

(iii). This is then followed by a pullback in Wave (b) and again another five

waves in Wave (c) of Wave (iii). It is then that Waves (iv) and (v) develop.

Figure 3.9 A

Standard Five-Wave Rally on the Left Compared to an Extended Rally on the Right

The

key to identifying this type of extension is that what is a five-wave Wave a on

the left will develop in three waves on the right. In addition, the wave

relationships in Wave i through Wave v will demonstrate harmonic ratios. In

particular this will become evident since the extension in Wave v will be a projection

of the rally from Wave (ii) and not from the very start of the rally. The

extension in Wave (iii) will also be a projection of Wave (i).

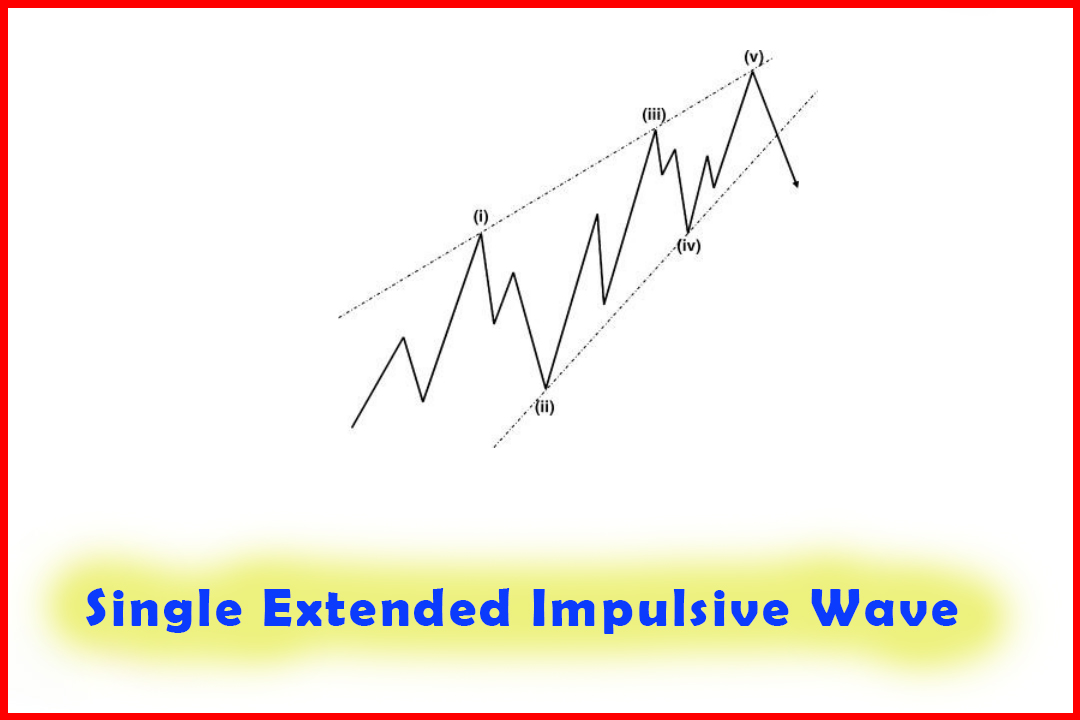

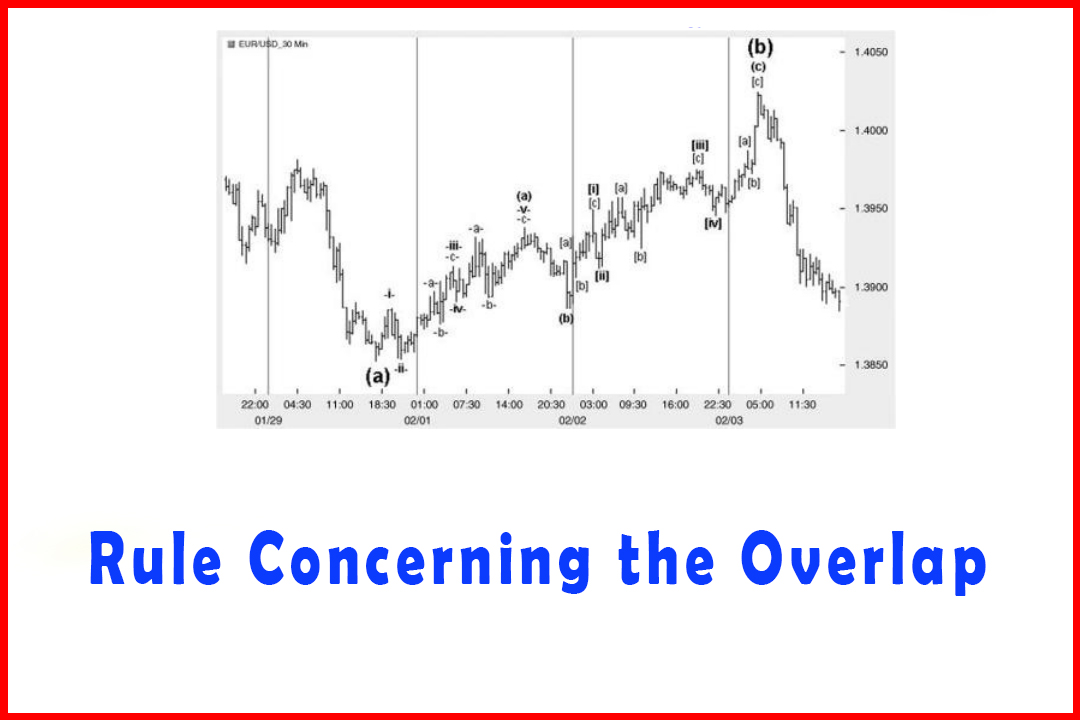

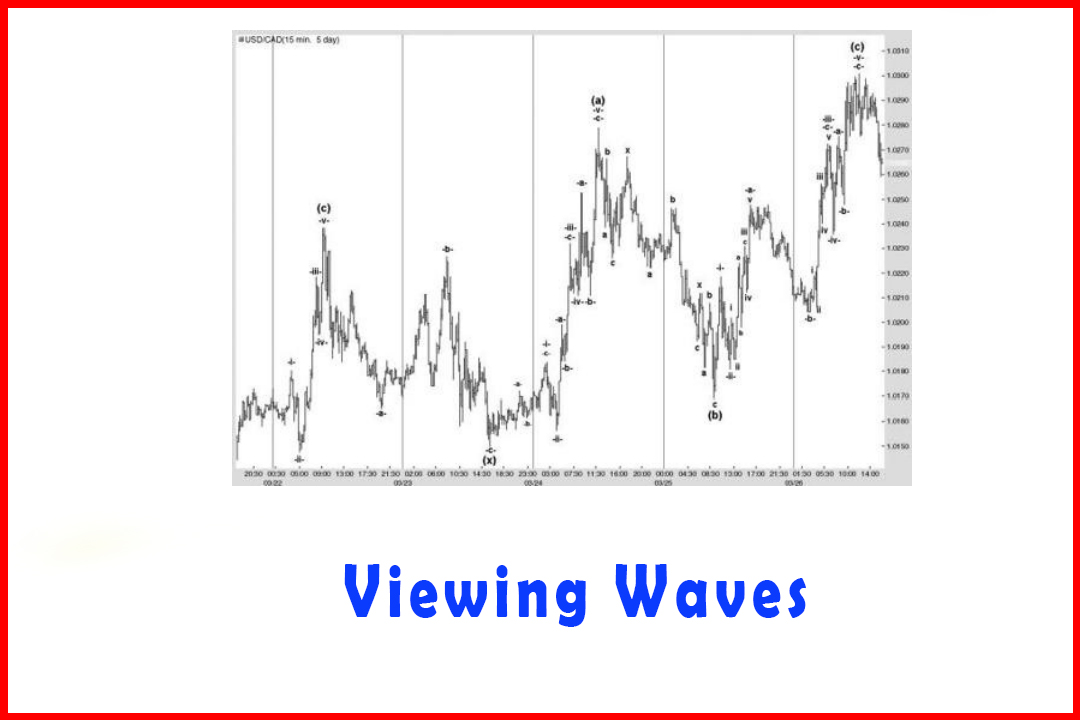

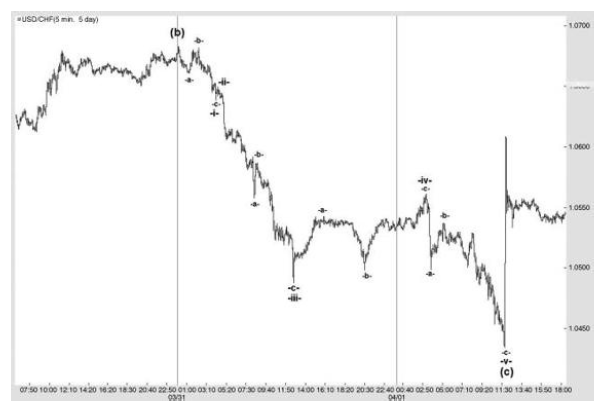

Figure

3.10 displays an example of a five-wave decline in the five-minute USDCHF

market in which the Wave -a-and Wave -c-of Wave -iii-developed as if they were

in the same wave degree as Wave -i-, -ii-, and -v-. Within both of these

declines a five-wave structure can be seen. Once again I will highlight the

wave relationships in Chapter 4.

Figure 3.10 A

Five-Wave Decline in Five-Minute USDCHF with an Effective Extended Wave -iii-

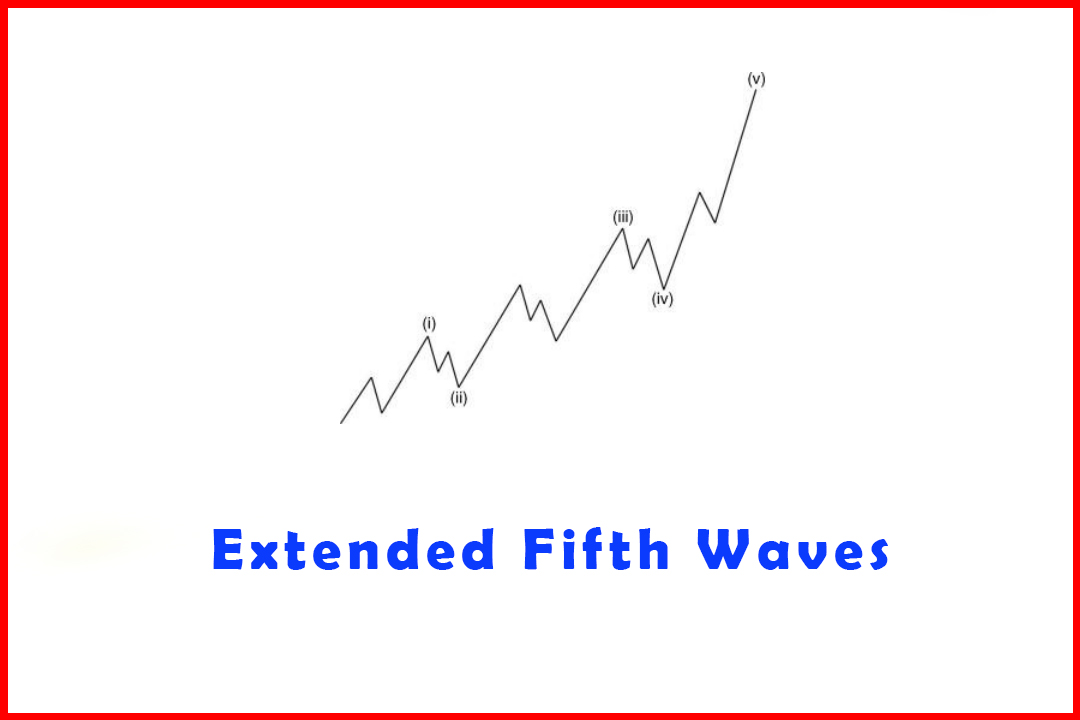

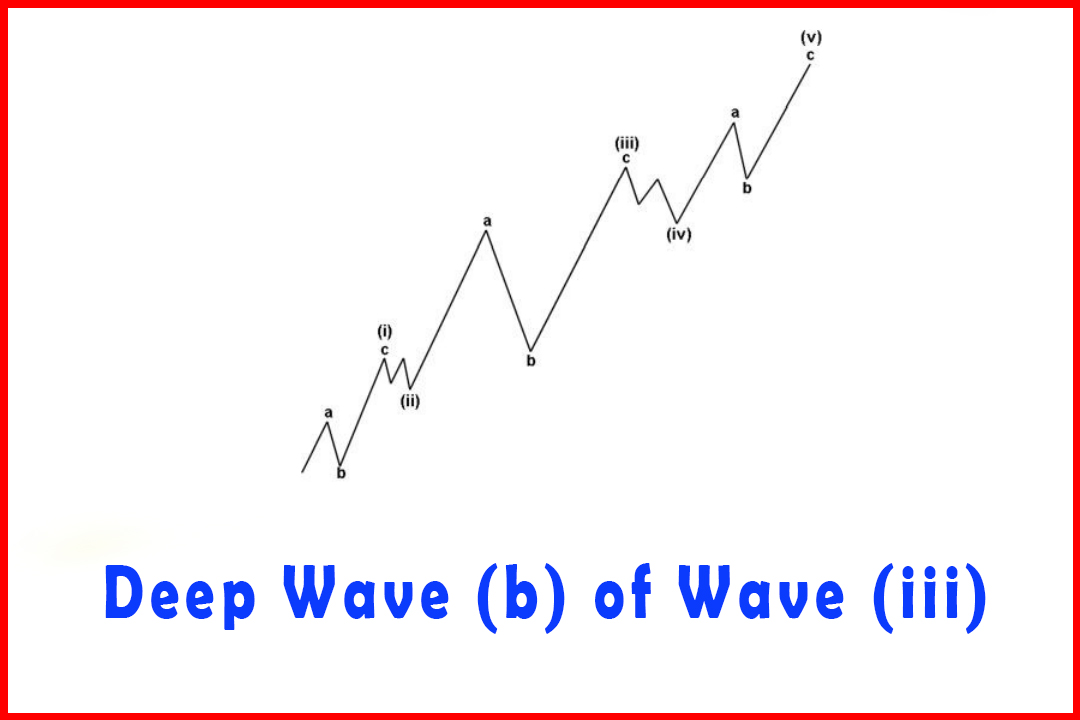

As

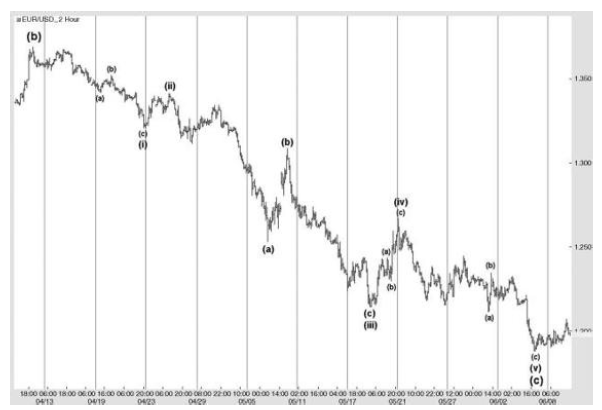

a second example of how extended waves develop in the harmonic structure I have

offered part of the decline in EURUSD. While yet to be confirmed, I had counted

this as the Wave (c) of Wave (iii) lower and therefore also had implied targets

from the projections in Wave (i) and of Wave (a) of Wave (iii).

Figure

3.11 displays a five-wave decline in EURUSD to the 1.1877 low. The nature of

the construction of Wave (i), (iii), and (v) being in three waves is very

clear, while the Wave (a)'s and Wave (c)'s are all clearly

developing in more direct structures that are actually five-wave moves. All the

waves had excellent relationships, with only the Wave (v) stalling short of

normal projections but it actually met long-term projections in Wave (iii) and

the projection of Wave (a). I shall cover the relationships in Chapter 4.

Figure 3.11 A

Five-Wave Decline in Hourly EURUSD with an Effective Extended Wave (iii)

Harmonic Elliott Wave : Chapter 3. Impulsive Wave Modification : Tag: Elliott Wave, Forex : harmonic structure, How to trade Harmonic Pattern, Impulsive wave trading, best trading strategy - Development of Extensions in the Harmonic Structure

Elliott Wave | Forex |