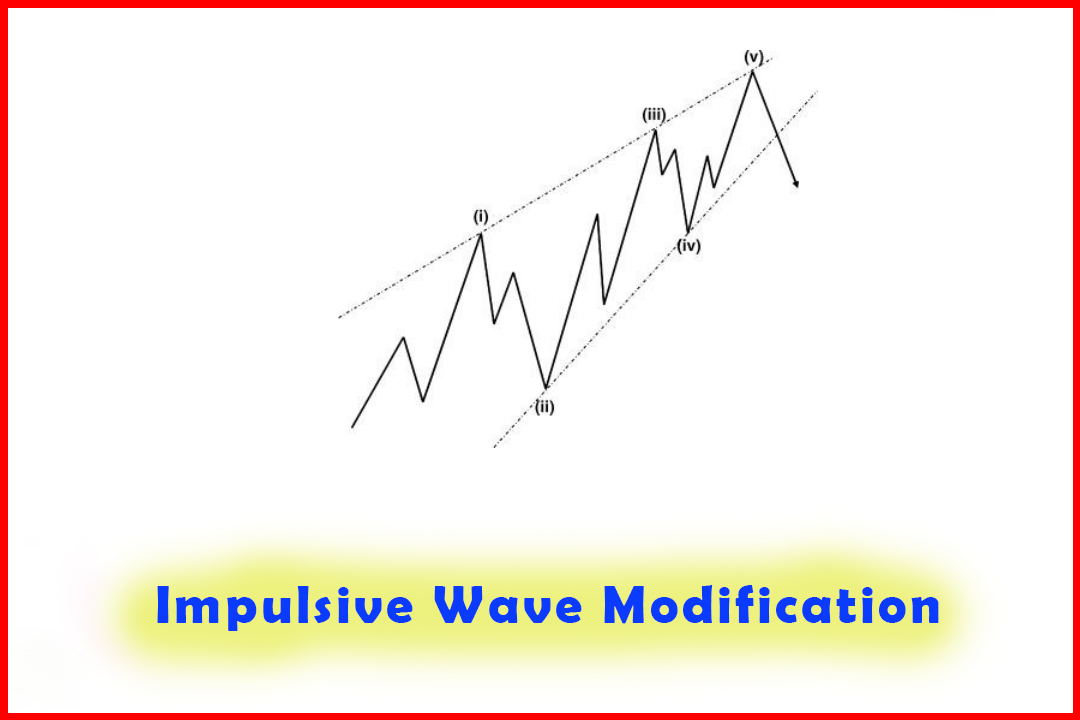

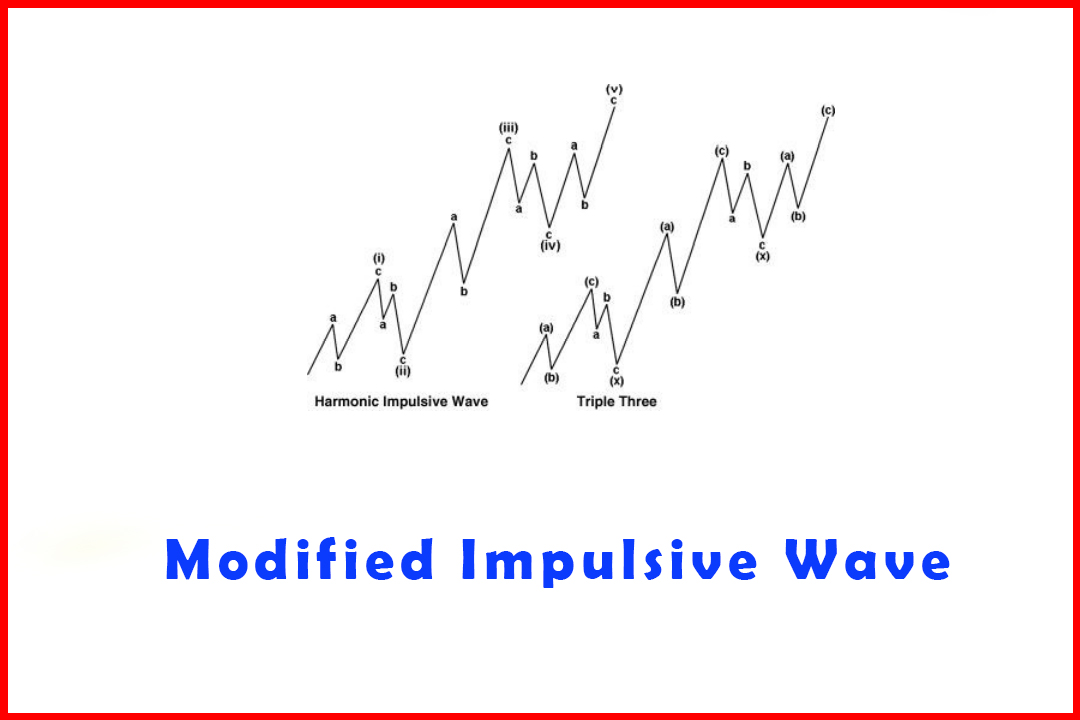

Difference Between a Modified Impulsive Wave and a Triple Three

Modified Impulsive Wave, Triple Three Trading Strategy

Course: [ Harmonic Elliott Wave : Chapter 3. Impulsive Wave Modification ]

Elliott Wave | Forex |

On the occasions I have mentioned my findings to others, a frequent question is how to spot the difference between a modified impulsive wave and Triple Three.

Identifying the Difference Between a Modified Impulsive Wave and a Triple Three

On

the occasions I have mentioned my findings to others, a frequent question is

how to spot the difference between a modified impulsive wave and Triple Three.

While there will always be occasions when it is harder to follow a structure,

in the majority of instances they are quite simple to identify. There are

several key issues to note. While there is no single 100% solution for this,

there are guidelines that identify the difference in the majority of cases:

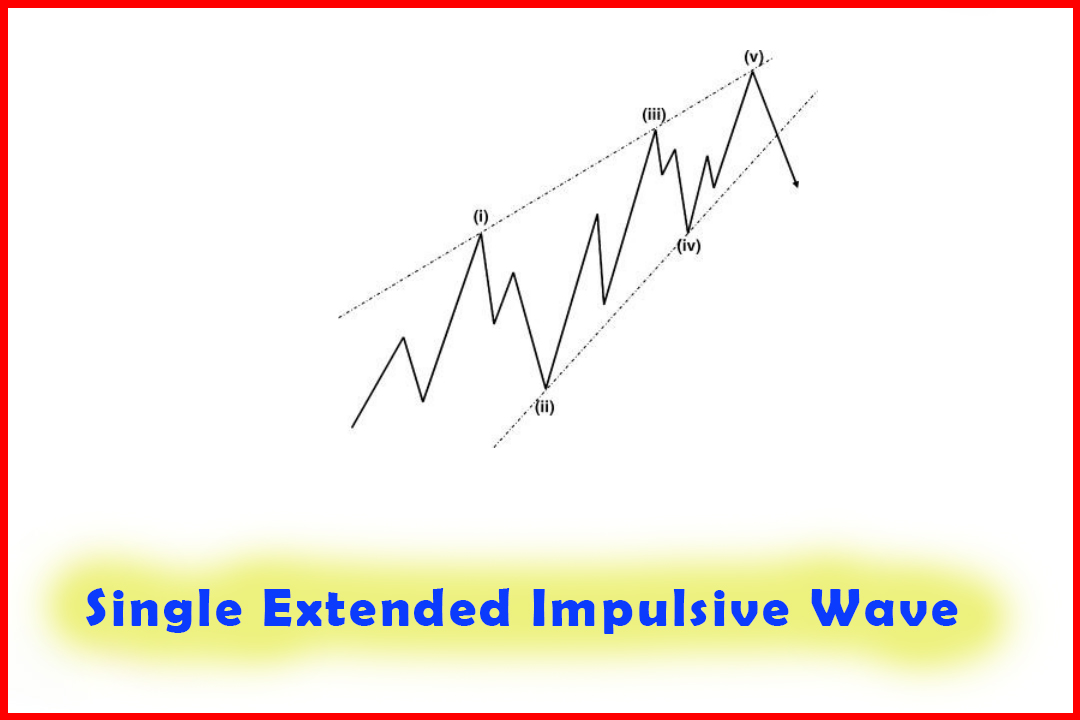

Triple

Threes must develop as a corrective wave: Wave (b), Wave (ii), Wave (iv), or

Wave (x). Therefore reference to the structure of the next higher wave degree

is of utmost importance.

While

Waves (ii), (iii), (iv), and (v) have relationships with each other, the three

groups of ABC waves in a Triple Three rarely have relationships between them.

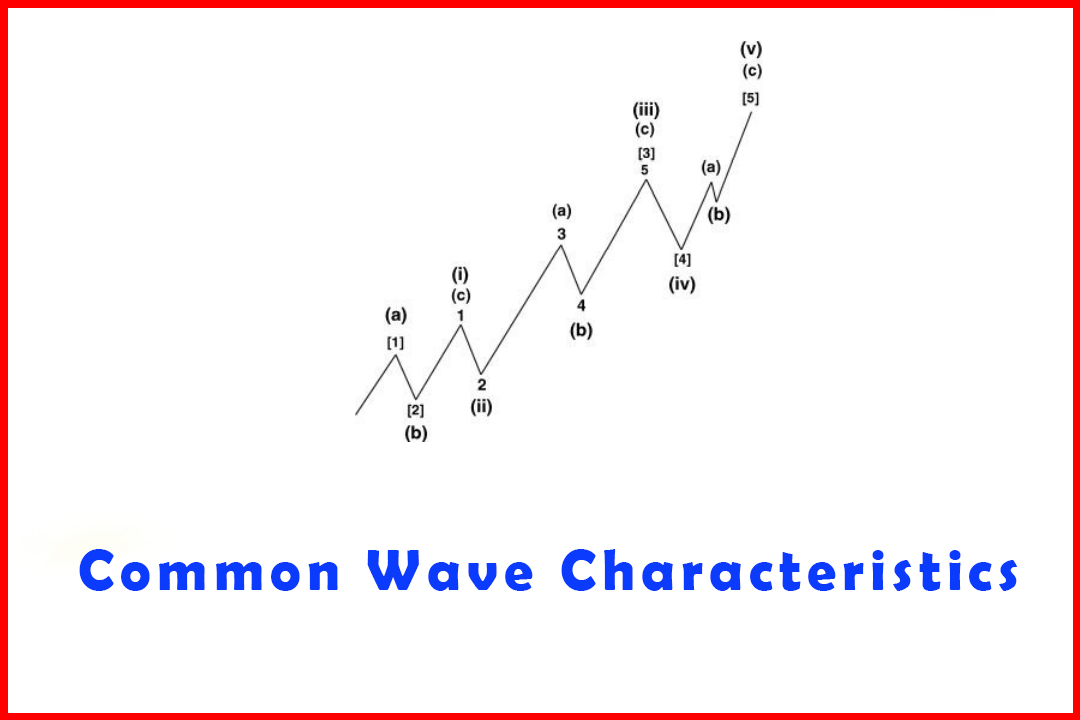

While

even impulsive waves can get quite complex, it is far more common for Triple

Threes to display a high level of complex structures.

I

shall provide one example of how this should be watched.

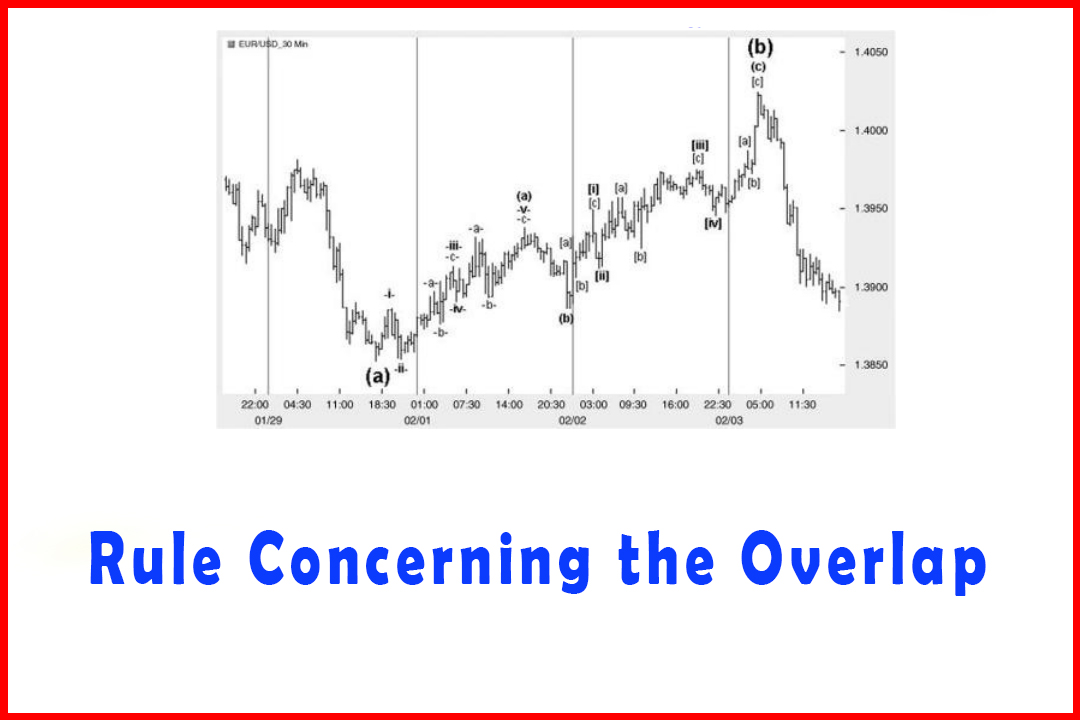

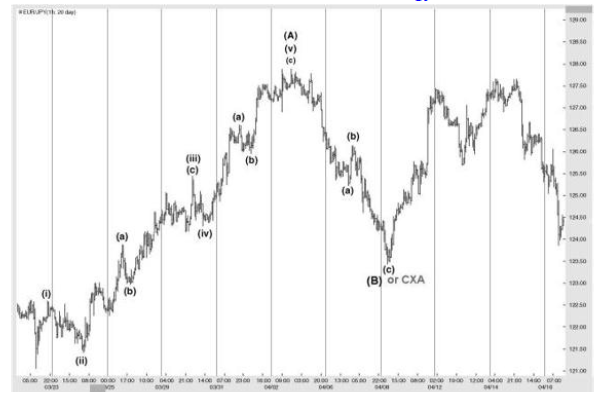

Figure

3.15 displays the hourly market in EURJPY in which there appears to be a

five-wave rally from 121.05 to 127.89. This is followed by a decline in three

waves. At this point with the correction being in three waves we cannot be

certain whether this is a complete Wave (B) or Wave cxa of a complex

correction.

Figure 3.15 A

Five-Wave Rally Labeled Wave (A) Followed by a Three-Wave Decline

Therefore,

as the rally from the 123.42 low develops it will be important to watch for

evidence of either the development of an impulsive structure or a corrective

structure that could develop as a Triangle, Flat Correction, or Expanded Flat

Correction.

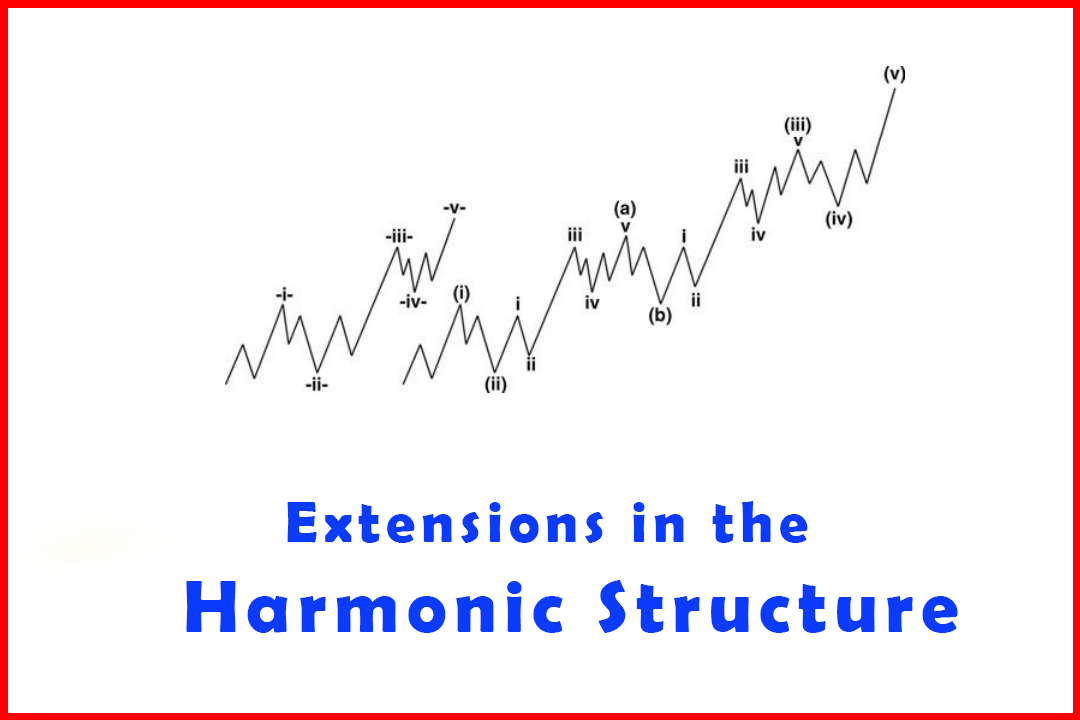

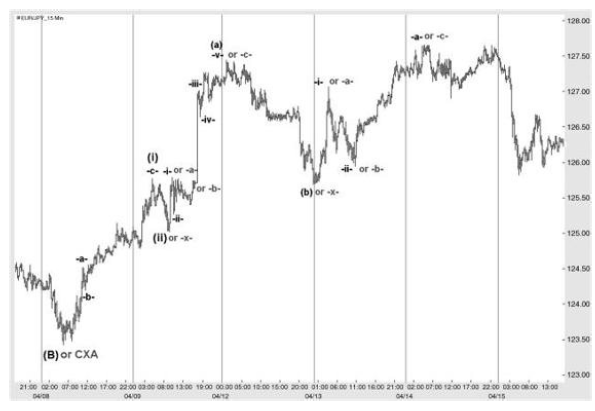

Figure

3.16 displays the rally seen from the Wave (B) (or Wave CXA) low. While it

would be simple to say that all wave structures are obvious from the wave

relationships, it is not uncommon for there to be a degree of uncertainty where

there are perhaps two projections of Wave -a-that match with subsequent peaks.

Figure 3.16

Breaking Down the Rally from Wave (B) to Identify the Structure

However,

in the case that this rally will become a larger Wave (C) and will therefore

end above 127.89, the Wave (i) must be of a suitable degree that would imply a

strong wave (iii) projection should end close to or preferably above 127.89. In

this example there was a very close relationship between the first Wave -a-and

the Wave -c-so that we could consider labeling this peak as a potential Wave

(i).

The

correction was very shallow, stalling just above the prior swing low that would

be Wave iv of Wave -c-. The move to new highs would imply that Wave (a) of Wave

(iii) or a second ABC move is developing. This rally was quite ambiguous, with

the impulsive structure having a truncated Wave -v-, while for the -a-, -b-,

-c-move to hold more accurate projections the Wave -b-must be considered to

have developed in an ascending Triangle.

Therefore,

at this stage the apparent cleaner look would favor a rally in Wave (a) of Wave

(iii). However, the truncated Wave -v-and the better relationship between the

alternative Wave -c-to Wave -a-provided an uncertainty to the entire structure.

This implies that close scrutiny of the following rally to identify whether

this will be a five-wave move in Wave (c) or a three-wave move in a third -a-,

-b-, -c-to complete a Triple Three must be undertaken. This latter alternative

will imply that the pattern will probably be a Flat Correction with a final

stalling point close to the 127.89 high or an Expanded Flat Correction that

adheres to common expansion ratios.

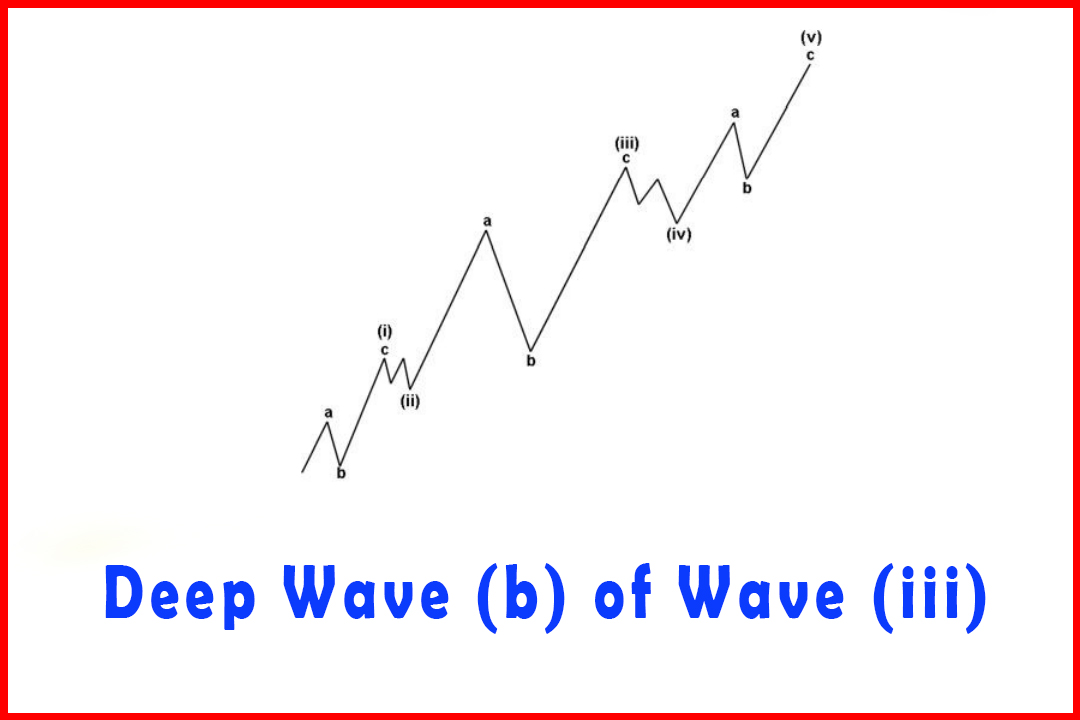

The

depth of the decline from the (potential) Wave (a) high was exceptionally deep.

This could still hold within an impulsive rally as Wave (ii) was exceptionally

shallow, so there was potential for this to be a deep Wave (b).

From

this point there must be a clear distinction to establish whether a Wave (c)

will develop to complete Wave (iii) or whether there will be a third -a-, -b-,

- c-move. Price recovered sharply and then saw a deep pullback. (The rally is

labeled Wave -i-or Wave -a-and the correction as Wave -ii-or Wave -b-.) Attempt

should be made to establish whether the rally developed in five waves or three.

Looking at the rally from the Wave (b) or Wave -x-low there is a sharp initial

move followed by a brief correction and then a stronger follow-through to a

peak that is labeled Wave -i-or Wave -a-. It certainly looks like three waves

in this time frame (15 minutes) but what appears to be Wave (c) is so sharp it

could hide the true nature of the structure.

If

it remains unclear then the labeling should continue to be “Wave -i-” or “Wave -a-” and

the subsequent rally should be observed. The confusion will be that a five-wave

rally will be expected in both alternatives, either as Wave -a-of Wave -iii-or

in a Wave -c-. The end of this rally moved to a marginal new high but below the

high in Wave (A) in Figure 3.15 at 127.89.

From

this point there are two alternatives. Either the decline will be a correction

in Wave -b-of Wave -iii-or the implication of a retracement of more than 50% of

the Wave -a-will suggest the rally is complete and it can be safely assumed

that this had been a Triple Three, and therefore a return to the Wave (B) low

will occur in a possible Flat correction.

This

example reflects an uncertain outcome as the structural development from the

Wave (B) low was unclear. However, in the majority of cases it is normally

possible to note one of several factors that will reveal the true nature of the

move:

Not

only was the assumed Wave (ii) shallow but also Wave (b) of Wave (iii) and Wave

(iv). Occurrences of limited pullbacks point to the structure more likely being

a Triple Three.

The

relationships between the three ABC moves (that is, the anticipated Waves (i),

(iii), and (v)) were not harmonic, which again suggests this is more likely to

be a Triple Three.

The

projection in the anticipated Wave (iii) would not be deep enough to satisfy a

Wave (v) that would match with a projection in the Wave (C) of the higher

degree.

Harmonic Elliott Wave : Chapter 3. Impulsive Wave Modification : Tag: Elliott Wave, Forex : Modified Impulsive Wave, Triple Three Trading Strategy - Difference Between a Modified Impulsive Wave and a Triple Three

Elliott Wave | Forex |