Insider Trading Information

insider trading meaning, insider dealing, insider information, insider trading definition, insider trading policy

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 1. Trading Vehicles, Stock, ETFs, Futures, and Forex ]

There is one more source of information that stock and spot forex currency traders can borrow from the futures industry. It is the Weekly Commodity Futures Trading Commission’s Commitment of Traders (COT) report.

INSIDER TRADING INFORMATION

There is

one more source of information that stock and spot forex currency traders can

borrow from the futures industry. It is the Weekly Commodity Futures Trading

Commission’s Commitment of Traders (COT) report. The CFTC market surveillance

staff closely monitors trading activity in the futures markets in order to

detect and prevent instances of potential price manipulation. Some consider

this “insider trading” information because every week we get to take a look at

which investor group is taking which side of a trade. (There are many studies

and books written on the subject. In fact, it was covered in my first book on

pages 162-165.)

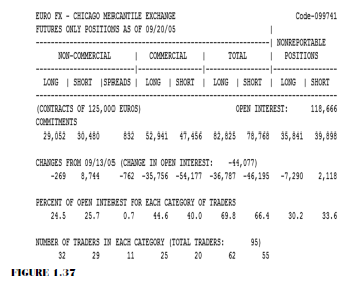

As a

futures trader for over 26 years, I have used this information to capture many

significant moves in the markets. Figure 1.37 shows that there are several

categories. The first is the “non-commercial”—all large professional traders or

entities, such as a hedge fund, a commodity trading advisor, commodity pool

operators, and locals on and off the exchange floors.

Any

trading entity that hits a reportable position limit (for instance, in the CME

currencies, at the end of 2005, the limit was 400 contracts) is reported by the

clearing firm to the exchange, which then turns the information over to the

CFTC.

The next category

is the “commercials”—banks and institutions or multinational conglomerate

corporations looking to hedge a cash position. The long and short open interest

shown as “non-reportable positions” are

derived by subtracting total long and short “reportable

positions” from the total open interest. Accordingly, for non-reportable

positions, the number of traders involved and the commercial/non-commercial

classification of each trader is unknown. This balance of positions is assumed

to be the small speculators. If you look at the first column under

non-commercials, you will see the breakdown of long positions versus short

positions. The next line down shows the changes from the prior week; this is

important information because you will be able to see if these guys unloaded

some of their positions or added to them from one week to the next. The line

under that tells you the percent of longs and shorts that are held. The last

line shows how many traders there are that control longs or shorts. The

information is gathered as of the close of business every Tuesday by each of

the clearing brokerage firms and is turned over to exchange officials, who then

report the information to the regulatory body know as the CFTC. This

information is released on Friday afternoons at 3:30 p.m. (ET).

It is

critical before acting on a decision based on this information to see if there

was a major price swing from Tuesday’s close to the time the information was

released on Friday, because positions may have changed hands. For example, in

Figure 1.37, if the British pound was at 1.7400 at 5 p.m. on Tuesday and the

price at Friday’s close was 1.7000, it will indicate a 400-point move. If the

COT showed small speculators net long, I will assume that the speculators were

no longer long, as not many small speculators can handle a 400-point loss.

Can

traders benefit and make money from this information? The answer is that there

is always a chance to make money. The key is to be able to afford to be not too

heavily leveraged if the market moves further than anticipated. The COT is like

an insider information report. It acts like a true consensus of who literally

“owns” the market. A forex trader can use this data to determine in a long-term

trend run if market participants are too heavily positioned on one side of the

market. It is generally the small speculator who is lefty holding the bag.

Let’s face it—money moves the market, and the banks and large professional

traders are a bit savvier when it comes to their business. After all, one would

think a bank has a good idea of what direction interest rates are going to go

once a central bank meeting occurs, right?

Suppose

the small speculators are showing a nice short position of, say, at least two

longs for every one short. If the non-commercials are net long and the

commercials are net long, chances are that the small speculators will be wrong.

I am looking for imbalances in markets that have been in a trending market

condition for quite some time, and therefore I can develop a game plan and start

looking for timing clues to enter trades accordingly. Keep in mind that the

commercials sometimes are not right; they are not in the market to time market

turns. They are hedging their risk exposure in a cash position. Therefore the

non-commercials, or professional speculators, in the short term are considered

the smart money.

Here are some general guidelines to follow for using the COT Report:

- If non-commercials are net long, commercials are net long, and the non-reportable positions category is net short by at least a two-to-one margin, look at buying opportunities. In other words, go with the pros.

- If non-commercials are net short, commercials are net short, and the non-reportable positions category is net long by at least a two-to-one margin, look at buying opportunities.

- If non-commercials are net long, commercials are net short, and the non-reportable positions category is neutral, meaning not heavily net long or short, look at buying opportunities and stick with the smart money speculating non-commercials.

The Candlestick and Pivot Point Trading Triggers : Chapter 1. Trading Vehicles, Stock, ETFs, Futures, and Forex : Tag: Candlestick Trading, Stock Markets, Pivot Point : insider trading meaning, insider dealing, insider information, insider trading definition, insider trading policy - Insider Trading Information