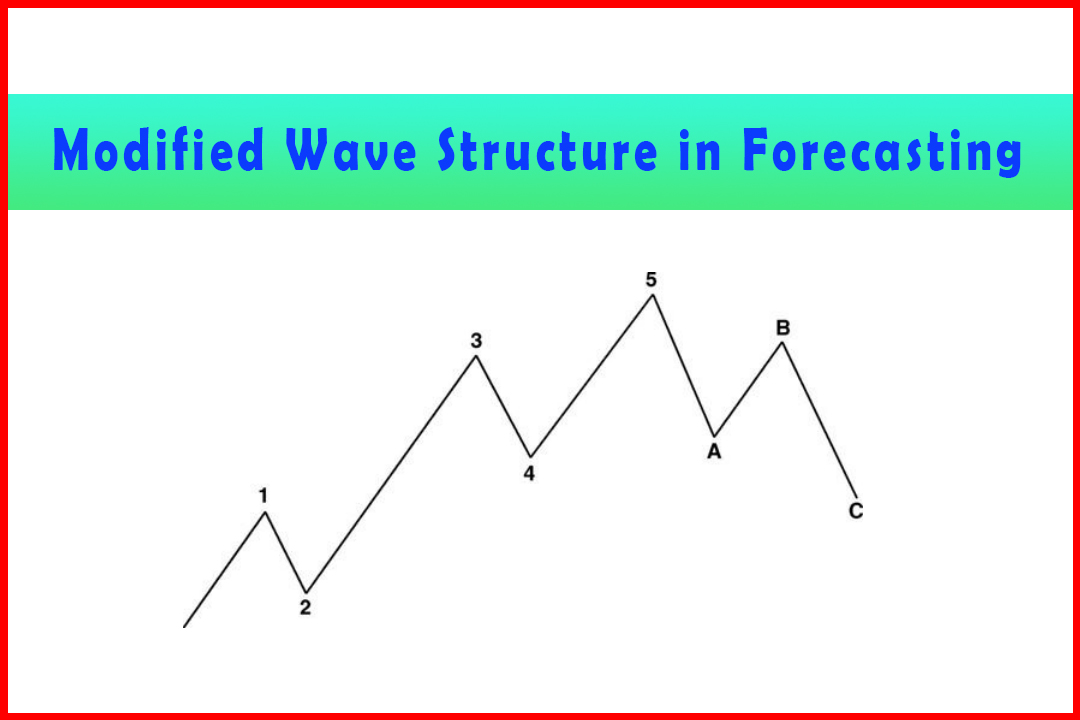

Ambiguous Projections

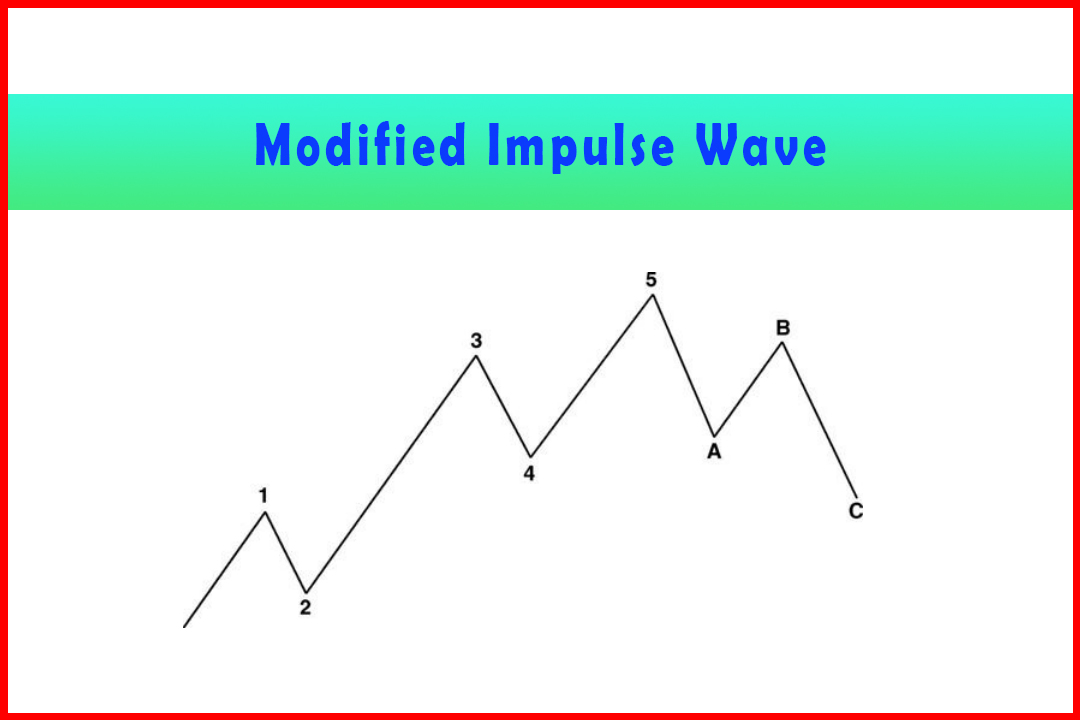

Modified Impulsive Wave, Triple Three Trading Strategy

Course: [ Harmonic Elliott Wave : Chapter 5: Modified Wave Structure in Forecasting ]

Elliott Wave | Forex | Fibonacci |

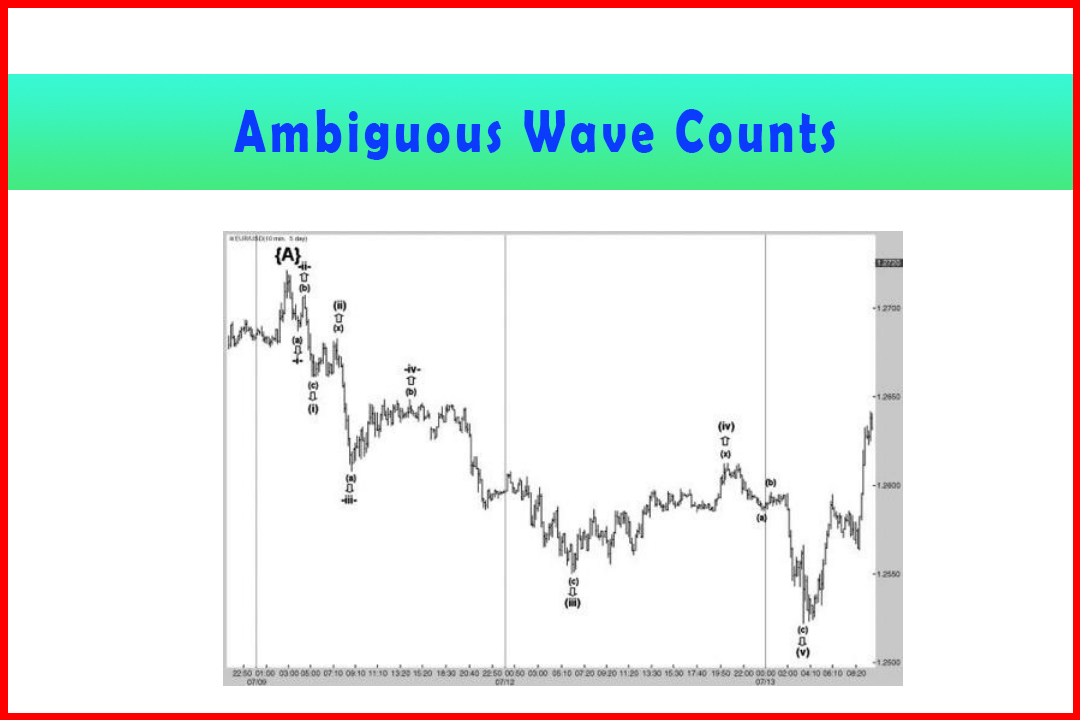

The start of a new five-wave sequence can cause some confusion on occasion. The issue is to identify the Wave (a), (b), and (c) that make up the first Wave (i).

Ambiguous Projections in Wave (c) of Wave (i)

The

start of a new five-wave sequence can cause some confusion on occasion. The

issue is to identify the Wave (a), (b), and (c) that make up the first Wave

(i). Occasionally what appears to be a straightforward first structure

isn't quite so obvious.

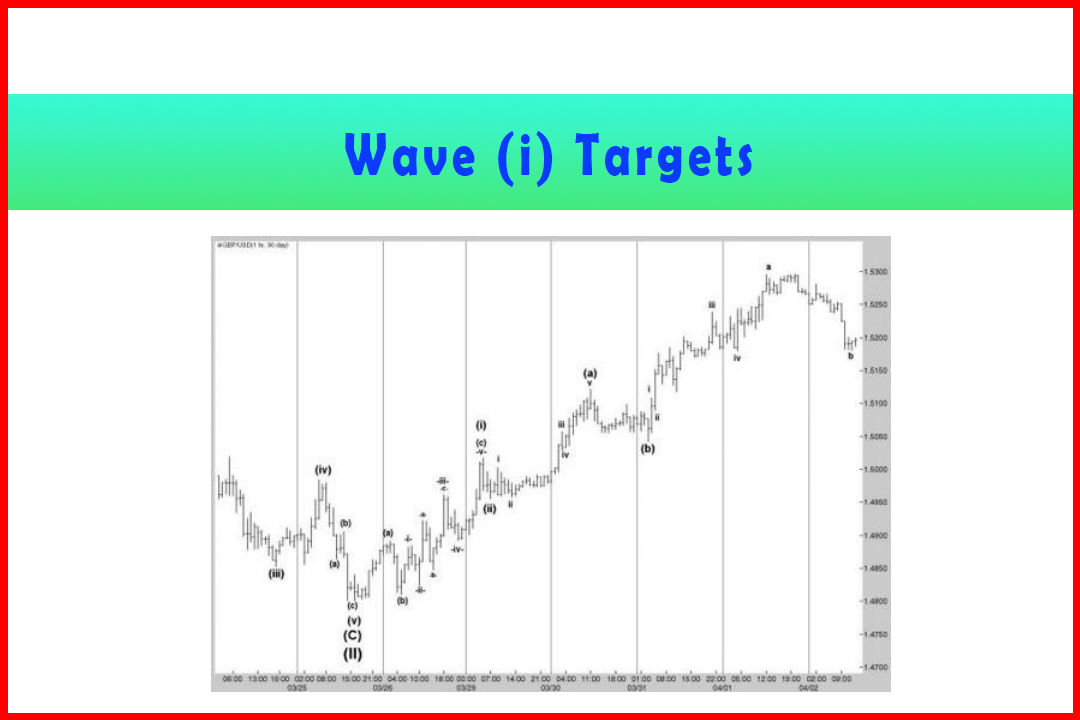

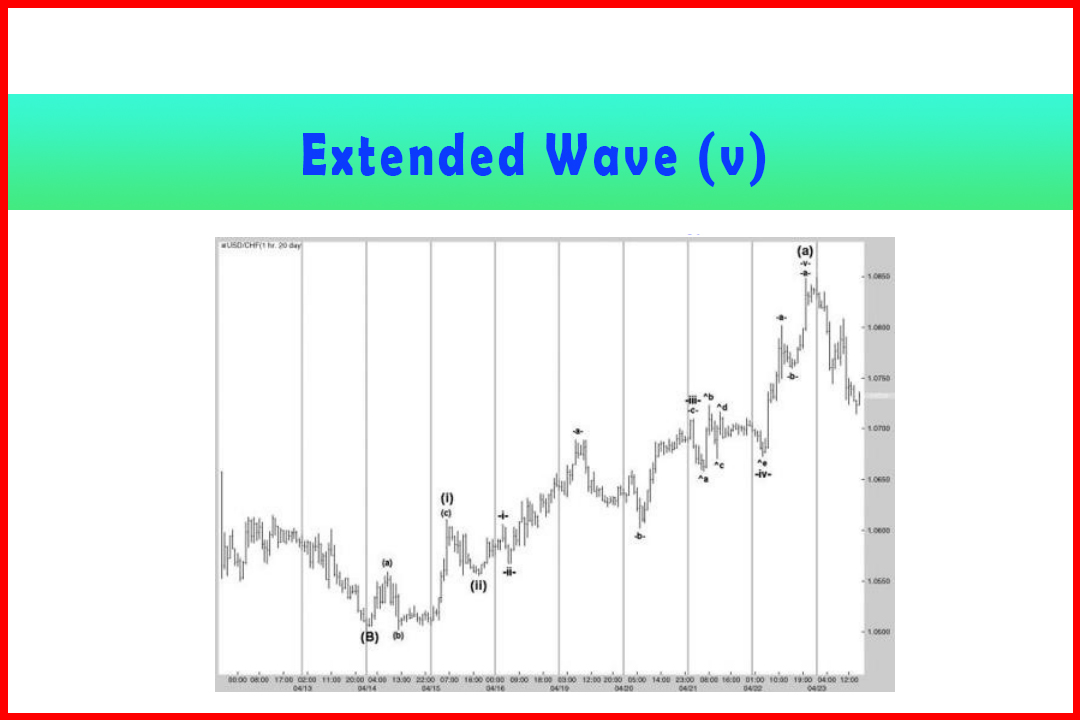

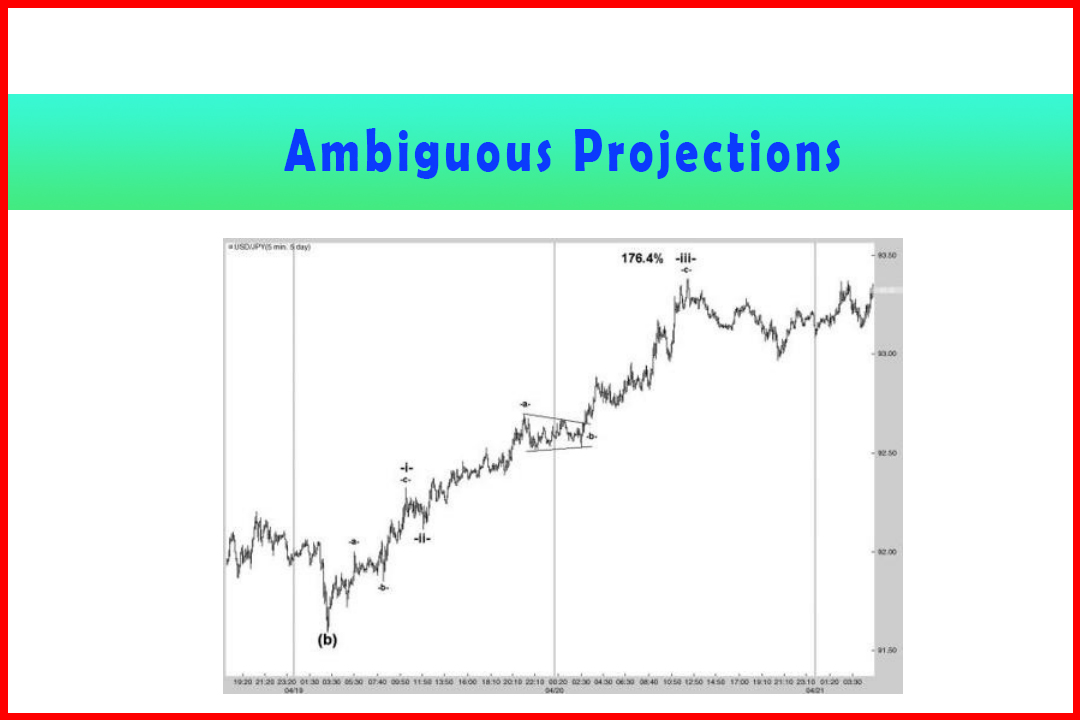

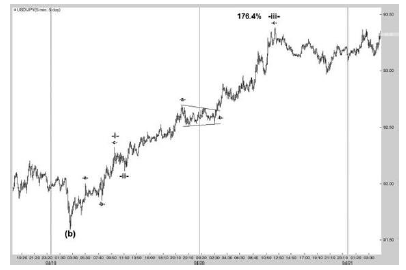

Figure

5.6 displays the end of what was considered a possible Wave (b) of Wave (iii)

and the subsequent rally. The call for a rally was correct, but there was a

problem in identifying the Wave -iii-. It can be seen that an initial rally was

counted as Wave -a-with an Expanded Flat Wave -b-, followed by a Wave -c-that

ended at a wave equality target. This was followed by another Expanded Flat

Correction, this time in Wave -ii-.

Figure 5.6 The

Start of a New Five-Wave Sequence Higher in the Five-Minute USDJPY Market

Taking

the normal type of projections of 176.4%-185.4% and 261.8%-285.4% I have marked

on the chart the 176.4% and 285.4% projection areas. Price stalled close to the

176.4% but nowhere close to the 285.4%. Could it be assumed that the peak where

I have labeled Wave -iii-is correct? Well, a 76.4% projection from the Wave

-iv-does end just about at the final peak. However, there is a problem with

this structure. Wave -ii-was around a 38.2% retracement of Wave -i-and the

labeled Wave -iv-is just under a 23.6% retracement. Although alternation is

only a guideline it does raise the question whether this is a valid wave count.

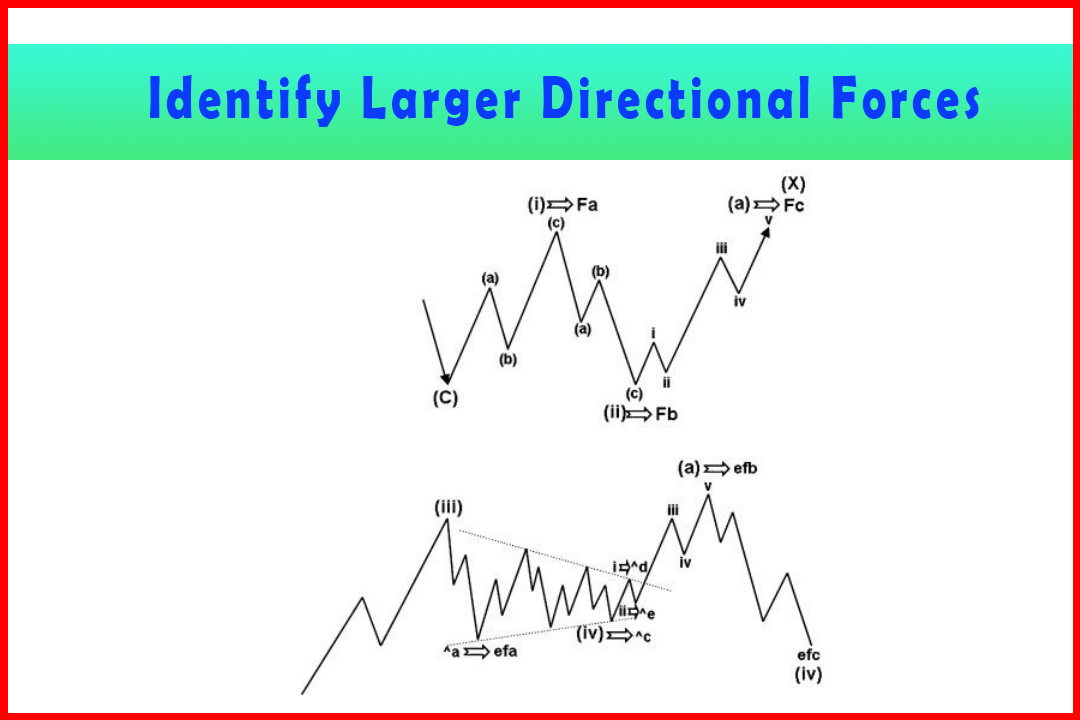

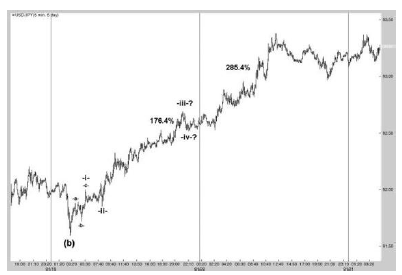

Let

us take a look at the start of the rally again (Figure 5.7).

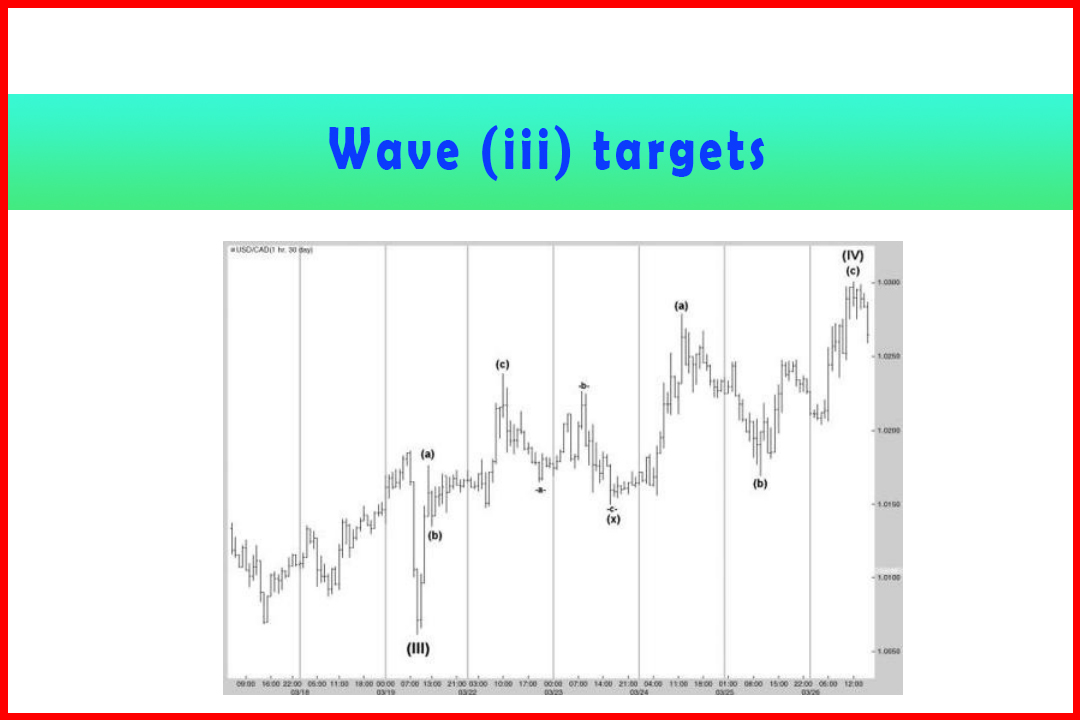

Figure 5.7 The

Start of a New Five-Wave Sequence Higher in the Five-Minute USDJPY Market

Figure

5.7 displays the same chart but with a change to the positions of Wave - i-and

Wave -ii-. Taking further measurements and on the assumption that the Wave v of

Wave -a-was an extended (wave equality) move, a 114.6% projection in Wave

-c-came exactly to the new Wave -i-peak. Then taking a 176.4% projection in

Wave -iii-it came precisely to the final peak at 93.38.

The

expectations must be for a deeper Wave -iv-and probably a full 58.6%

retracement before the Wave -v-can develop.

Harmonic Elliott Wave : Chapter 5: Modified Wave Structure in Forecasting : Tag: Elliott Wave, Forex, Fibonacci : Modified Impulsive Wave, Triple Three Trading Strategy - Ambiguous Projections

Elliott Wave | Forex | Fibonacci |