Using Momentum to Assist in Identifying Breakdown or Targets

How to use momentum Indicator, Momentum Indicator, Best elliott wave trading strategy

Course: [ Harmonic Elliott Wave : Chapter 5: Modified Wave Structure in Forecasting ]

Elliott Wave | Forex | Fibonacci |

Harmonic Elliott Wave provides a solid base for forecasting, but as I wrote in my first book, Integrated Technical Analysis, the need for complementary analysis is vital to bring strength to forecasting and also a sense of practicality when trading.

Using Momentum to

Assist in Identifying Breakdown or Targets

I

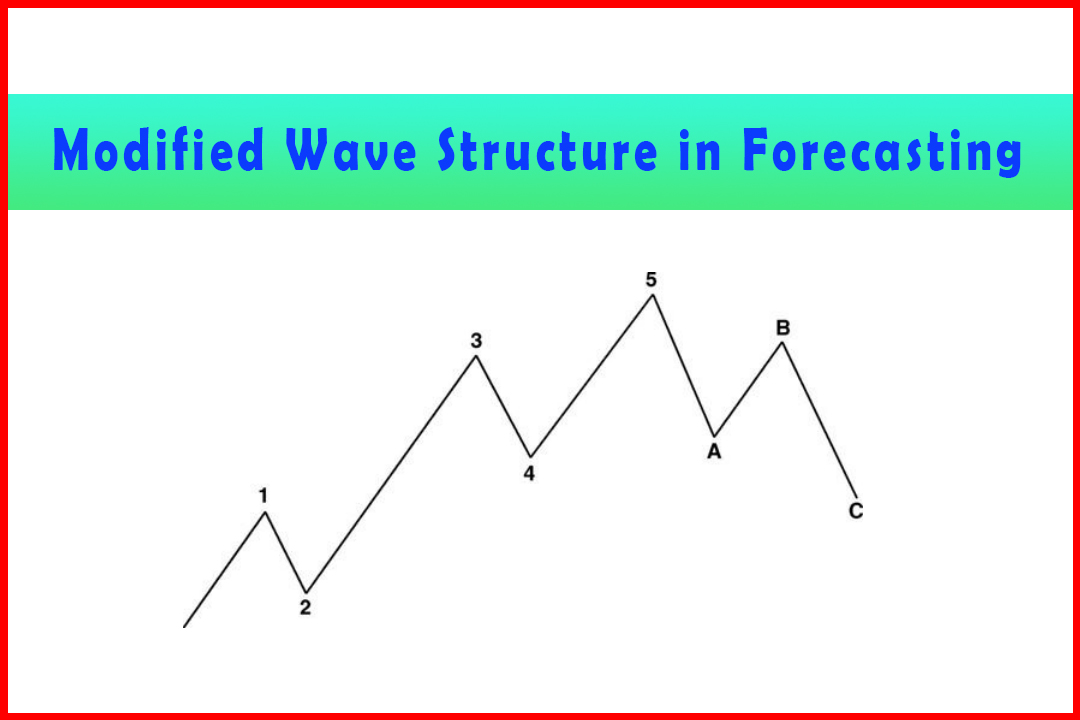

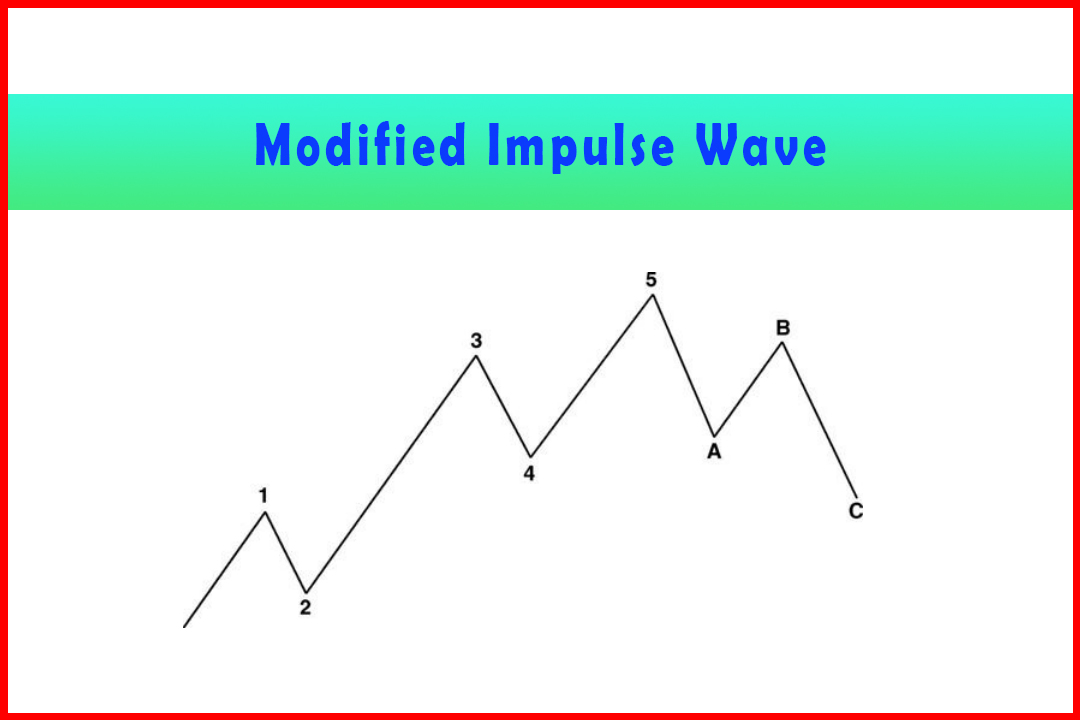

fully believe that Harmonic Elliott Wave provides a solid base for forecasting,

but as I wrote in my first book, Integrated Technical Analysis, the need for

complementary analysis is vital to bring strength to the forecasting and also a

sense of practicality when trading. The production of anticipated projections

and targets can be generated easily but it does rely on the identification of

the correct beginning of the wave structure. If Waves (i) and (ii) are not

identified accurately then any projection in Wave (iii) and retracement in Wave

(iv) may be wrong. Thus, blind placing of orders at these levels can cause

losses.

I

find momentum can provide excellent support at these events. I tend to use my

own form of RSI, which is more sensitive, swings between overbought and

oversold more frequently even in trending markets, and provides excellent

divergence indications.

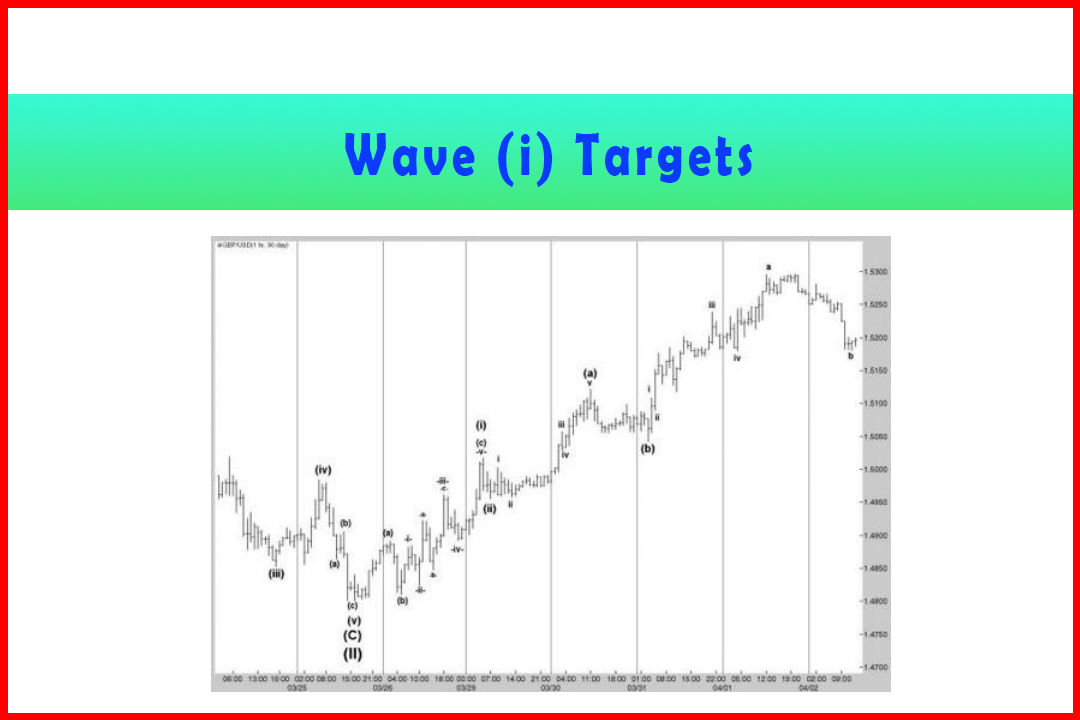

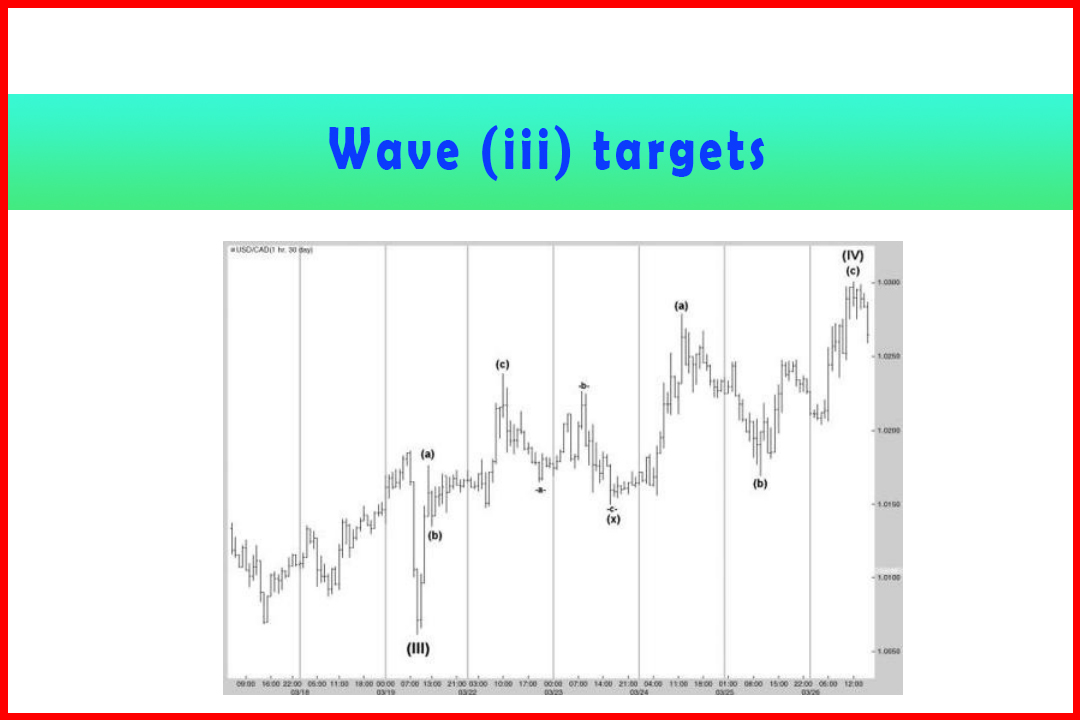

Earlier

in this chapter when discussing the identification of Wave (i) and (ii) I

offered an example of a rally in USDJPY. This described the potential confusion

in recognizing both Wave (a) and Wave (c), which impacts on the identification

of Wave (iii). The following charts offer a method of checks and controls.

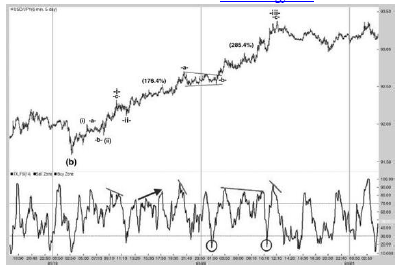

Figure

5.14 displays the same chart as in Figure 5.6 earlier in this chapter but this

time with my version of RSI. I have placed labels of Wave (i) and Wave (ii)

where there may have been an error of judgment, along with what became the

correct wave count. I have also labeled where the 176.4% and 285.4% projections

in Wave (iii) would be implied.

Figure 5.14

Potential Confusion in Identifying Targets in a Rally in Five-Minute USDJPY

It

can be seen that at the Wave -i-and Wave -a-peaks the five-minute RSI displayed

bearish divergences. This was not true for the peak in Wave (i) nor at the

series of peaks at the 176.4% projection in Wave (iii). In fact, at this

projection area the RSI peaks were rising, which is a sign of strong momentum.

At the 285.4% projection of Wave (iii) there was a mild bearish divergence,

again at the final Wave -iii-peak.

It

can be seen that this version of RSI also allows moves to oversold levels even

in an uptrend. This occurred at Wave -ii-, again at the final low in the Wave

-b-Triangle, and then at the final pullback before the Wave -iii-high.

However,

this is just five-minute momentum, and this can turn within several bars. It is

never wise to base analysis and trades on a single time frame. Therefore it is

preferable to also consider the momentum in a higher time frame.

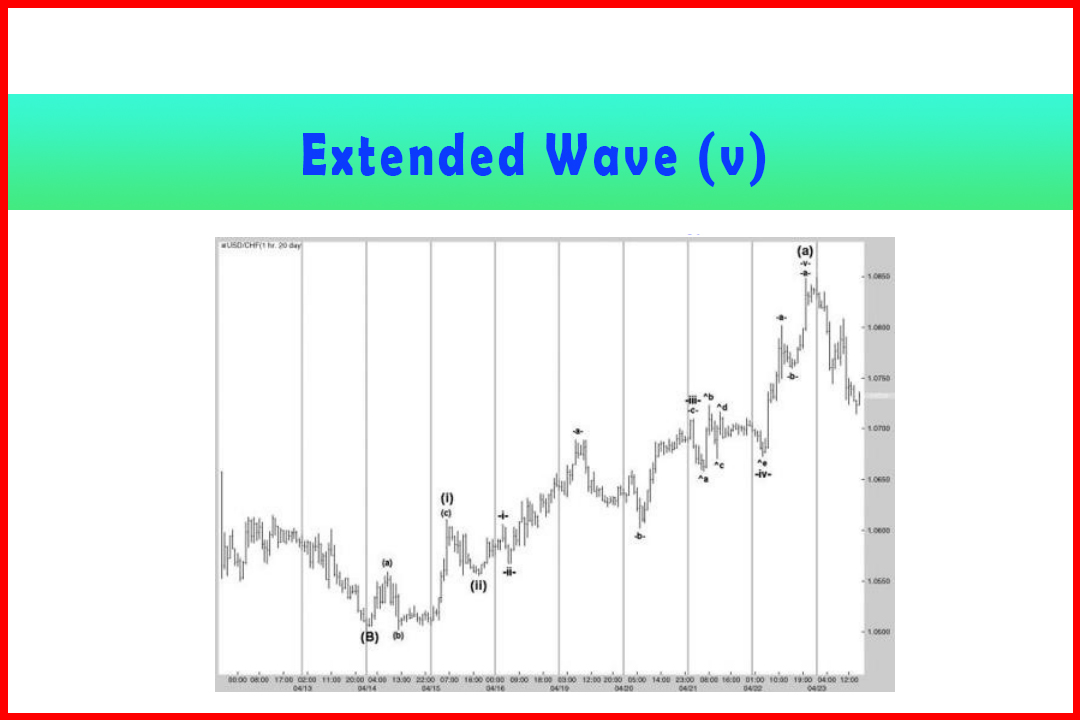

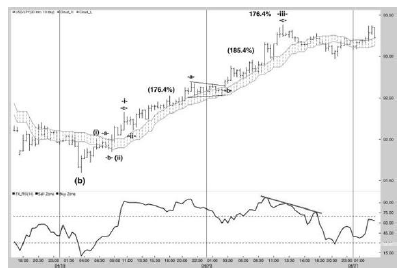

In

Figure 5.15 I have applied the same version of RSI to the 30-minute chart. It

can be seen that momentum rose right through the Wave (i) that could have been

considered, and all the way to the Wave -i-high before beginning to drift

lower. Thus there was a bearish divergence in the five-minute chart but none in

the 30- minute. It would imply a correction, although we would have no idea at

that point how deep the correction may be. It should also force us to

reconsider the Wave (i) label and at least seek alternatives. This could have

provided us with an earlier opportunity to identify the correct wave count.

Figure 5.15

Confirming Momentum Conditions in 30-Minute USDJPY

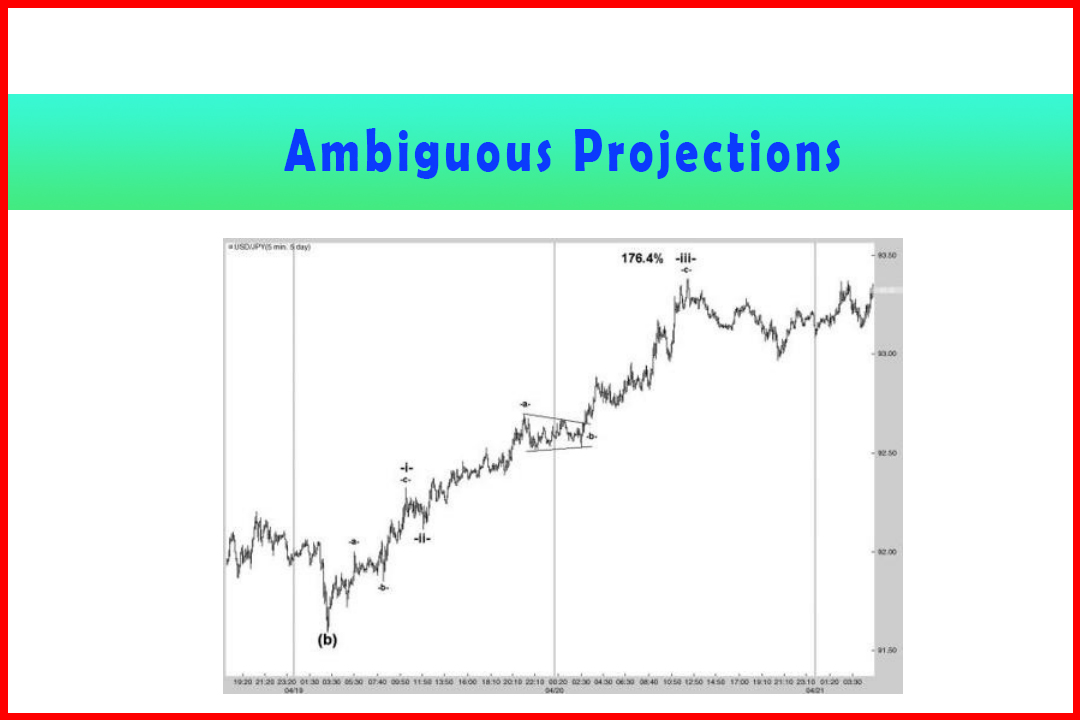

As

the 30-minute RSI began to drift lower, price rose to a new high and stalled

for a few bars. The potential for this to be an Expanded Flat could be

considered. However, in the five-minute chart there was a small abc pullback

before again rising, and at this point the Wave -ii-was confirmed and

projections for Wave - in-generated.

Note

that at the time price approached the 176.4% projection in the original Wave

(iii) while 30-minute RSI was declining, the five-minute RSI was recording new

highs—a bullish factor. Therefore emphasis is on identifying Wave -a-of Wave

-iii-. As noted earlier the five-minute chart recorded a bearish divergence at

the Wave -a-peak. However, the 30-minute chart saw RSI rising again by this

time to a new high—a bullish factor. Thus the risk that we would just see a

correction was high.

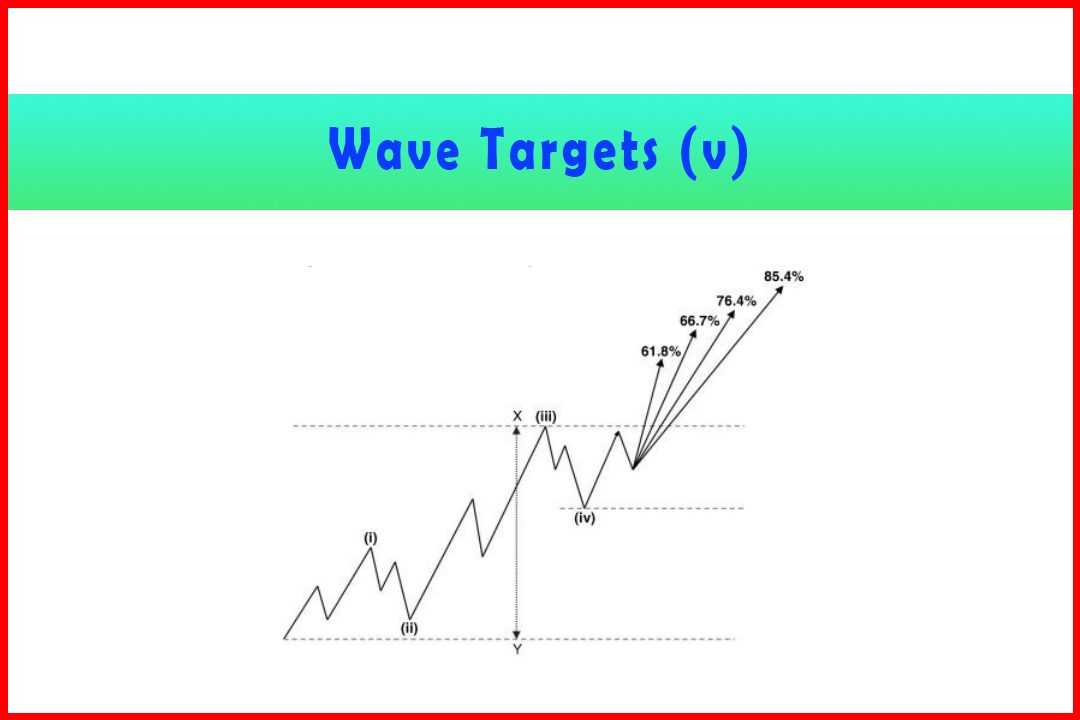

The

Triangle price rallied again, forcing five-minute RSI to successive high levels

while 30-minute RSI rose back to new highs for a third time. This was occurring

around the 185.4% projection in Wave (iii), so once again there was no

indication from momentum that the rally was due to end. However, by the time

price reached the 176.4% projection in Wave -iii-both time frames recorded

bearish divergences. This provides a much stronger basis for a trade.

Thus,

the use of a good momentum tool to confirm projection levels and avoid trades

at inappropriate targets is a vital addition to the armory. It need not just

end with momentum; the addition of a favored indicator that provides support or

resistance can also be useful. Figure 5.16 displays the same 30-minute chart

with an Equilibrium Cloud that I designed to identify market equilibrium.

Figure 5.16

Confirming Momentum Conditions in 30-minute USDJPY

The

Equilibrium Cloud provides a reliable area of support or resistance in directional

moves. Note how this supported almost the entire rally once price had reversed

above the Cloud.

Most

traders and analysts have favored tools. As long as these are complementary and

not providing the same information (such as applying RSI, Stochastics, and

MACD), the quality of the analysis is enhanced and provides more confidence in

the wave structure. In addition to confirming a wave count, indicators can

forewarn of a breakdown in the anticipated structure.

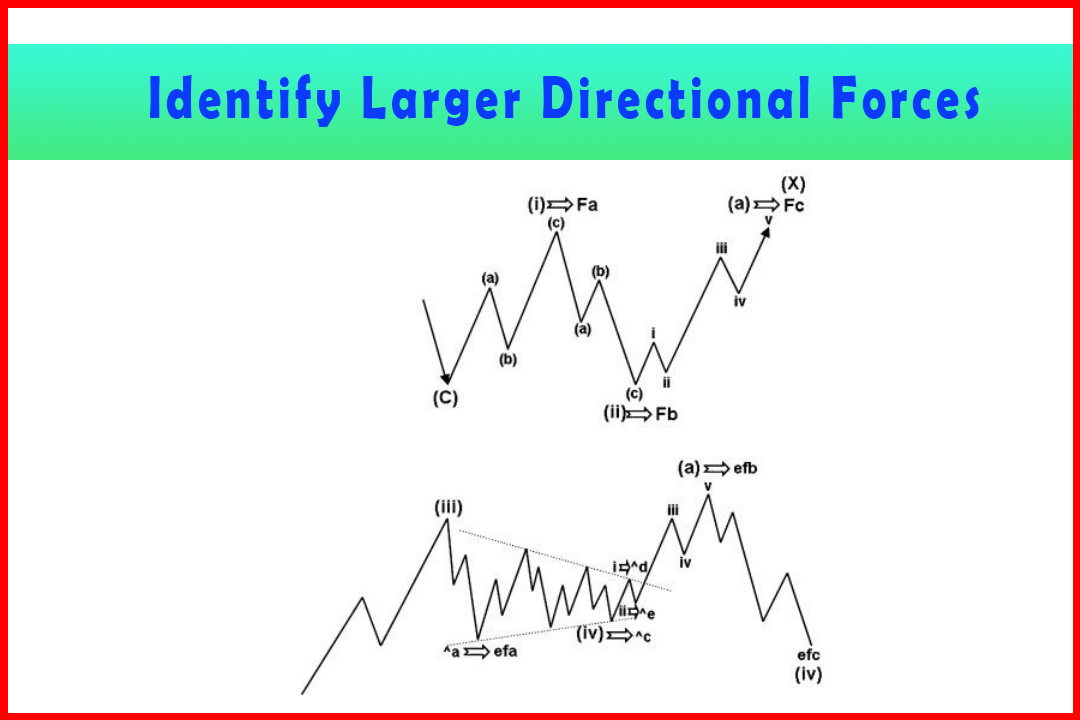

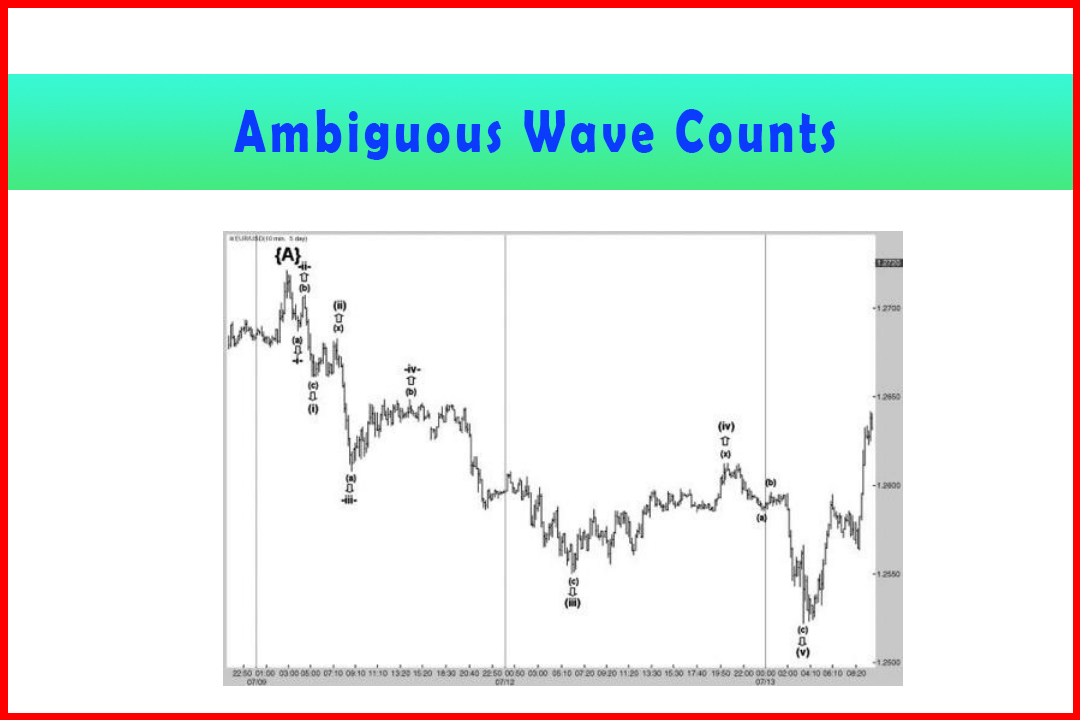

Figure

5.17 provides an example of how a wave count may break down an anticipated

bullish rally in Wave (C). It is impossible to identify the correct wave

structure 100% of the time. We all make errors of judgment and sometimes wave

structures can morph into more complex corrections.

Figure 5.17 Using

Indicators to Forewarn of a Breakdown in a Bullish Wave Count

In

this example, it is assumed that the first high marks the completion of a Wave

(A) where momentum displayed a bearish divergence. In the pullback the analyst

feels that it developed in three waves and, due to other factors, feels there

is more risk of Wave (C) developing to new highs directly.

Price

rallies to stall just below the Wave (A) high, and being bullish the analyst

labels this as Wave (i) and the correction as Wave (ii). However, the

subsequent follow-through fails, with a second bearish divergence having

developed. This could be due to a possible Expanded Flat in Wave (ii), but the

clean break lower through the anticipated Wave (ii) low with price also

reversing below the Equilibrium Cloud extends the decline to a wave equality

target.

Thus

the alternative is for the first correction to be labeled Wave (a), the

corrective peak as Wave (b), and the new corrective low as Wave (c) to complete

Wave (B).

Use

of momentum can assist in providing warning signals. It is possible to remain

bullish believing that price will rally to break the bearish divergence.

However, the signal is there to keep as a warning that if price

doesn't rally a second decline can be expected in a possible Flat

correction.

Similar

movements can occur with Expanded Flat corrections as price pushes to a new

high but then fails amid a bearish divergence. While these occurrences are

frustrating, the important point to remember is that once the preferred count

is proven incorrect there is often an immediate alternative. In this case the

breakdown automatically signals a Flat correction and a new target identified.

Harmonic Elliott Wave : Chapter 5: Modified Wave Structure in Forecasting : Tag: Elliott Wave, Forex, Fibonacci : How to use momentum Indicator, Momentum Indicator, Best elliott wave trading strategy - Using Momentum to Assist in Identifying Breakdown or Targets

Elliott Wave | Forex | Fibonacci |