Wave (iii) targets

Elliott wave targets, Third wave targets, Best Trading Strategy, Best Pattern Trading

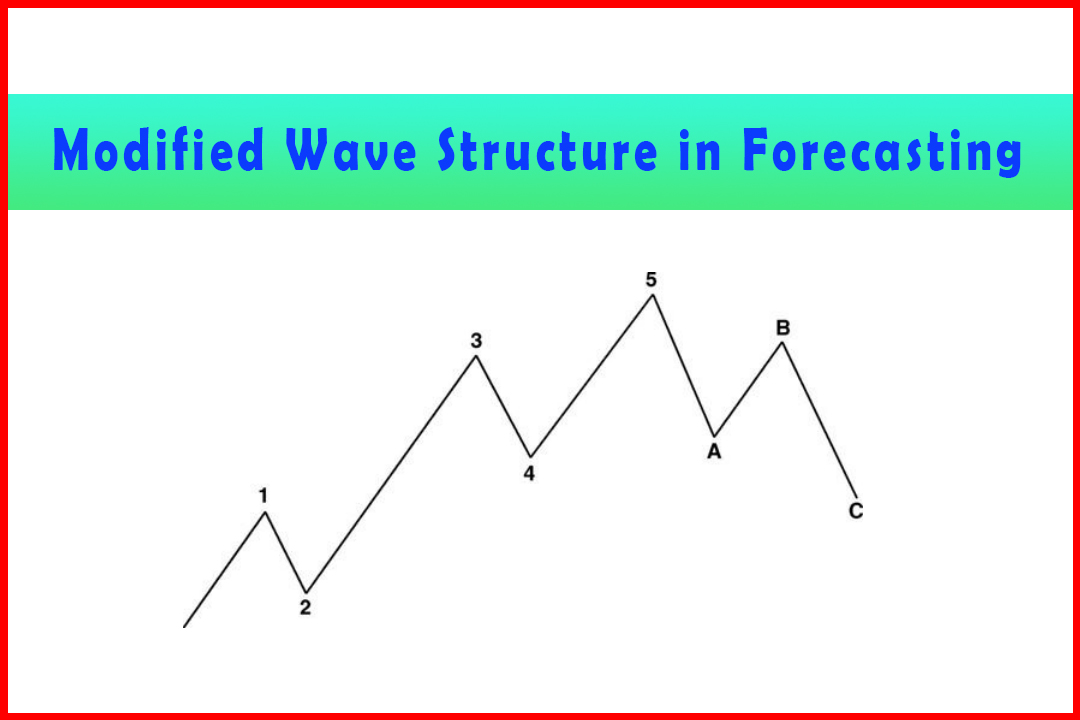

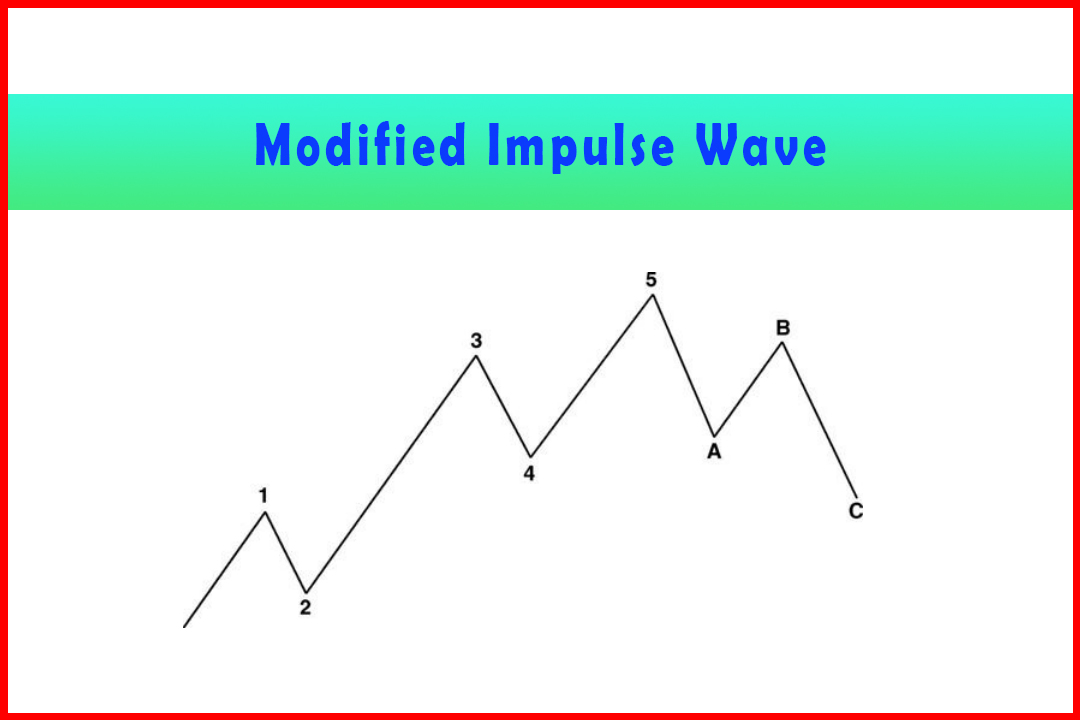

Course: [ Harmonic Elliott Wave : Chapter 5: Modified Wave Structure in Forecasting ]

Elliott Wave | Forex | Fibonacci |

Once Wave (i) and Wave (ii) have been established the immediate task is to identify where Wave (iii) will probably end. After all, there are multiple projections that could occur.

Wave (iii) targets

Once

Wave (i) and Wave (ii) have been established the immediate task is to identify

where Wave (iii) will probably end. After all, there are multiple projections

that could occur. Most common are 176.4%, 185.4%, 223.6% and in stronger moves

276.4% and 285.4%.

There

are several elements to this, and I shall cover each in turn.

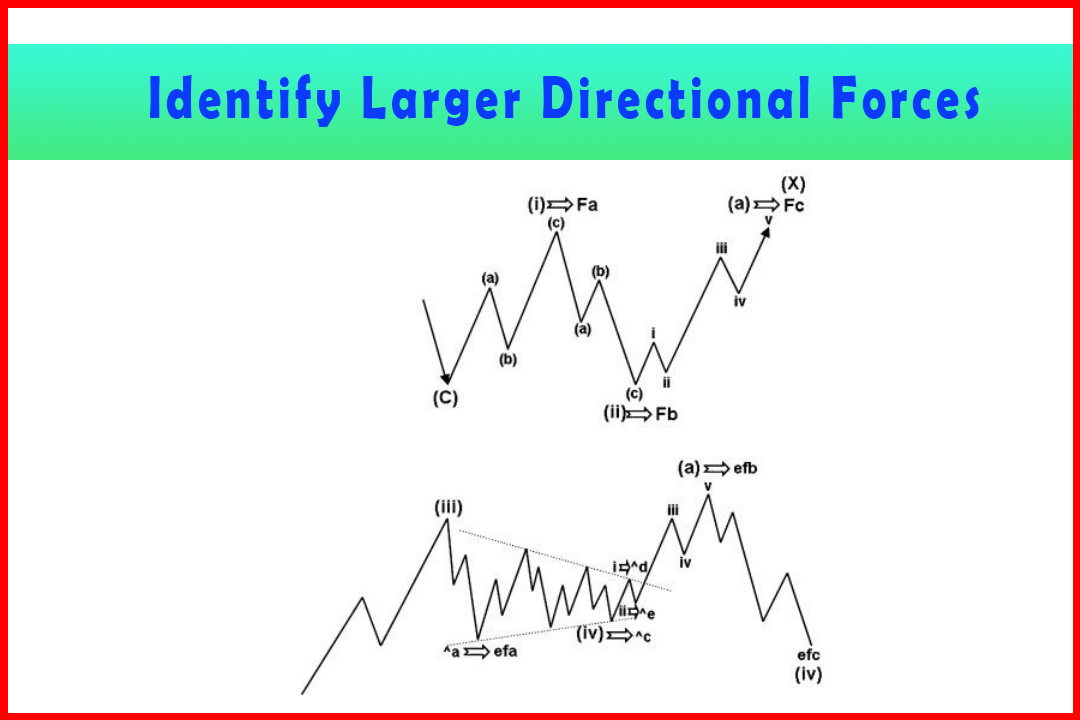

The Wave Structure of One Higher Degree

A Wave (iii) only occurs in two waves: Wave (A)

or Wave (C).

The positions of Waves (A) and Wave (C) generate

different implications and may occur within:

- Wave (i), Wave (iii), Wave (v);

- a Zigzag, Double Zigzag, or Triple Three;

- a Triangle.

Wave

(A) will always follow Wave (C). Wave (C) will always end in a Wave (v).

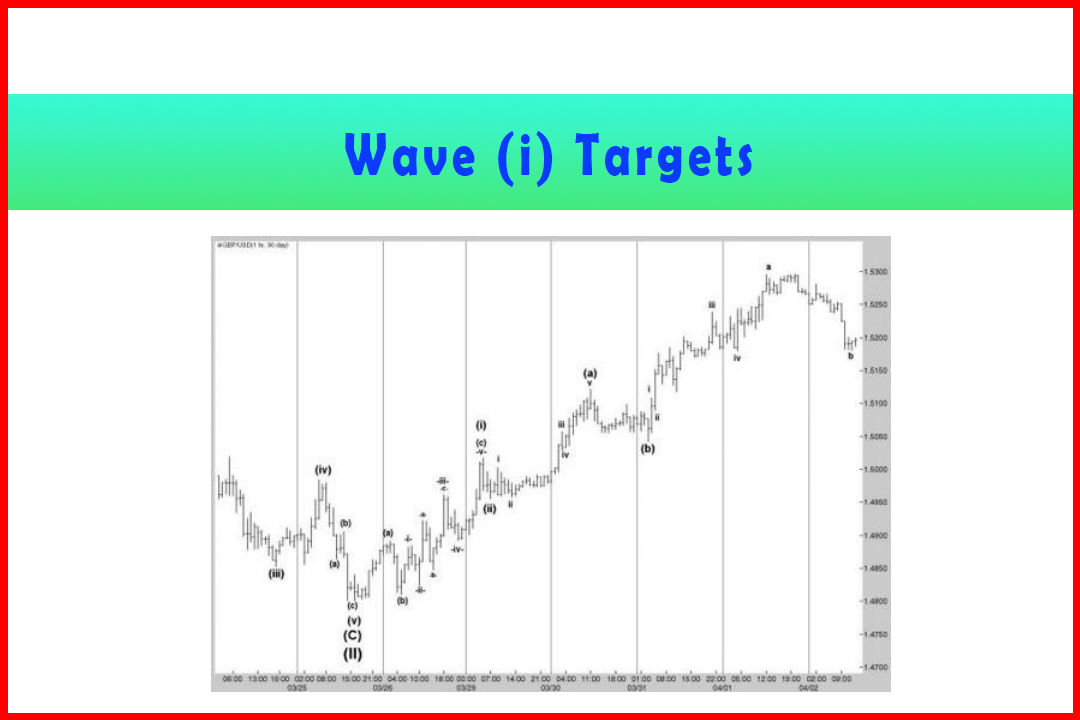

Wave iii of Wave (a) in Larger Wave (i)

A

common initial target following the completion of a Wave (v) will be the Wave

(b) of Wave (v). This may be the new Wave i, Wave iii, or indeed the full Wave

(a). The target for Wave iii should therefore be considered within this

structure.

Wave (iii) of Wave (a) of Wave (III)

There

is no universal guideline for this and it will depend on exactly what is

happening in the larger wave degree. The more important guide will be the expectation

of where Wave (A) is to end, which in turn will provide an idea of where the

Wave (a) of Wave (III) will need to complete to be within striking distance for

Wave (v) to reach the target.

In

Figure 5.8, I will show an example of how this may be achieved.

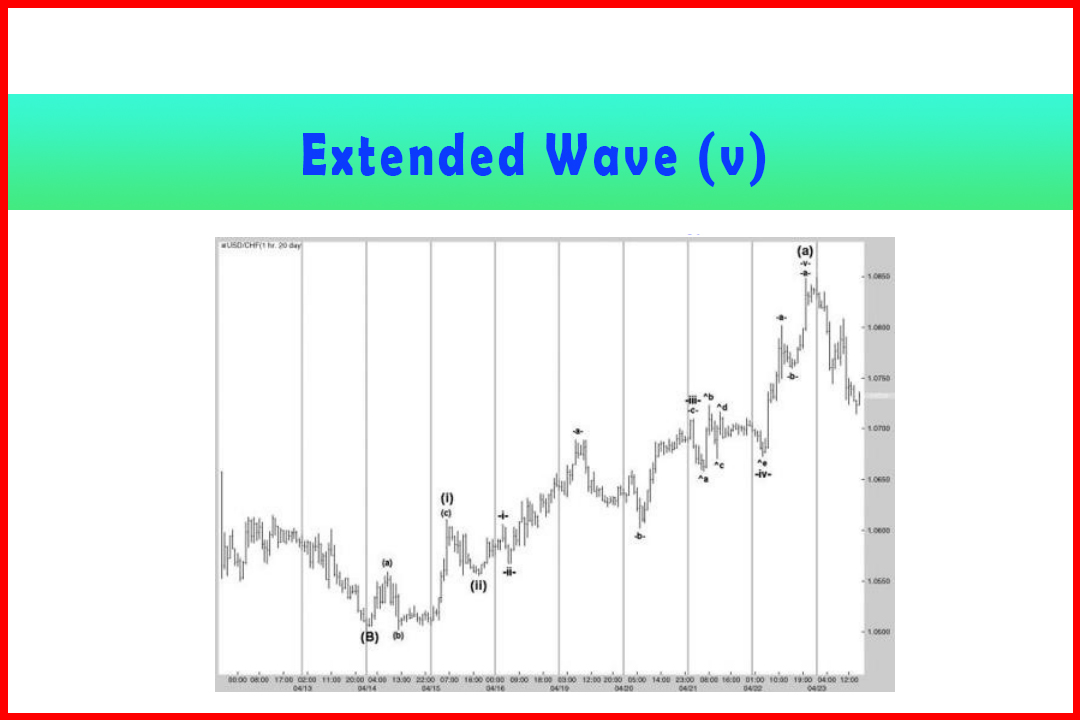

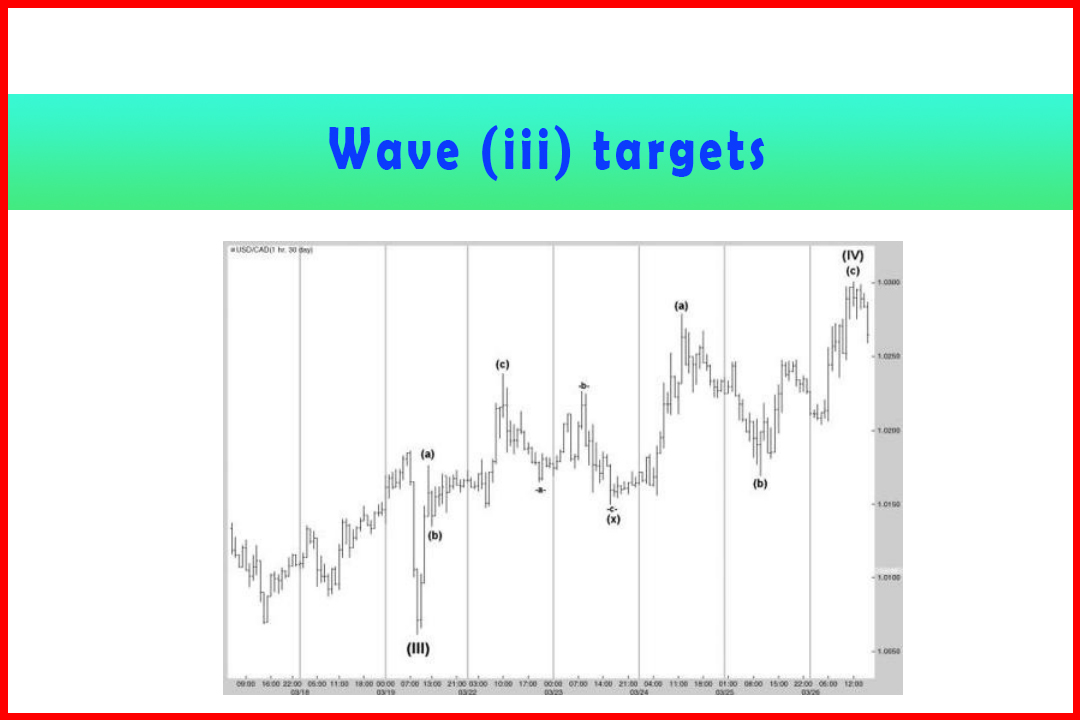

Figure 5.8 Wave

(IV) Correction in Hourly USDCAD

In

Chapter 3 I provided an example of a deep Wave -b-of Wave -iii-within a Wave

(c) higher in USDCAD. This was within a Wave (IV) of one higher degree. In

Chapter 4 I demonstrated the amazing accuracy and synchronicity of the final

(a)(b)(c) waves.

The

first problem to be considered is whether this actually completed Wave (IV).

The recovery from 1.0062 developed in a Double Zigzag. If this represented a

full 50% or perhaps 58.6% retracement in Wave (IV) then it would be a clearer

implication that the 1.0301 high was indeed Wave (IV). In this instance the 50%

retracement was at 1.0317. This was also around where two prior corrective

highs were situated in the Wave (c) of Wave (III) decline. The Wave (II)

retracement was 41.4%.

Therefore,

this case was not a clear-cut certainty that a third ABC structure would not

occur. A move below the prior Wave (b) at 1.0169 would assist that view, and

also below the prior Wave (x) at 1.0150 being another key swing low. The market

tends to avoid breaking key swing highs/lows on the first test and therefore

some reactions should be expected. The guideline of a reaction from the prior

Wave (b) would also be a factor. Therefore the approach to this general area

will need to be observed in order to assess whether the decline was developing

in line with what should be a Wave (A) of Wave (V) if this was to confirm

whether the Wave (V) would develop rather than a Wave (x) and followed by a

third ABC rally.

If

this is the start of a Wave (V) then normally Wave (A) will stall somewhere in

the region of the Wave (III) low. This would provide a general idea where Wave

(iii) of Wave (A) needs to fall to allow Wave (v) to reach the area around the

Wave (III) low.

Figure

5.9 displays how the first decline develops. The chart displays the final Wave

-c-of Wave -iii-from the deep Wave -b-, followed by the three-wave rally in

Wave -v-. In either a Wave (x) correction that would lead to a new ABC

structure higher in Wave (IV) or a five-wave decline in Wave (A), the first

development must be an ABC move.

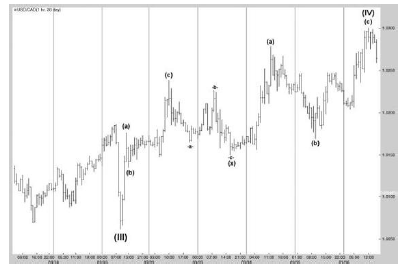

Figure 5.9

Initial Decline from the 1.0301 Peak in Five-Minute USDCAD

As

should be expected, the initial decline in Wave -a-reached the area of the

prior Wave iv and Wave b of Wave v. Identifying the five waves in Wave -a- (and

therefore the Wave iii) in a five-minute chart is normally impossible. Wave

-b-then followed, and then five waves in Wave -c-to reach the prior Wave -b-of

Wave -v-higher and just below but holding above the prior Wave -iv-. Wave -c-

was just over 223.6% of Wave -a-. This was at 1.0245.

At

this point there is no way of knowing precisely whether this decline formed

Wave (I) of Wave (A) or whether it was a pullback in Wave (x), or perhaps just

one ABC decline within a Wave (x). The recovery from the 1.0245 Wave -c-low

ended between the 41.4% and 50% retracement at 1.0270 and between the prior

Wave b of Wave v and the peak of Wave iv.

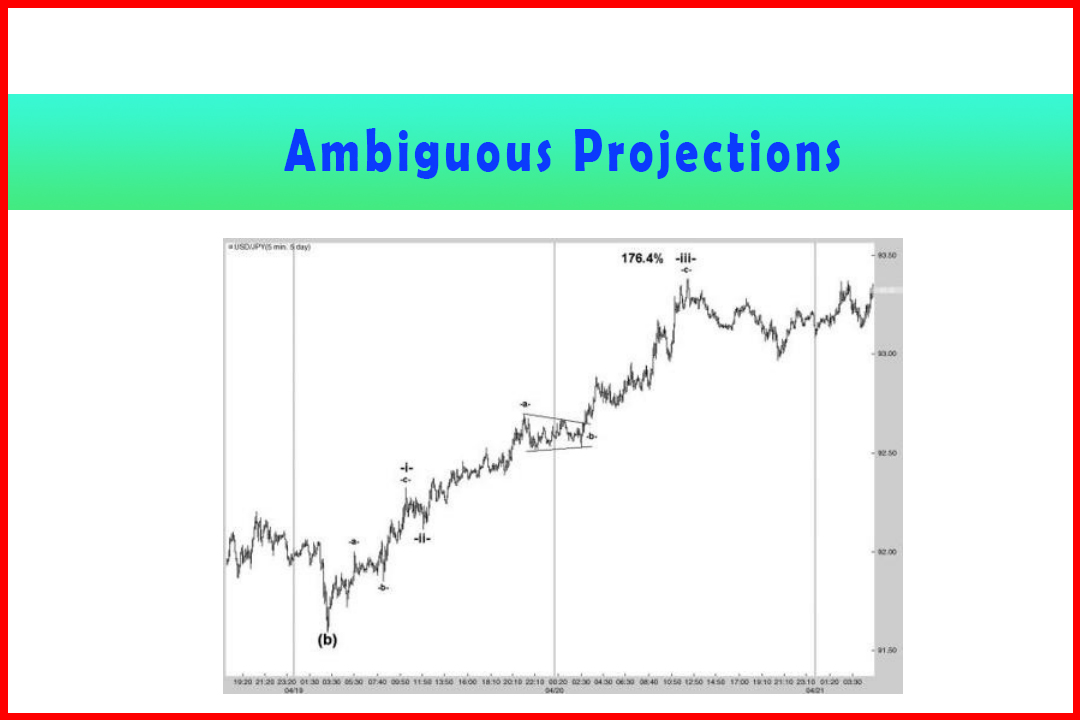

The

next move should define the structure of the decline. For this to be a Wave (x)

the next three-wave decline must see the Wave C below the 1.0245 low unless it

was to turn into a complex correction in Wave (x).

If

this was to be Wave (a) of Wave (III) then the next move should be five waves

lower in Wave (a). It should also test the prior Wave (b) at 1.0169 and

possibly the 1.0150 prior Wave (x). This would enable a retracement in Wave (b)

and extension in Wave (c) of Wave (III) to reach closer to the prior higher

degree Wave (III) low at 1.0062. To identify where Wave -iii-should stall the projections

for Wave -iii-should be observed in conjunction with those of Wave -c- (once

Wave -b-had been completed).

Wave

-c-projections:

85.4%

= 1.0222

100.0%

= 1.0217

114.6%

= 1.0212

123.6%

= 1.0210

138.2% = 1.0205

161.8%

= 1.0198

Wave

-iii-projections:

176.4%

= 1.0235

185.4%

= 1.0233

223.6%

= 1.0227

261.8%

= 1.0220

285.4%

= 1.0216

423.6%

= 1.0193

From

these we could consider a potential target around 1.0216-20.

In

fact, what transpired was Wave -in-measuring a rather unusual 376.4% projection

of Wave -i-and Wave -c-of Wave -iii-being 161.8% of Wave -a- reaching 1.0200.

This begins to highlight the issue of also identifying the individual wave

structure of Wave -c-.

Wave

-iv-was then two points above a 41.4% retracement of Wave -iii-and Wave -v-was

precisely 76.4% at 1.0176. This was perfect in terms of the retest of the prior

Wave (b) in Wave (IV) higher. Thus this could now be confirmed as a developing

Wave (A) lower, and the next step was to identify a correction in Wave (b) and

then extension in Wave (c) to complete Wave (III).

The

next step would be to identify an approximate target for Wave (III) from where

a Wave (IV) retracement would develop and provide somewhere between a 61.8% and

76.4% (or possibly an extended wave of 85.4%) to reach close to the 1.0062 low.

Wave

(III) projections:

176.4%

= 1.0171

185.4%

= 1.0166

223.6%

= 1.0145

261.8%

= 1.0123

285.4%

= 1.0110

Since

Wave (a) had reached 1.0176, the first two projections can be ruled out. The

223.6% projection at 1.0145 may well be possible, as well as the 261.8%

projection at 1.0123. The 285.4% is rather deep but shouldn't really

be ruled out.

Next

the retracements in Wave (b) can be derived:

38.2%

= 1.0212

41.4%

= 1.0215

50.0%

= 1.0223

58.6%

= 1.0231

Note

should be taken of the prior Wave -b-of Wave -v-and also the Wave -iv-. These

were at 1.0229 and 1.0222. This would lead to the favored retracement being

between 1.0212 and 1.0223.

The

recovery from 1.0176 reached 1.0221 and thus two points below the 50.0%

retracement (see Figure 5.10). Compared to the decline in Wave (a) it was quite

brief, but the likelihood is that it would be considered as Wave (b).

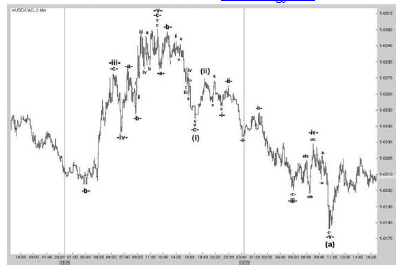

Figure 5.10 Wave (c) Decline in Wave (III) in Five-Minute USDCAD

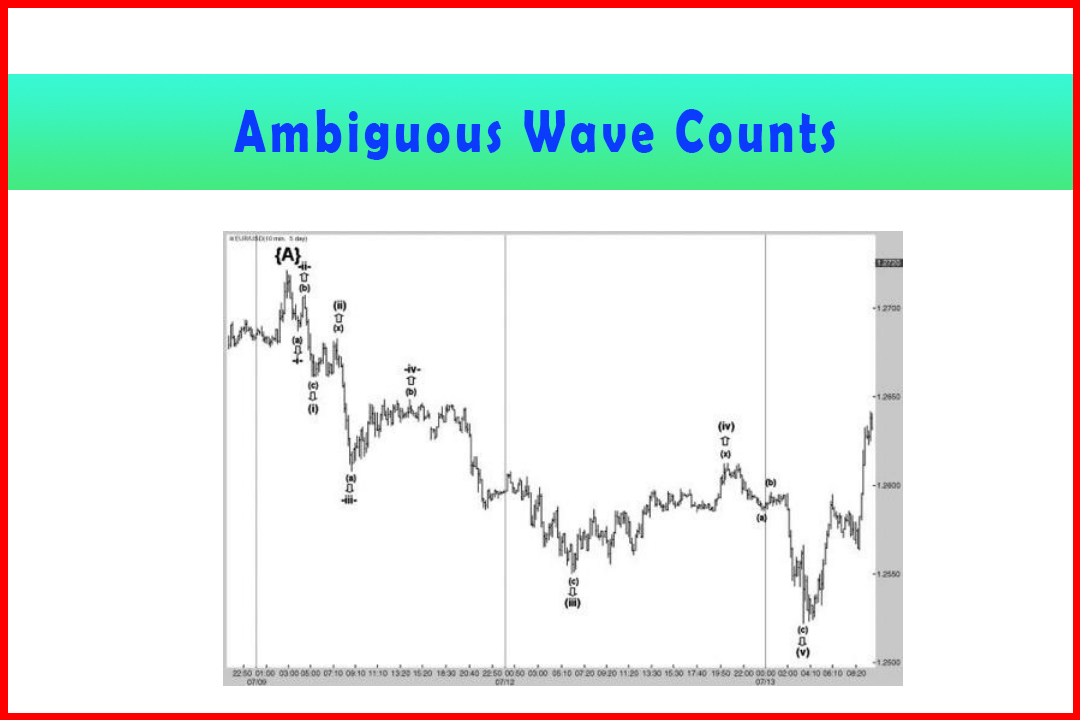

From

that peak the wave development became more uncertain. I have marked a five-wave

decline which did hold quite good relationship ratios. However, the low was at

1.0156 and above the prior swing low at the 1.0150 Wave (x). This does not

satisfy a Wave (III) target.

The

possibility of these being a mistake in the bearish wave count should be

considered, although the breach of the prior Wave (b) is normally (but not

always) a sign that there has been a reversal.

On

a closer look there was a secondary wave count that implied a three-wave

decline with the alternative Wave -c-being 85.4% of Wave -a-. It is also

therefore possible that this is an Expanded Flat. If so, the 1.0156 low should

represent an expansion of the alternative Wave efa. Indeed, this was a 41.4%

expansion which would imply a five-wave rally in Wave efc to around the Wave

efa high. This occurred with the Wave efc stalling at 1.0214, and this would

then be counted as Wave (b).

A

target in Wave (c) could then be calculated:

85.4%

= 1.0134

100.0%

= 1.0120

114.6%

= 1.0106

Matching

with the projections anticipated in Wave (III) between 1.0212¬1.0223, it would

appear that Wave (c) would also likely stall in the same area. The five waves

lower developed with normal ratios to reach 1.0125.

Wave

(IV) developed with an almost 50% retracement to 1.0195.

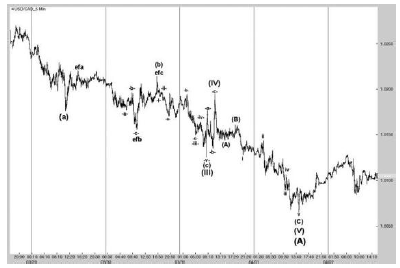

Finally,

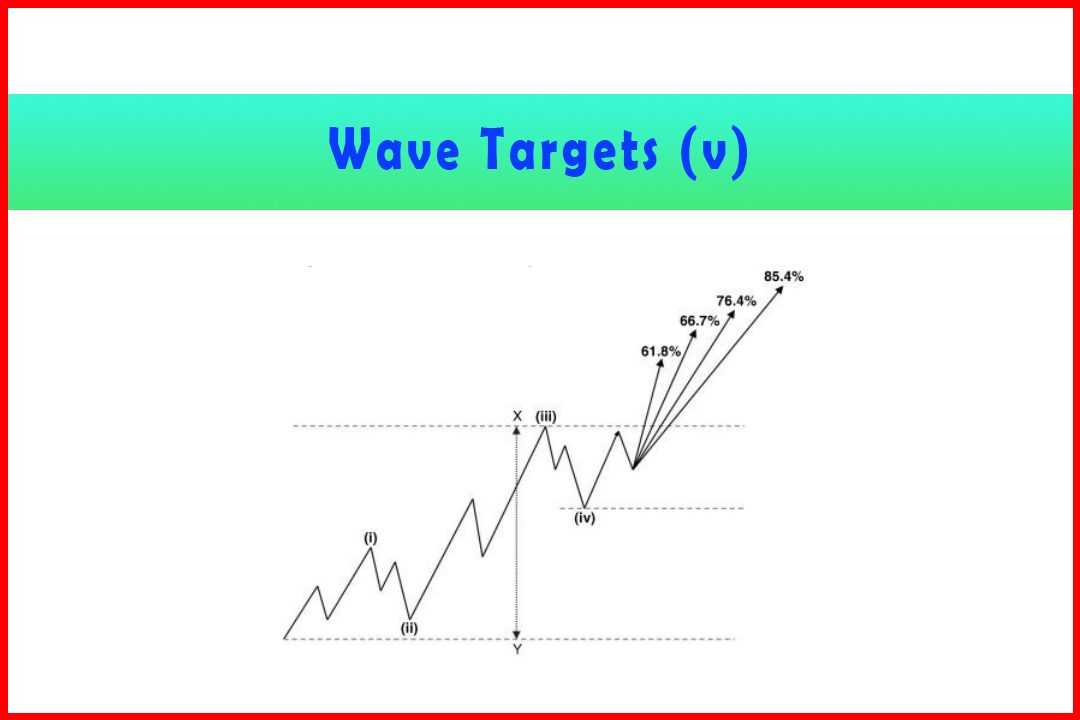

this allowed targets for Wave (V):

61.8%

= 1.0086

66.7%

= 1.0078

76.4%

= 1.0061

The

Wave (III) low of one higher degree was at 1.0062 and the Wave (V) to complete

Wave (A) completed at 1.0065 (see Figure 5.11).

Figure 5.11 Wave (V) Decline in Wave (A) in Five-Minute USDCAD

This

walk-through demonstrates the technique of estimating the Wave (iii) targets,

both internally from the Wave (c) target within Wave (iii), and also as a

projection of Wave (i) and a general expectation of where a Wave (iii) should

fall if the target in the Wave (A) or Wave (C) is to be achieved.

This process provides several

factors in bringing confidence to the expected wave count or whether it begins

to break down:

- A move will always be expected in either five waves or three waves, dependent on the location within the larger wave count.

- The early stages can be linked to the prior Wave (b) and/or Wave -b-of Wave -iv-of the preceding move. Estimates can be made for the general area where Wave (iii) should be expected to end.

- If a five-wave move is anticipated then there should be valid relationships between them. If not, then an alternative structure may be developing.

- Relationships between Wave (i), Wave (iii), and Wave (v) need be confirmed by projections of the internal Wave abc.

- The general adherence to ratios normally provides excellent break levels to the anticipated wave count. For example, if a Wave iii reaches a common expansion ratio in a possible complex correction then this can be highlighted by a break through the anticipated Wave iv retracement.

Harmonic Elliott Wave : Chapter 5: Modified Wave Structure in Forecasting : Tag: Elliott Wave, Forex, Fibonacci : Elliott wave targets, Third wave targets, Best Trading Strategy, Best Pattern Trading - Wave (iii) targets

Elliott Wave | Forex | Fibonacci |