Extended Wave (v)

Elliott wave targets, Fifth wave targets, Best Trading Strategy, Best Pattern Trading

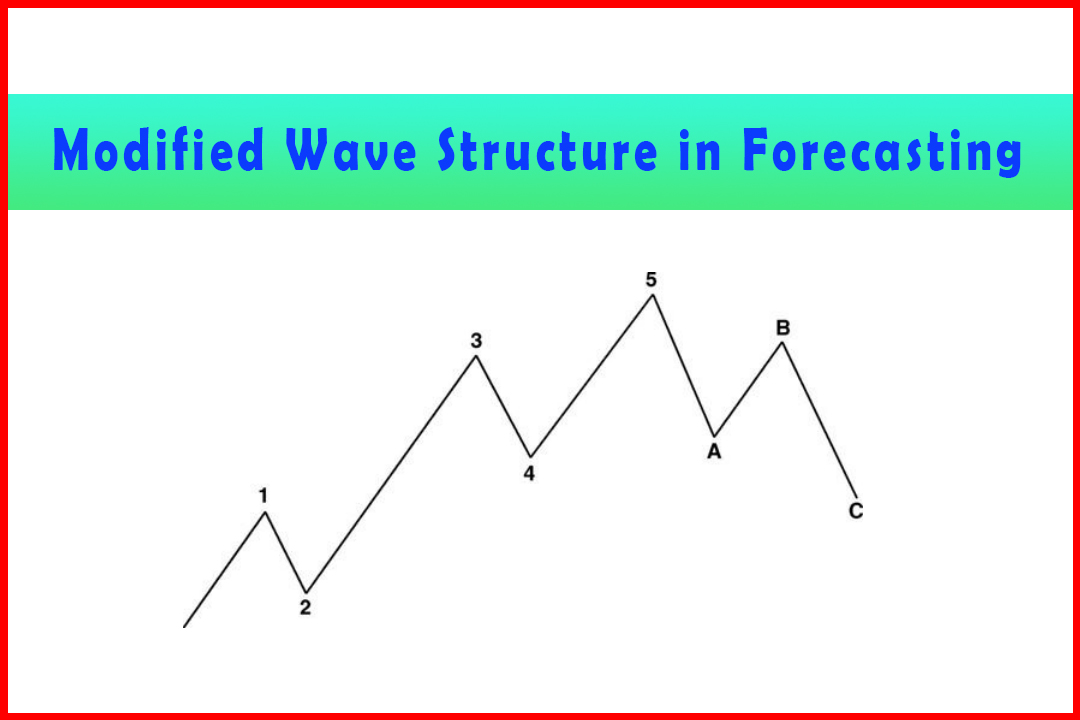

Course: [ Harmonic Elliott Wave : Chapter 5: Modified Wave Structure in Forecasting ]

Elliott Wave | Forex | Fibonacci |

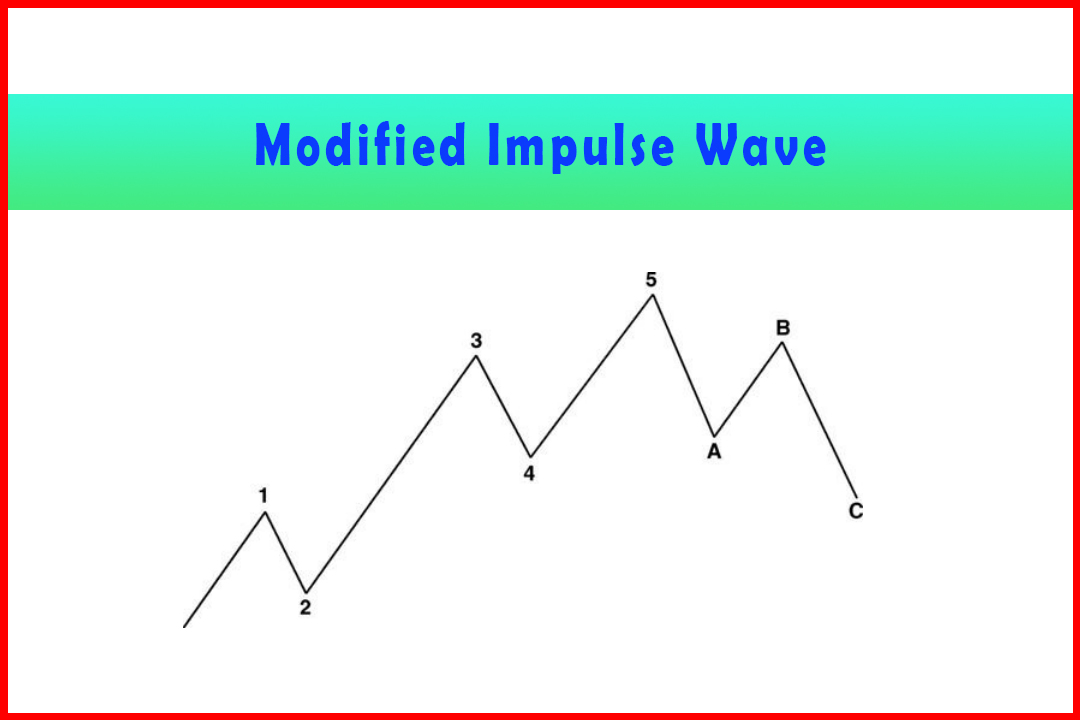

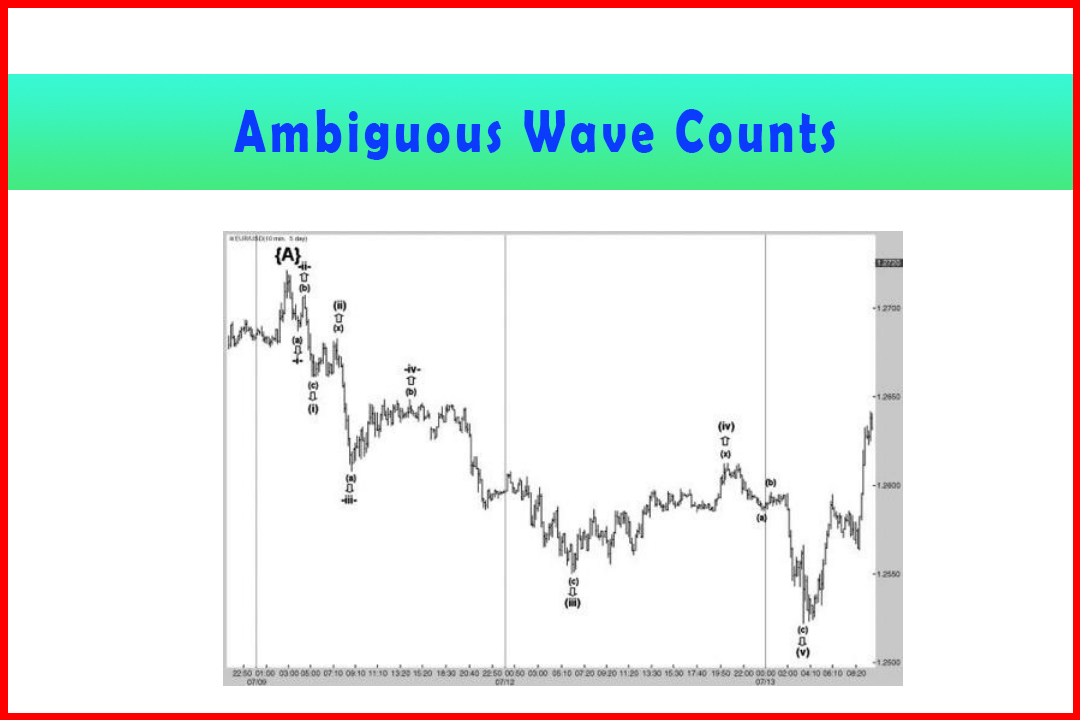

The topic of extended fifth waves was covered in both Chapters 3 and 4 to demonstrate how they develop. However, these can be some of the most difficult to anticipate, and due to the common sharp and aggressive development the final stalling point can be difficult to predict.

Extended Wave (v)

The

topic of extended fifth waves was covered in both Chapters 3 and 4 to

demonstrate how they develop. However, these can be some of the most difficult

to anticipate, and due to the common sharp and aggressive development the final

stalling point can be difficult to predict.

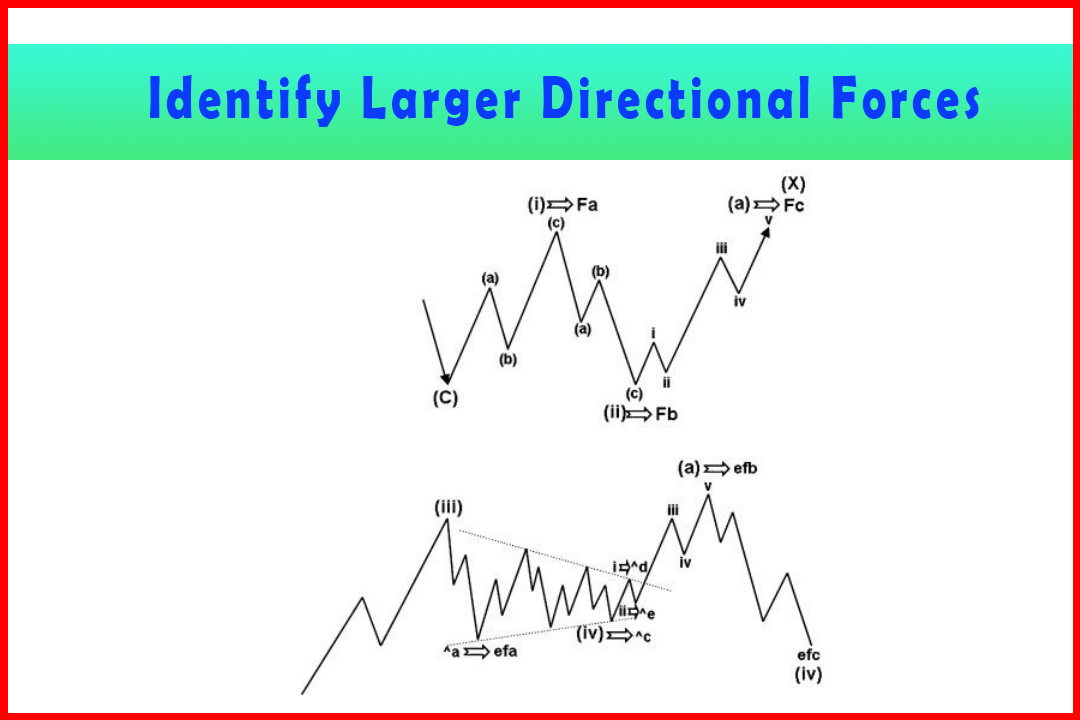

The

same situations described for identification of common chart barriers such as

prior Wave (iv)'s, swing peaks or troughs, or even congestion areas

applies also to extended fifth waves. However, it is good practice to observe

prior wave projections, especially in Wave (c) developments as a stalling point

for intermediate waves can occur at these levels. This occurred in the hourly

USDCHF market as I was writing this chapter.

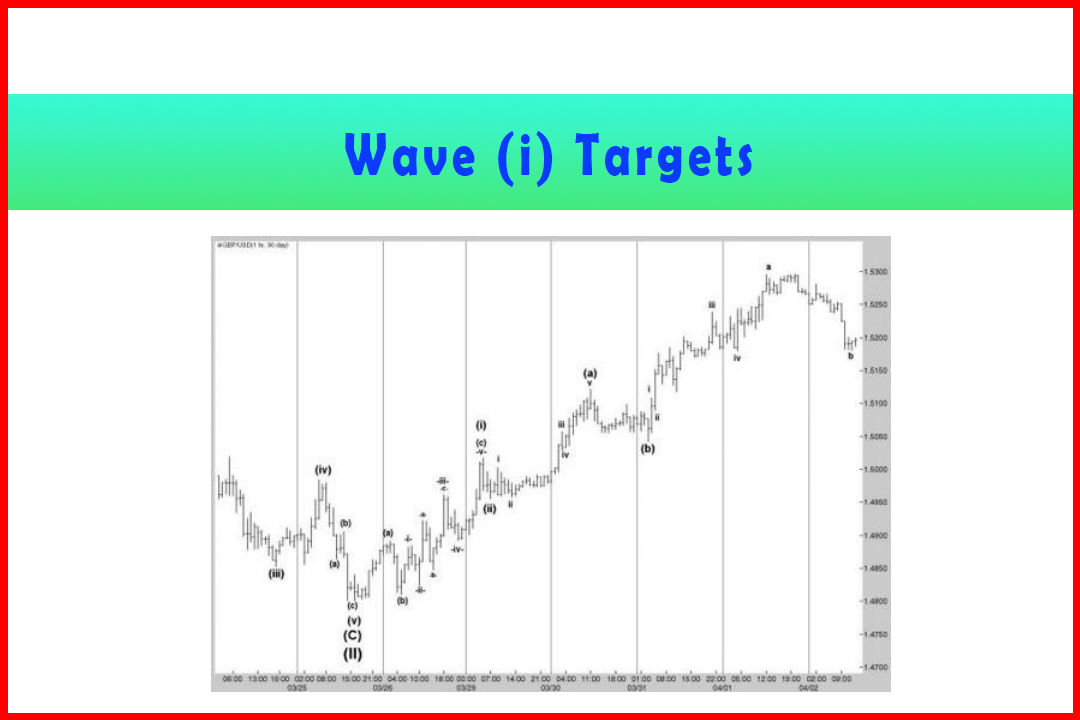

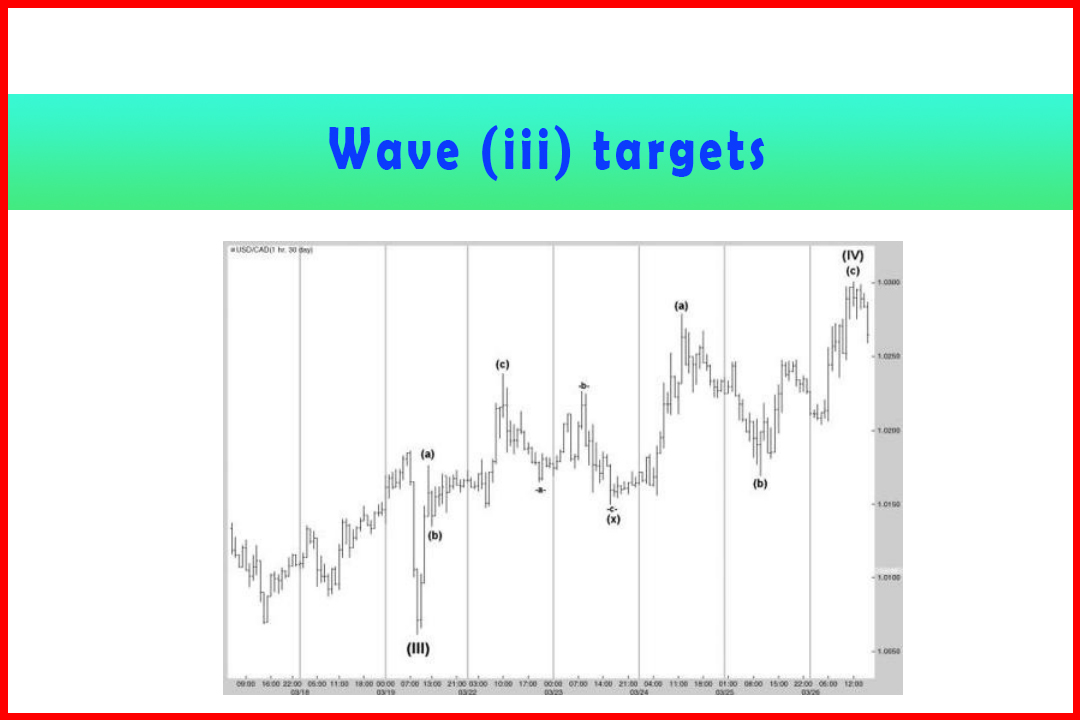

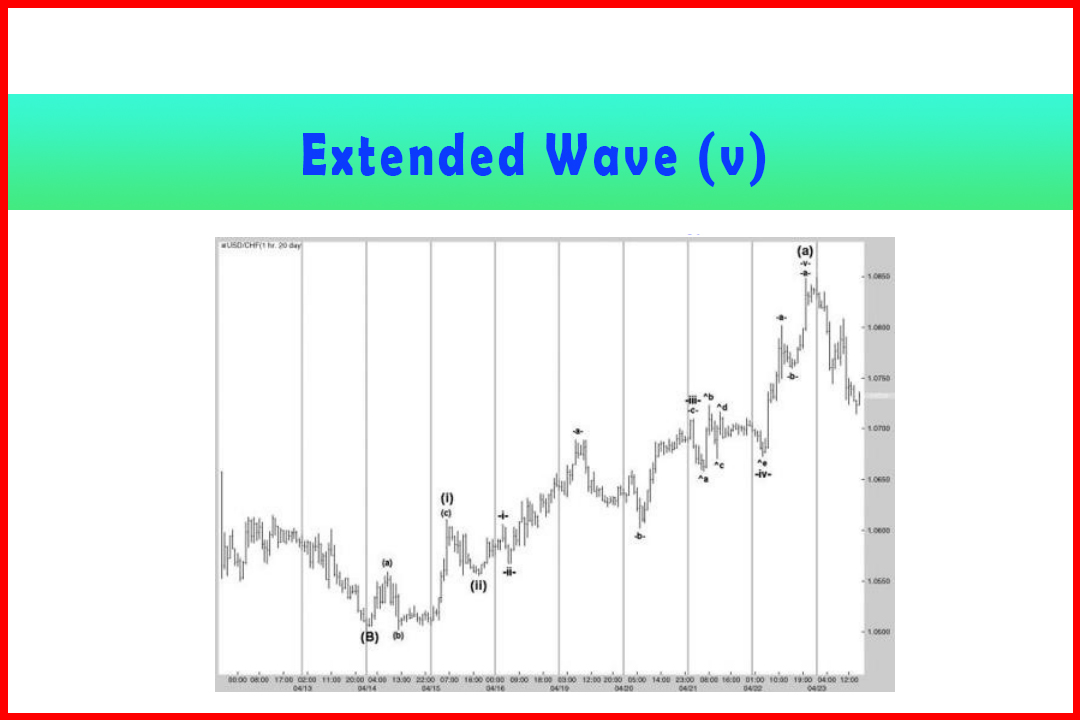

Figure

5.13 displays a rally in Wave (i) and Wave (ii) followed by a Wave (a) with

extended Wave -v-in the hourly USDCHF market. In some ways it was an unusual

and somewhat complicated structure to follow, as the Wave -b-of Wave - iii-was

unusually deep for the prior Wave -ii-but then translated into a shallow Wave

-iv-in a Triangle in which Wave Ab was expanded. The final Wave -v- extended by

114.6% of the distance from Wave (ii) to the end of Wave -iii-.

Figure 5.13 Wave

(a) Rally in Wave (iii) in Hourly USDCHF Ending in an Extended Fifth Wave

While

being an extension ratio I have seen on several occasions, it is not that

common and to anticipate this without any other factor would be difficult.

However, it will be noticed that the entire rally originated from the 1.0501

low which is labeled Wave (B). The Wave -v-came to an end just two points below

the wave equality target in Wave (C). While this move is still in progress at

the time of writing and I cannot be totally certain that the final high has not

been seen at 1.0849, the structure of the rally to that point does not appear

to be in five waves. Indeed, I suspect that the entire rally began from the

Wave (X) low at 1.0434 which I provided in an earlier example of an extended

Wave (iii). If that count proves correct then we must see an eventual move to a

new high above the 1.0897 high that was seen on February 19, 2010. From this

point I am therefore anticipating a Wave (b) of Wave (iii) and will then match

the projections in Wave (c) with those of Wave (iii).

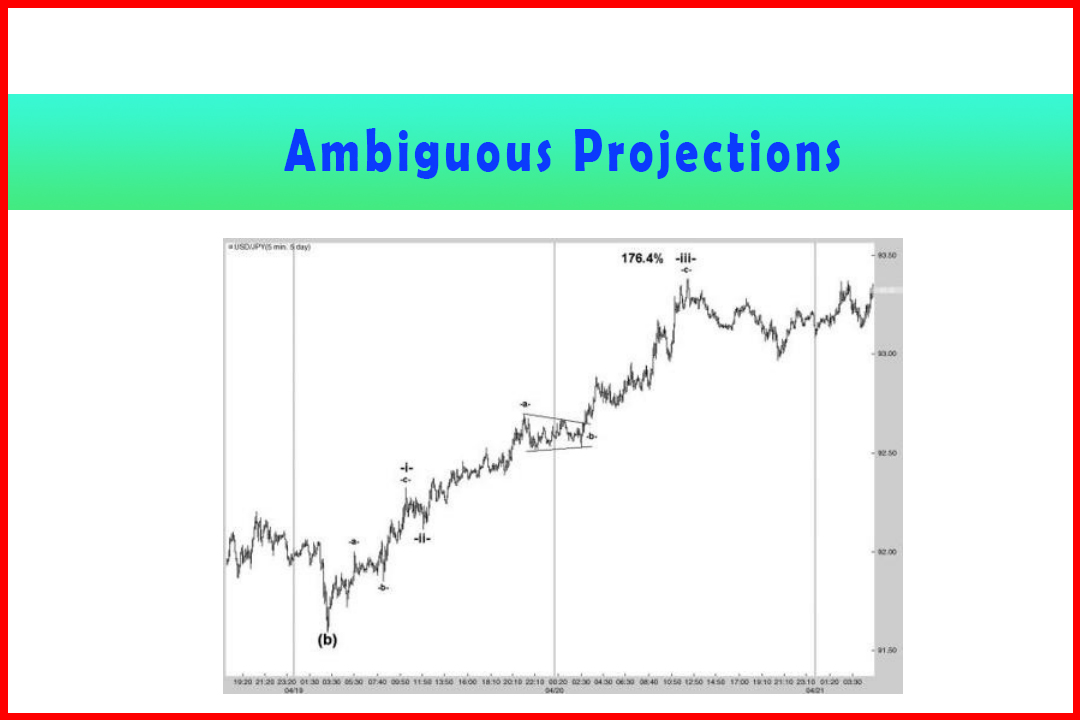

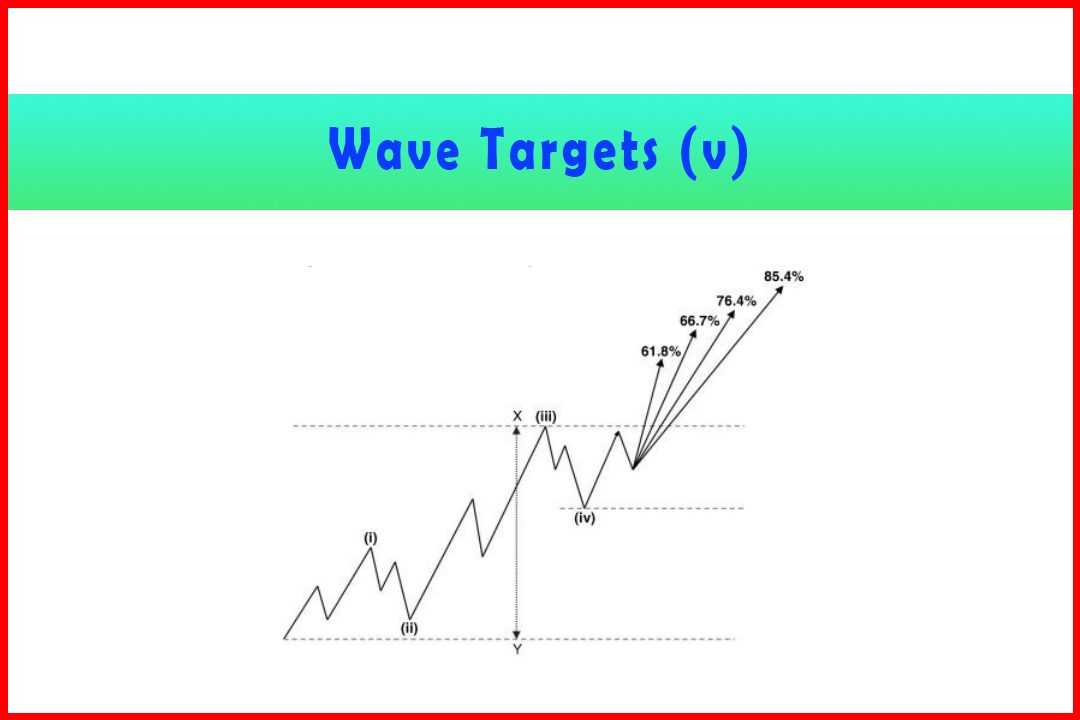

While

in this example the Wave (a) of Wave (iii) ended at the wave equality target in

Wave (C), I have also noticed that they can stall at short Wave (iii)

projections such as the 176.4% extension. After the Wave (b) retracement and

follow-through in Wave (c) the final Wave (iii) extension could be around

261.8% or 276.4% or more.

Harmonic Elliott Wave : Chapter 5: Modified Wave Structure in Forecasting : Tag: Elliott Wave, Forex, Fibonacci : Elliott wave targets, Fifth wave targets, Best Trading Strategy, Best Pattern Trading - Extended Wave (v)

Elliott Wave | Forex | Fibonacci |