Wave (i) Targets

Best trading Analysis, Best Forecasting Analysis

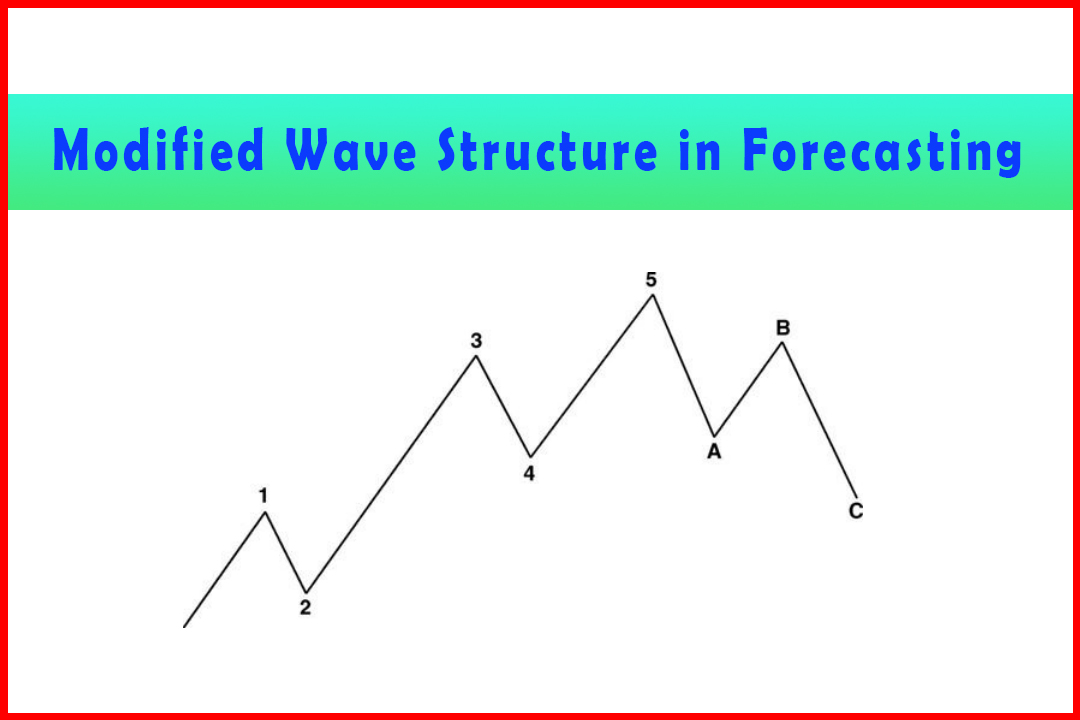

Course: [ Harmonic Elliott Wave : Chapter 5: Modified Wave Structure in Forecasting ]

Elliott Wave | Forex | Fibonacci |

There is no uniform way of identifying where this will stall as it is not related to any prior wave. It is possible to consider the prior Wave b of Wave (v) and occasionally the prior Wave (iv), especially when this is a key swing high or swing low in a trend.

Wave (i) Targets

The

simplest target to watch for is a projection in Wave (c) that is a ratio of

Wave (a). In Chapter 4 covering retracement and projection targets I

highlighted the following:

There

is no uniform way of identifying where this will stall as it is not related to

any prior wave. It is possible to consider the prior Wave b of Wave (v) and

occasionally the prior Wave (iv), especially when this is a key swing high or

swing low in a trend. Markets tend to shun testing a swing low/high on the

first test. Other areas to consider are pivot levels, which I find of

particular benefit.

If

this is a Wave (a) of Wave (i) in a daily chart then again we should be

watching the development of the five waves that construct Wave (a) and matching

the projections in the internal Wave v with any of the prior Wave b of Wave

(v), the prior Wave (iv) or pivot level.

Following

this we shall need to observe the pullback in Wave (b) and then calculate

projections in Wave (c).

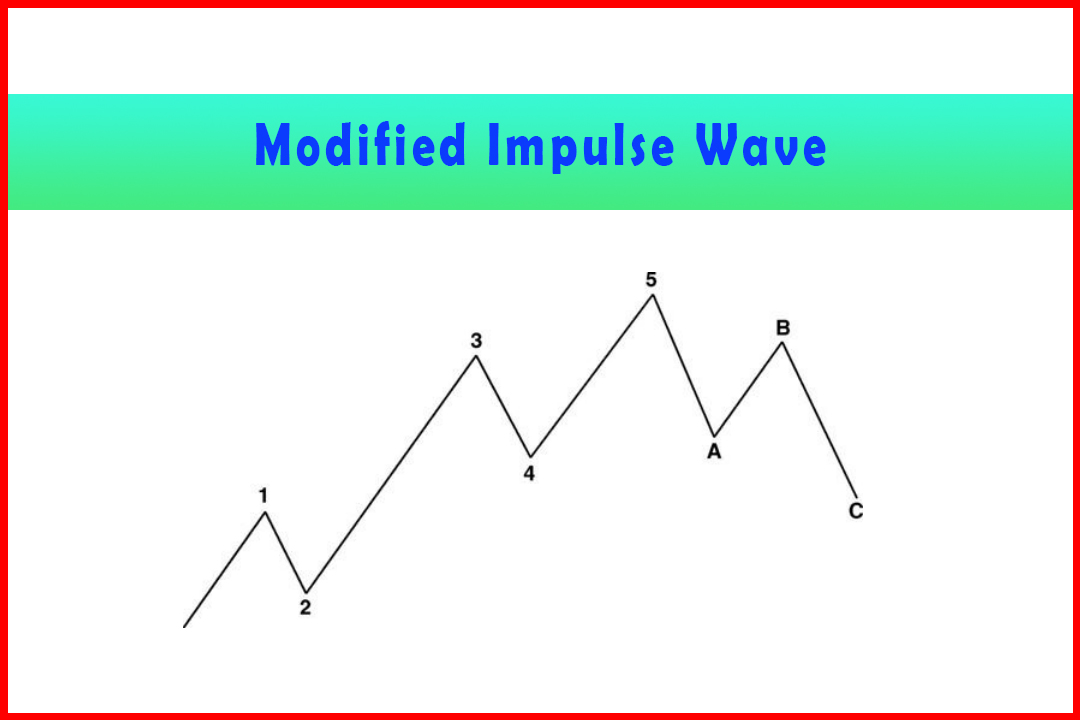

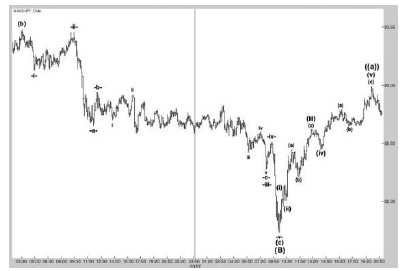

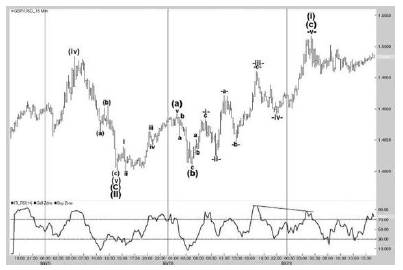

Take

the example of a pullback in Wave (B) in the AUDJPY market and the subsequent

development of Wave (I) of Wave (C) (shown in Figure 5.1).

Figure 5.1 The

Early Stages of a Reversal Higher in Wave (C) from a Wave (B) Retracement Low

In

Figure 5.1. I have shown the decline in Wave (c) of Wave (B) within a rally in

AUDJPY. Naturally for a Wave (C) the expectation will be for a rally in five

waves that should reach a projection of a ratio of Wave (A) commencing from the

Wave (B) low.

Within

Wave (I) of Wave (C) there first needs to be a Wave ((a)) constructed of five

waves followed by a Wave ((b)) and then projection in Wave ((c)).

Normally

the easiest guideline is to look for the prior Wave b of Wave -v-. In this case

this is not discernable and therefore the next stronger resistance will be the

span of the prior Wave -iv-. Above there we can see the broad sideways

congestion area from the top of the prior Wave -b-to the lows just below Wave -

a-. These areas can be expected to provide resistance and normally cause

corrections.

In

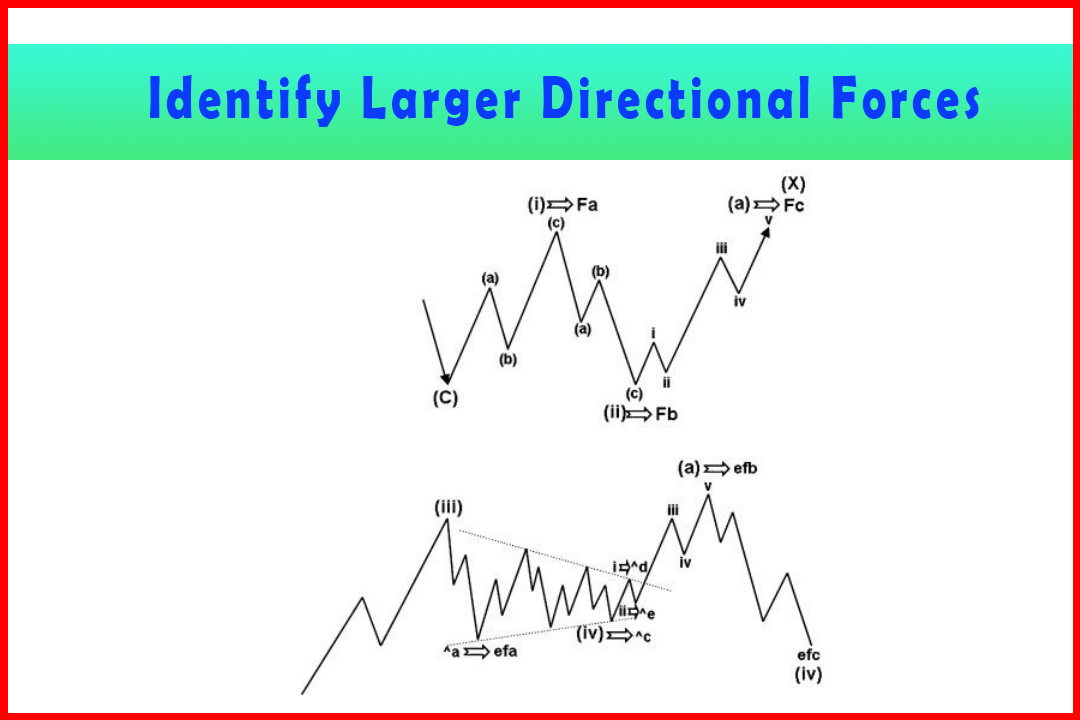

the early stages of this wave development, consideration needs to be given to

the potential of Wave a. Wave b. and Wave c to form the first Wave (i) of Wave

((a)). A possible initial target would be the prior Wave (b). This is often the

stalling point of the Wave a of Wave (i). This will be followed by a Wave b and

then a projection of Wave a to complete Wave c. This will be Wave (i). In

trying to determine whether Wave (i) is in approximately the right area we

should consider a minimum target of a 176.4% projection of Wave (i) that would

imply a Wave (iii) that would stall in around the right area that would allow a

pullback in Wave (iv), then follow through in Wave (v) to reach close to a

realistic target for Wave ((a)).

Thus,

approximate estimations should be made to qualify the first abc rally in Wave

(i) and ensure that Wave b is a ratio of Wave a and then Wave c a projection of

Wave a. In this example, while it is too small to label, Wave b was a 41.4%

retracement of Wave a while Wave c was a 176.4% projection of Wave a. This

formed Wave (i) at 82.10. Wave (ii) was a 38.2% retracement of Wave (i).

At

this point projections in Wave (iii) can be generated. I shall cover these

later in this chapter.

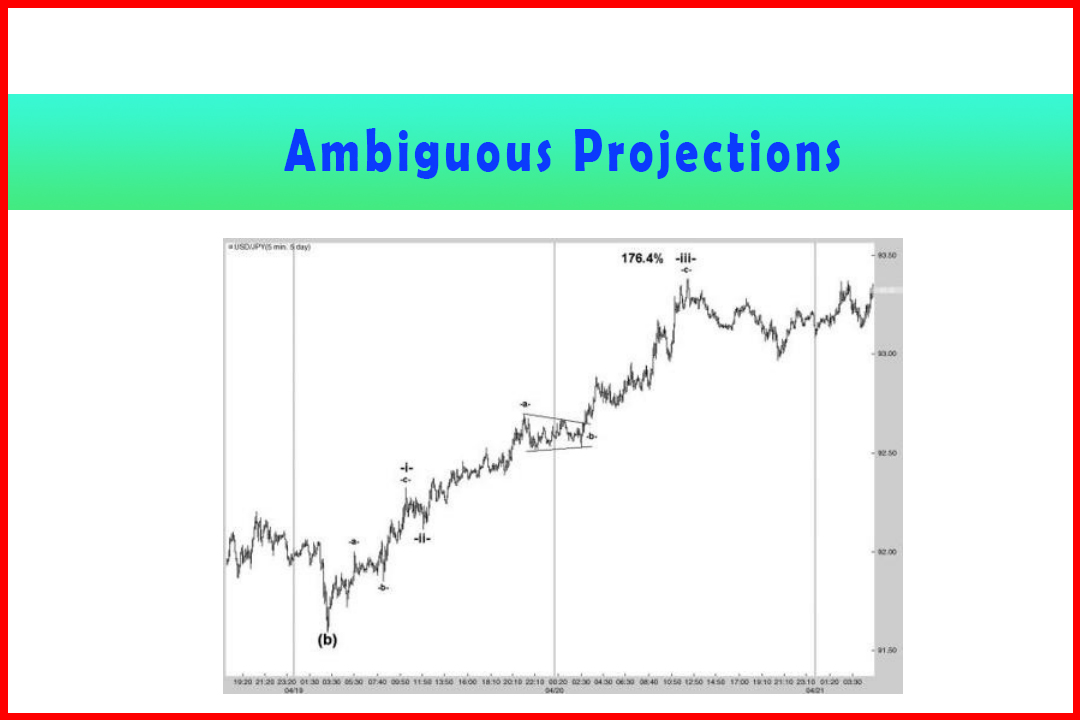

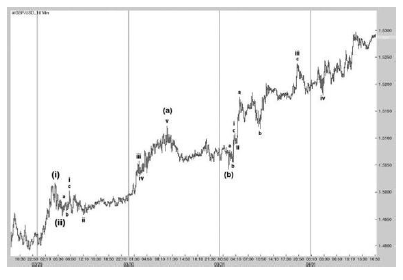

Wave

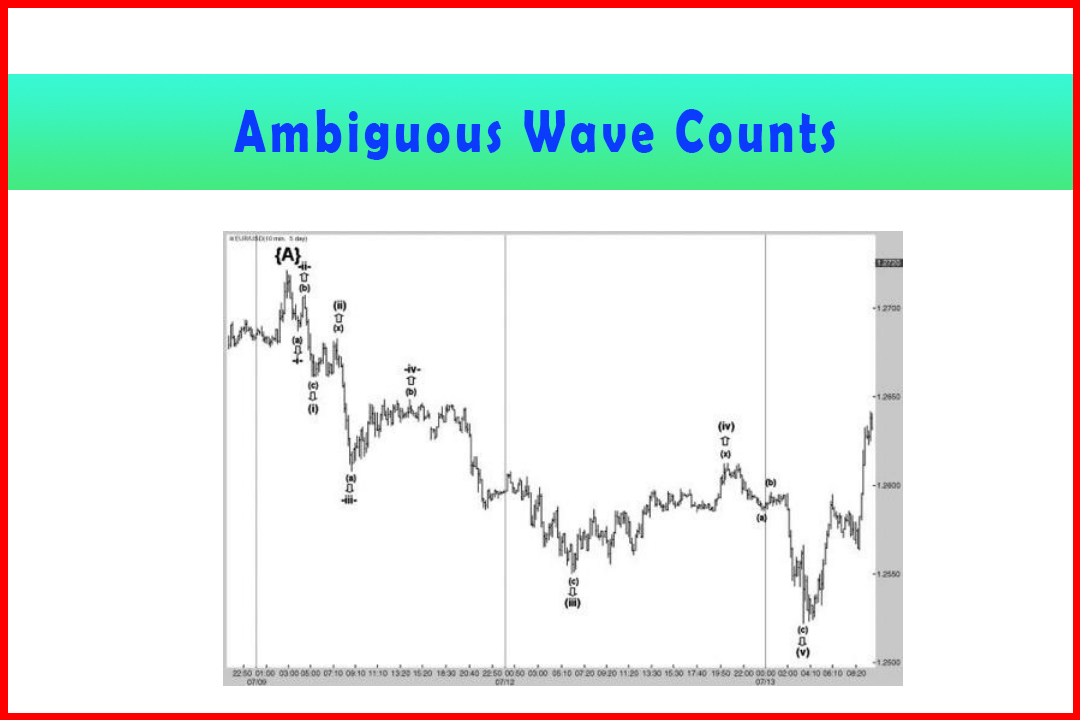

(i)'s can develop in different ways, at times with a very tight abc

move and sometimes with a long Wave c followed by steep or shallow wave

(ii)'s. There has been an interesting rally in the GBPUSD market which

includes the development of several Wave (i)'s that can be used as

solid examples (shown in Figure 5.2)

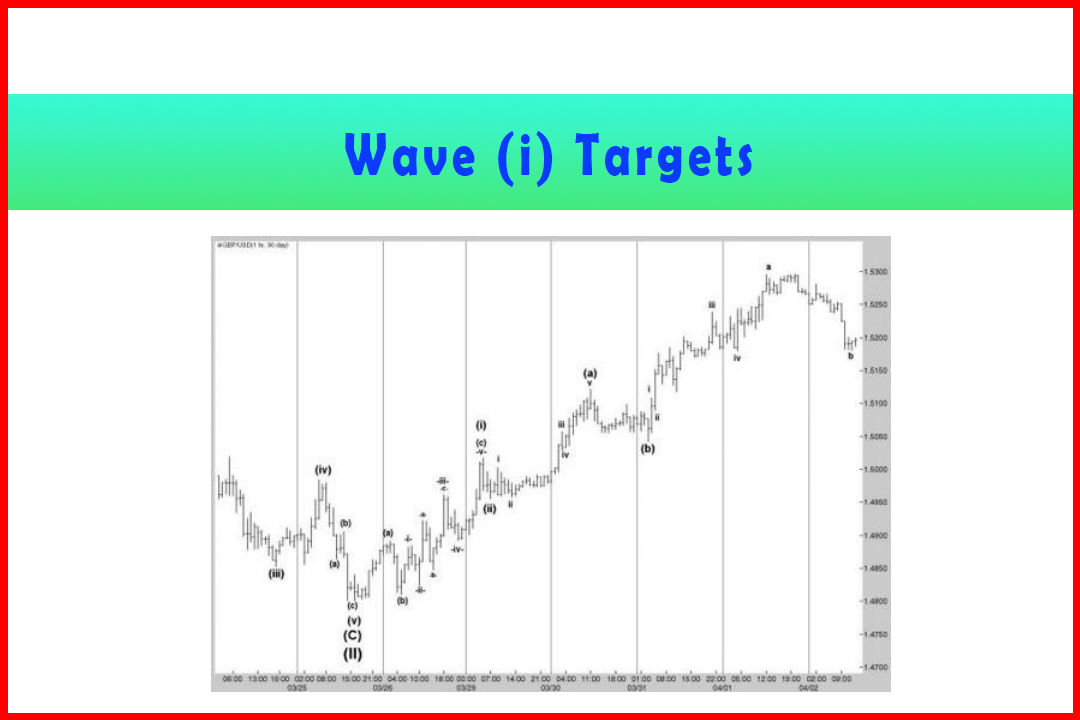

Figure 5.2 The

Initial Stages of a Rally in Wave (A) of Wave (III) in Hourly GBPUSD

Figure

5.2 displays the initial stages of development in Wave (A) of Wave (III) in the

hourly GBPUSD market. Within this are four instances of Wave 's, and

all are different in structural development in terms of pullbacks and

extensions. Also included are various examples of alternation between Wave (ii)

and Wave (iv) and, indeed, while the final Wave v of Wave (c) could not fit

into the image there is also an example of how Wave b of Wave v can also be

deep when Wave ii and Wave iv are both shallow.

To

highlight the different structures I shall zoom in on the key areas with the

use of lower time-frame charts (Figure 5.3).

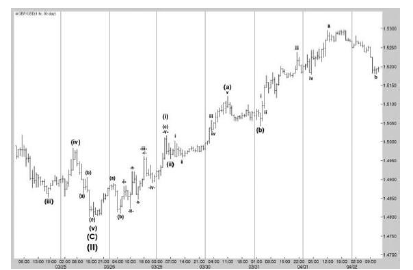

Figure 5.3

Development of Wave (i) Including the Wave i of Wave (a) and Wave (c)

Figure

5.3 displays the first Wave (i) within which there are instances of Wave i in

both Wave (a) and Wave (c).

The

initial Wave i higher from the Wave (II) low is more often than not impossible

to predict. As long as the end of Wave (II) was expected it really sets a

marker down for subsequent wave development. However, the prior Wave (b) of

Wave (v) lower is a common target on initial reversals. In this case, although

not labeled, there was a brief Wave a followed by a sideways consolidation in

what appears to be a Triangle before the rally in Wave c to reach Wave iii. The

extension in Wave iii was 166.7%. Given the deep Wave ii, the expectation is

for a shallow Wave iv (33.3%) followed by a final Wave v (76.4%) into the span

of the prior Wave (b) of Wave (v) lower. This five-wave rally can then be

labeled as Wave (a) of Wave (i).

How

deep Wave (b) will retrace would be unknown, and in the end it turned out to be

a deep 90.02% retracement to 1.4810 which was exactly in the middle of the Wave

b Triangle in Wave iii. The next step will be to consider where a probable

target for Wave (i), and therefore Wave (c), could end. To judge this, a strong

idea of the larger wave structure must be known. This Wave (i) will be part of

Wave (A) of Wave (III). The Wave (iv) high is a possibility if it represents a

key swing high that would confirm a swing reversal of the previous downtrend,

which is more often than not the case. Wave (iv) was at 1.4984. Projections of

Wave (a) should also be made.

100.0%

= 1.4886

114.6%

= 1.4912

138.2%

= 1.4933

161.8%

= 1.4954

Therefore

the broad 1.4886-1.4933 area is where the Wave (c) is most likely to end, with

a lower risk of the 161.8% projection at 1.4954.

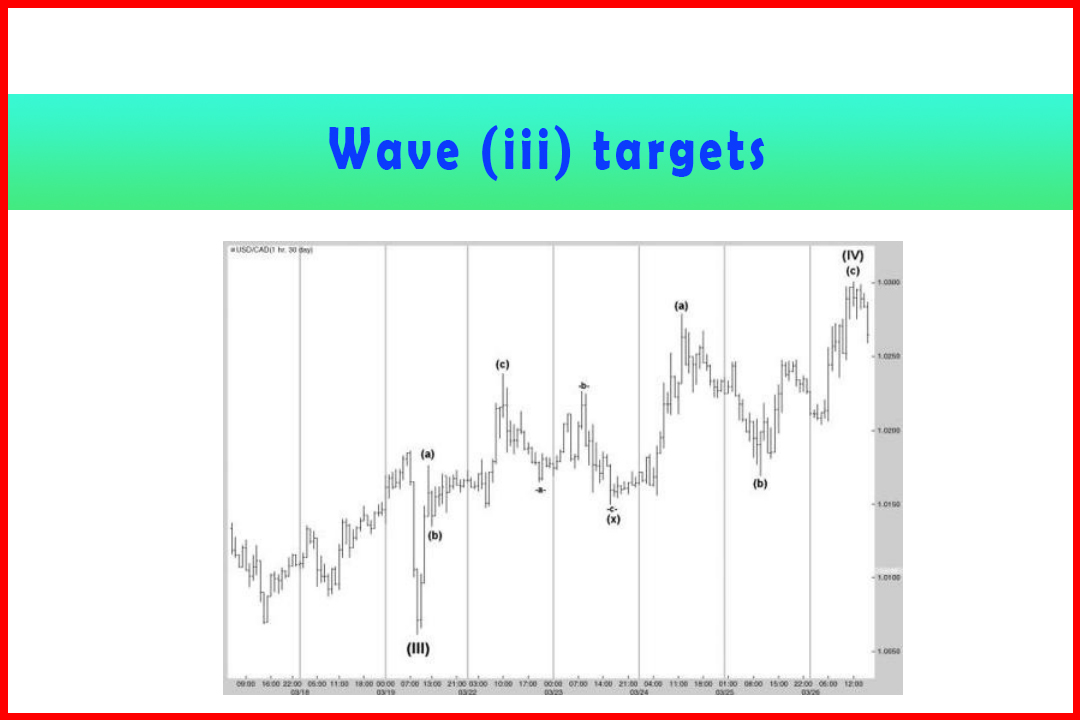

Wave

-i-rallied in three waves to the high of the prior Wave b of Wave (b). The

correction was quite deep, to two points below the 76.4% retracement. From here

a target in Wave -iii-can be estimated:

138.2%

= 1.4927

176.4%

= 1.4956

185.4%

= 1.4962

Wave

-a-rallied and reached 1.4922 with Wave -b-being also very deep to the 76.4%

retracement. It is possible that some doubts could arise over the depth of

retracements as there doesn't appear to be much evidence of

alternation. However, a target for Wave -c-can be generated and matched with

targets for Wave -iii-.

85.4%

= 1.4931

100.0%

= 1.4949

114.6%

= 1.4959

With

Wave -a-having completed at 1.4922 the 85.4% projection can be eliminated. That

leaves a target area of around 1.4956-59 and possibly 1.4962. In fact, Wave

-iii-ended at 1.4961.

Now,

with Wave -iii-having ended at 1.4961 it has already exceeded the 161.8%

projection in Wave (c) at 1.4954. Therefore deep projections should be

considered. At the same time, a retracement in Wave -iv-and then extension in

Wave -v-should also be considered.

In

Wave (c):

185.4%

= 1.4975

223.6%

= 1.5009

238.2%

= 1.5022

261.8%

= 1.5043

With

the depth of retracement in all corrections until this point it would seem

probable that a shallower correction would be most likely. In the event even

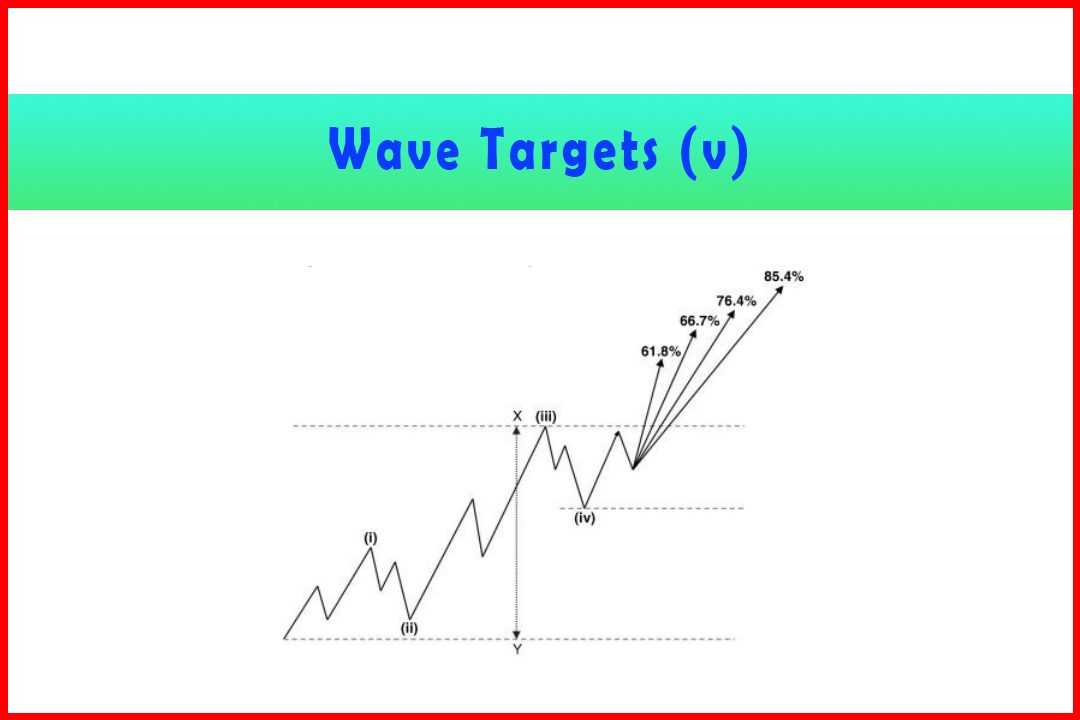

Wave -iv-was a full 50% to 1.4891, and this provided projections of:

61.8%

= 1.4984

66.7%

= 1.4992

76.4%

= 1.5006

85.4%

= 1.5020

100.0%

= 1.5042

There

are several matching projections here; the 223.6% Wave (c) with 76.4% Wave -v-,

the 238.2% Wave (c) with the 85.4% Wave -v-, and the 261.8% Wave (c) with the

wave equality target in Wave -v-.

Identifying

just where this final wave will end requires supporting analysis, a projection

in Wave c of Wave -v-, and the use of momentum.

In

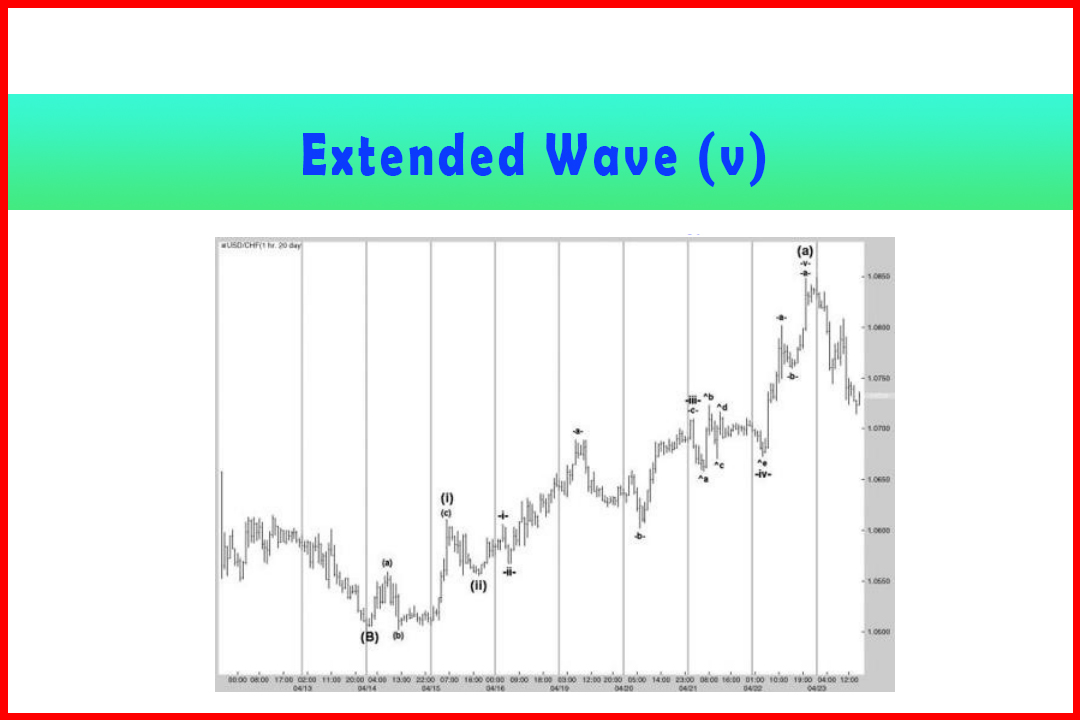

Figure 5.4 I have added my own RSI, a more sensitive version that tends to

swing more frequently between high and low extremes and identify divergences

more effectively. The high finally came at 1.5017.

Figure 5.4

Identifying the Completion of Wave -v-and Wave (c) Using Momentum

From

this point, focus can be made on identifying the Wave (ii) and resumption of

the uptrend in Wave (a), Wave (b), and Wave (c) of Wave (iii).

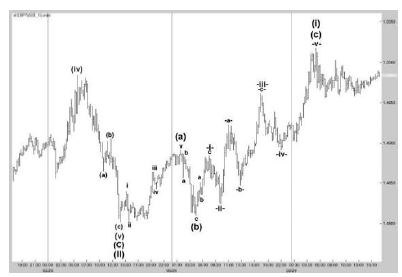

Figure

5.5 displays the development of Wave (a) and most of Wave (c) of Wave (iii). I

shall not go into as much detail for these as the intention is more to provide

examples of the different ways a Wave (i) can develop. Here, Wave (ii) was

exceptionally brief and therefore highlights the risk of a long and deep Wave

(iv) (which eventually did happen). In Wave (a) the Wave i stalled a little

short of the Wave (i) high and saw a deep Wave ii, while in Wave (c) there was

a similar strong extension in Wave c to complete Wave i and a shallow Wave ii

as was seen in Wave (i) and Wave (ii).

Figure 5.5

Extension in Wave (a), Wave (b), and Wave (c) of Wave (iii) Higher in GBPUSD

Harmonic Elliott Wave : Chapter 5: Modified Wave Structure in Forecasting : Tag: Elliott Wave, Forex, Fibonacci : Best trading Analysis, Best Forecasting Analysis - Wave (i) Targets

Elliott Wave | Forex | Fibonacci |