Using Cycles to Identify Larger Directional Forces

Harmonic Elliott Wave, Expanded Flat, Wave Structures, Bearish structure

Course: [ Harmonic Elliott Wave : Chapter 5: Modified Wave Structure in Forecasting ]

Elliott Wave | Forex | Fibonacci |

Harmonic Elliott Wave is an amazing tool that provides structure, expectation, and a great deal of accuracy that can be even pin point in the shorter time frames.

Using Cycles to Identify Larger Directional Forces

Harmonic

Elliott Wave is an amazing tool that provides structure, expectation, and a

great deal of accuracy that can be even pin point in the shorter time frames.

However, as with any technique it is not foolproof as patterns and structures

can change as markets evolve.

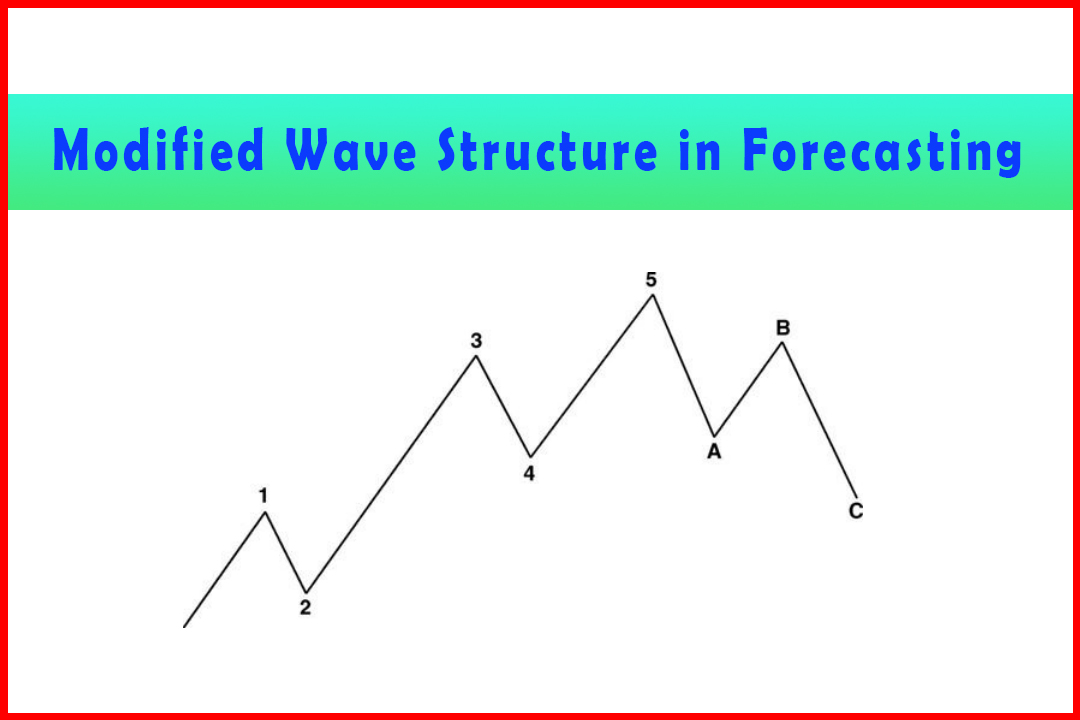

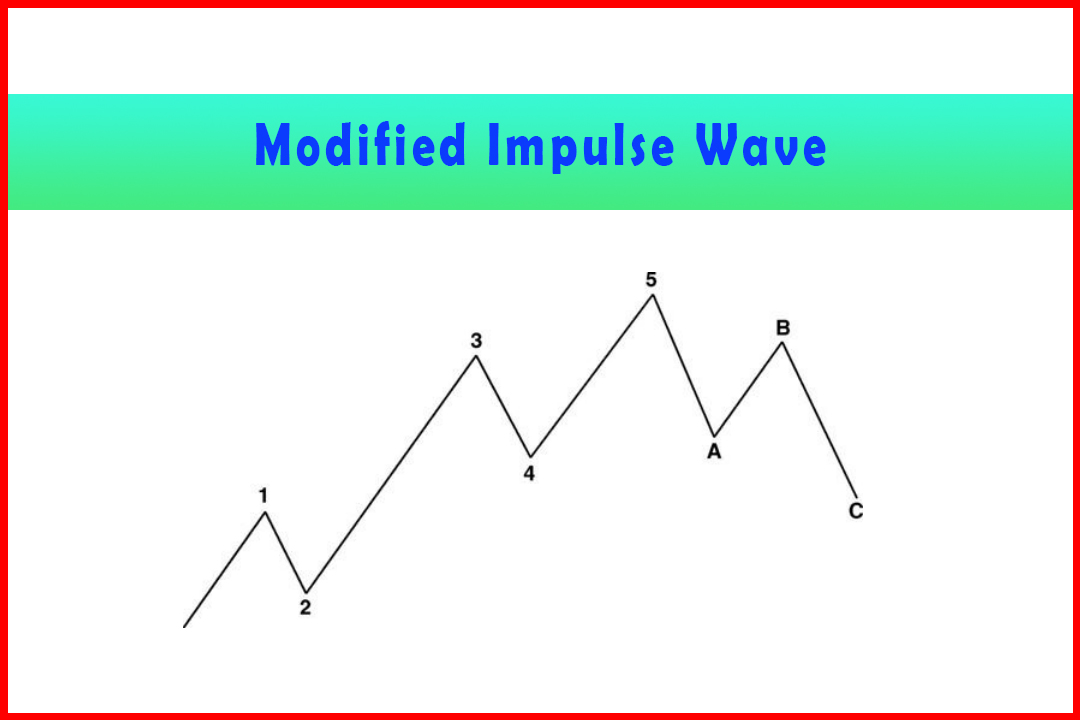

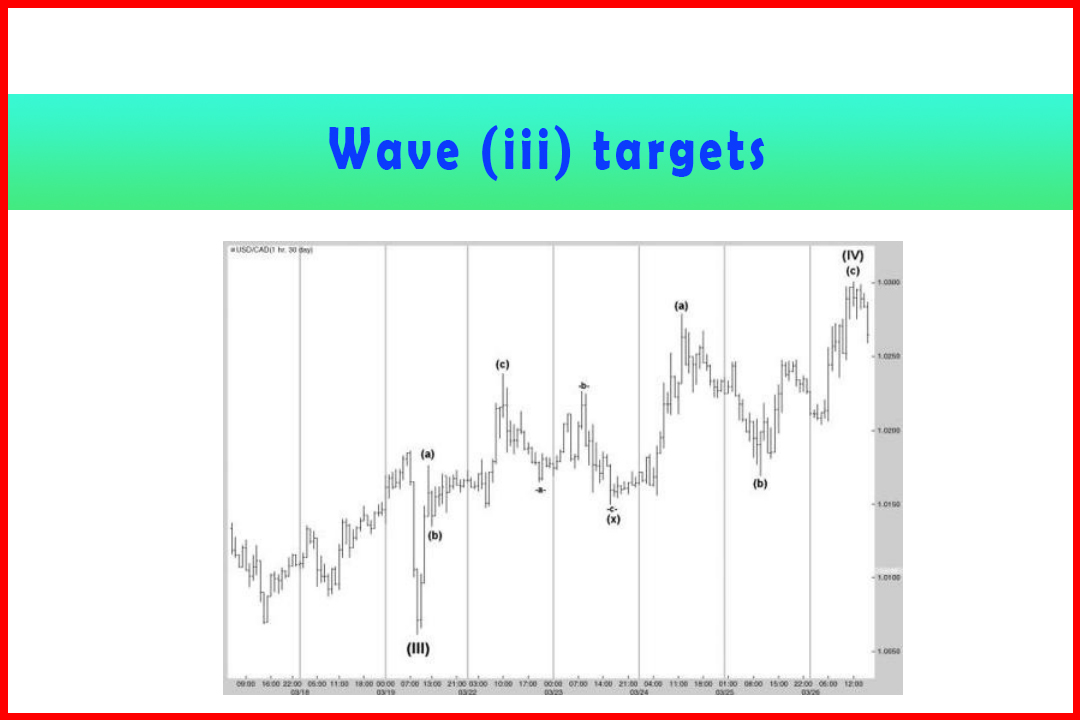

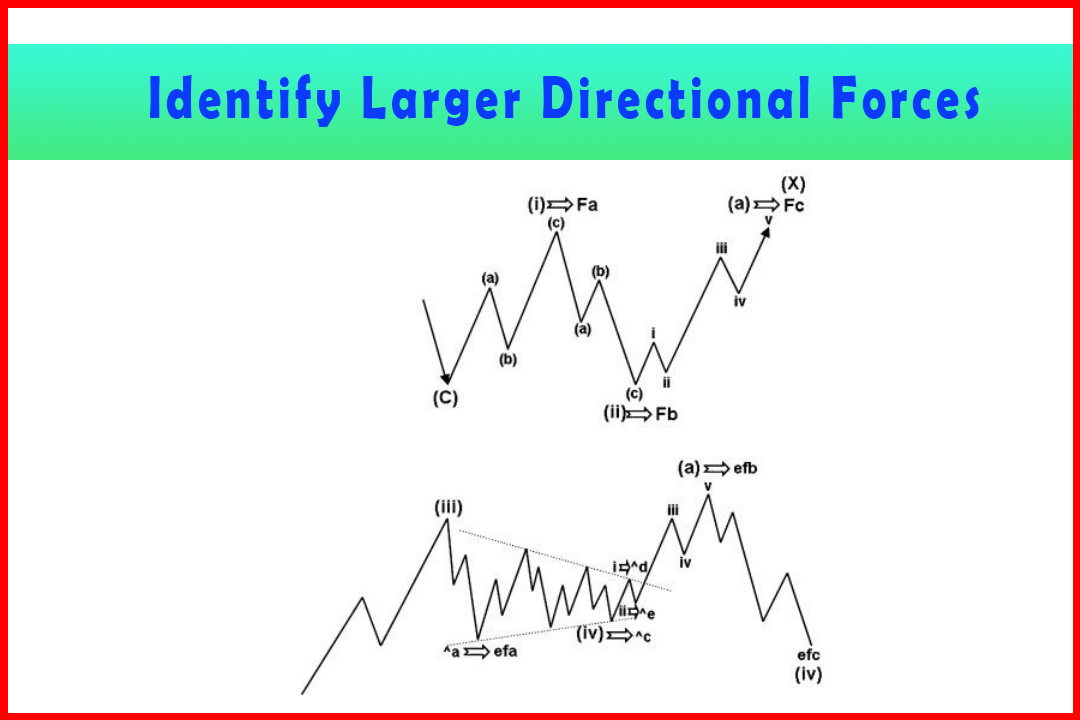

For

example, Figure 5.18 displays two examples of how assumed wave structures can

change and yet retain the same internal wave development. The top structure

shows an assumed Wave (i), almost 100% retracement in Wave (ii), followed by a

Wave (a) to just above the Wave (i) high that is actually the same wave count

as a Flat correction. The bottom example shows a rally in a Wave (iii) followed

by what looks to be a break out from a Triangle Wave (iv) that could extend

above Wave (iii) and then stall to reverse in an Expanded Flat. This would

imply the rally in what had been assumed to be Wave Ab was actually an abc move

and then the Triangle extends so that what had been Wave i was Wave Ad followed

by Wave Ae where a Wave ii is labeled. This in turn would be counted as Wave

(x) followed by a second abc move (instead of the assumed Wave iii, iv, and v)

to complete a Double Zigzag in Wave efb.

Figure 5.18 Two

Examples of how Assumed Wave Structures can Change

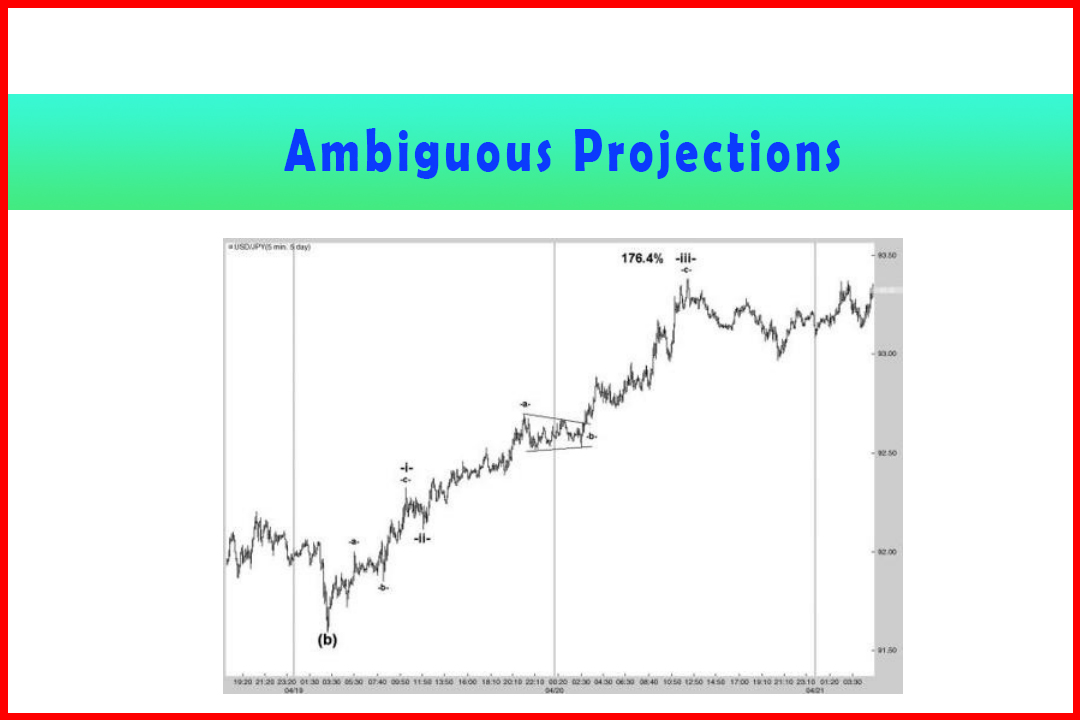

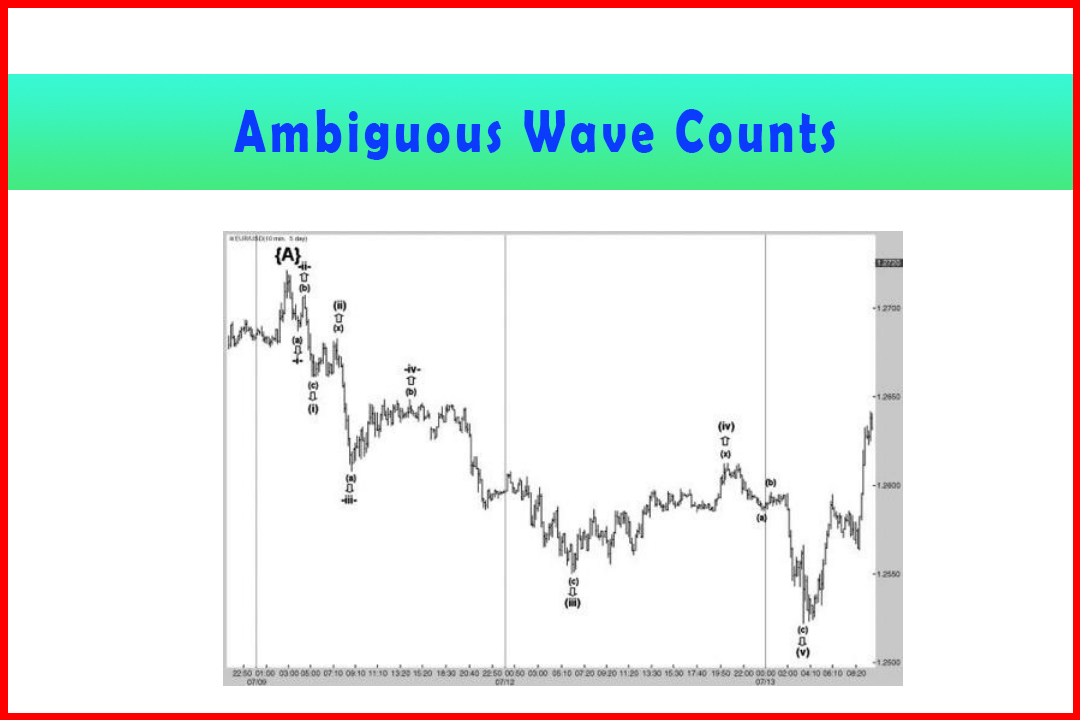

When

these types of situations occur in the shorter time frames such as five

minutes, it can be frustrating; in the hourly charts recipients of the analysis

may shrug their shoulders but when this occurs in the daily or weekly charts

they will wonder how the analysis was so wrong. Of course, full attention

should be given to momentum, but the larger picture application of cyclic tools

is one option to consider.

Over

the 21 years I have been a technical analyst I have met several analysts who

employ cycles. One Japanese trader showed me his Mercury cycles, which forecast

the timing and approximate pattern of how USDJPY would move during the following

three to four months after the 79.70 historic low in April 1995. I have a

subscriber who uses lunar cycles with astonishing accuracy to identify turning

dates. Others use astrology, though most seem to be applying Fibonacci-

calculated turning points.

In

forex, I have found the use of simple fixed cycles provides quite solid

indications on weekly and monthly charts, though daily cycles tend to be a

little less reliable. I do like the cycles to generally correlate across the

major currencies, with only relatively minor variances in the timing of major

reversals.

The

following three charts provide the cycles I have been following for several

years and which all appear to suggest a multi-decade dollar low around the

first half of 2012 approximately. I have not included the Euro since it is such

a new currency pair, and even synthetically generated history is just not long

enough.

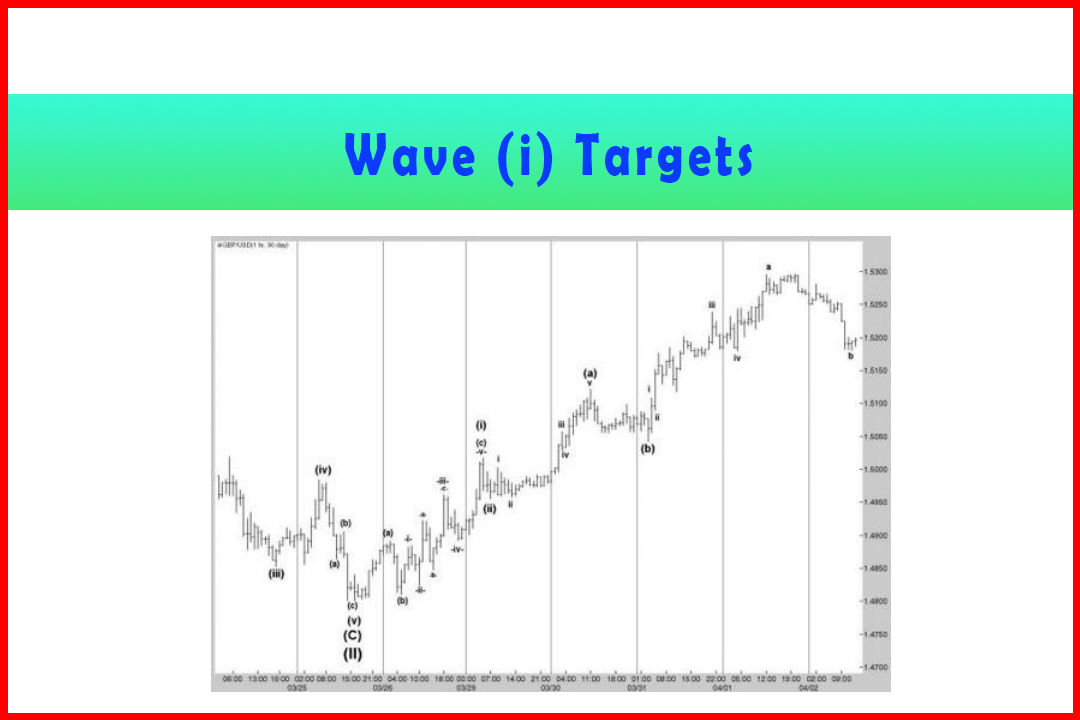

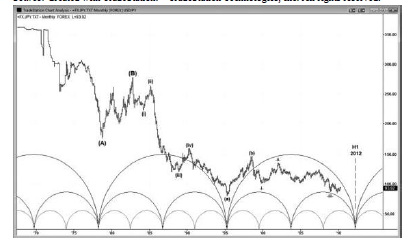

Figure

5.19 displays the monthly chart of USDJPY with cycles applied. Note that the

correction from the late 1970s lasted only around one-quarter of the period of

the largest cycle. The same occurred after the 1995 low. This represents quite

significant right translation (that the decline lasts much longer than the

earlier recovery), indicating a bearish market and most probably a new historic

price low. The approximate timing is in the first half of 2012, and this has

caused me to look more for a bearish structure. I suspect the 147.66 high in

August 1988 was a Wave (b) retracement high of a Wave (v) lower. Common targets

for the projection in Wave (v) and in Wave (c) are around 60.00-64.00. This

also matches a target generated from the descending Triangle starting from the

Wave -i-low.

Figure 5.19 Cycles

in the Monthly Chart of USDJPY

Figure

5.20 displays the monthly chart of USDCHF with cycles applied. In this chart

too the strong right translation in the cycles is evident in the corrections

from the Wave (A) low and Wave efb low being less than half of the largest

cycle. This major cycle is also due to find a low around the end of the second

quarter of 2012, to match the same approximate time target of USDJPY. I have

labeled the 1.8300 high in October 2000 as the end of a long Expanded Flat

correction in Wave (iv), and thus the current decline would logically be Wave

(v). Common targets for the Wave (v) and Wave (c) of Wave (v) appear to around

the 0.5000 area.

Figure 5.20 Cycles

in the Monthly Chart of USDCHF

Finally,

Figure 5.21 displays the monthly chart of GBPUSD with cycles attached. Since

GBPUSD is quoted as dollars per pound, the chart is necessarily “reversed”

compared to the other two cycle charts. The wave count is less certain here,

but due to the cyclic implications I feel we may be seeing a large multi-decade

Flat Wave (x) or even an Expanded Flat Wave (x).

Figure 5.21 Cycles

in the Monthly Chart of GBPUSD

The

sharp decline from the 2.1160 high in November 2007 appeared to develop in five

waves and thus suggest this may have been a Wave (a). Therefore we are in the

middle of a Wave (b) correction. Where the current bullish cycle will finally

stall is not yet clear, but from a timing perspective the earliest would appear

to be soon after the smallest cycle begins to turn lower around October 2011

and the latest by the time the middle cycle begins to turn down around July

2013. This does, of course, tend to match the expectations of a major US dollar

low somewhere around the first half of 2012. Note the larger cycle low is not

due until around the middle of 2017.

The

application of fixed time cycles is certainly an approximate guide only, but

can provide the general outlook which can often differentiate between two

conflicting wave counts and, in conjunction with observance of momentum, warn

of a breakdown of a possible wave count being followed in favor of a larger

complex correction. They also help to retain a certain perspective of whether a

general move higher or lower should be anticipated. Additional complementary

tools are always beneficial for comprehensive analysis.

Harmonic Elliott Wave : Chapter 5: Modified Wave Structure in Forecasting : Tag: Elliott Wave, Forex, Fibonacci : Harmonic Elliott Wave, Expanded Flat, Wave Structures, Bearish structure - Using Cycles to Identify Larger Directional Forces

Elliott Wave | Forex | Fibonacci |