Ambiguous Wave Counts

Harmonic Elliott Wave, Expanded Flat, Wave Structures, Bearish structure

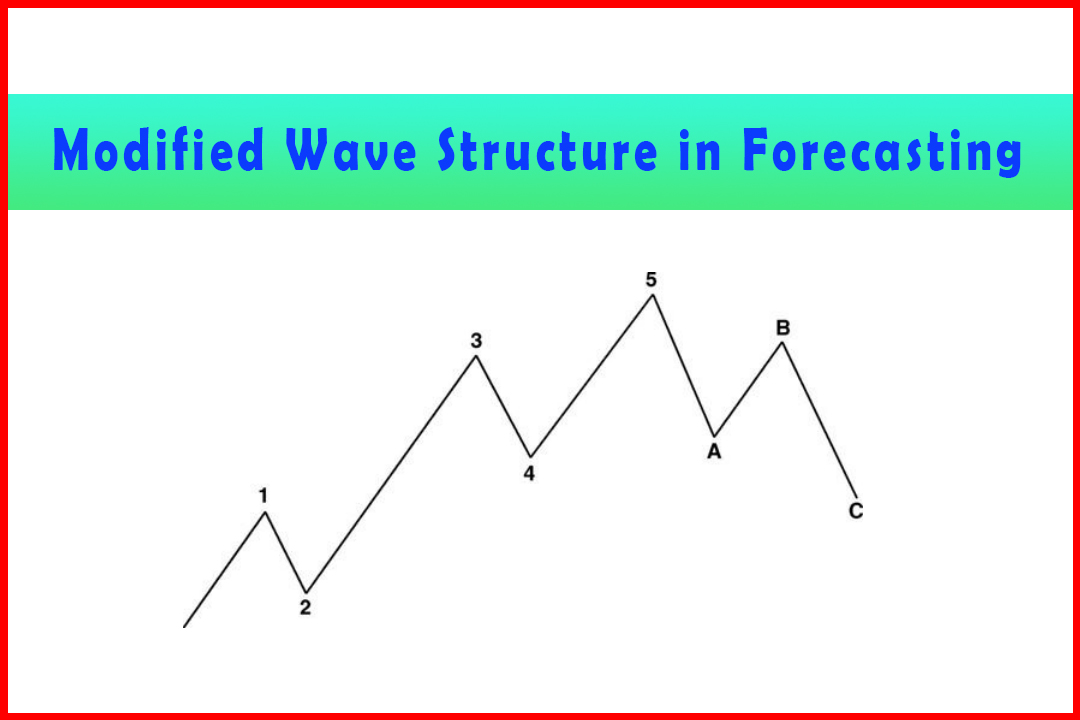

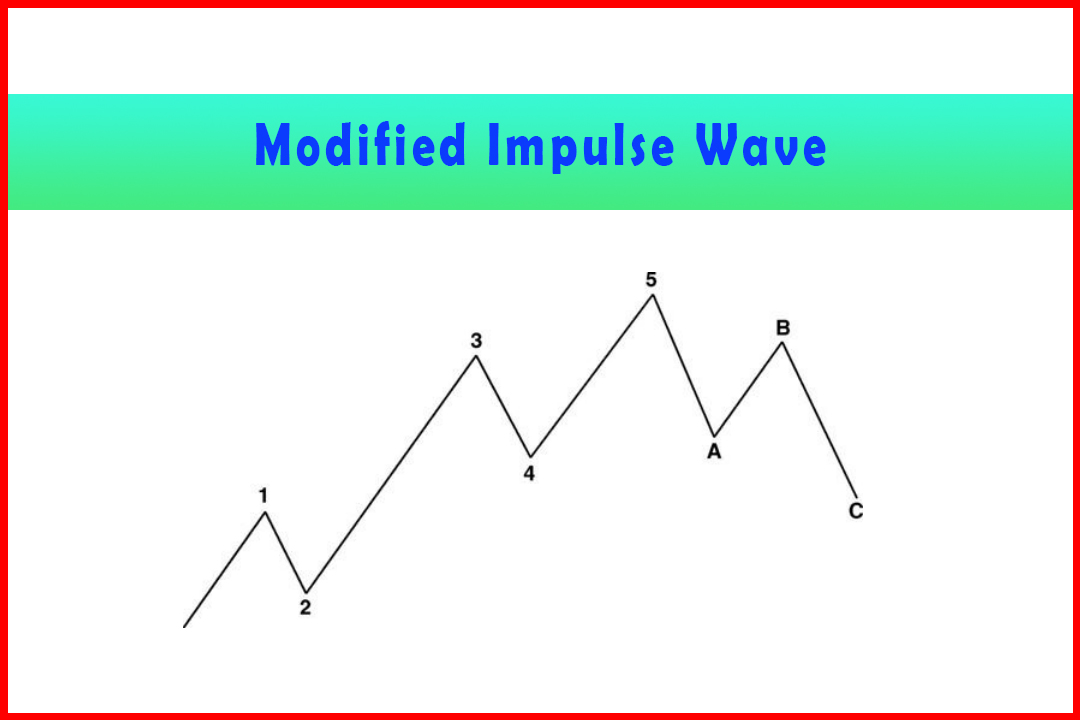

Course: [ Harmonic Elliott Wave : Chapter 5: Modified Wave Structure in Forecasting ]

Elliott Wave | Forex | Fibonacci |

It is easy to sit and write about forecasting, providing examples that hold perfect wave relationships that give the impression that all your problems are solved.

Ambiguous Wave Counts

It

is easy to sit and write about forecasting, providing examples that hold

perfect wave relationships that give the impression that all your problems are

solved. I have always taken the view that if a forecasting technique is easy

then everyone will learn the process with the idea that it will be a

self-fulfilling prophesy. Very clearly this is not the case, since if everyone

knows what the market is going to do there'll be the contrarian with

large funds to push around to hammer stop losses. As much as Harmonic Elliott

Wave is a fabulous tool, there are still numerous barriers to overcome,

confusing wave development that seems to lack any relationships, and

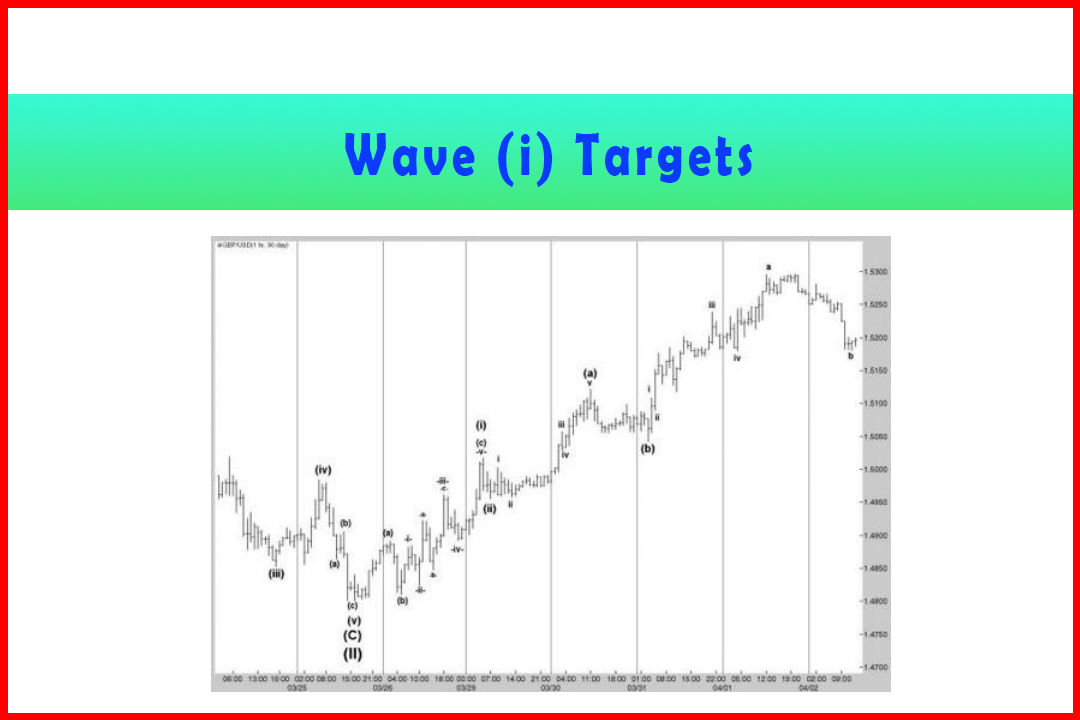

difficulties in identifying Wave (i) and Wave (ii) in particularly erratic

beginnings to a new wave.

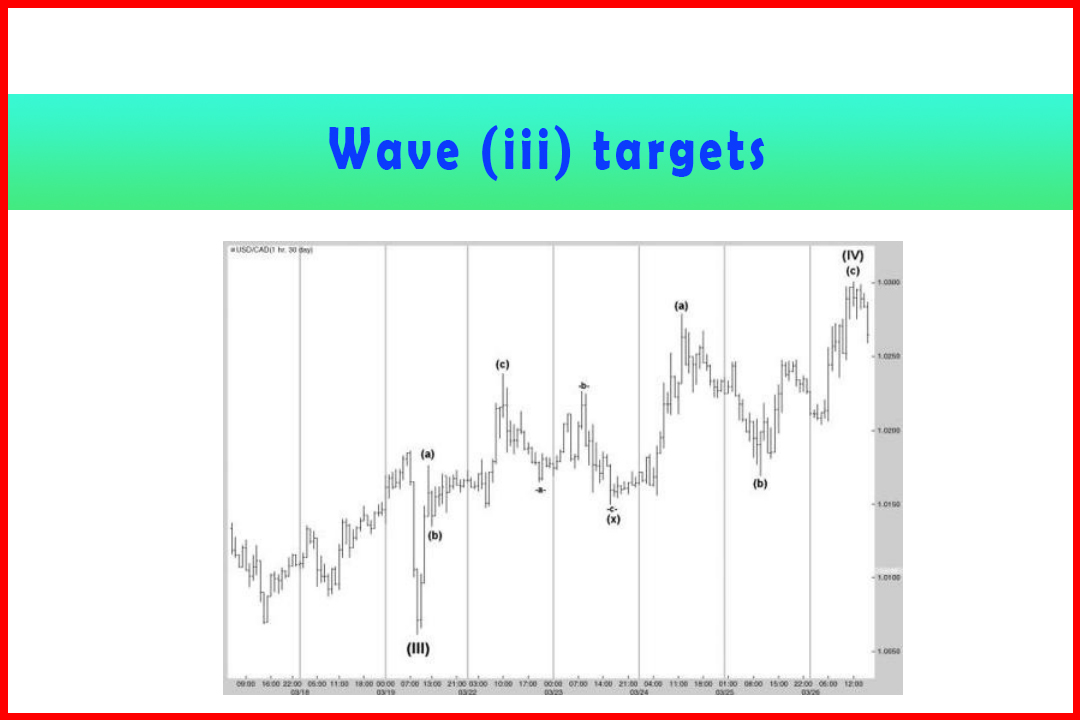

Not

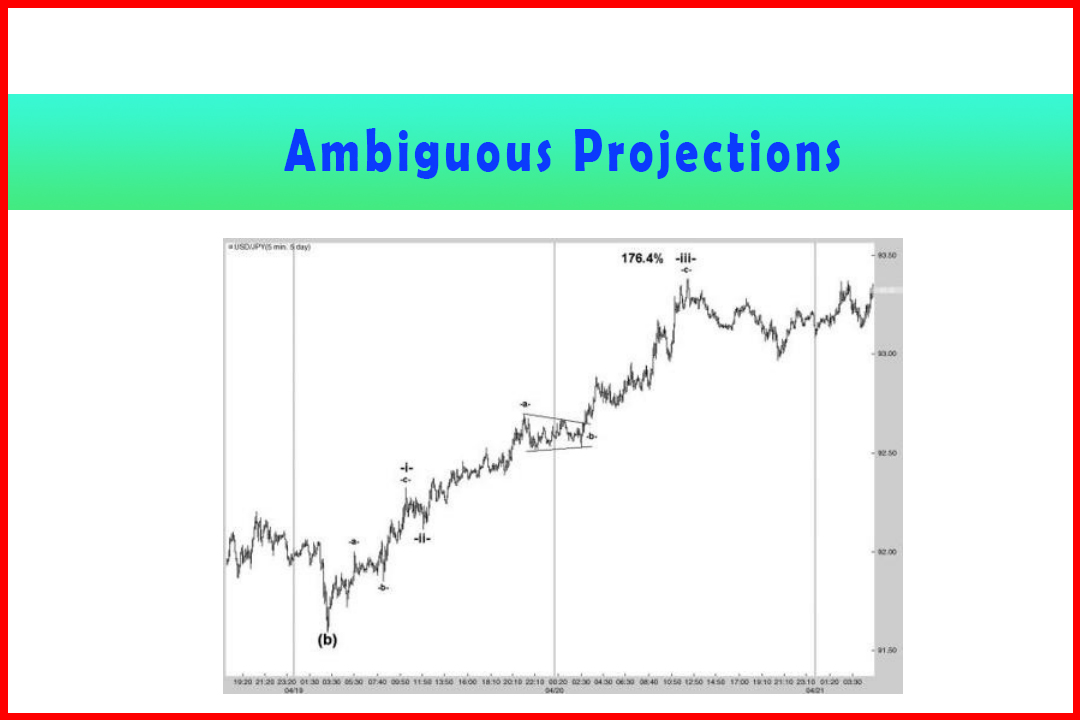

all wave counts are obvious, and on occasion, because of the natural order of

Fibonacci ratios in particular, the wave relationships become ambiguous. Figure

5.22 is an example of a recent wave development in EURUSD.

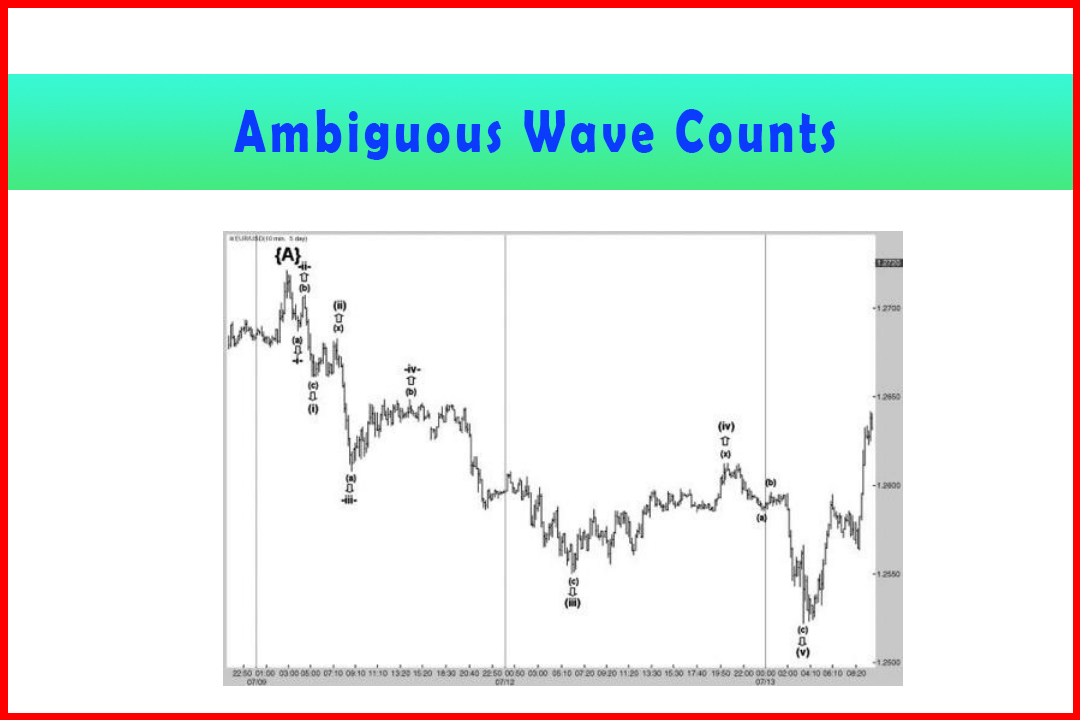

Figure 5.22 How Ratios can have Multiple Potential Relationships

Figure

5.22 is the five-minute chart of EURUSD. This correction occurred within a

rally from the June 2010 low at 1.1877, and is actually still in development at

the time of writing. I judged this to be a correction, which is yet to be

confirmed, but the rally has developed quite well within the general

expectation of this being a large Wave (IV) correction.

The

1.2722 high labeled Wave {A} was anticipated as being the Wave {A} of Wave

{III} of Wave (C) of the entire Wave (IV). The prior Wave {II} had been very

brief and shallow, exceptionally so. This raised the risk that we may see a

deep Wave {B}.

As

this Wave {B} commenced there was no way of knowing whether this would be a

simple ABC decline, a Double Zigzag, Triple Three, or possibly even a more

complex correction. Thus the initial stages of the decline were more about

judging what structure may develop. This was complicated by the fact that there

were multiple retracement ratios with a minimum of 50%:

50.0%

= 1.2518

58.6%

= 1.2482

61.8%

= 1.2469

66.7%

= 1.2449

The

first move lower from the 1.2722 peak certainly had more of a look of a

five-wave move and was labeled Wave (a). This was followed by a pullback in

Wave (b) and a decline logically in Wave (c) at 1.2661. This represented a

161.8% projection.

This

was followed by a shallow correction in Wave (x) and sharp decline to 1.2608,

which was then labeled as a second Wave (a). The appearance therefore was that

the correction was developing in a multiple ABC move. However, an interesting

development was that 1.2608 was just three points below the 261.8% projection

of Wave (a). Consideration should be given to the possibility that Wave (a)

should have been labeled Wave -i-and thus we had seen a 261.8% projection in

Wave -iii-. To verify this, the wave relationships between the decline from the

labeled Wave (x) high to the second Wave (a) should be a common extension ratio

of the decline from the labeled Wave (b) to the first Wave (c). In fact, this

turned out to be 161.8% also . . .

This

opens an ambiguous interpretation. Either the multiple ABC decline will work

through, or perhaps this was part of a five-wave decline in Wave (a) to be

followed by a retracement in Wave (b) and final decline in Wave (c) as a large

Zigzag. Given the potential for this to be a deep Wave {B}, it certainly had

reasonable grounds for consideration.

The

next measurement to take to try to clarify which structure was developing was

to look for between a 41.4% and 50% retracement in what could be Wave (b) or

Wave -iv-. The possible Wave -ii-had retraced around 61.8% and this tended to

imply a greater chance of a 41.4% retracement. It met that perfectly at 1.2649.

Let's

just recap what has occurred until this point.

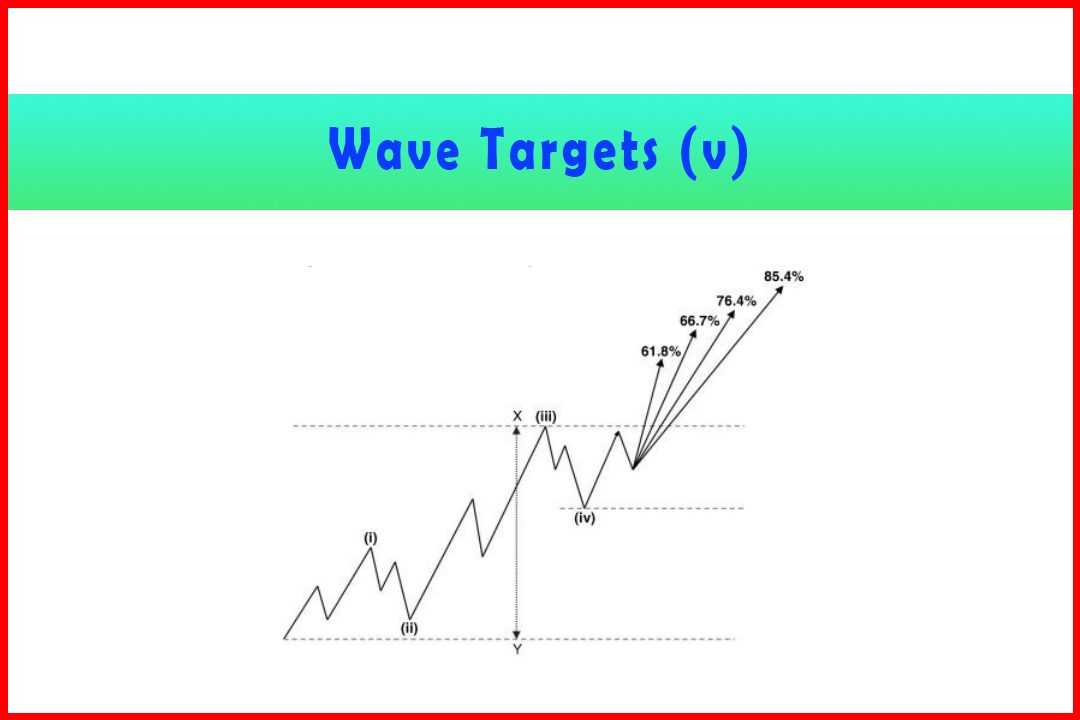

Figure

5.23 displays the initial decline with ratios displayed. Clearly there are two

possible interpretations but with differing expectations. If the 1.2649 high

was a Wave (b) then a five-wave decline in Wave (c) will be expected; if this

is a Wave -v-decline then we must expect a three-wave decline and with

projection ratios calculated from the distance from the 1.2722 high to the

1.2608 low extended from 1.2649. These would be:

61.8%

= 1.2579

66.7%

= 1.2573

76.4%

= 1.2562

85.6%

= 1.2552

Figure 5.23 Reviewing the Wave Relationships

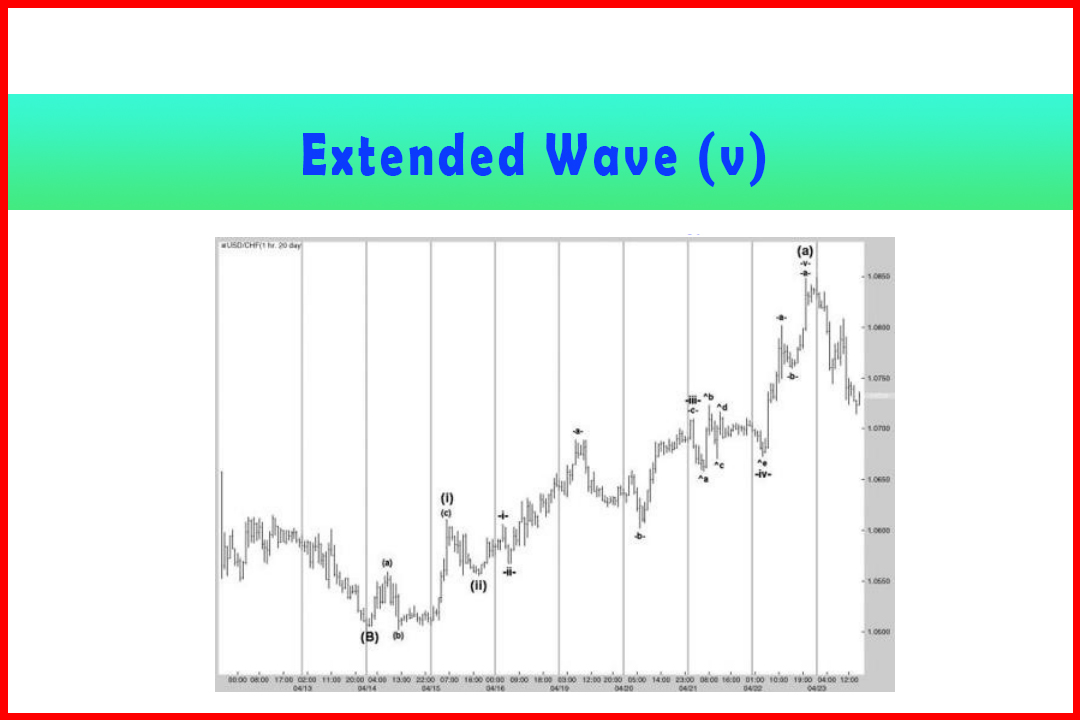

Therefore

there is a need to observe how the beginning of the decline develops to judge

from the structure whether it develops in three waves or five. At the end of

the decline price stalled at 1.2550, just two points below the 85.6%

projection.

Figure

5.24 displays the decline from 1.2649 appeared more to be like a five- wave

move which swayed the wave count in favor of a Triple Three, with this being

the second Wave (c) that had stalled 32 points above the 50% retracement in

Wave {B} at 1.2518. This would allow a further ABC decline that could stretch

to 1.2518 or even perhaps one of the deeper Wave {B} retracement levels.

Figure 5.24

Reviewing the Wave Relationships

However,

there was a further complication. Now that the decline has come in two sets of

ABC moves this will mean the 1.2661 low may well be a Wave (i), which in turn

could imply a larger ABC decline with this being Wave A. The first Wave (c) was

161.8% of Wave (a). The second Wave (c) was between 123.6% and 138.2% and also

represented a 223.6% extension of the Wave (i).

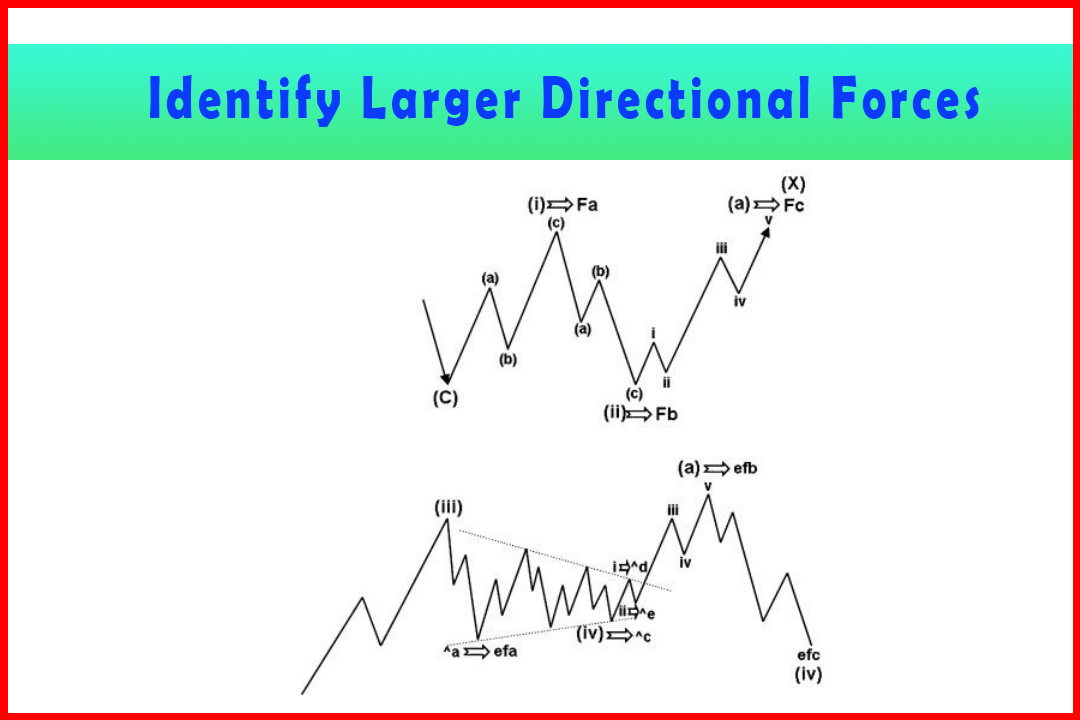

Once

again, verification of the possibility of a Wave (iv) is required. Wave (ii)

had retraced close to 38.2% and therefore the Wave (iv) should be around 50%.

In fact it stalled at 1.2613, which was just short of 50% but could still

provide a projection in Wave (v), the common projections being:

61.8%

= 1.2507

66.7%

= 1.2498

76.4%

= 1.2482

Refer

back to Figure 5.22. The final low was at 1.2522, which was four points above

the 50% retracement level in Wave {B} and represented between a 50% and 58.6%

projection in Wave (v). Wave (c) was a 276.4% extension of Wave (a).

At

this point I forecast a recovery, and probably quite a deep one. However, there

was still an ambiguity. This was after all a decline of three sets of ABC

structures, and at the 50% retracement in Wave {B} could represent a completed

correction. The alternative was that given the reasonably good wave

relationships this could also be Wave A of a larger ABC decline that would see

a deep Wave B and then Wave C decline to a level closer to one of the deep Wave

{B} retracement levels.

In

fact, price maintained the recovery to new highs to confirm the 1.2522 low as

Wave {B}, and thus a rally in Wave {C} of Wave {III} was underway. There is a

further validation to be made here. This was assumed to be a Wave {iii} and therefore

there would be projections in Wave {III}, and these will need to match with a

valid projection in Wave {C}.

Harmonic Elliott Wave : Chapter 5: Modified Wave Structure in Forecasting : Tag: Elliott Wave, Forex, Fibonacci : Harmonic Elliott Wave, Expanded Flat, Wave Structures, Bearish structure - Ambiguous Wave Counts

Elliott Wave | Forex | Fibonacci |