Wave Targets (v)

Elliott wave targets, Fifth wave targets, Best Trading Strategy, Best Pattern Trading

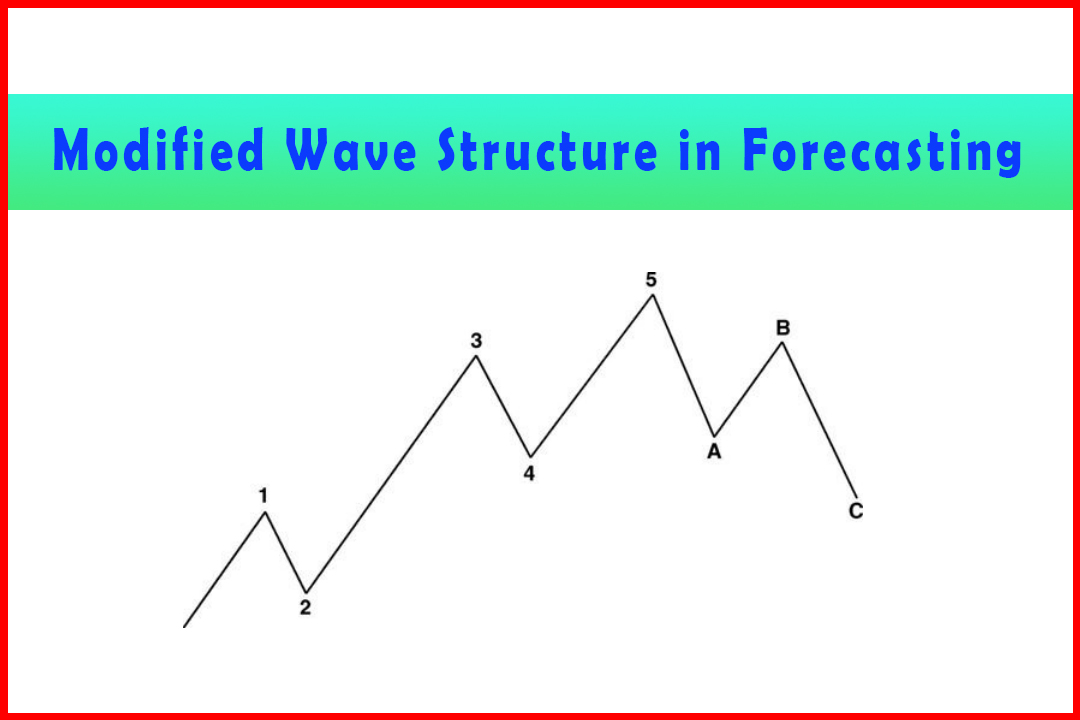

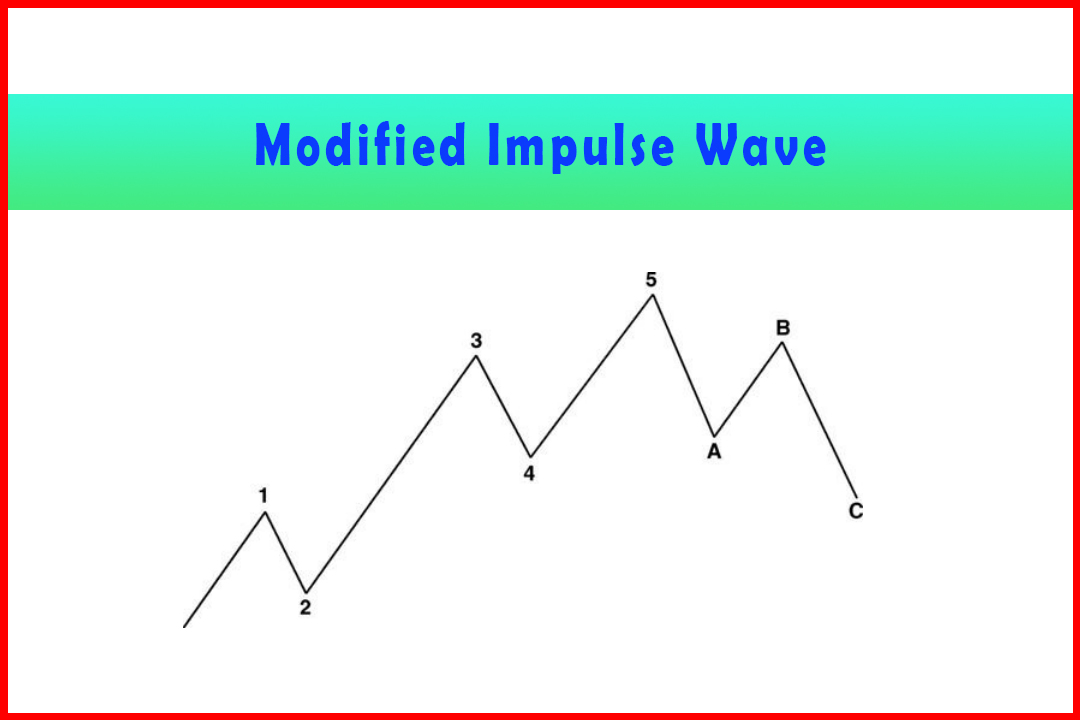

Course: [ Harmonic Elliott Wave : Chapter 5: Modified Wave Structure in Forecasting ]

Elliott Wave | Forex | Fibonacci |

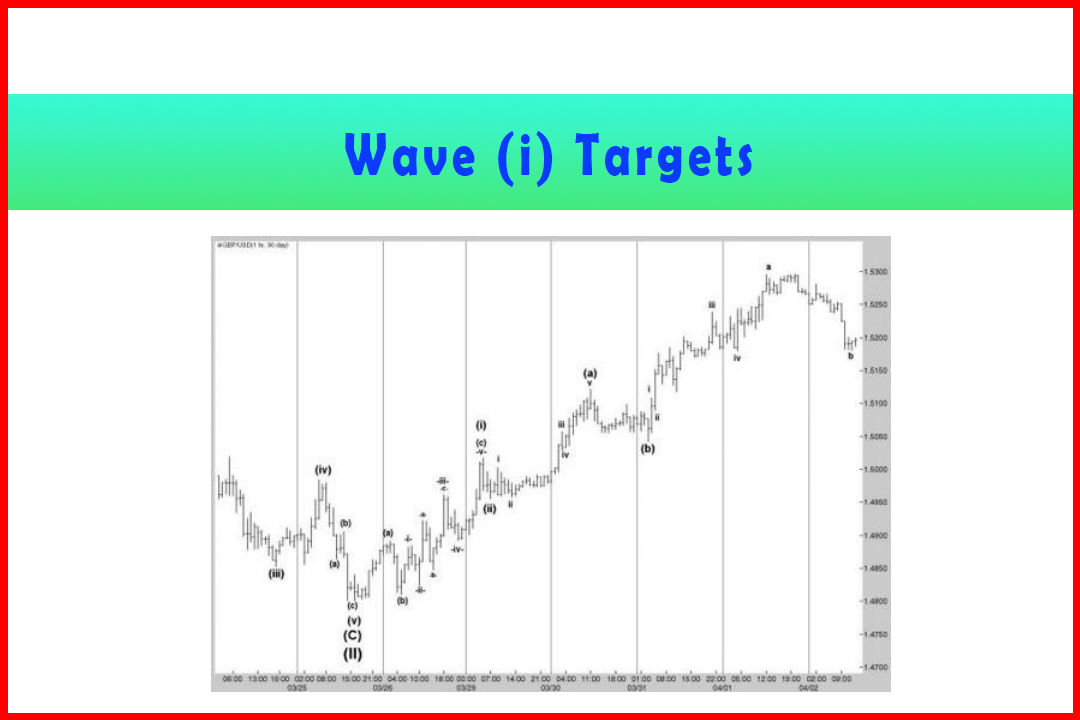

Before considering the possible targets that can be considered for a Wave (v), we have to overcome the problem of knowing which projection ratio to use for the extension of the prior wave development.

Wave (v) targets

Before

considering the possible targets that can be considered for a Wave (v), we have

to overcome the problem of knowing which projection ratio to use for the

extension of the prior wave development.

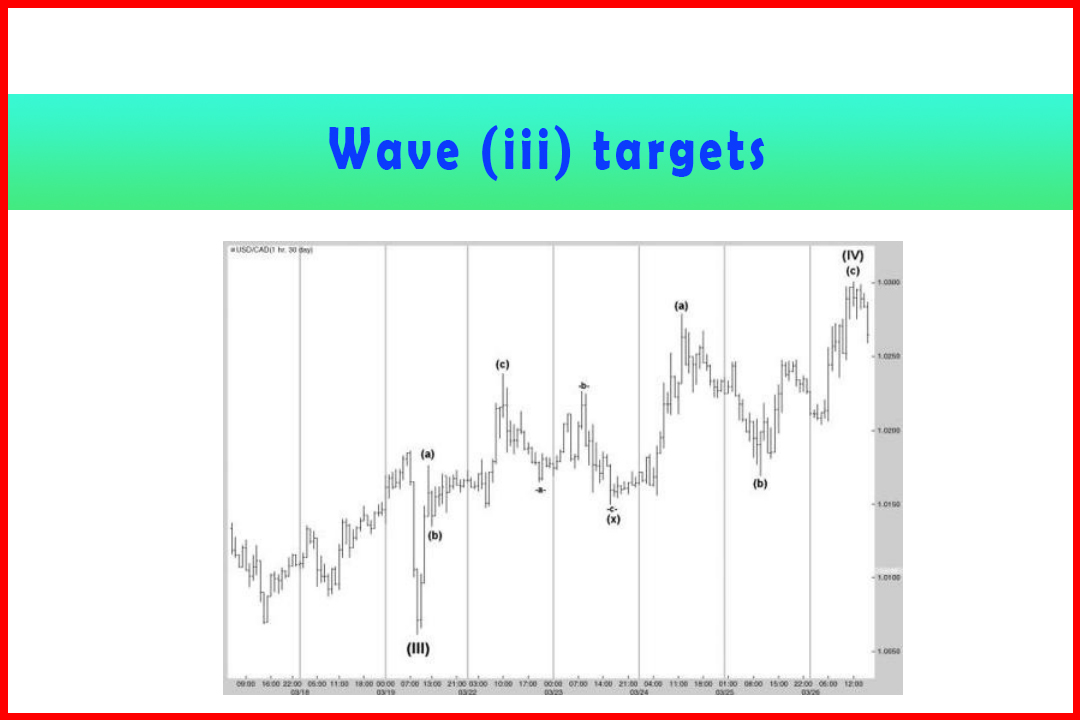

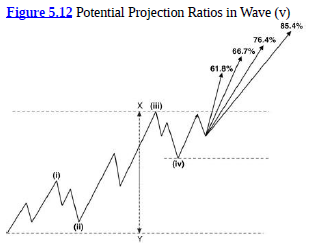

As already explained in Chapter 4, a Wave (v) most commonly extends by a ratio of the distance traveled from the start of Wave (i) to the end of Wave (iii) and from the completion of Wave (iv). In Figure 5.12 this would imply:

Wave (iv) + (X - Y) * ratio

In

my experience I have found 66.7% probably to be the most frequent extension.

However, there is no way of truly knowing in advance whether it will stall at

the shorter 61.8% or even the extended wave ratio 85.4%. Indeed, it is not

impossible for an extended Wave (v) to meet a wave equality target.

Perhaps

the simple answer is that since internally a Wave (v) is constructed of an

(a)(b)(c) move, we should look for a normal extension ratio of Wave (a). The

problem here is that Wave (c) can extend by possibly just 85.4% of Wave (a) or

as much as 261.8%. I have also found to my frustration at times that, for

example, a wave equality target in Wave (c) matches with a 61.8% projection in

Wave (v) while a 138.2% projection in Wave (c) matches with a 66.7% projection

in Wave (v), and possibly even a 161.8% projection in Wave (c) matches with a

76.4% projection in Wave (v).

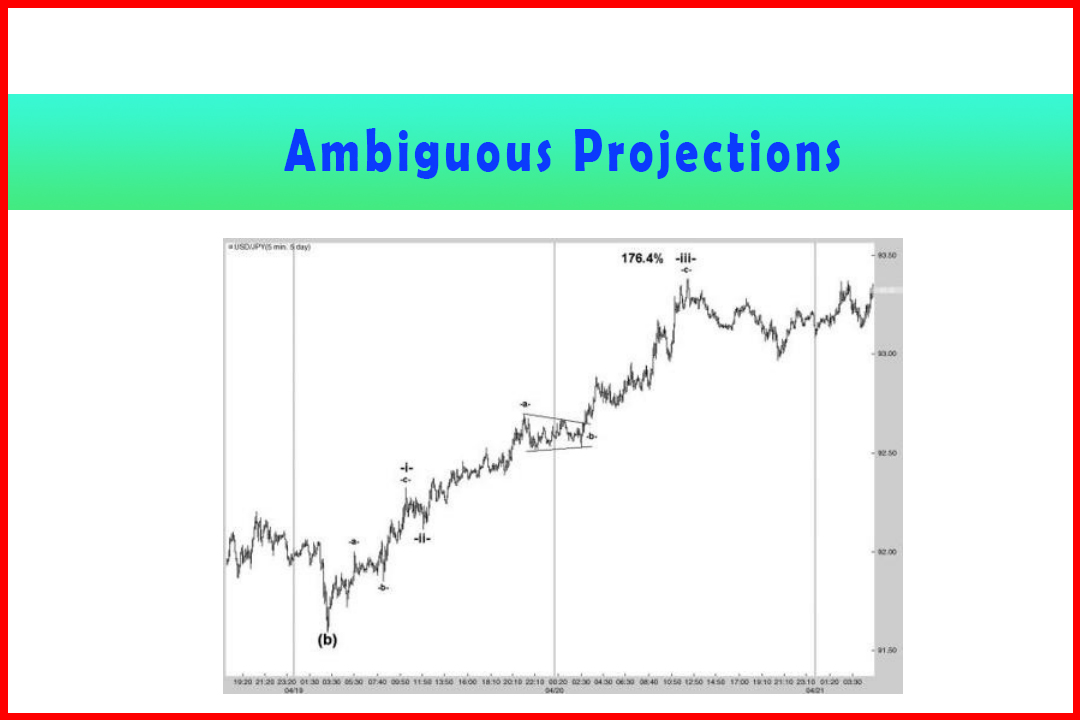

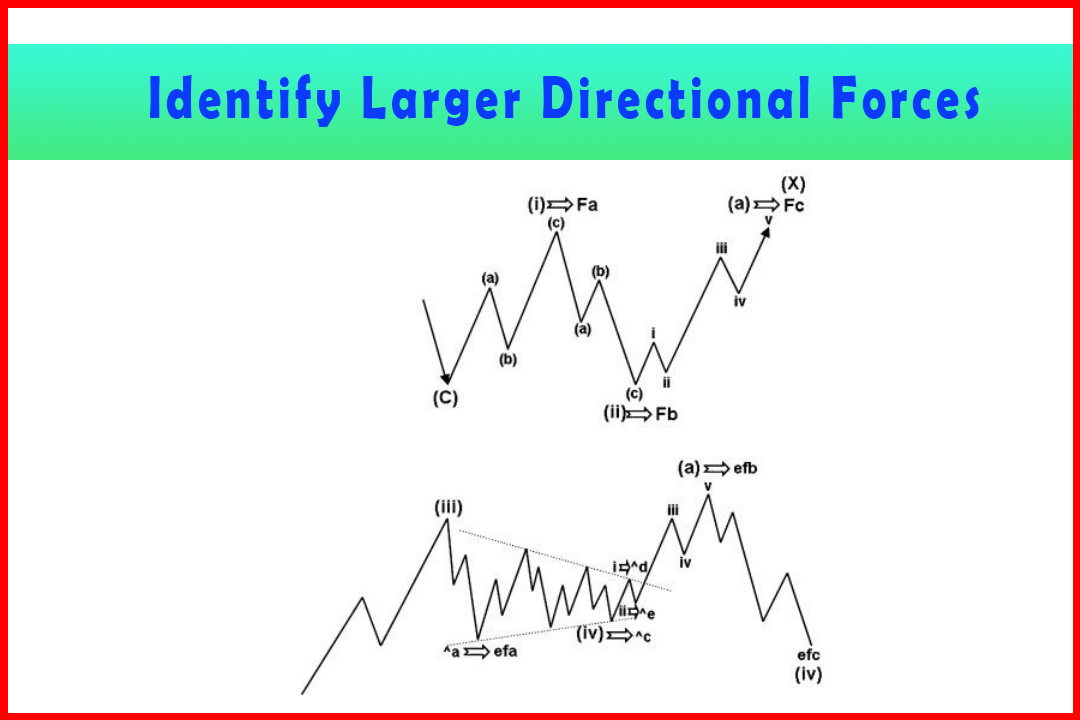

Therefore

we have to look at other possible methods of identifying the eventual wave (v)

completion. What we do know is that a Wave (v) will also always occur either at

the conclusion of a Wave (A) or a Wave (C) of a larger degree. Of the two,

identifying the completion of a Wave (A) is probably one of the most difficult

when considering forecasting. A Wave (v) of Wave (C) should have the same

targets as the projection of Wave (A).

Since

the first instance of a Wave (v) after a reversal comes in the first Wave (a),

the guidelines I provided earlier in this chapter concerning targets for Wave

(i) (and inherently the Wave (a) of Wave (i)) are relevant. The sort of areas

that were discussed were the Wave (b) of Wave (v), then the Wave (iv) extreme

if it represented a key swing level in the prior trend. It is also not too

unusual for a prior low in a downtrend (or high in an uptrend) to provide a

pivotal barrier on the reversal.

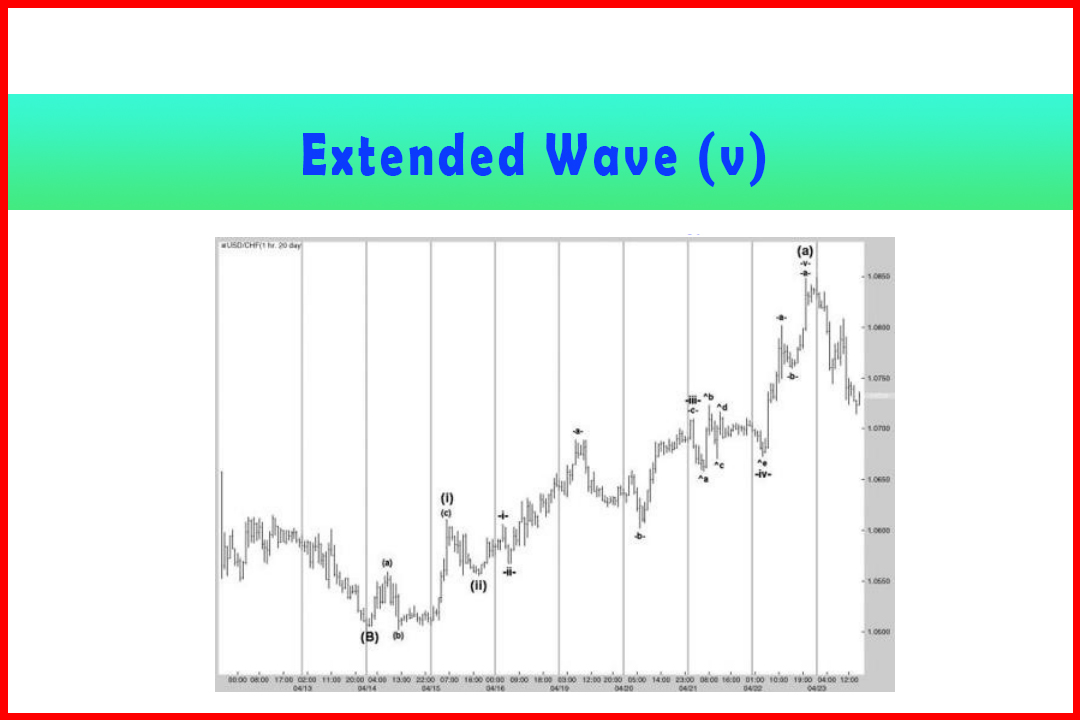

Other

areas to observe are periods of congestion which generally provoke a reaction

when retested, and in a non-aggressive Wave (iii) the Wave v of Wave (a) can

often stall around the extreme of the Wave (i). Another fairly common

occurrence I have noted on many occasions is that in an extended Wave (iii) in

which the Wave (a) of Wave (iii) stalls some distance past the extreme of Wave

(i), the stalling point can be a projection of Wave (i). For example, it may be

a wave equality target of Wave (i) or even a 138.2% projection of Wave (i). If

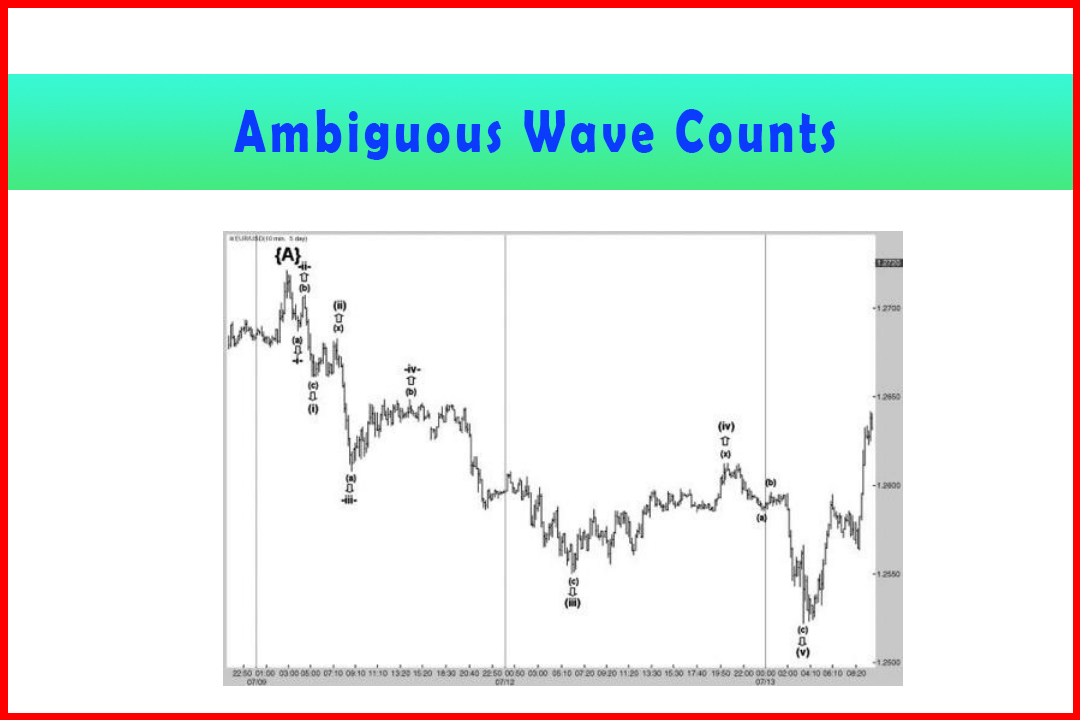

the structure of the Wave (a) is rather messy it can cause confusion as to

whether the end of Wave (a) is actually Wave (a) or the end of Wave (iii). It

is therefore important to be attentive to the structure of the move from the

Wave (ii). Even then, if there is a wave equality target in Wave V of Wave (a)

that ends at a 138.2% projection of Wave (i), it can be mistaken as being a

short Wave (iii).

Instead

of repeating several examples I would suggest that the reader should scan over

previous examples and note the various types of targets in Wave (v).

Harmonic Elliott Wave : Chapter 5: Modified Wave Structure in Forecasting : Tag: Elliott Wave, Forex, Fibonacci : Elliott wave targets, Fifth wave targets, Best Trading Strategy, Best Pattern Trading - Wave Targets (v)

Elliott Wave | Forex | Fibonacci |