Every Traders Must Know 13 Chart Pattern in Forex Trading

Head & Shoulders, Ascending Channel, Double Top, Descending Channel, Triangle, Expanding Triangle

Course: [ Top Trading Strategy ]

The above continuation patterns are the bull flag and the bear flag. These patterns are spotted in a bullish trend or a bearish trend respectively forming the corrective phase in a trending market.

Top 13 Important Patterns in Forex Trading

·

Head

& Shoulders

·

Inverse

Head & Shoulders

·

Double

Top

·

Double

Bottom

·

Ascending

Channel

·

Descending

Channel

·

Rising

Wedge

·

Falling

Wedge

·

Bull

Flag

·

Bear

Flag

·

Flat

continuation

·

Triangle

· Expanding Triangle

Reversal Pattern

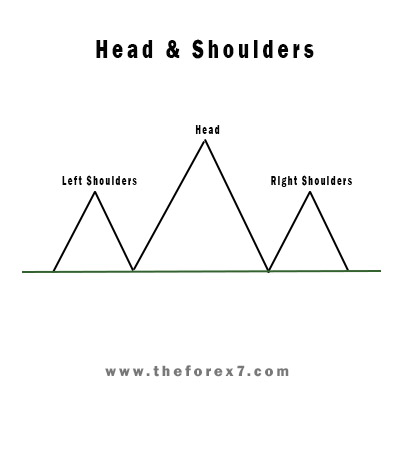

Head & Shoulders

The

head and shoulders pattern is very common amongst many different FX strategies.

However, within Forex7 this pattern is strictly used as another piece of

evidence to take a trade.

Price

forms the left shoulder, retraces to the "neckline", tests higher to

form the head of the pattern, and tags the neckline once more, before forming

the right shoulder of the pattern and breaking lower.

Price

has now "rejected" this area 3 times and increases the probability of

heading to the downside.

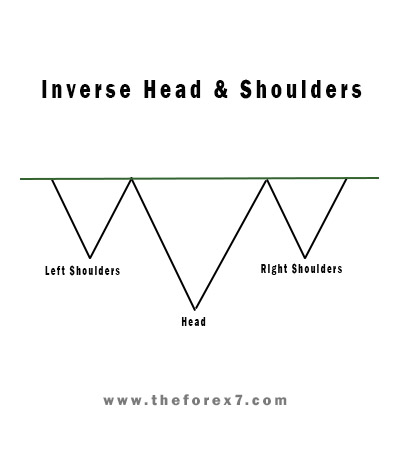

Inverse Head & Shoulders

The

same is true for the opposite which is called the inverse head and shoulders

pattern.

Three

rejections of a certain area or structure result in that added evidence to

look for buying opportunities within the position.

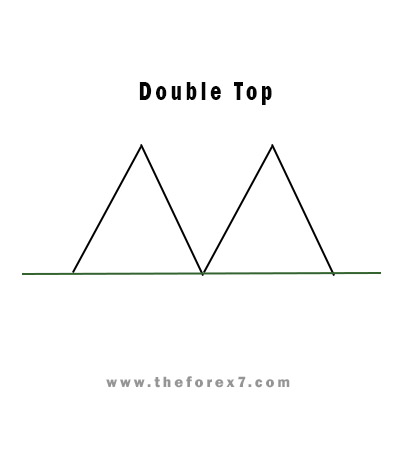

Double Top

The

same is true for the double top reversal formation. Price comes back up to tag

the same area for a second time-confirming the opportunity for a sell and bias

to the downside.

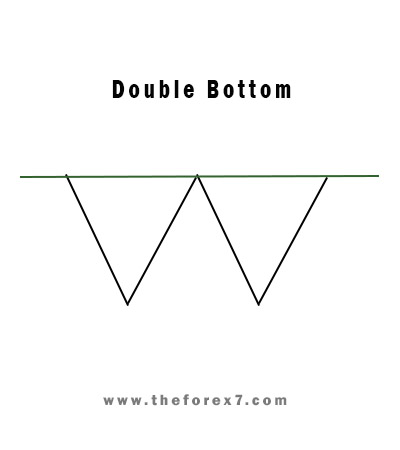

Both the double bottom and double top can also be for triple bottoms and triple tops-although they will not be listed as they are straightforward.

Double Bottom

The double bottom reversal pattern is price tagging the same "area" twice and confirming a certain structure or level. It signifies a buying opportunity and is commonly used within Forex7 to determine entries.

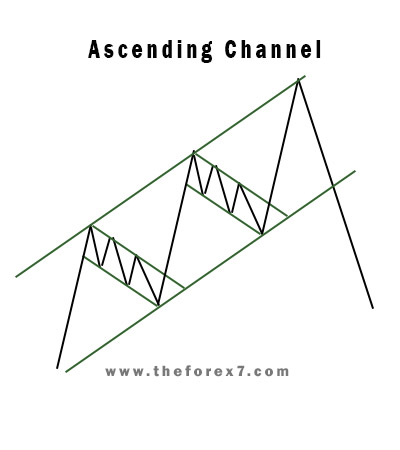

Ascending Channel

The

ascending channel is a reversal pattern that is extremely common. It allows us

to capitalize on very large risk to reward positions by combining it with our

entry criteria and management techniques.

As Covered in the first season of the Forex7 Quick Tips series, a third touch at the top of this pattern represents a high-value area for a sell.

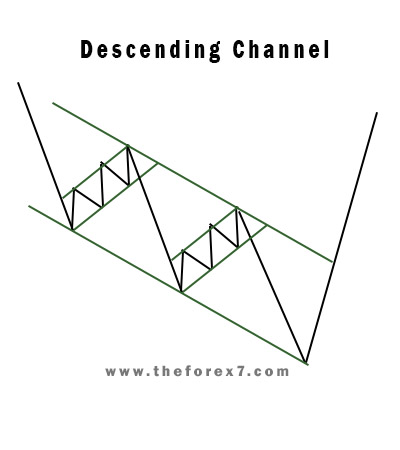

Descending Channel

The

descending channel allows us to capitalize in the same way with a buying

opportunity, Price moves to the downside in a clear channel before finally

reversing.

The more touches on this channel the more probable it is of playing out and playing out impulsively to the upside.

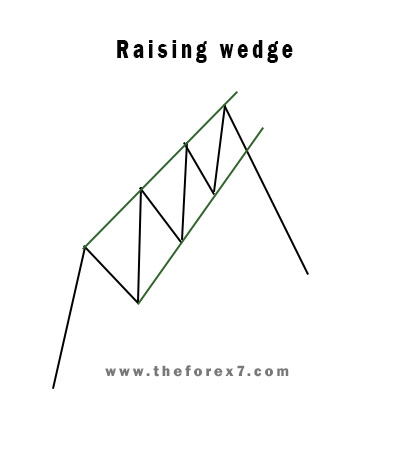

Rising Wedge

The rising

wedge reversal pattern is one of the most common, price action is approaching

the top of the structure and this pattern signals the opportunity for a sell.

The probability of this pattern playing out increases as more “touch points” become apparent throughout the course of the wedge.

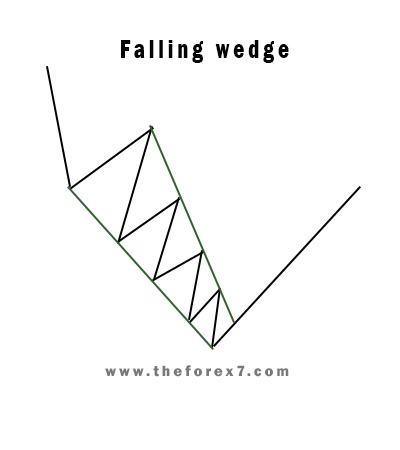

Falling Wedge

The

falling wedge is the same as the price is approaching the bottom of the structure signaling

an opportunity for a buy.

Both the rising wedge and falling wedge patterns are seen commonly and traded often within Forex7.

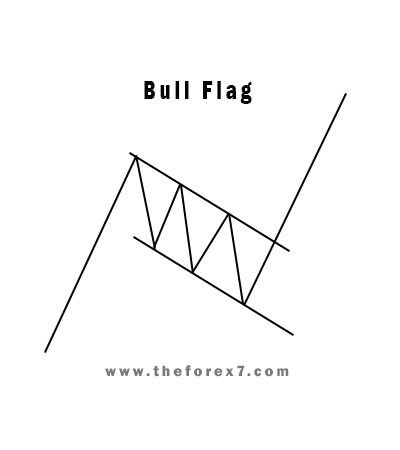

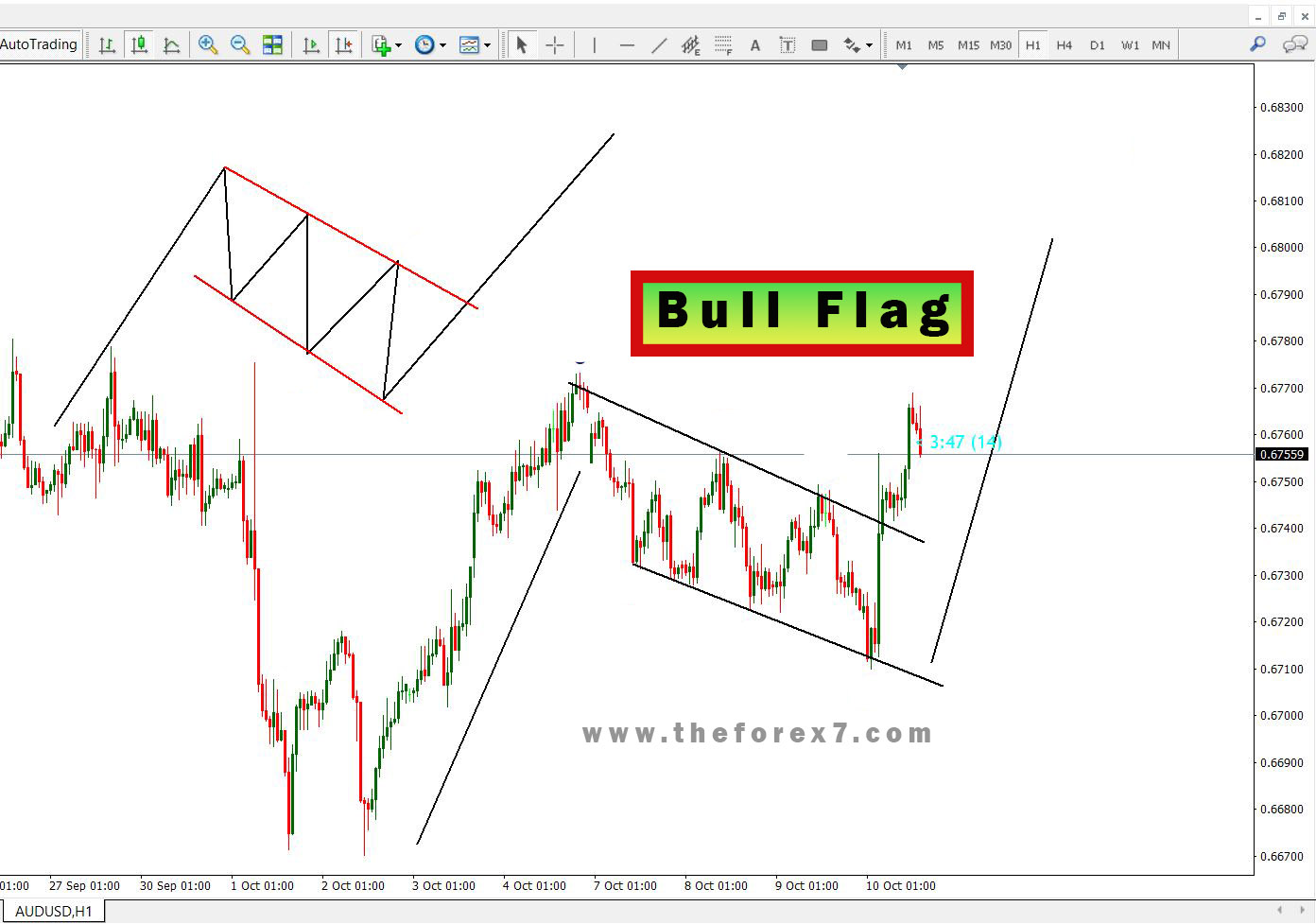

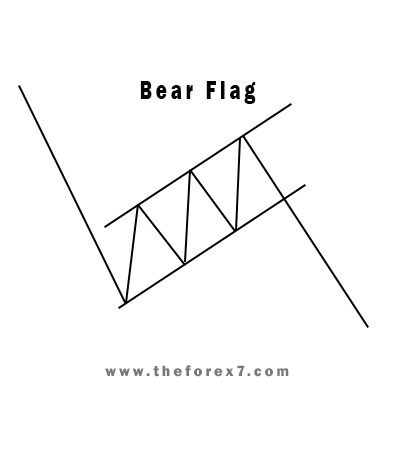

CONTINUATION PATTERN (Flag Pattern)

Bull Flag

Bear Flag

The above continuation

patterns are the bull flag and the bear flag. These patterns are spotted in a

bullish trend or a bearish trend respectively forming the corrective phase in a

trending market.

They are called bull flags

because the pattern resembles a flag on a pole.

We utilize these patterns

heavily in Forex7 to outline impulsive price movements to the upside and to the

downside.

These patterns are very common within the markets and throughout your journey within Forex7 you will see a lot of opportunities utilizing the reduced risk entry-capitalizing on these flag formations.

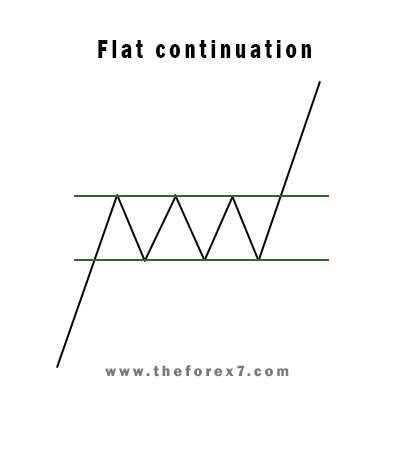

Flat continuation

Flat continuation patterns

can be either bearish or bullish and closely relate to the flag continuations

within the market. They differ very slightly in shape however signal the same

opportunity within the market.

Again, these patterns are seen in either a bullish or bearish market.

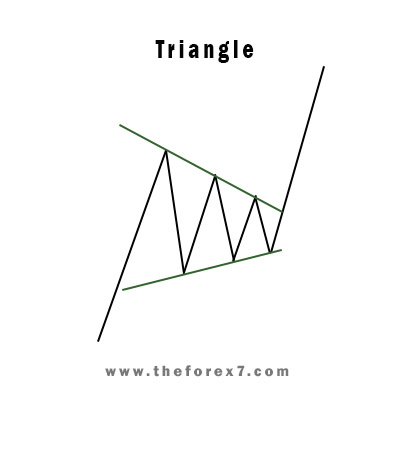

Triangle

Another form of continuation

pattern used within Forex7 is the triangle continuation. Another shape that a

continuation pattern can take within the market- it is rare to find picture-perfect patterns within the charts however as price action develops you begin

to class it as one of these various categories.

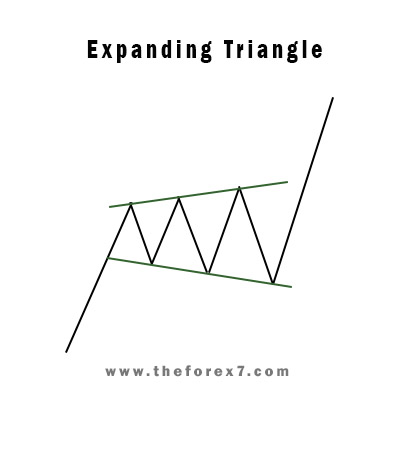

Expanding Triangle

The last form of continuation pattern we pay attention to within Forex7 is the expanding triangle. As a flag or flat continuation would retain its general parallel structure the expanding triangle broadens as price action develops. This pattern results in a very nice risk-to-reward ratio with particular entry styles you’ll learn throughout the content.

Top Trading Strategy : Tag: Top Trading Strategy, Forex : Head & Shoulders, Ascending Channel, Double Top, Descending Channel, Triangle, Expanding Triangle - Every Traders Must Know 13 Chart Pattern in Forex Trading