CANDLESTICK CHART PATTERNS IN FOREX TRADING

BULLISH PATTERN | BEARISH PATTERN | HEAD & SHOULDER PATTERN | DOUBLE TOP

Course: [ Top Trading Strategy ]

A rectangle is basically a trading range bound by two horizontal lines marking the top and bottom of the range (See Figure 1). It can either be a continuation or reversal pattern, although it should be assumed that the breakout will occur in the direction of the existing trend unless proved otherwise by technicals or market sentiment.The upper line acts as resistance, where the lower line acts as support. This pattern is very commonly found in Forex charts, and indicates a temporary balance between buyers and sellers in the transition period.

Chart Patterns

In this lesson, I will teach you some

basic chart patterns which may signal trend continuation or reversal. If you

spot them before the patterns are completed, you may be in for a high

probability trade. If you recall, the aim of technical analysis is to spot big

movements before they happen so that you can take advantage, and prepare for a

trade at a good entry point.

Here are some of the patterns that I am going to cover:

Rectangle

Figure

1

Figure

1

A rectangle is basically a trading range bound

by two horizontal lines marking the top and bottom of the range (See Figure 1).

It can either be a continuation or reversal

pattern, although it should be assumed that the breakout will occur in the

direction of the existing trend unless proved otherwise by technical or market

sentiment. The upper line acts as resistance, while the lower line acts as

support.

This pattern is very commonly found in Forex charts and indicates a temporary balance between buyers and sellers in the transition period.

Symmetrical Triangle

Figure

2A

Figure

2A

Figure

2B

Figure

2B

Symmetrical triangles are known to be very

unreliable formations.

As you see from Figure 2A, a symmetrical

triangle is consists of two converging trendlines that join a series of lower

highs and higher lows. Although we should assume that the pattern will be

resolved in the existing trend direction, breakouts can be either to the upside

or downside, and there is no way you can predict its direction until one of the

lines are penetrated.

Breakouts usually occur in the final 1/3 of the

triangle, as can be seen in Figure 2B.

Ascending Triangle

Figure

3A

Figure

3A

Figure

3B

Figure

3B

Ascending or descending triangles can be

reversal or continuation patterns. They are more reliable and more predictive of

future price movements than symmetrical triangles. Unlike symmetrical

triangles, one of the lines is horizontal. Ascending triangles are bullish

patterns based on their upward slope.

In Figure 3A, the pattern shows an upward

sloping trendline that creates the lower boundary of the triangle with higher

lows. The upper boundary, which is approximately horizontal, represents

resistance. Every time the currency price goes up to a certain level, people

are more enthusiastic about selling at the high. But once the price exceeds

this psychological level, the sellers are caught in the wrong direction and

are desperate to close their shorts by bidding higher. It is common for the

breakout to occur in the final 1/3 of the triangle formation.

Figure 3B shows the upside breakout of this

pattern.

If the ascending triangle is formed during an

existing uptrend, it acts as an uptrend continuation pattern. But if it is

formed during an existing downtrend, it acts as a bullish reversal pattern.

Descending Triangle

Figure

4A

Figure

4A

Figure

4B

Figure

4B

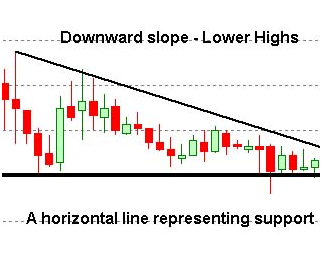

Descending triangles are bearish patterns based

on their downward slope.

In Figure 4A, the downward sloping trendline

creates the upper boundary of the triangle with lower highs. The lower

boundary, which is approximately horizontal, represents support. Every time the

currency price goes down to a certain level, people are more enthusiastic about

buying at the low. But once the price goes below this psychological level, the

buyers, positioned in the wrong direction, become desperate to cover their

longs. It is common for the breakout to occur in the final 1/3 of the triangle

formation.

Figure 4B shows the downside breakout of this

pattern.

If the descending triangle is formed during an

existing downtrend, it acts as a downtrend continuation pattern. But if it is

formed during an existing uptrend, it acts as a bearish reversal pattern.

Trading Tips for Ascending or Descending Triangles

- Remember

that they may be continuation or reversal patterns based on whether the

slope is downward or upward.

- They

are commonly found in Forex charts.

- As

continuation patterns, they are an ideal second entry point to join the

existing trend if you have missed the first signal.

- If

you are already involved in existing trend, it may be a good point to add

to your positions.

- But if you spot it as a reversal signal, you may wish to place your stop below the support horizontal line or above the resistance horizontal line if the trend turns against you.

Double Top

Figure

5

Figure

5

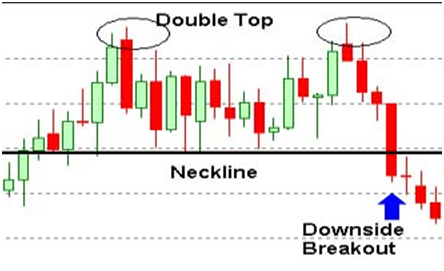

Double tops are quite commonly found on the

charts and offer very good reversal signals. It is a good place to enter early

on a trend reversal.

Figure 5 shows a double top pattern consisting

of two final peaks separated by a valley. The two peaks need not be of the same

height for the pattern to be considered a double top. When the price breaks

below the neckline connecting the valley low and the base of the tops, it

signals a downside breakout and a good entry point for shorting.

The objective of the breakout is measured by projecting the maximum distance between the higher top and the neckline from the breakout point.

Double Bottom

Figure

6

Figure

6

A double bottom is a mirror image of a double top. Figure 6 shows an upside breakout from the neckline violation.

Trading Tips for Double Top and Bottom

- Sometimes

double tops and bottoms may extend into triple or even quadruple tops or bottoms,

which are far less common.

- Triple

or quadruple tops or bottoms represent a more prolonged battle between

buyers and sellers, and hence such breakouts are usually followed by more

forceful reversals.

- From experience, I find that double tops and bottoms generally give more reliable reversal signals than heads and shoulders, which are covered next.

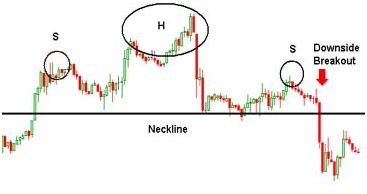

Head and Shoulders (H&S)

Head-and-shoulders can occur as reversal or

continuation formations. If the pattern is found at the end of an uptrend, it could

signal a bearish reversal or consolidation period before continuing the

uptrend. If it is found at the end of a downtrend, it could signal a bullish

reversal or consolidation period before resuming the downtrend. H&S

reversal patterns are notorious for false breakouts.

Figure 7 shows a classic head and shoulders pattern at the end of an uptrend.

It consists of the head, which is the final rally, separated by two smaller

rallies, known as shoulders, that need not be identical. The neckline shown

here is a horizontal trendline drawn connecting the lows of the left and right

shoulder. When the price breaks decisively below the neckline, the trend is

deemed to have reversed.

Figure

7

Figure

7

The minimum price objective is obtained by

measuring the distance from the head to the neckline, and projecting it down

from the breakout point.

When the H&S fails, it will usually rebound and may stage an explosive rally off the neckline because sellers of the H&S downside breakout will have their stops triggered when the direction goes against their positions.

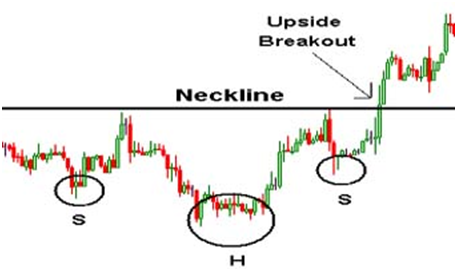

Inverse Head and Shoulders

The inverse head and shoulders is similar to the

H&S above, except that it is upside down.

Figure

8

Figure

8

As you can see from Figure 8, it consists of the

head, which is the final low, separated by two smaller declines which make up

the left and right shoulders. The neckline shown here is a horizontal trendline

drawn connecting the highs of the left and right shoulder. When the price

breaks decisively above the neckline, the trend is deemed to have reversed.

The minimum price objective is also obtained by

measuring the distance from the head to the neckline, and projecting it down

from the breakout point.

Similarly, when the inverse H&S fails, it may stage an explosive decline off the neckline because the majority of the market is poised in the wrong direction, and many stops will be triggered as shorts are forced to cover.

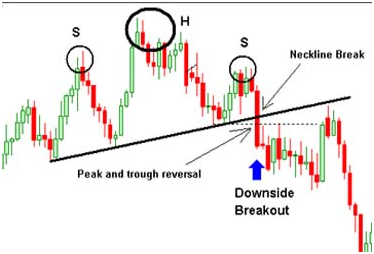

Sloping Head and Shoulders

A sloping H&S refers to either an upward or

downward sloping of the neckline.

From Figure 9, you can see that, unlike the

horizontal H&S, the upward-sloping break occurs in two stages: first with a

neckline break, then followed by a peak and trough violation. It is better to

short from the peak and trough break as the evidence is reinforced by this

second violation.

Figure

9

Figure

9

Note that the extended neckline later becomes

resistant, and triggers more selling pressure. The same rules apply to the

downward-sloping H&S.

Trading Tips for H&S

- A

H&S reversal is likely to fail if the trendline has a steep ascent or

decline.

- H&S failures can happen quite often in currency pairs, and unfortunately, there is no way of knowing if the failed pattern will be followed by a small or large price movement. Sometimes the price may explode, and at other times, the price may be in a confusing period of volatility. If you sense you are in the wrong direction, it is better to get out as quickly as you can.

Top Trading Strategy : Tag: Top Trading Strategy, Forex : BULLISH PATTERN | BEARISH PATTERN | HEAD & SHOULDER PATTERN | DOUBLE TOP - CANDLESTICK CHART PATTERNS IN FOREX TRADING