What is a stop raid?

What is stop hunting? | Retail trader stop loss

Course: [ Top Trading Strategy ]

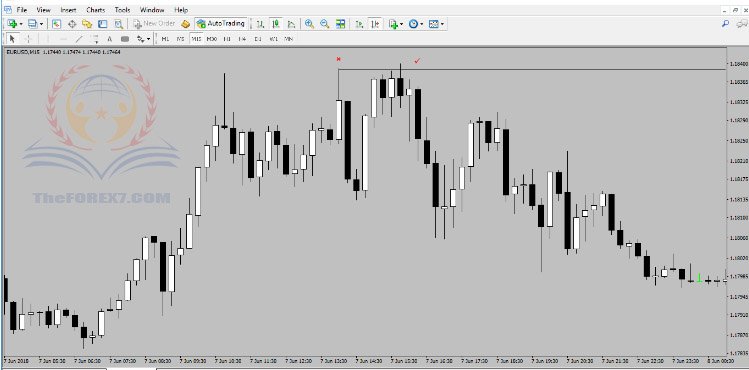

Stop raids are rapid movements in price which target previous recent highs or lows set (depending on trend) are taken out, and price rapidly moves back in the opposite direction, usually then distributing heavily in the same direction the overall trend has been moving in.

What is a stop raid?

Stop raids are

rapid movements in price which target previous recent highs or lows set

(depending on-trend) are taken out, and price rapidly moves back in the

opposite direction, usually then distributing heavily in the same direction the

overall trend has been moving in.

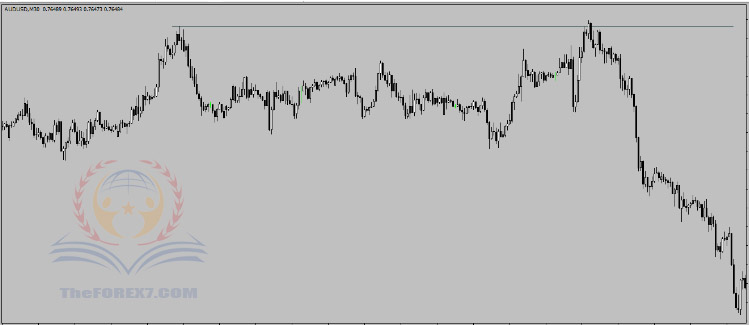

We find

stop raids happen most of the time in liquid areas of the market, where there

are a lot of retail traders stop losses and stop entries, and also in areas

where there are voids (empty gaps)

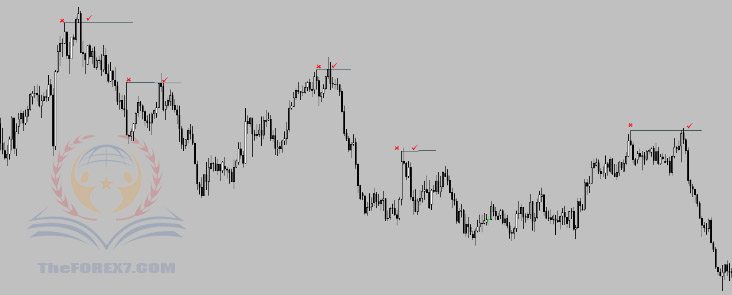

Here at

Evolve, we only take trades in line with order flow, and this remains

consistent with most parts of our analysis, but there are many traps in FX.

Something that looks like a stop raid against order flow is more than likely a

break in market structure and not a stop raid.

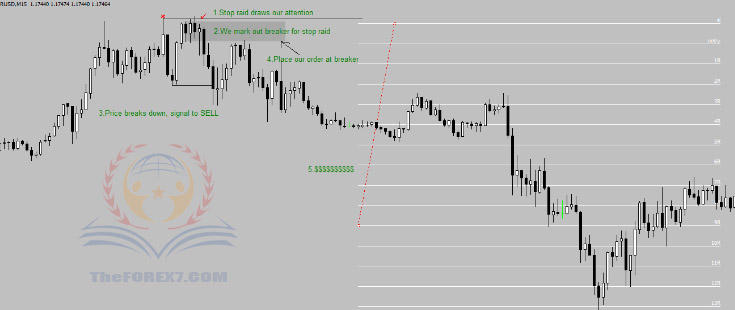

We don’t

use stop raids as a method of entry, we use them as a confluence. Stop raids

usually happen too quickly to enter them directly, and also. Although we are

anticipating it, that doesn’t mean we're automatically correct. On 15 min time frame

and above, its best to wait for the breakdown in direction of true order flow, and

once you get a confirmation, then its time to enter the trade

Top Trading Strategy : Tag: Top Trading Strategy, Forex : What is stop hunting? | Retail trader stop loss - What is a stop raid?