Fibonacci Price Grouping

Fibonacci Numbers, Fibo trading, Fibonacci Retracements, Fibonacci trading course

Course: [ Advanced Fibonacci Trading Concept : Fibonacci Trading Strategy ]

Every calculation, so far, was a variation on price. We took ratios of prices, and added them to other prices, and so on. But ‘time’ is also passing (as we look for trades and watch them develop), and it seems as though ‘time’ is just as harmonic as ‘price’.

Adding Time to the Mix - Fibonacci Trading

Up to this point, we have only looked at

price. Every calculation, so far, was a variation on price. We took ratios of

prices, and added them to other prices, and so on. But ‘time’ is also passing

(as we look for trades and watch them develop), and it seems as though ‘time’

is just as harmonic as ‘price’. It would only make sense to add time

calculations to your trading arsenal.

I am only going to do a small primer here on

this topic, although at some point I may do a work devoted entirely to the

concept of harmonic time calculations. I want the reader to be aware of the

concept, and to start to research and experiment with the concept.

For simplicity’s sake, let’s start by just

looking at some examples where we have a trend, and then the trend corrects.

1’11 choose these examples such that we have a fairly deep correction (not just

a small pullback), and then the trend continues. The question on a trader’s

mind might be, ‘Will this thing stop correcting and the previous trend

re-establish itself, and if so, when?’ Let’s just look at some simple Fibonacci

time retracements like .618 and .786. See figures 11.1-11.3.

Let’s also look at some Fibonacci time

retracements that are greater than 1.000, such as 1.618. See figure 11.4 and

11.5.

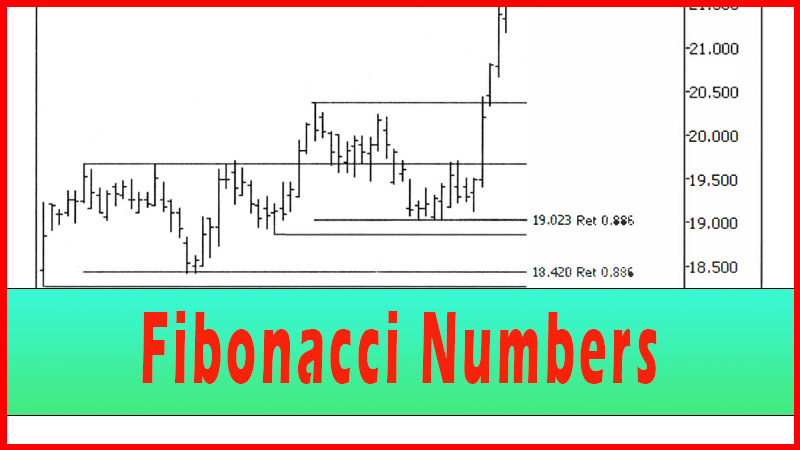

Notice how KMB, in figure 11.5, is very choppy

and discontinuous, yet the pullback ended exactly on a 1.618 time retracement.

Also interesting to note is that the chart shows an internal price retracement,

whereas the time retracement would be ‘external’ i.e. greater than 1.000. This

example, perhaps, lends credence to the idea of ‘giving a trade time to work’,

as long as the original premise of the trade remains intact.

This chart also provides a test for the

reader’s eye, and shows how harmonic KMB is trading, despite the choppiness. Do

you see it? Let me show you the same chart, with one more time retracement

added on. See figure 11.6.

KMB first ended its price retracement at

exactly a .618-time retracement and began to fall off. It then went

sideways-to-up, and set a very nominal new high, just twelve cents above the

high set at the .618-time retracement. This nominal new high was set exactly at

the 1.618-time retracement, and this time the retracement was complete.

Although the chart looks very helter - skelter, the stock was actually trading

quite harmonically.

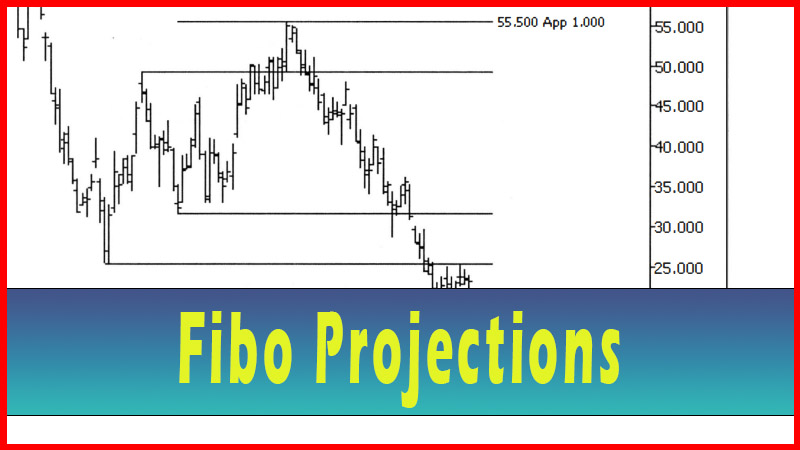

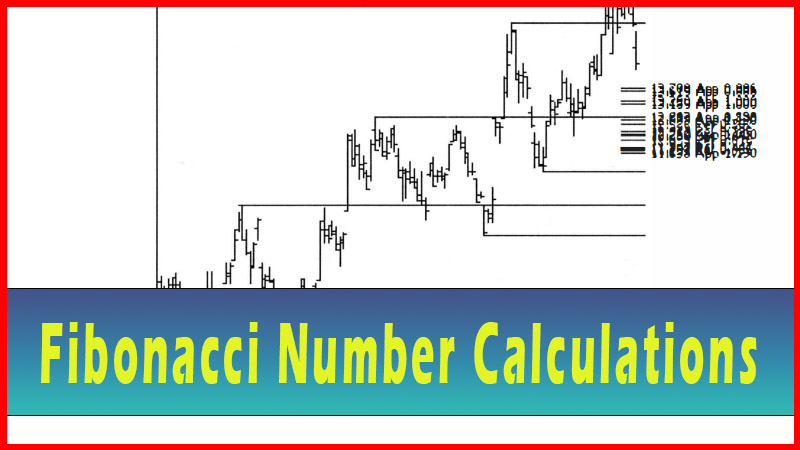

In conclusion, let’s recall how we’ve seen

many examples of corrections as they approach a Fibonacci price grouping, and

have considered possible trade opportunities. But what if we also saw this

happen at a Fibonacci time retracement? This would seem to strengthen the

probability of a zone holding. This would be something a trader might consider

when making a decision in a zone. What if an issue went into a Fibonacci price

grouping, triggered a trade, and it happened at a Fibonacci time retracement?

Now I can hear some readers asking ‘Hey, can

you do groupings of time, just like with price?’ (I hope some of you are saying

this. If you are, I will feel this work has taught you something!) The answer

to the question is ‘yes’. Fibonacci price grouping, Fibonacci time grouping,

and a trigger. Hmmm. I hope this has you thinking. For now, I will leave it to

the reader to experiment with this, and if I do a work on time harmonics it

will revolve around time groupings. Also note that the Dynamic Trader software I

used for the charts in this work can do many variations of time groupings.

Advanced Fibonacci Trading Concept : Fibonacci Trading Strategy : Tag: Fibonacci Trading, Forex : Fibonacci Numbers, Fibo trading, Fibonacci Retracements, Fibonacci trading course - Fibonacci Price Grouping