Filtering out Information Overload

Support and Resistance levels, Pivot Points Levels, Best Trading strategy, Trading triggers

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 5. Pivot Points ]

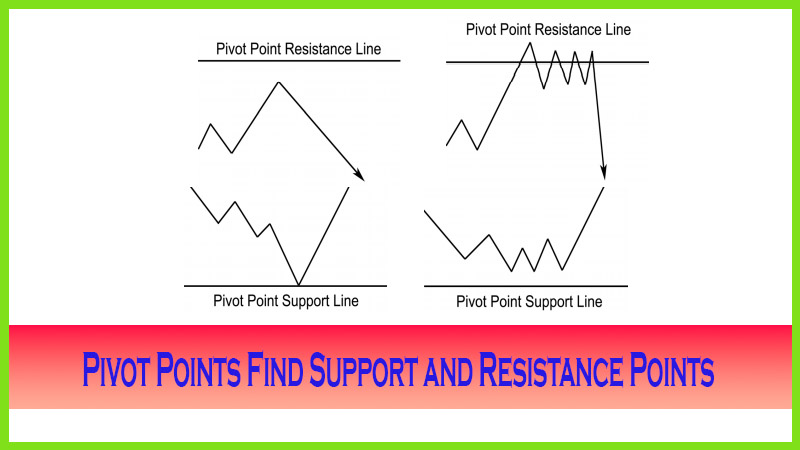

Technically speaking, in a bearish market, the highs should be lower and the lows should be lower than those of the preceding time frame. If they are, then I use that information to help me filter out unnecessary data or excessive support and resistance numbers on my charts.

FILTER OUT INFORMATION OVERLOAD

I have developed a method

to filter out the pivot numbers; this is just one facet that I explain to

attendees of my trading seminars and to students. Keep in mind that this methodology

applies to all markets, including stocks, futures, and especially spot foreign

currency markets, or forex. This method can work for a short-term application

for identifying a potential range for a day, a week, or a month. By having a

good idea, well in advance, of what the high or the low for a given time period

might be, you are able to use this information to apply the right trading

vehicle or strategy, such as whether it is simply selecting an entry level or

getting in or selecting a profit objective or getting out of a trade. You could

also determine whether to apply an option strategy or when to use an exchange

traded fund, as we discussed in Chapter 1.

Predicting

Highs and Lows Using the Calculations

What I do

to determine the potential range for a given session is to take the R-1 and the

S-1 initially for my analysis, especially in low-volume consolidating trading

sessions.

I use the

actual pivot point for many things; one that is useful is understanding that it

can be used as an actual trading number in determining the high or the low of a

given time period, especially in strong bull or bear market conditions. In an

extremely bullish market condition, the pivot point can become the target low

for the trading session. This number represents the true value of a prior

session. In an up-trending market, if the market gaps higher above the pivot

point, then a retracement back to the pivot will attract buyers. Until that

pivot point is broken by prices trading below that level, traders will step in

and buy the pullback. The opposite is true in an extremely bearish market

condition; the pivot point will act as the target high for the session. If a

news-driven event causes the market to gap lower, once traders access the news

and discover it is not as bearish as thought, prices may trade back up to test

the pivot point; if the market fails to break out above that price level and

trades higher, sellers will enter the market and take action, pressing the

market lower again.

Filtering the Numbers

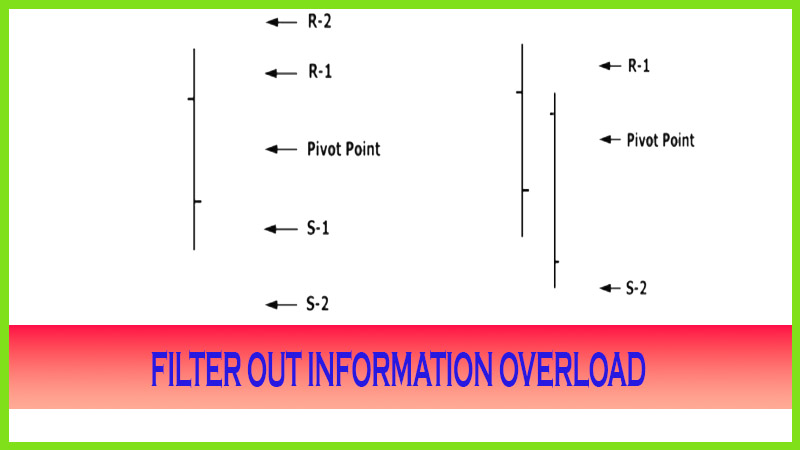

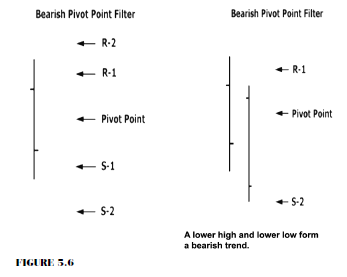

Technically

speaking, in a bearish market, the highs should be lower and the lows should be

lower than those of the preceding time frame. If they are, then I use that

information to help me filter out unnecessary data or excessive support and

resistance numbers on my charts. I use the actual pivot point up to the R-1

number for resistance, and then I target the S-2 for the potential low or for

that time period’s trading range.

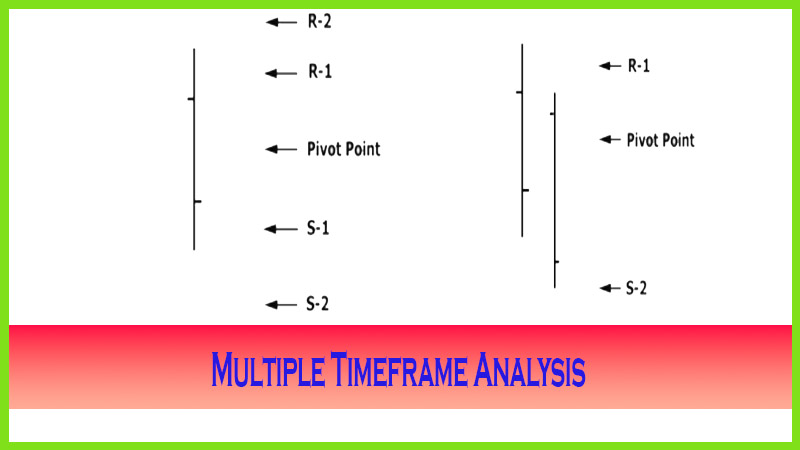

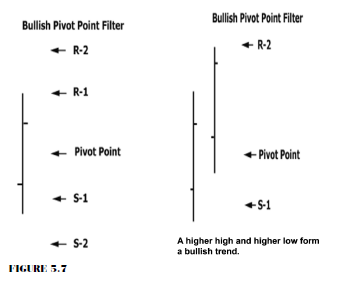

As you can see in Figure 5.6, if I determine the market is bearish and if I understand the relationship of the geometric distance of the resistance and support targets, I can eliminate the R-2 number, since in a bearish environment we should see a lower high. If I am looking for a lower low, then I can eliminate the S-1 support number as well; and now I have reduced the field to just three numbers.

If I

apply the same methodology on daily, weekly, and monthly charts, instead of 39

numbers, I am now working with just 9 numbers. Once again, I am not using the

numbers to place orders ahead of time (even though you could); I use the

numbers as a guide. These numbers work so well and often act as a

self-fulfilling prophecy because so many institutions and professional traders

do use them. Many have different size positions on. Some traders may not wait

for the exact number to hit and may start scaling out of positions (as I do);

and so should you. With this method, you can use these numbers as exit areas on

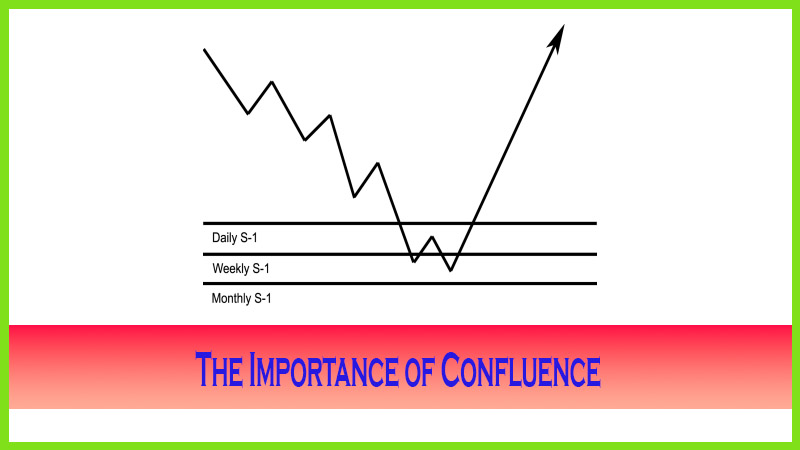

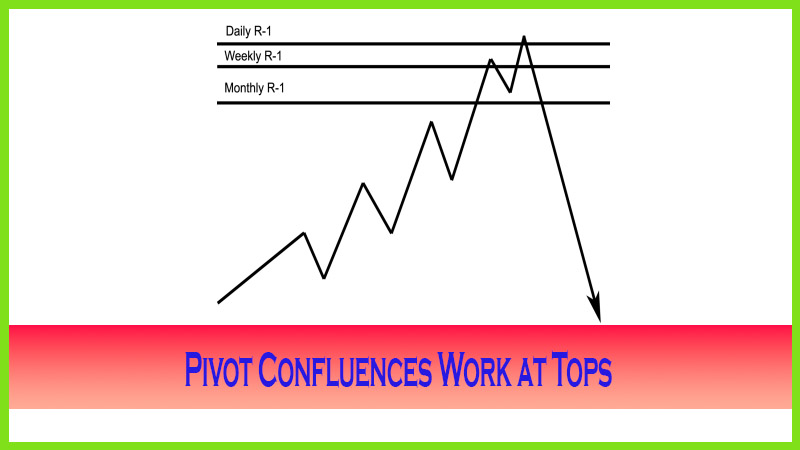

your trades. As Figure 5.7 depicts, in a bullish market environment, by

definition you may agree that the highs should be higher and the lows should be

higher than those of the preceding time period. When I have determined that we

are in a bullish trend, I target the S-1 up to the pivot point for the low of

the session and the R-2 for targeting the high; and that will give me an idea

of what the potential trading range will be.

Lining Up the Numbers

When the

market goes through the projected daily target numbers, I then use the next

time periods for a better gauge or reliability as to the next price objective.

That is where the significance of the weekly and the monthly numbers comes into

play.

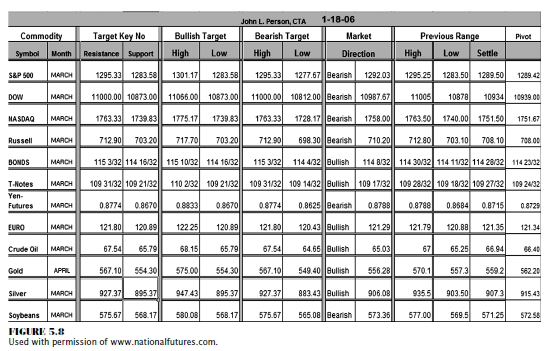

Back in

the late 1990s when I owned a brokerage firm, I developed a method to help me

line up the pivot point levels as shown in Figure 5.8; I had all my brokers use

these numbers, and many still do to this day. The table of information was for

the trading session of 1/18/2006.

My method

categorizes the pivot point levels to the various market conditions, such as

neutral (Target Key) bullish, and bearish. I like to know what the prior time

period’s range and close were for fast access, so I included that in as well.

Since the pivot point is important, I include that on the sheet, as shown in

the last column on the right. The third column from the right states Market

Direction. That is a moving average of the actual pivot point.

If the

pivot point and the close or settlement price are below the market direction

number, then the market condition is deemed to be in a bearish mode; and it

helps me to line up the R-1 and S-1 numbers as the projected target range for

that next session.

If you look down the far-left column to where

you see “Bonds,” you will see that the market direction number classified the

market condition as bullish due to the location of the previous settlement and

that the pivot point was above the pivot point moving average.

The

numbers targeted the high in bonds to be 115% (R-2) and the low to be 114%

(S-1). The pivot point was 114%.

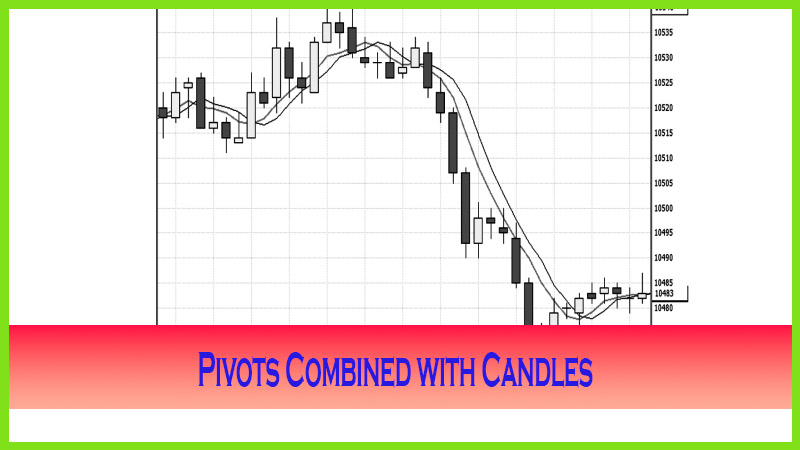

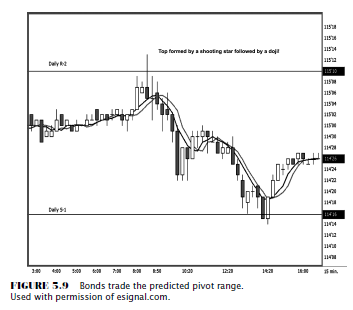

Since the

market closed at 114%, there was a strong chance to see 115%, as well as a low

of 114%. Figure 5.9 shows the exact trading session activity on a 15-minute

candle chart. If you are a candle chart aficionado, you will have spotted that

the high was formed by a shooting star pattern and that the low was made by a

bullish engulfing pattern. While the market broke out above the targeted

resistance, it certainly did not stay there long. Notice how the price

penetrated the low but reversed off the projected low as well. We will use this

chart later in the book as we share statistical in-formation on which candle

patterns have high frequency of forming tops and bottoms. At this point, just

heighten your awareness that there was a doji after the star at top and a doji

near the bottom.

This

chart also has another component—a moving average method that we will discuss a

variation of as well. By using the true value of the market, which I refer to

as the pivot point, we can help determine the market condition and the

projected price ranges as well as potential turning points as market conditions

change from bullish (uptrend) to bearish (downtrend).

The Candlestick and Pivot Point Trading Triggers : Chapter 5. Pivot Points : Tag: Candlestick Pattern Trading, Forex, Pivot Point : Support and Resistance levels, Pivot Points Levels, Best Trading strategy, Trading triggers - Filtering out Information Overload