Pivot Points Find Support and Resistance Points

pivot points support and resistance lines indicator, pivot points support and resistance calculation, what is pivot support resistance

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 5. Pivot Points ]

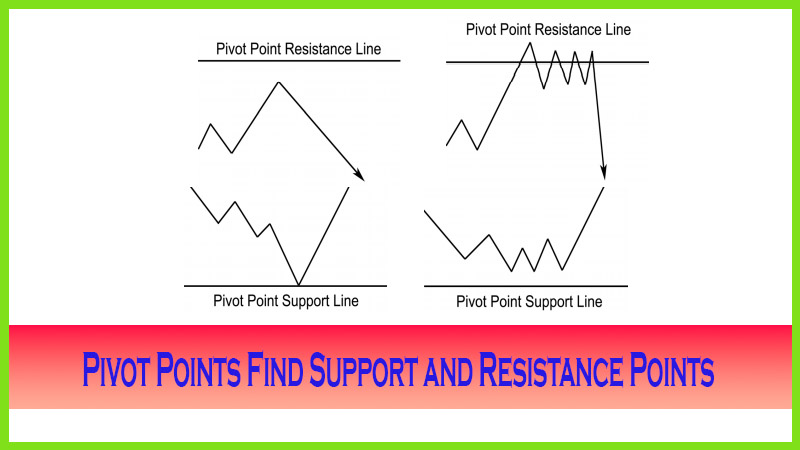

The patterns we see and the way a market behaves at or near a pivot point support or resistance level will be different. Therefore, the velocity and the magnitude of a price move will vary every time.

POSSIBLE OUTCOMES WHEN PRICES ARE NEAR PIVOT AREA

You need

to stay in the “now,”

to focus on the current market condition or environment. Keep telling yourself

that what happened in the past or perhaps even your last trade is of no concern

to the current trade you are in. Remember that each trade will have a different

outcome. The patterns we see and the way a market behaves at or near a pivot

point support or resistance level will be different. Therefore, the velocity

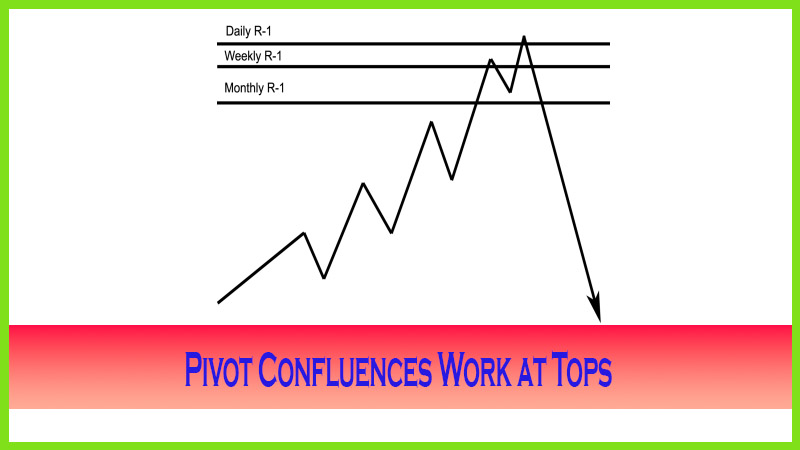

and the magnitude of a price move will vary every time. For example, as shown

in Figure 5.1, prices could come close to but not exactly hit the pivot level.

That does not mean prices will do that every time. As Figure 5.2 shows, prices

can exceed resistance by a small margin; this may invite you to buy a breakout

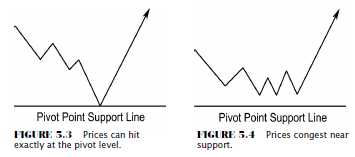

of the resistance level and trap you into buying the high. Then, as Figure 5.3

illustrates, prices can hit the pivot support number exactly, which does happen

frequently. But if you program yourself to anticipate, that will be the outcome

every time; you will be in for a rude awakening due to the potential that

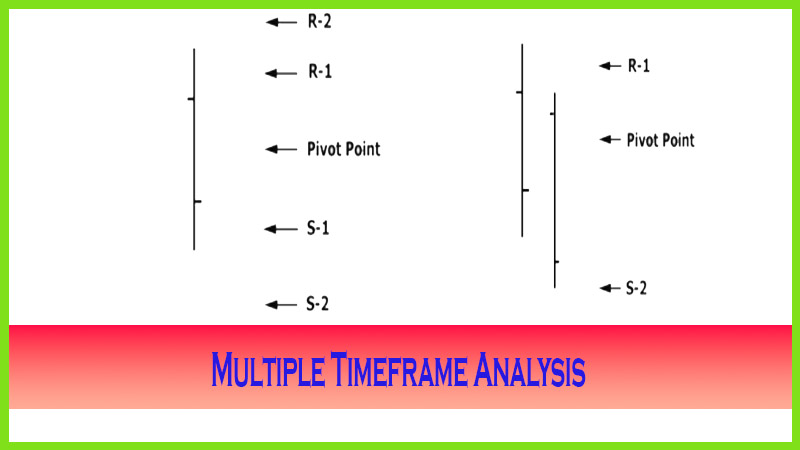

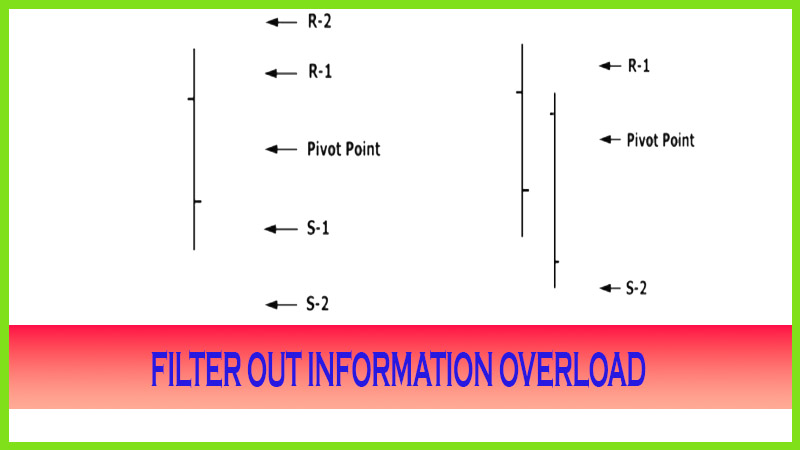

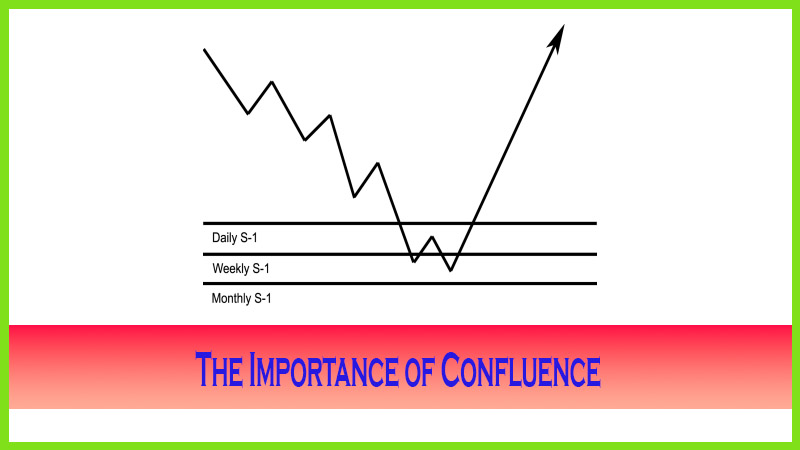

Figure 5.4 represents the occurrence that sometimes prices just come close and

consolidate or congest near the pivot point support or resistance levels for a

period of time before reacting off those levels. Once again, the market’s past

performance is not indicative of future results; so we need more information in

the thought process to initiate a trade and to exit a trade. The pivot point

levels will allow you to set up a particular game plan; therefore, when you

apply more layers of analysis, such as candle patterns and a moving average

approach of the pivot point, that is where you will improve on your trading

decisions, from both your entries and your exits.

DETERMINE THE RANGE

Data

should be used for the all session trading markets with the close of business

as the settlement price. In the futures markets, I do not use just the U.S.

markets’ open outcry trading session. Here is why: The night sessions of most

markets include the Asian and the European markets; and those participants do

trade in U.S. financial markets. If an event took place that caused a market to

move and a trade price was recorded, then it is a valid price point and will be

put in the history books as a trade occurring. Therefore, I consider that

information as accurate from a valid trading session. Most U.S. retail or

individual speculators may not be up at 3 a.m. (CT) trading off a market move;

but potentially, professional traders are, and therefore the information is

considered valid. Gosh, even the exchanges seem to believe it’s valid since

money moves into and out of an account if a trade is made; so the high or low

of that period should be considered.

The Candlestick and Pivot Point Trading Triggers : Chapter 5. Pivot Points : Tag: Candlestick Pattern Trading, Forex, Pivot Point : pivot points support and resistance lines indicator, pivot points support and resistance calculation, what is pivot support resistance - Pivot Points Find Support and Resistance Points