Indicators Mathematical Calculations

Pivot Point indicators, Support level calculations, Resistance level calculations, pivot point analysis

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 5. Pivot Points ]

Pivot point is a mathematical formula designed to determine the potential range expansion based on a previous time period’s data, which include the high, the low, and the close or settlement price.

MATHEMATICAL CALCULATIONS

Pivot

point is a mathematical formula designed to determine the potential range

expansion based on a previous time period’s data, which include the high, the

low, and the close or settlement price. One reason why I believe in using these

variables from a given time period’s range is that they reflect all market

participants’ collective perception of value for that time period. In the

beginning of the book, I quoted Jesse Livermore: “The patterns the traders and

technicians observe are simply the reflections of human emotional behavior”

[Richard Suitten, Trade Like Jesse Livermore (Wiley, 2005, p. 70)]. The range,

which is the high and the low of a given time period, accurately reflects all

market participants’ exuberant bullishness and pessimistic bearishness for that

trading session. The high and the low of a given period are certainly important

as they mirror human emotional behavior. Also, the high is a reference point

for those who bought out of greed, thinking they were missing an opportunity;

they certainly won’t forget how much they lost and how the market reacted as it

declined from that level. The opposite is true for those who sold the low of a

given session out of fear that they would lose more by staying in a long trade;

they certainly will respect that price point the next time the market trades

back at that level. So the high and the low are important reference points of

interest. With that said, pivot point analysis incorporates the three most

important elements—the high, the low, and the close—of a given trading session.

THE LEADING INDICATOR

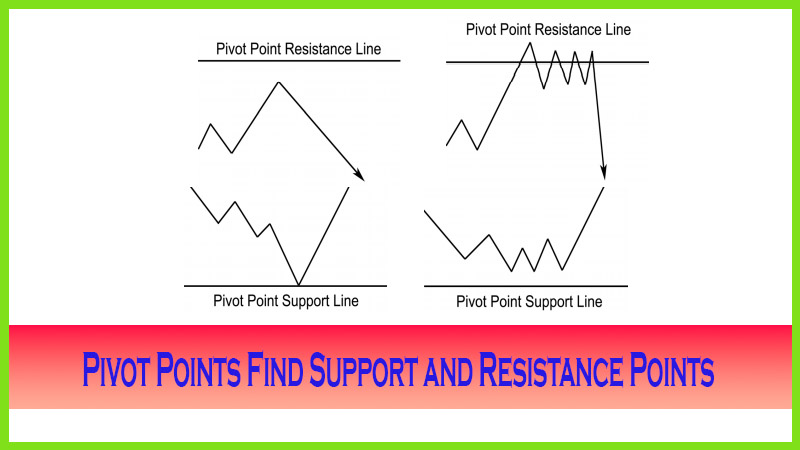

The

definition of the pivot point is the average of the high, the low, and the

closing price. Pivot point analysis is mainly used as support and resistance

levels. The pivot point is the heartbeat of the analysis; without it, projected

ranges and market condition cannot be determined. It does act as a support or

resistance level as well. Pivot point analysis helps as a leading price

indicator for traders because it gives traders advanced indication of potential

highs or lows or, in some cases, both in a given time period, unlike Fibonacci

studies, where there is no predicted time period in which a projected price

correction or projection will occur. I want to step up the concept so that you

can develop a trading system on some powerful setups and on what triggers a

trade. As I disclosed, professional stock, forex, and futures traders have had

significant success in utilizing these “hidden lines”; and

I think that with a more thorough understanding of the concept, so will you.

As a

quick review, one of the main benefits for using pivot point calculations is

that they help determine when to enter and when to exit positions. As a trader,

you already know you can only book a profit when you exit; and if you don’t exit

a losing trade quickly, it is hard to maintain, or keep, what you have already

made. Pivot points are used to project support and resistance or actual highs

and lows of trading sessions. These numbers are derived from a mathematical

formula; there are several versions that, for your benefit, I will go into; but

keep in mind that I still use the most common method to derive my analysis.

Here are the most common formulas:

- Pivot

Point—the pivot point (P)

is the sum of the high (H), the low (L), and the close (C) divided by three.

P = (H + L + C)/3

- Resistance

Level 2—R-2 is the pivot

point number plus the high and minus the low.

R-2 = P + H - L

- Resistance

Level 1—R-1 is the pivot

point number times two minus the low.

R-1 = (P x 2) - L

- Support

Level 1—S-1 is the pivot

point number times two minus the high.

S-1 = (P x 2) - H

- Support

Level 2—S-2 is the pivot

point number minus the high plus the low.

S-2 = P - H + L

Some

analysts are adding a third level to their pivot calculations to help target

extreme price swings on what has occurred on such occasions as a price shock

news-event-driven market reaction. It seems that I have noticed that the spot

forex currency markets tend to experience a double dose of price shocks because

they are exposed to foreign economic developments and U.S. economic

developments that pertain to a specific country’s currency. This tends to make

wide trading ranges. Therefore, a third level of projected support and

resistance were calculated

Resistance Level 3-R-3 = H + 2 x (Pivot - Low) or (P -

S-1) + R-2

Support Level 3-S-3 = L - 2 x (High - Pivot) or P -

(R-2 - S-1)

There are

other variations that include adding the opening range, in which case you would

simply find the sum of the open, the high, the low, and the close; and then

divide it by four to derive the actual pivot point.

P = (O + H + L + C) /4

One more

variation of that concept—to factor in gaps from adverse price moves from one

day to the next is to take the previous session’s high, low, and close, add in

the new trading session’s open, and then add in those variables and divide by

four. In using both open prices, you still calculate the extreme support and

resistance levels with the same formulas.

P = (new O + old H + old L + old C) /4

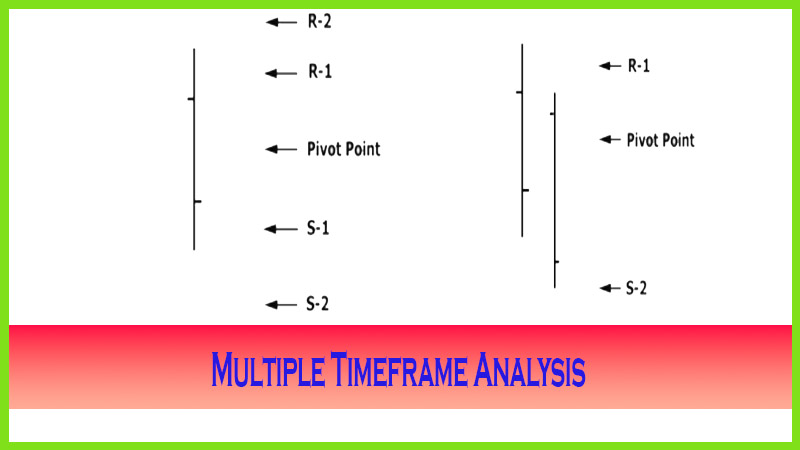

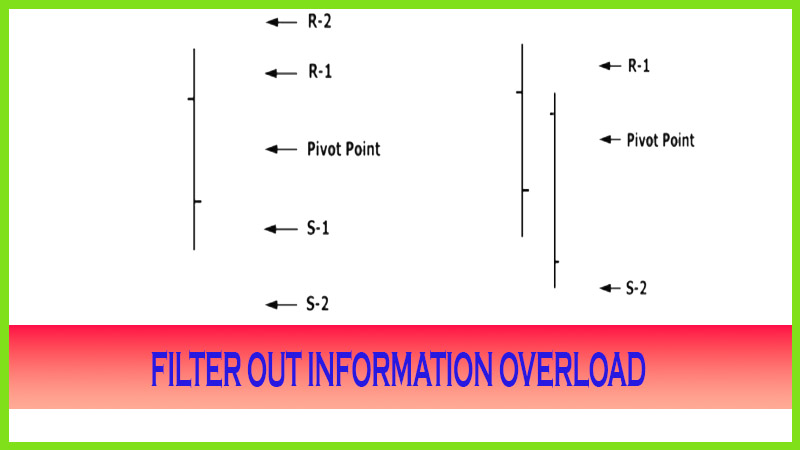

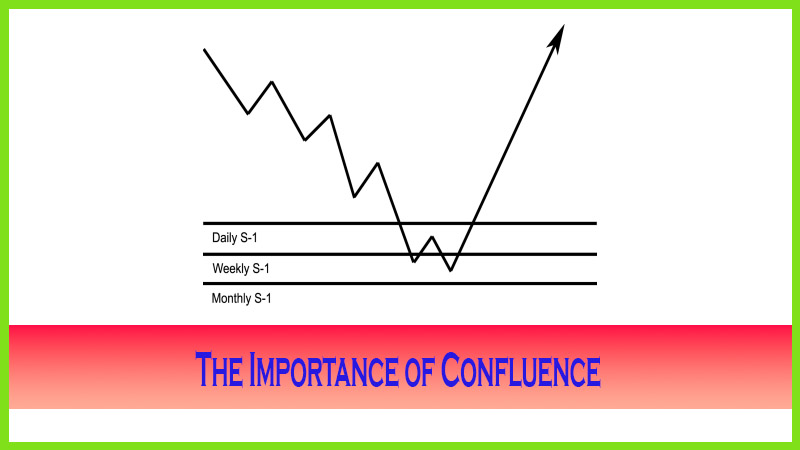

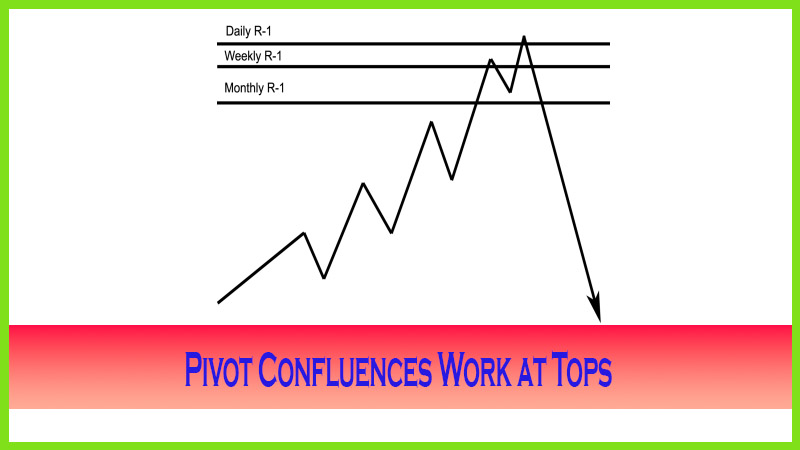

Let’s go

over what these numbers mean and how price action reacts with these projected

target levels. But first, let me state that I personally do not use the R-3 or

S-3 levels because I believe in looking at the progressively higher time

period’s price support or resistance projections. For example, from the daily

numbers, I would look at the weekly numbers, and then from the weekly numbers I

would look at the monthly numbers. The longer the time frame, the more

important or significant the data. Also, it is rare that the daily numbers will

trade beyond the extreme R-2 or S-2 numbers; and when the market does, it is

generally in a strong trending condition, in which case we have methods to

follow the market’s flow, which we will cover in the next few chapters. By

focusing in on just a few select numbers and learning how to filter out excess

information, I eliminate the analysis paralysis from information overload. Do

yourself a favor and keep reading because this does get exciting. The following

list shows how the numbers would break down by order, what typically occurs,

and how the market behaves. Keep in mind that this is a general description.

You will learn what to look for at these price points in order to spot

reversals so you can become more profitable from trading in the markets.

- Resistance

Level 3—Extreme bullish

market condition generally created by news-driven price shock. This is where a

market is at an overbought condition and may offer a day trader a quick

reversal scalp trade.

- Resistance

Level 2—Bullish market price

objective or target high number for a trading session. It generally establishes

the high of a given time period. The market often sees significant resistance

at this price level and will provide an exit target for long positions.

- Resistance

Level 1 —Mild bullish to

bearish projected high target number. In low volume or light volatility

sessions or in consolidating trading periods, this often acts as the high of a

given session. In a bearish market condition, prices will try to come close to

this level but most times fail.

- Pivot

Point—This is the focal

price level or the mean that is derived from the collective market data from

the prior session’s high, low, and close. It is the strongest of the support

and resistance numbers. Prices normally trade above or below this area before

breaking in one direction or the other. As a general guideline, if the market

opens above the primary pivot, be a buyer on dips. If the market opens below

this level, look to sell rallies.

- Support

Level 1—Mild bearish to

bullish projected low target number in light volume or low volatility sessions

or in consolidating trading periods. Prices tend to reverse at or near this

level in bullish market conditions but most times fall short of hitting this

number.

- Support

Level 2—Bearish market price

objective or targeted low number. The market often sees significant support at

or near this level in a bearish market condition and is a likely target level

to cover shorts.

- Support

Level 3—Extreme bearish

market condition generally created by a news-driven price shock. This level

will act as the projected target low or support area. This is where a market is

at an oversold condition and may offer a day trader a quick reversal scalp

trade.

Most of

the research and books written on technical analysis cover the topic of trade

entry and how to use indicators, oscillators, and moving average studies. Few

go over how to target exits. Longer-term traders have read the works done on

volume analysis to help determine the strength or the weakness of a trend.

There is further information on consensus studies, such as the Commitment of

Traders (COT) reports; the VIX, which is a volatility index, is based on

calculations using options on the Standard & Poor’s (S&P) 500 Stock

Index. Plus, the put-to-call ratio helps give investors an idea if a trend is

ready to change. None of these studies actually helps a trader with targeting a

potential trading range in a given time period. That information will help a

trader with setups and triggers on entering a position and, most important,

exiting a position. This is where pivot point analysis will help you.

Think for

a moment: If most technical tools are lagging indicators and if most traders

follow and use these trading indicators to make trading decisions, then it

would make sense that most traders get trading signals and execute entering

into a position on a lagging basis or well after a move has been established.

Then, if the same indicator gives the exit signal too late, perhaps that is

what perpetuates habit or the consistency of losing money in the markets, from

entering or exiting later, based on lagging indicators.

Then, in

order to adjust getting in too late, traders anticipate a market turn; and more

times than not, that turns out to be a bad trading decision. Or traders may

decide to just “hang in there” a while longer, thinking that the market may

just return and give them back the sweet profits that were just accumulated in

the trade. That is a syndrome that many traders tell me they fell victim to. By

using pivot point support and resistance levels, you can speed up the

analytical process on entries; and by employing certain trade management

techniques that we will go over in a later chapter, you can effectively help

improve your exits. After all, that is one of the most important aspects of

trading. A profit is just a paper asset until a position is offset. The offset

relies on an exit strategy. Ask yourself this question: How many times have I

been in a trade and thought I was doing the correct thing by letting my winners

ride, by holding on to the position only to see my paper profits erode and then

perhaps turn into a loss? The flip side to this is: How many times have I taken

a quick profit, banked the money, and no more than a few moments later watched

the market explode dramatically further in the direction of my original

position? Just when you say the market can’t move any further, that’s when it

usually does. You need discipline and patience to stay with a trade. These

situations will likely happen; but by utilizing pivot points and by watching

the market’s behavior at or near these levels, you will be better prepared to

make better trading decisions, especially on exits.

The Candlestick and Pivot Point Trading Triggers : Chapter 5. Pivot Points : Tag: Candlestick Pattern Trading, Forex, Pivot Point : Pivot Point indicators, Support level calculations, Resistance level calculations, pivot point analysis - Indicators Mathematical Calculations