The Importance of Confluence

Time and Price, different time periods, Pivot calculations, pivot point analysis

Course: [ The Candlestick and Pivot Point Trading Triggers : Chapter 5. Pivot Points ]

Time is an essential element in trading. There are many instances when traders are correct in their predictions for a top or a bottom in a market; but they are off in their timing, which results in a loss.

THE IMPORTANCE OF CONFLUENCE

Time is

an essential element in trading. There are many instances when traders are

correct in their predictions for a top or a bottom in a market; but they are

off in their timing, which results in a loss. Many analysts were calling for a

top or for the bubble to burst in the stock market in 1999. In that situation,

not demonstrating patience to wait would have resulted in dramatic loss of

profit potential or worse, actual losses due to selling short stock too early.

How about economists’ predictions of a housing bubble back in 2003 and their

expectations for a decline in real estate prices? By July 2006 we had started

to see prices go back down but not to the severity as was predicted and

certainly not at the time that was expected by economists. I can go on and on

with examples when prognostications were correct, but timing was really wrong,

resulting in a financial loss.

Time and Price

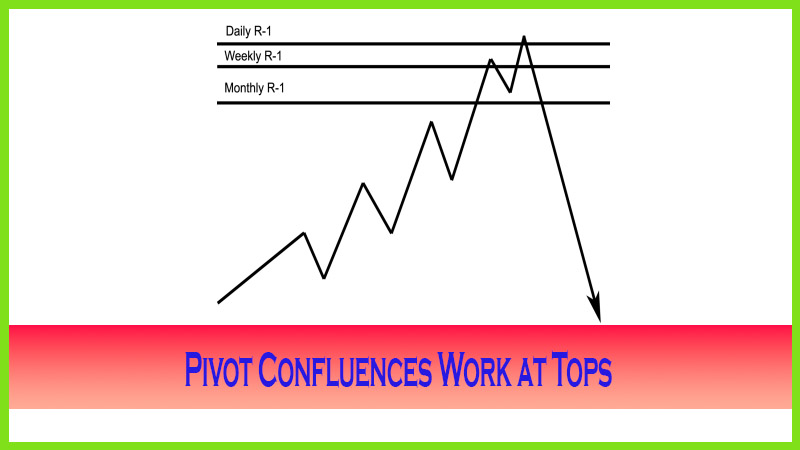

As I

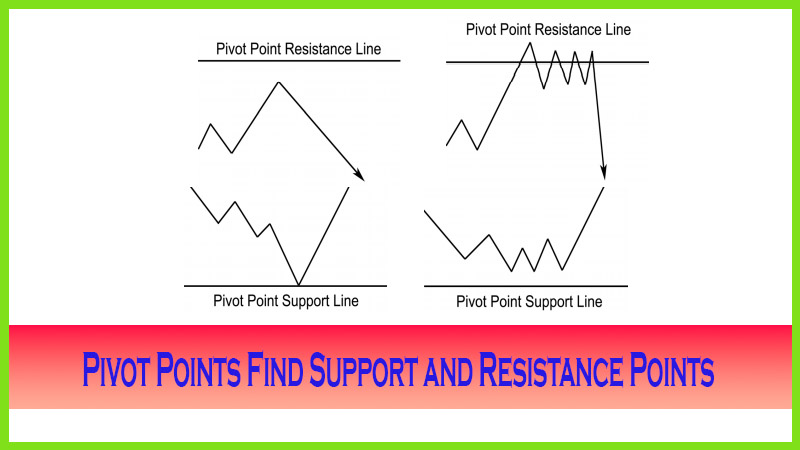

stated earlier, pivot point analysis relies on both time and price specifics in

its calculations to project future support and resistance levels. By

incorporating price data for various time frames, such as daily, weekly, and

monthly, the more price areas that coincide with the different time periods,

the greater is the likelihood that these price clusters will repel the market’s

advance in an uptrend or cause prices to reverse in a downtrend. This

clustering, or confluence, from more than one time period that convergences

with another is an awesome event and can translate into a very lucrative setup.

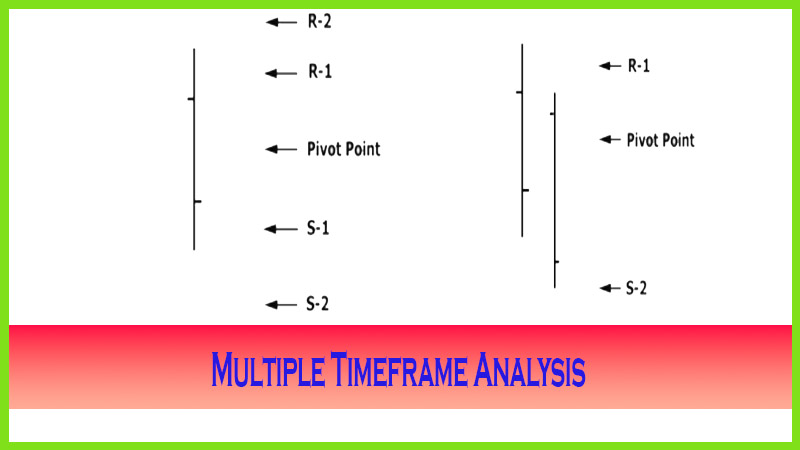

The time frames of numbers that target a specific price level is termed

confluence; in other words, the more corroborating numbers that target a

general area, the greater is the significance of that specific targeted price

level. Pivot calculations work to pinpoint almost exact times and prices for

trades in various markets and can be used to validate other analysis. Remember

this phrase: “There

is always strength in numbers!” The

more pivot numbers that line up, the greater is the potential for a reaction

off those levels. This knowledge, combined with identifying the shift in

momentum by identifying and acting on strong triggers, increases the probability

of a successful trade.

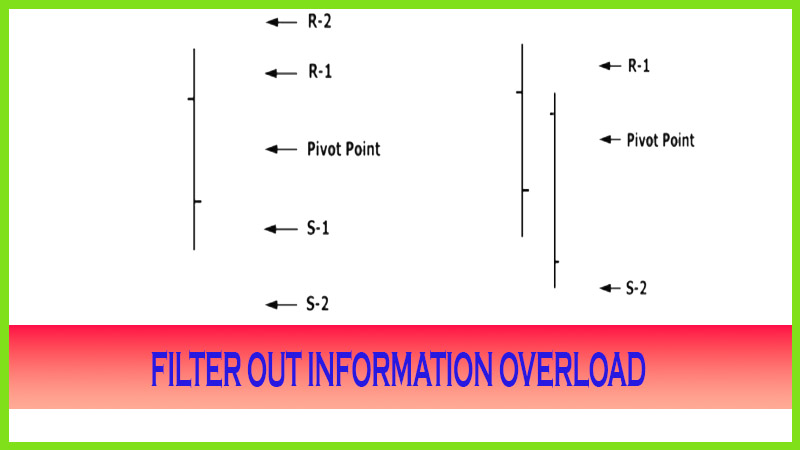

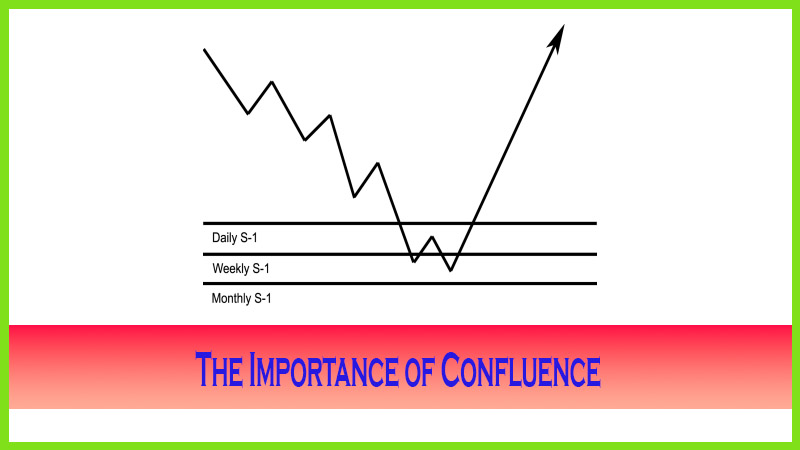

As an

example, Figure 5.14 shows the daily, weekly, and monthly pivot point numbers

drawn across the chart; this gives a trader a heads up that the market may

reach an unsustainable extreme or oversold market condition. Just by looking at

the graph, you can see that the market has been in a prolonged downtrend.

Generally, the market may stop its descent at

a confluence support zone; then you would want to wait for a shift in momentum

to trade a potential price reversal. When the market starts to give clues as to

a bottom, you can determine a low-risk entry, as a bottom has been defined.

What would not be known is how high the market’s reaction will be off this

target level of support. This is where the candle chart section will play an

important role in helping to determine the strength of the trend’s reversal.

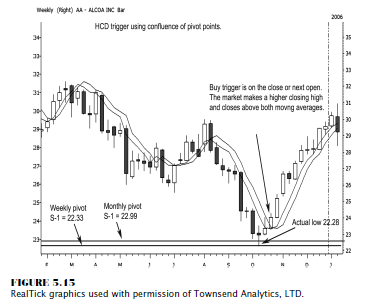

In Figure

5.15, we have a weekly stock chart on Alcoa. Here we see a confluence of two

higher-degree time periods, such as the weekly and monthly support numbers.

What is uncanny is that the weekly pivot S-1 target low number was 22.33, with

the actual low coming in at 22.28, just pennies below the pivot support number.

The monthly number lined up a little higher than that at 22.99, which is a

slightly wider margin of error. Remember, when I am trading, I am not looking

to catch a falling knife by anticipating a bottom, even though in this example

you could have placed a buy order at the weekly number; and as the price moved

through your buy order, you may have been filled—and that was a great buy.

However, the better course of action, and the more reliable method to trade off

this confluence area, was to wait for a confirmed buy signal, such as the high

close doji signal (we go over that in Chapter 7). Notice the moving average

crossover and that prices confirm a conditional change in the market by closing

above the open and closing above both moving average components. The true buy

signal was generated at 24.20, and the risk would be using a stop below the low

at 22.28.

Volatility Is Good

As long

as there is trading volume—liquidity so you can enter and exit positions and

price movement, otherwise known as volatility—pivot point analysis will work in

any market for position traders and short-term day traders. No matter what your

choice is for a trading investment vehicle, it makes no sense that you would

not want to incorporate this methodology into your trading style. Let’s examine

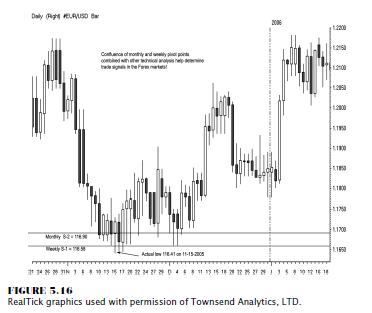

the chart in Figure 5.16, which is a daily look at a spot forex euro currency

versus the U.S. dollar. The monthly S-2 target low was 116.90, the weekly S-1

lined up in close proximity at 116.58, and the actual low was 116.41. Looking

at the market’s reaction three days after the low, we see a bullish engulfing

pattern. The confluence of pivot support numbers gave one of the best and only

predictive support targets. Therefore, it should be noted that the longer-term

numbers should be watched carefully for clues not only for trading

opportunities to enter positions but also as a warning that the current trend

could be exhausted and potentially reverse. At the very least, you may not have

wanted to establish a long position; you certainly would have been alerted not

to sell short at the low.

Let’s

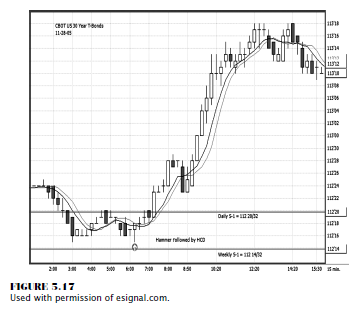

examine the 15-minute candle chart in the 30-year Treasury bonds (T-bonds)

shown in Figure 5.17. Once again, the market price scrapes against the lows,

and a hammer pattern forms the exact bottom. But notice that the weekly pivot

S-1 support target is 112%, which coincides with the daily S-1 support target

of 112%. The actual low was 114%! Notice that the market broke the daily

support but did not make much of a decline and certainly did not remain below

the support for a long period of time. That leads me to this point: There are

those who believe that once a support level is violated, you should go with

that breakdown momentum and sell short. That may work occasionally, but it

needs to be defined in more detail, with a list of special rules and certain

criteria in order for that to be an automatic trading rule for me to initiate a

trade. I believe that you should look for buy signals at support and for sell

signals at or near resistance, especially when there is a confluence of pivot

point price targets. It is more fruitful in buying the projected support, as

this example shows.

In Figure

5.17, we see a trigger to go long after the high close doji trigger is made at

112% (notice that the low was also formed by a hammer).

As the

market goes into trend mode and rallies nearly a full basis point higher, the

signal to liquidate occurs once we see prices change conditions. As the candles

indicate, prices are closing below each period’s open; a lower closing low from

a doji top occurs and the moving averages cross; and, finally, the market price

closes below both moving averages. That triggers the exit at 113%. This was a

28-point (each thirty-second is 31.25 per point) gain for $875.00 profit per

position on a day trade.

The Candlestick and Pivot Point Trading Triggers : Chapter 5. Pivot Points : Tag: Candlestick Pattern Trading, Forex, Pivot Point : Time and Price, different time periods, Pivot calculations, pivot point analysis - The Importance of Confluence