French CAC 40 Index

Equity market, Best Trading Strategy

Course: [ Harmonic Elliott Wave : Chapter 7: A Case Study in EURUSD ]

Elliott Wave | Forex | Fibonacci |

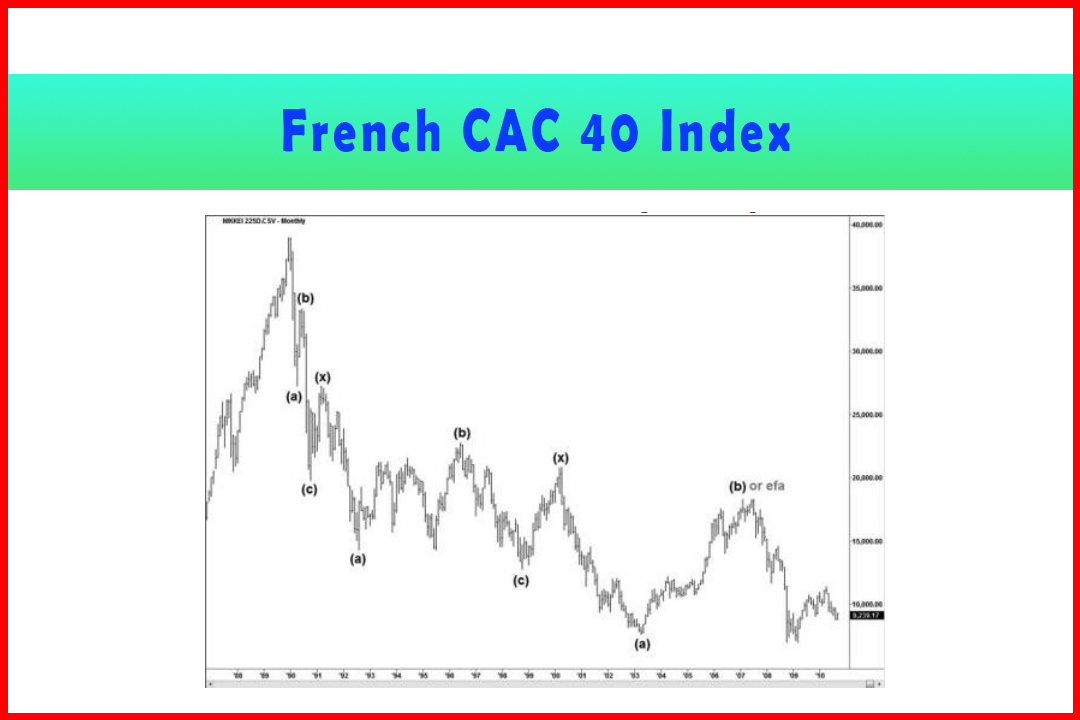

I'd like to add two more examples of equity markets, starting with the French CAC 40 Index, just to provide more than a single equity market. However, there is still the final forecast for this which may or may not occur, but by the time this book is published the result will be known.

French CAC 40 Index

I'd like to add two more examples of

equity markets, starting with the French CAC 40 Index, just to provide more

than a single equity market. However, there is still the final forecast for

this which may or may not occur, but by the time this book is published the

result will be known. I will highlight the key break areas that would render my

forecast as incorrect.

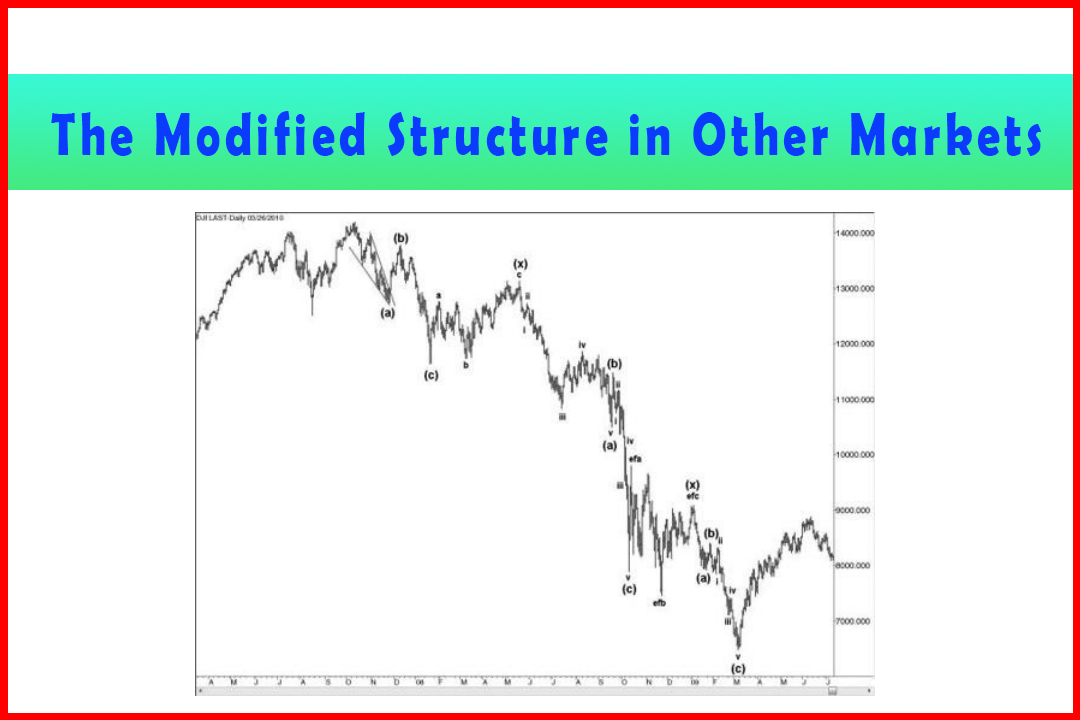

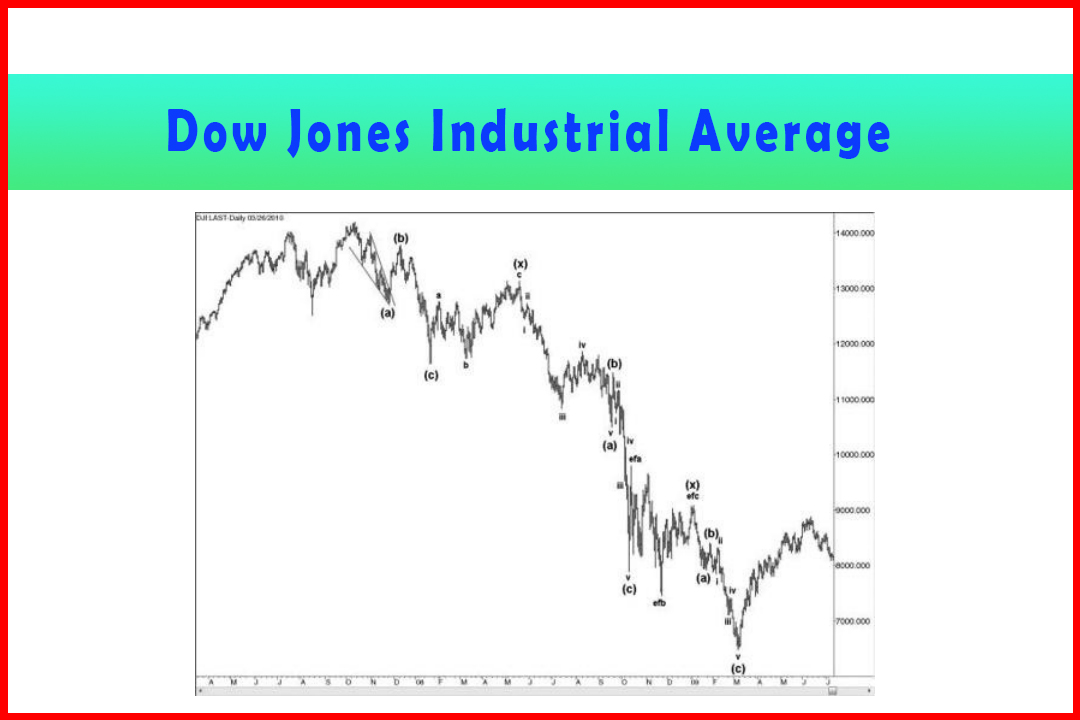

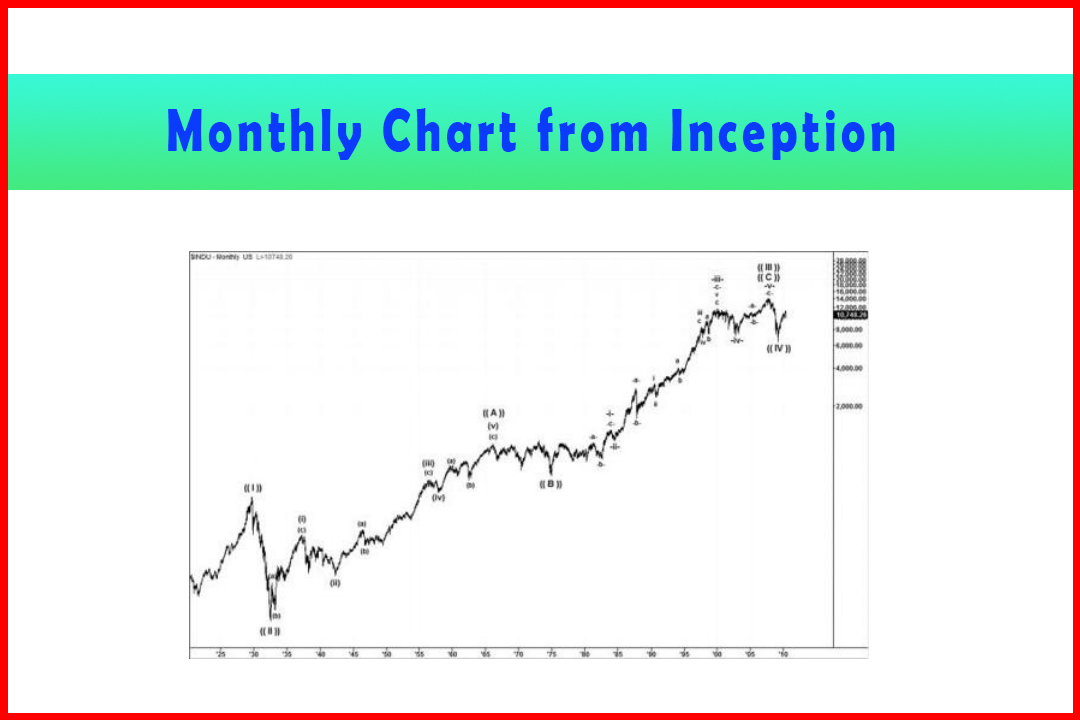

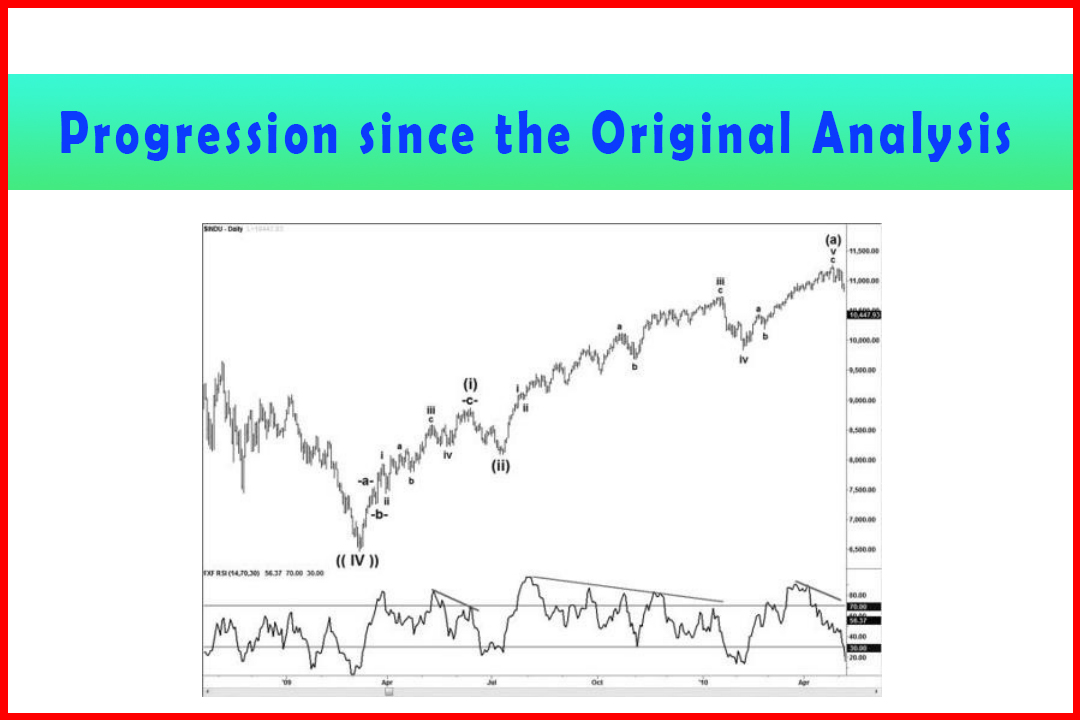

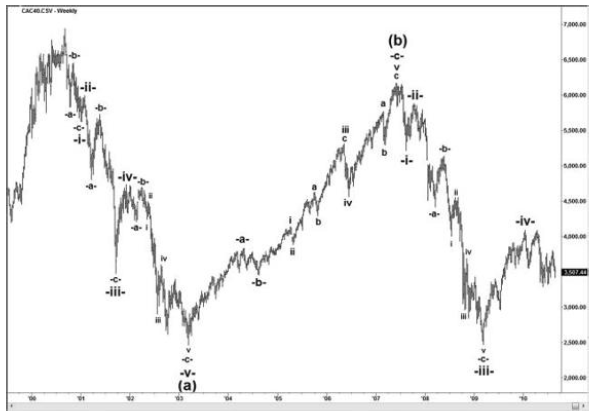

In Figure 7.13 the French CAC 40 Index is

displaying what appears to be a weekly Zigzag lower from the September 2000

high at 6,944.77.

Figure 7.13 An Incomplete (a)(b)(c) Decline in CAC 40 Index

At this point I find it hard to conceive any

other wave count, with the decline to Wave -iii-in Wave (c) having stalled just

64.00 above Wave (a) and the pullback in Wave -iv-being just a little less than

50% of Wave -iii-. Still, this outlook needs to be confirmed and only time will

tell. The following tables provide the wave relationships in the three legs.

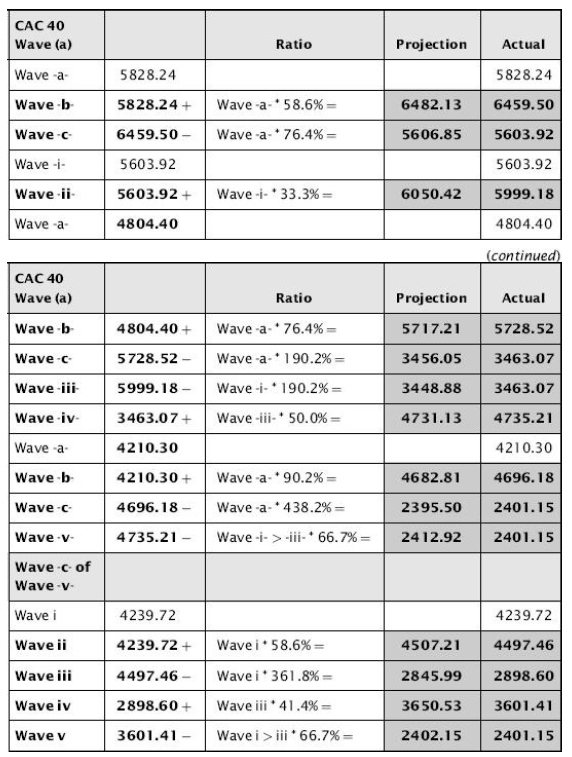

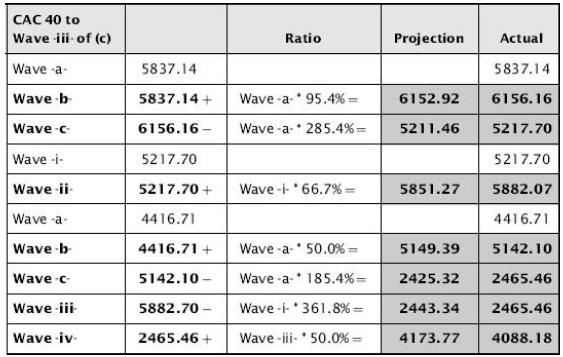

As shown in Table 7.13, there are some quite

accurate relationships in the Wave (a) decline and some not quite so accurate,

but overall the general correlation of target levels, in particular the final

2,401.15 low, is quite convincing. Where perhaps there are more mild deviations

from normal ratios is in the corrective waves, but that is not an uncommon

observation. The correction in Wave -ii-of Wave (a) generated a difference of

50.0 between the 33.3% retracement and final stalling point, but still only

represented less than a 1% deviation. In Wave -c-of Wave -v-there were also two

other instances of a 50.0 difference between the final result and closest

normal retracement/projection. However, overall I feel this does represent a

solid reflection of the harmonic structure.

Table 7.13 Decline in Wave (a) in the CAC 40 Index

As shown in Table 7.14, the Wave (b) correction

was very deep, just short of an 85.6% retracement. Again, I can't say

the relationships developed with the level of consistency I prefer to see, but

without any doubt this was a correction and should therefore be labeled as a

Wave (b).

Table 7.14 Correction in Wave (b) in the CAC 40 Index

The decline in Wave (c) has been constructive,

and I feel the weight of evidence does still point to a new low that should be

in place by the time this book is published.

As shown in Table 7.15. again while the wave

relationships aren't particularly spot-on, the projection in what I

feel is Wave -iii-and pullback in Wave -iv-appear quite convincing. I feel

there is still a small risk of a slightly deeper retracement in Wave -iv-since

the full 50% retracement was not met, but the balance of the rough 66.7%

retracement in Wave -ii-and the mild shortfall in the 50% retracement in Wave

-iv-do tend to complement each other in terms of alternation.

Table 7.15 Decline in Wave (c) in the CAC 40 Index

Should the current Wave -iv-high at 4,088.18

remain intact, as I feel it may, then a 66.7% projection in Wave -v-will target

the 1,618.49 area. Equally, a wave equality target implies a target at

1,624.53, which is obviously very close.

If this outlook is incorrect then a break above

the 50% retracement in Wave - iv-at 4,173.77 and the 58.6% retracement at

4,467.59 would imply a deeper recovery that would require an adjustment to the

entire structure.

Harmonic Elliott Wave : Chapter 7: A Case Study in EURUSD : Tag: Elliott Wave, Forex, Fibonacci : Equity market, Best Trading Strategy - French CAC 40 Index

Elliott Wave | Forex | Fibonacci |