Japanese Nikkei 225 Index

Equity market, Best Trading Strategy

Course: [ Harmonic Elliott Wave : Chapter 7: A Case Study in EURUSD ]

Elliott Wave | Forex | Fibonacci |

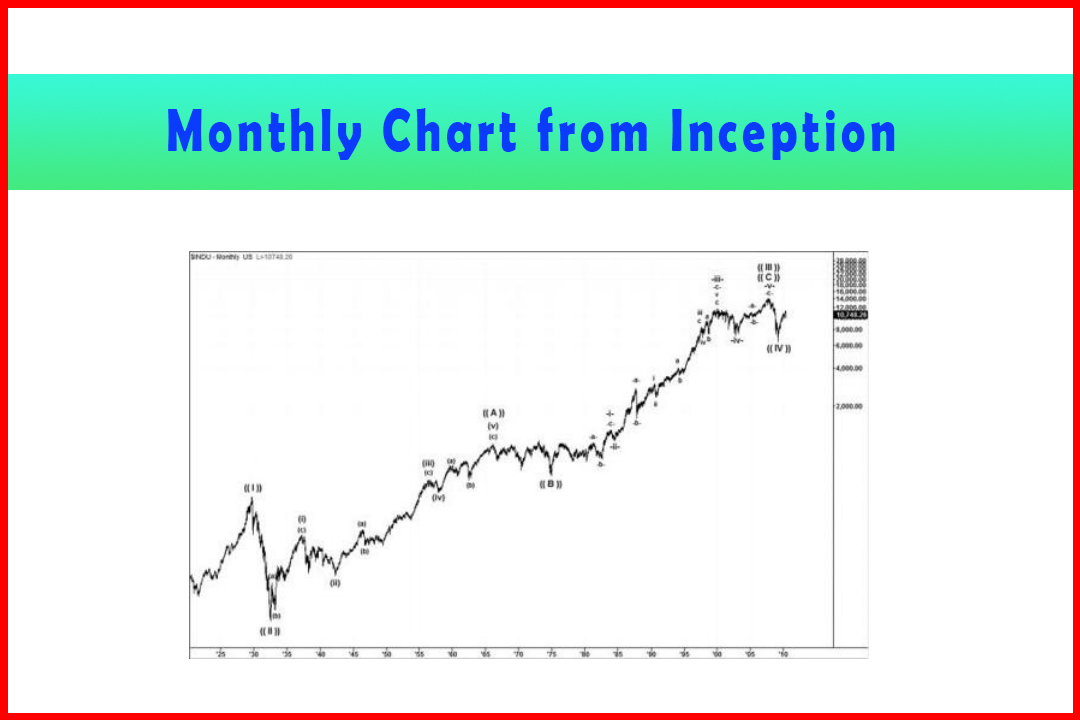

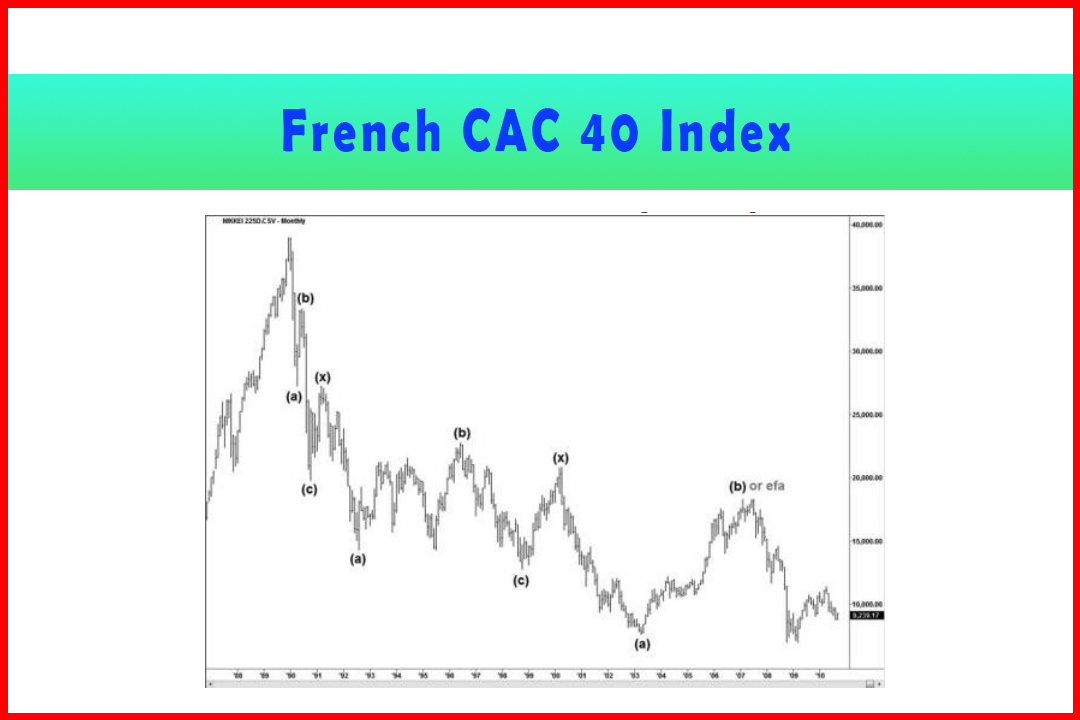

Another equity index which I thought would make for an interesting analysis is the Japanese Nikkei 225, which made its high in December 1989 and has seen a general decline from there which thus far has lasted over 20 years.

Japanese Nikkei 225 Index

Another equity index which I thought would make

for an interesting analysis is the Japanese Nikkei 225, which made its high in

December 1989 and has seen a general decline from there which thus far has

lasted over 20 years. I think we can say without too much argument that this

was a strategic high and probably also the end of a five-wave rally. Therefore

I'd like to present what looks to me to be the structure of the

decline from then.

I shall cover the initial basic moves first and

then break down the movement seen during the past 10 years in more detail to

highlight the harmonic structure.

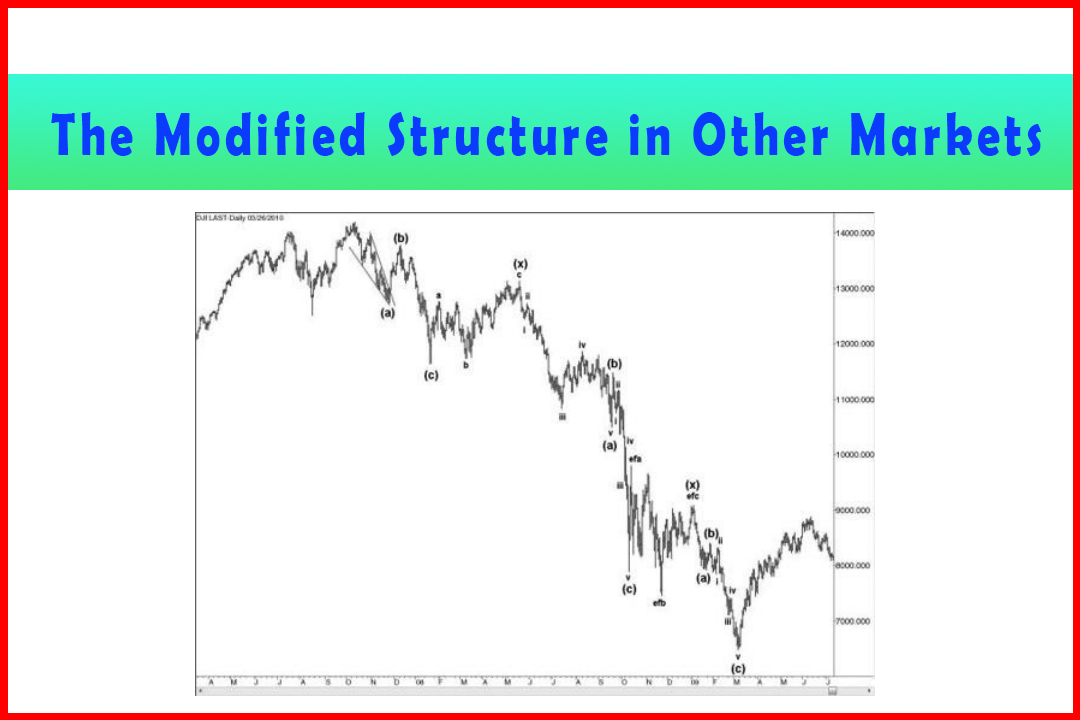

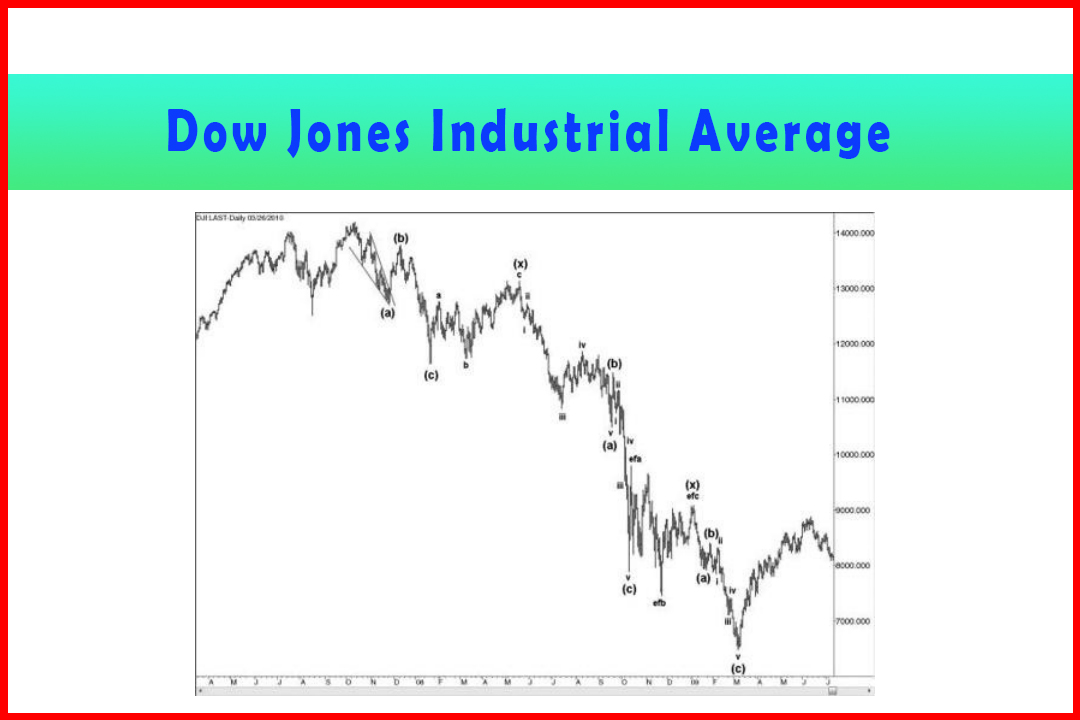

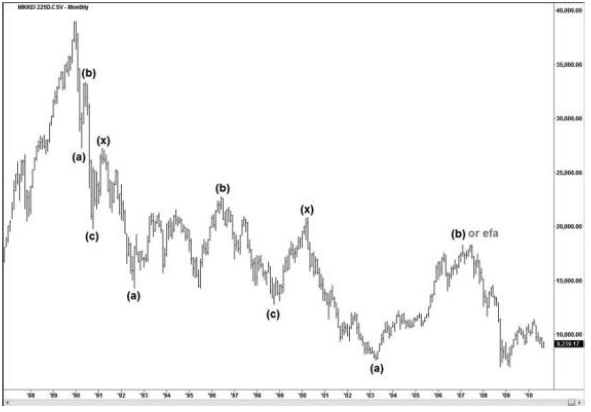

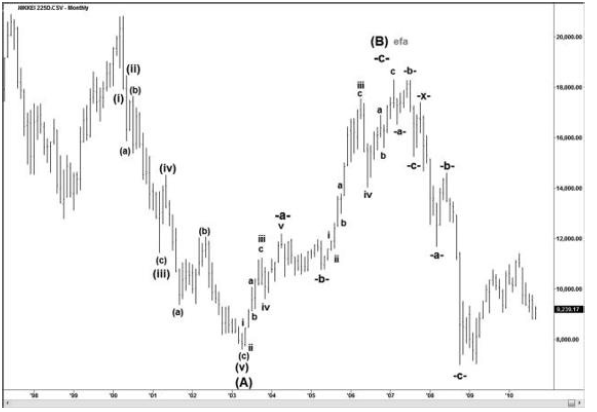

Figure 7.14 displays the monthly chart of the

Nikkei 225 Index, from which it can be seen that the structure appears to be a

Triple Three. The first two (a)(b)(c) declines are complete, while the third is

either on its final Wave (c) or alternatively the Wave (b) may be developing as

a complex correction. The first two (a)(b)(c) declines are recorded in the

following tables.

Figure 7.14 Decline in the Japanese Nikkei Index since the 1989 High

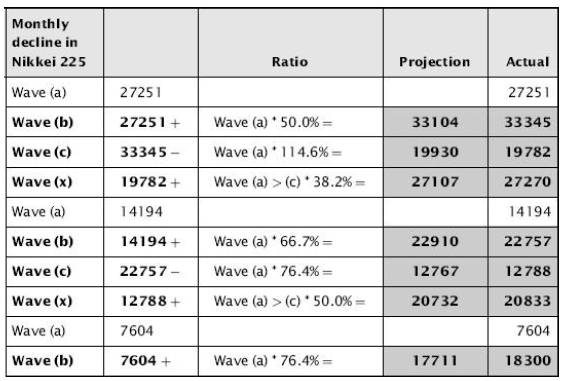

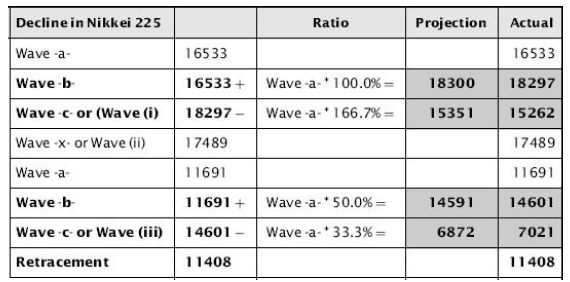

Table 7.16 displays an accuracy that sees a

variance from standard retracement and projection ratios of around 1% or less.

I therefore feel there is a strong argument for this wave count to probably

represent the correct structure.

Table 7.16 Decline in Nikkei 225

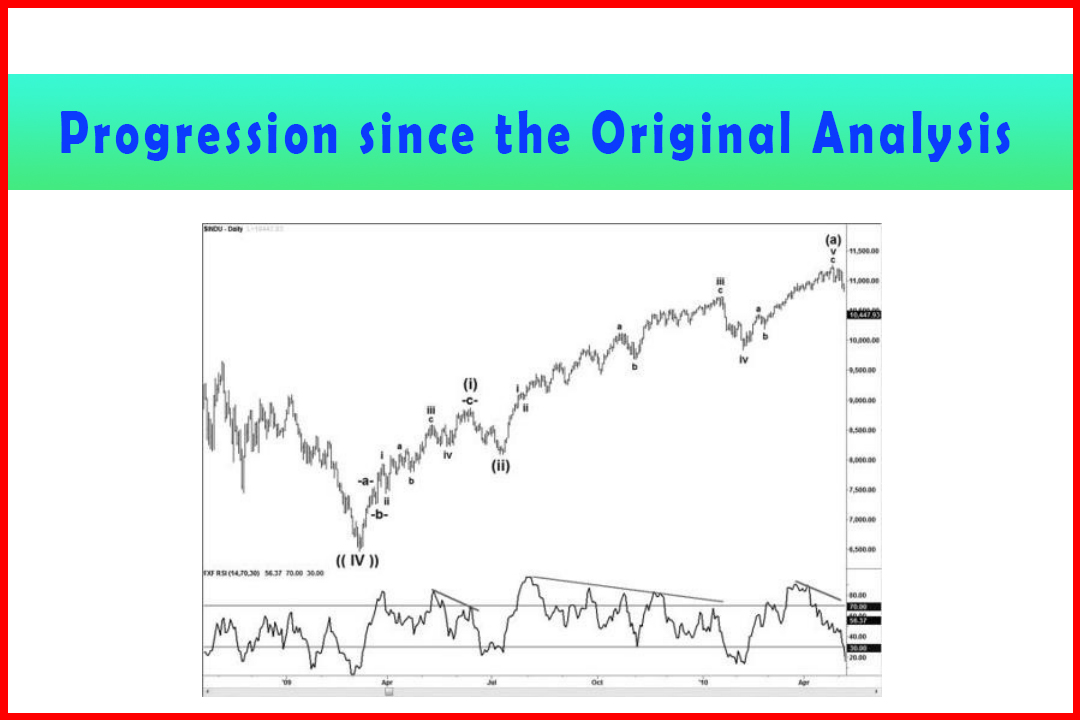

Since the third Wave (a) has already developed,

followed by a correction higher, the question of whether we are in a final

decline in Wave (c) that would generate a reversal higher, or whether this will

develop as a complex Wave (b), is very critical. I have therefore provided

these waves in more detail.

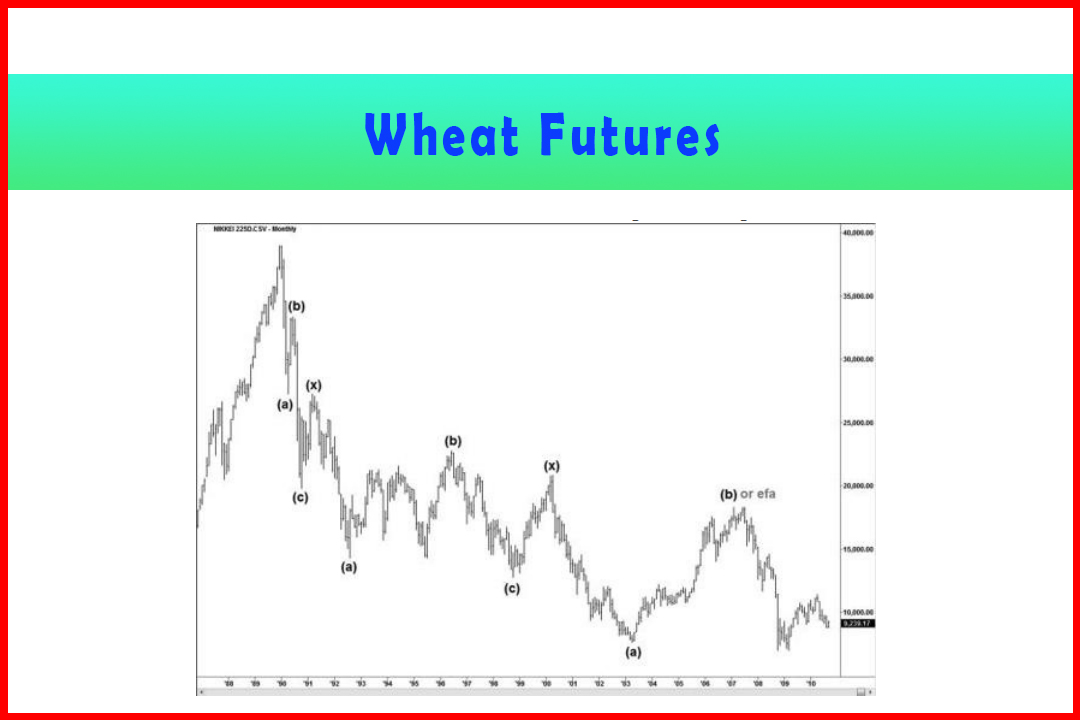

Figure 7.15 shows the five-wave harmonic decline

in Wave (A) followed by the three-wave correction. This may have completed Wave

(B) or possibly be the first wave of a complex correction. Given that the low

from the Wave (B) peak has moved below Wave (A) it may be possible to

alternatively label the Wave (B) high as Wave efa. This would imply that the

current decline is Wave efb.

Figure 7.15 Wave (A) Decline and Correction in Wave (B) or Wave efa

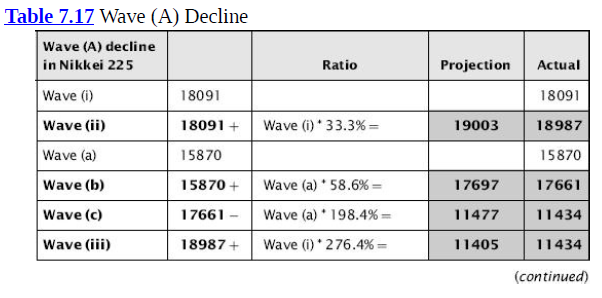

As can be seen from Table 7.17, the Wave (A)

decline developed with all retracement and projection ratios being common

harmonic relationships and the variance from those being extremely limited.

From that point of view, I am confident this was a valid Wave (A).

Table 7.17 Wave (A) Decline

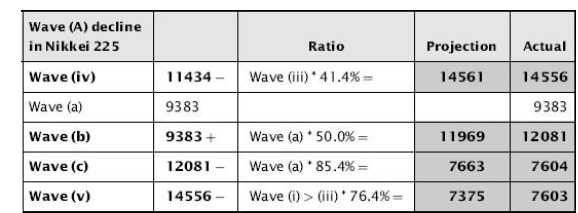

The correction in Wave (B) developed in three waves; Table 7.18 provides the wave relationships.

Table 7.18 Wave (B) Relationships

Again the majority of wave relationships are

common harmonic ratios. There are one or two more unusual ratios—for example,

the Wave iii in Wave -a-at 441.4% is not one I would normally expect to see—but

the 95.4% projection in Wave c of Wave iii is very common. In general the

levels of variance between the ideal harmonic ratios and actual stalling points

were limited.

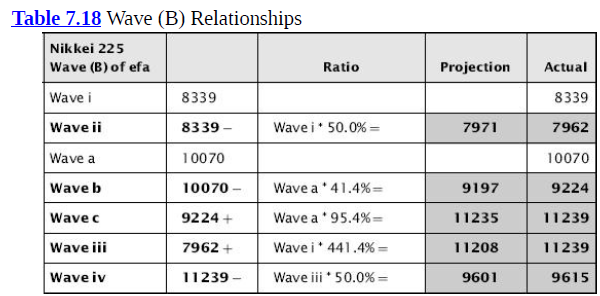

Therefore, we have had a Wave (A) lower followed

by a deep correction in three waves that consequently raises the potential for

the Wave (B) to develop in a complex manner. To try to decide whether the

decline from there will be the final Wave (C) or whether it will be an Expanded

Flat, I have detailed the wave relationships in the decline so far (Table

7.19).

Table 7.19 Wave Relationships in the Decline So Far

It can be seen this time that to judge whether

this decline is corrective or impulsive I have added the alternative count next

to the preferred count shown in Figure 7.15. If the Wave -c-low at 7,021.00 was

actually Wave (iii), it would have implied a projection of 344.4% and the

correction from there which reached 11,408 would suggest a Wave (iv)

retracement of 41.4%. I can't say 344.4% is a projection ratio I would

expect, but there were one or two unusual projections so possibly retaining an

open mind may well be preferable.

If this turns into an Expanded Flat then ratios

we may look for would be:

14.6%

6,041

23.6%

5,078

38.2%

3,517

If an assumption is made that the correction at

11,408 was a Wave (iv) then projections in Wave (v) could be estimated at:

61.8%

4,437

66.7%

3,884

76.4%

2,790

Furthermore, the common projections in Wave (C)

can also be generated:

105.6%

4,330

109.2%

3,854

123.6%

1,949

I would suggest that if this turns out to be an

Expanded Flat then the 14.6% or 23.6% expansions at 5,078-6,041 are the most

likely. However, what is striking are the 61.8% projection in alternate Wave

(v) at 4,437 that matches closely with the 105.6% projection in Wave (C) and

the 66.7% projection in Wave (v) at 3,884 that matches closely with the 109.2%

projection in Wave (C). I am open to either alternative.

Harmonic Elliott Wave : Chapter 7: A Case Study in EURUSD : Tag: Elliott Wave, Forex, Fibonacci : Equity market, Best Trading Strategy - Japanese Nikkei 225 Index

Elliott Wave | Forex | Fibonacci |