Resistance Become Support

Moving Average Crossover, SBR, RBS, Candlestick signals, Resistance level, Investor sentiment

Course: [ How To make High Profit In Candlestick Patterns : Chapter 2. Moving Averages ]

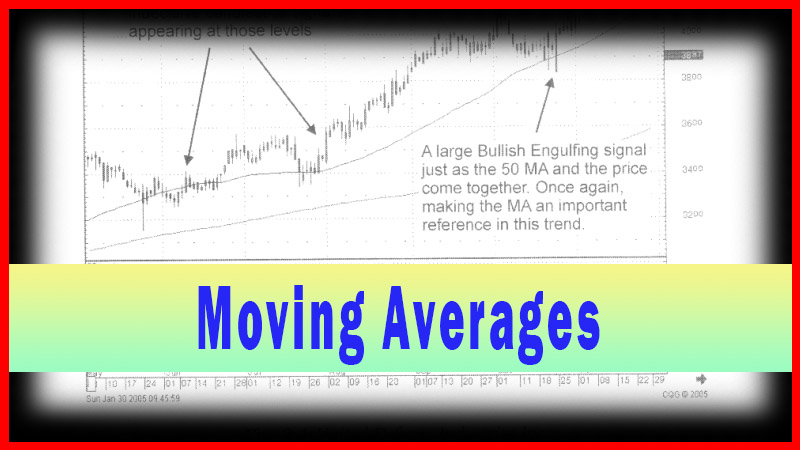

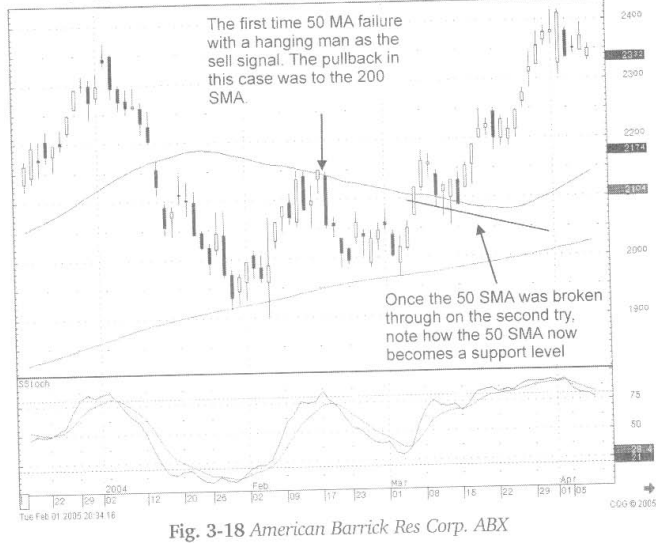

Moving averages that have shown to be resistance previously and are breached will now become support in a new uptrend. This basic rule works very well with the moving averages. The candlestick signals help with a visualization of that phenomenon.

Resistance then Support

Moving

averages that have shown to be resistance previously and are breached will now

become support in a new uptrend. This basic rule works very well with the

moving averages. The candlestick signals help with a visualization of that

phenomenon. The analysis of what is happening at a moving average becomes a

function of which signals are occurring at those levels. This makes trading in

the moving average area very simple to analyze visually.

Another

common technical analysis rule is that the first time a resistance level is

touched, it will usually fail. The only subjective word in that rule is

“usually”. If this first attempt failure is a general rule, then being able to

visually see what is happening at that resistance level produces a better

insight. A candlestick signal that shows weakness at the point where crossing a

moving average is first attempted creates a much different analysis than if the

candlestick formation is a strong bullish candle that blasts through the

moving average. Although this may seem simplistic, the signals reveal what the

investor sentiment is at those levels. Improving the probability factor of this

pattern can be easily applied by knowing the signals that occur at that level.

The

probabilities are greatly enhanced when an investor can anticipate where

candlestick signals should occur. For the aggressive trader, selling all or

part of a position when a price encounter one of the major moving averages,

anticipating that a candlestick signal could occur, creates a highly profitable

low-risk trading program. Highly profitable in the sense that an investor is

buying or selling right at a major support or resistance level. If the trade

works as expected from that level, an optimal entry price was probably

obtained. For the option trader, buying on an extended move down that just

barely touches the lower major moving average allows options to be bought at a

low price and probably with a minimal amount of option premium built into the

price. The risk of this aggressive approach is that the downward trend does not

stop at that support level. However, the point of the trade was that a

downtrend stretching to that support level had the probabilities of acting as

a support. If the price does not hold at that level, then the trade would be

closed immediately, limiting the loss.

On

the other hand, whether buying the stock or the option, it may have been bought

at the most optimal price before the reversal signal appeared. Again, in the

case of an option trade, this aggressive approach would have a double benefit.

The price of the option will be low and the premium will have diminished. As

the price starts to move back up, the premium will expand as confidence builds

back up.

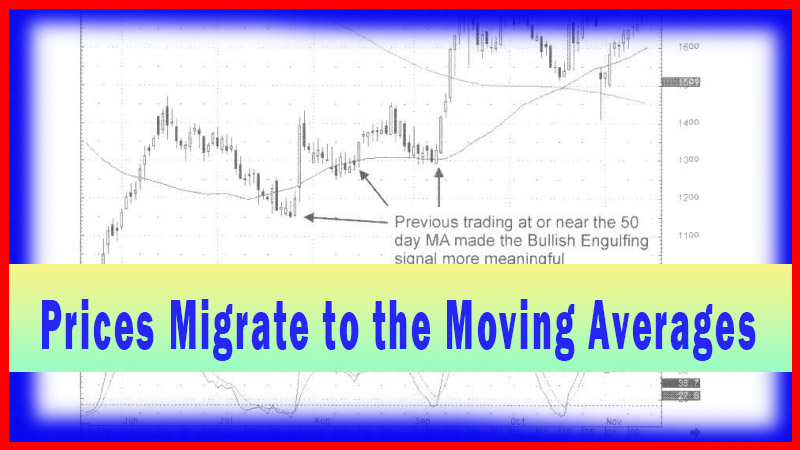

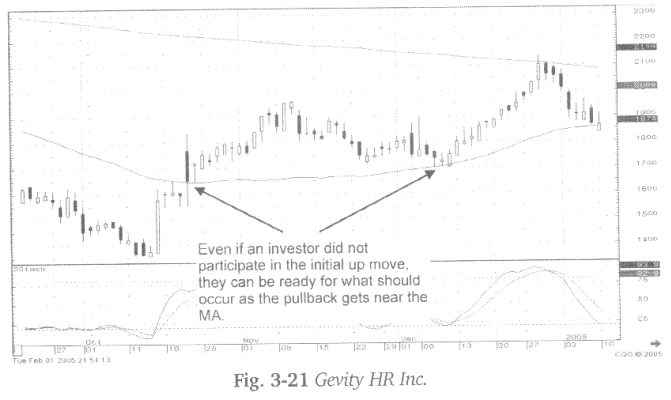

If

moving averages are used as support and resistance levels, they will be quickly

confirmed upon viewing a candlestick buy signal at support or a candlestick

sell signal at resistance. The possibility of a moving average becoming a

target becomes enhanced when analyzing candle formations as price approaches a

target. For example, viewing candlestick bodies getting bigger, creating large

black candles after a downtrend has been in existence for a good while, or

seeing a gap down in price when the stochastics are in the oversold area would

be good indicators that a trend is getting near the bottom. If this is all

occurring when a moving average is within striking distance, then entering at a

price right at that moving average becomes a better-calculated entry point.

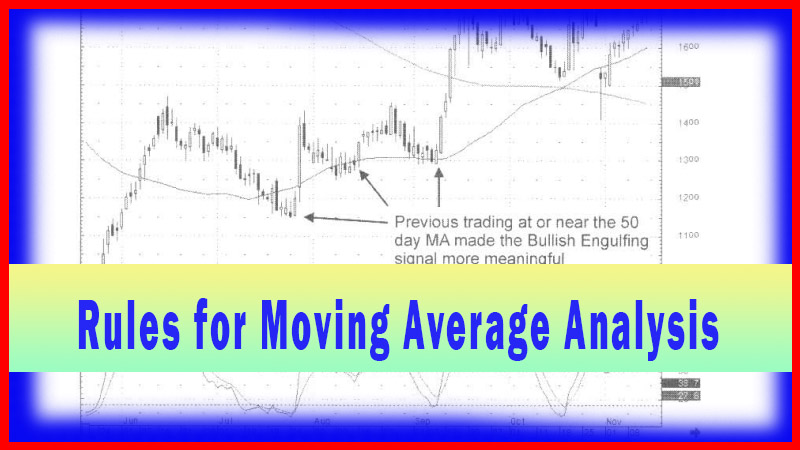

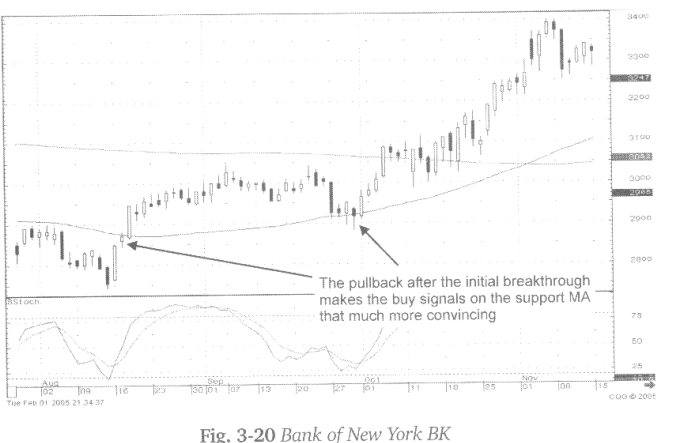

Whether

this analysis is done after an extended downtrend or after a pullback after a

recent breakthrough of a moving average in uptrend, it provides a logical

target for a when a trade should be entered. The more conservative approach is

to wait and see if a candlestick “buy” signal is formed after the moving

average has been touched and the time-frame has ended. Although the latter

approach is more conservative, the candlestick signal analysis will usually

put an investor into a trade well before the conventional technical analyst

feels the support level has been confirmed.

The

combination of visually being able to identify the candlestick signals and

understanding which moving averages produces high probability support and

resistance levels provides a powerful trading format. Through simple scan

techniques, an increased number of highly profitable trade potentials can be found

on a constant basis.

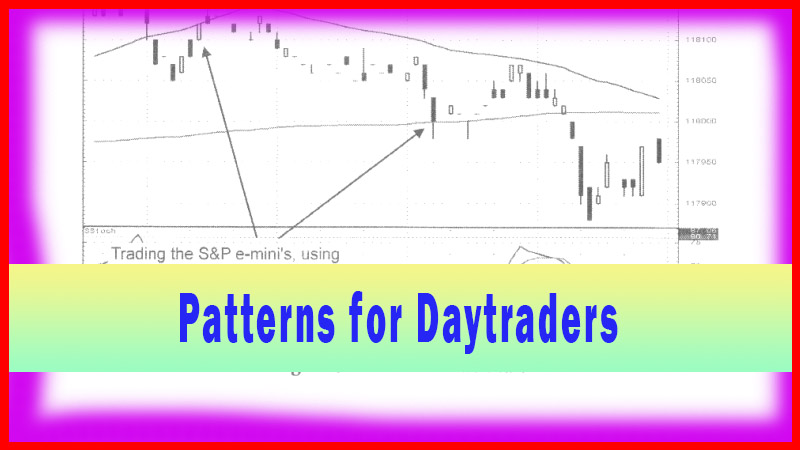

Fig.

3-19, The Apartment Investment & Management Co. chart reveals a strong buy

signal after the gap up from the Bullish Harami in the beginning of the second

week of July. As illustrated, the gap up bullish candle after the Harami

demonstrated that there was no resistance at the 50-day moving average as seen

one week prior. At that time, the Shooting Star signal just touched the moving

average for the first time. The gap up from the Harami was a very strong

bullish signal. The up-move remains strong until the first week of August when

the Hanging Man signal was followed by a Doji/Harami. The gap- down the

following day was confirmation that the uptrend was over. A pullback should be

occurring.

What

would be the target for the pullback? Obviously, the moving averages! In this

case, when both the 50-day and the 200-day moving average are close together,

either one or both could have been the support level. The Bullish Harami

confirmed this support and prices gapped up the next day.

How To make High Profit In Candlestick Patterns : Chapter 2. Moving Averages : Tag: Candlestick Pattern Trading, Forex : Moving Average Crossover, SBR, RBS, Candlestick signals, Resistance level, Investor sentiment - Resistance Become Support