How Becomes a Support Level

resistance level, support level, moving average, 200-day moving average, Doji signal

Course: [ How To make High Profit In Candlestick Patterns : Chapter 2. Moving Averages ]

n technical analysis, there are some simple basic rules. One is that when a resistance level has been breached during an uptrend; it will now act as support upon any pullbacks.

When a Resistance Level is Breached, It Becomes a Support Level

In

technical analysis, there are some simple basic rules. One is that when a

resistance level has been breached during an uptrend; it will now act as support

upon any pullbacks. Armed with that little tidbit of knowledge, analyzing price

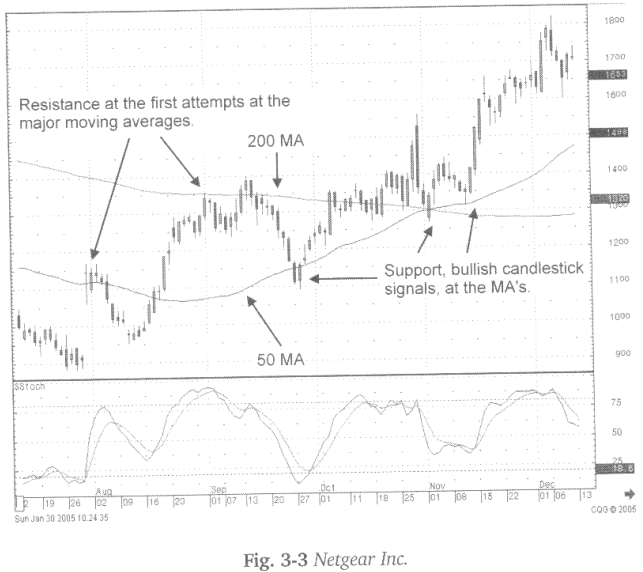

movements becomes a little clearer. Fig. 3-3, The NetGear, Inc. chart

illustrates the support concept as well as a few other simple rules when using

moving averages.

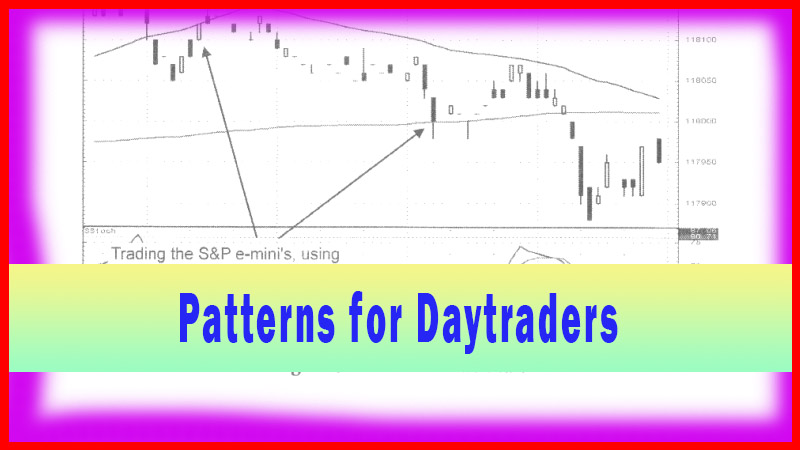

Another

rule can be applied a majority of the time. When a price tests an important

technical level the first time, it will usually fail. However; if it comes back

up to test that level again, it will often go through. Notice in the NetGear

Inc. chart the last day of July showed a gap up. It formed a Doji just above

the 50-day moving average. The uptrend had a hard time continuing the first

time it tested the 50-day moving average. As can be seen with the pullback into

mid- August. It was then followed by a second test of the 50-day moving

average. The advantage of the candlestick signals is that they reveal what the

investor sentiment is doing right at those important levels. The second test of

the 50- day moving average occurred when the strong bullish candle went

through. That revealed the moving average was not going to be a resistance

point. If the 50-day moving average is no longer a resistance point, what

becomes the next target? The 200-day moving average!

Notice

how the 200-day moving average was first tested on September 1. The failure at

that level was indicated by a Doji/Harami showing the buying had stopped. This

occurring, with the stochastics in the overbought area starting to turn back

down, becomes a clear indication the sentiment failed to take prices up through

the 200-day moving average. That would be an excellent time to take profits.

The next push went through but failed just above the 200- day moving average

with the appearance of a Bearish Engulfing signal.

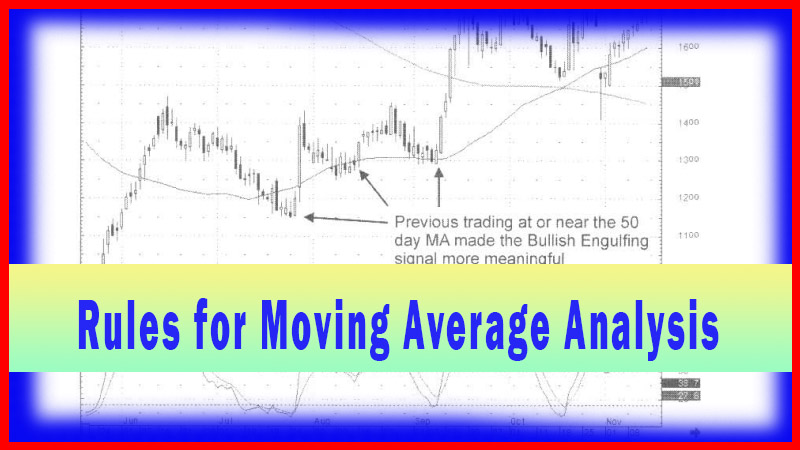

When

a moving average fails, what is the next target? The other major moving

average! The 50-day moving average now becomes a likely target. This either

provides a good short situation or allows an investor to take profits and wait

to see what signals will form once the 50-day moving average is touched. As

illustrated in this case, when prices got back to the 50-day moving average, a

Bullish Harami formed as the stochastics reach the oversold area and started to

curl back up. Now what becomes the next target? The 200-day moving average

again.

The

congestion area from that point remains fairly close to the 200-day moving

average. The Piercing Pattern occurring when the 50-day MA crossed the 200-day

MA produces important information. As can be seen, that signal, occurring at

the intersection of the two major moving averages, was a significant factor in

the next strong move upwards. After the initial buying, note how the pullback,

with the Doji signal just touching the 50-day moving average, was followed by a

Bullish Engulfing pattern that started the strong buying. The analysis of this

chart provides a format for when to be looking for significant candlestick

signals.

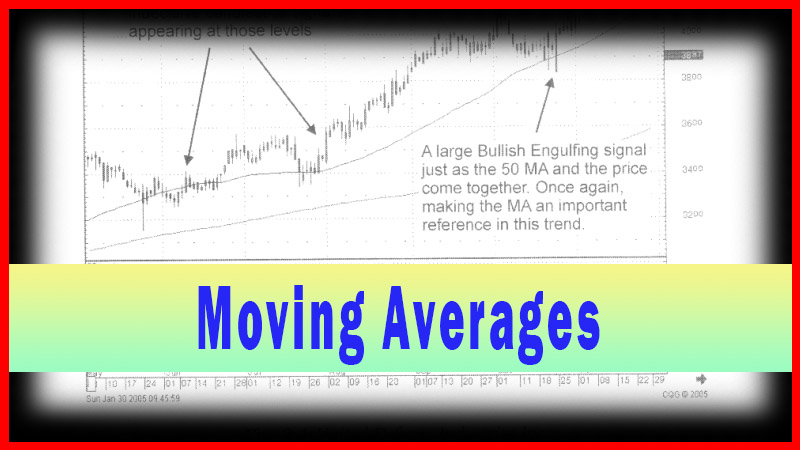

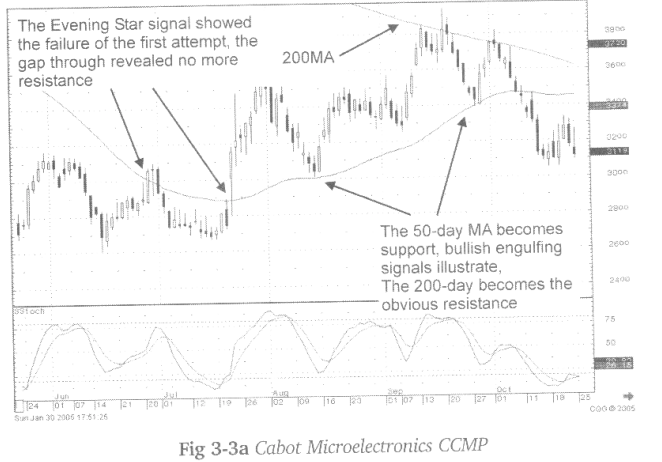

Fig.

3-3a, Cabot Microelectronics Corp. also reveals a failure of the 50-day moving

average on July 1, only to come back up through the 50-day moving average with

force in the latter part of July. After the initial run up, coming up through

the 50-day moving average it pulled back. Notice how it supported exactly on

the moving average line before the Bullish Engulfing signal revealed that

buying was not going to take the price any lower.

Where

did the first major resistance come into play? At the 200-day moving average in

mid-September! When it fails the 200-day moving average, where is the potential

pullback target? The 50-day moving average! The Bullish Engulfing signal at

that level indicates the next target is the 200-day moving average again. Once

there, the evening star signal reveals another failure of the 200- day moving

average.

Notice

there is a definite candlestick signal right at the major averages. Once again,

it does not take too long to realize that the moving averages are important

targets. It was also easy to evaluate what was happening at those targets with

the identification of candlestick signals.

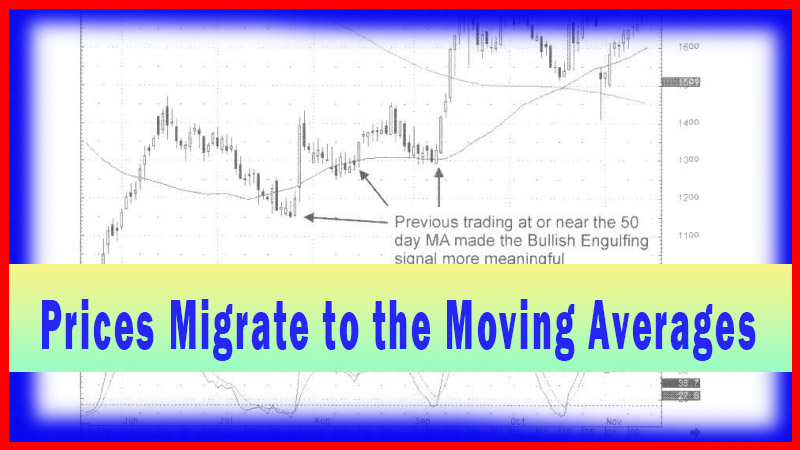

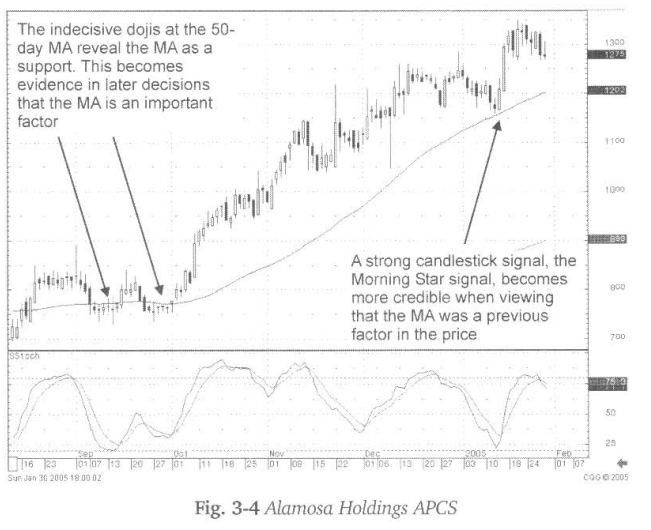

Fig.

3-4, the Alamosa Holding Inc. chart also reveals the importance of a major

moving average acting as a substantial indicator affecting prices. September

revealed two time-periods of great indecision. The series of Doji and Hammer

formations were signals that investor sentiment was not able to push the price

away from the moving average.

The

gap up at the 50-day moving average becomes a signal that strong buying is

coming into the trend, as discussed in the chapter on GAPS. As seen in the

early part of January, the moving average once again acts as a support level,

as indicated by the Doji followed by the Bullish Engulfing signal. Price moves

occurring at these major moving averages is not happenstance. Many technical

traders watch for these indicators. They are waiting to see what happens at

these levels. The advantage provided to the candlestick investor is being able

to visually witness what is happening at these levels immediately. Other technical

investors may require a few trading days of confirmation before they commit

funds.

How To make High Profit In Candlestick Patterns : Chapter 2. Moving Averages : Tag: Candlestick Pattern Trading, Forex : resistance level, support level, moving average, 200-day moving average, Doji signal - How Becomes a Support Level