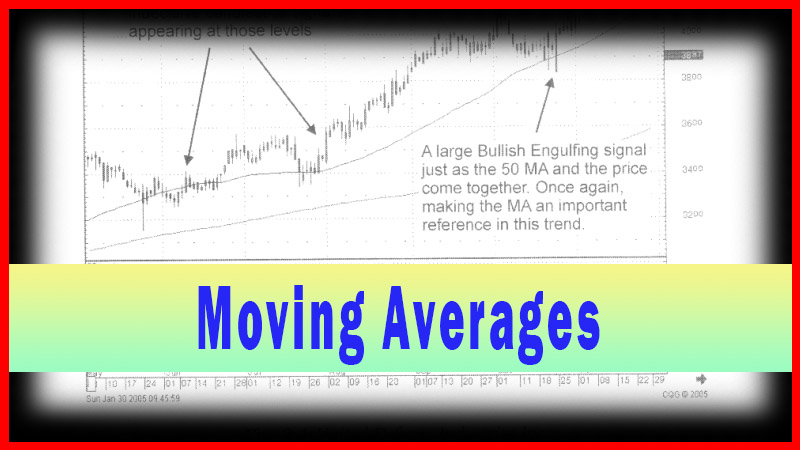

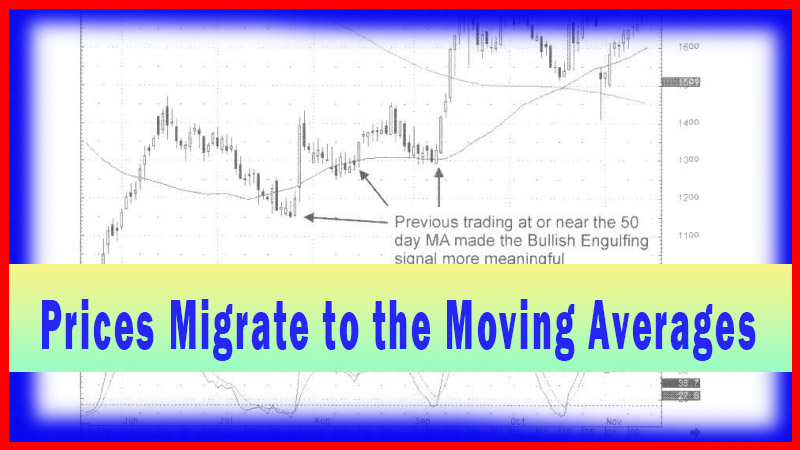

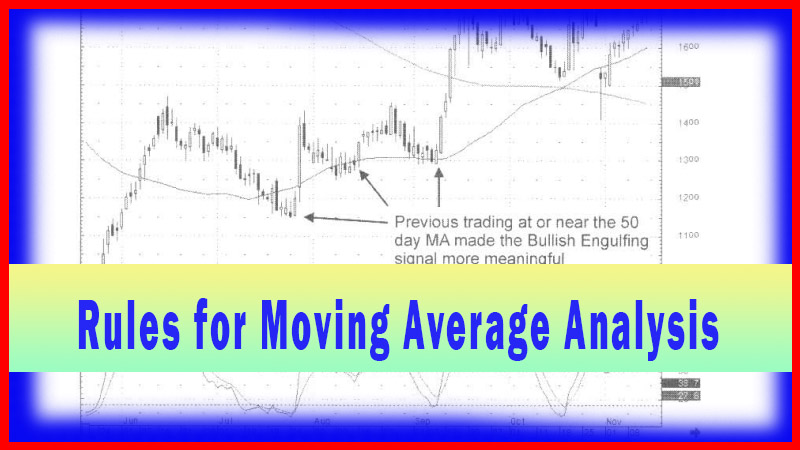

Moving Average Patterns

pattern day trading rule, Moving Average Best Pattern, Moving Average Signal

Course: [ How To make High Profit In Candlestick Patterns : Chapter 2. Moving Averages ]

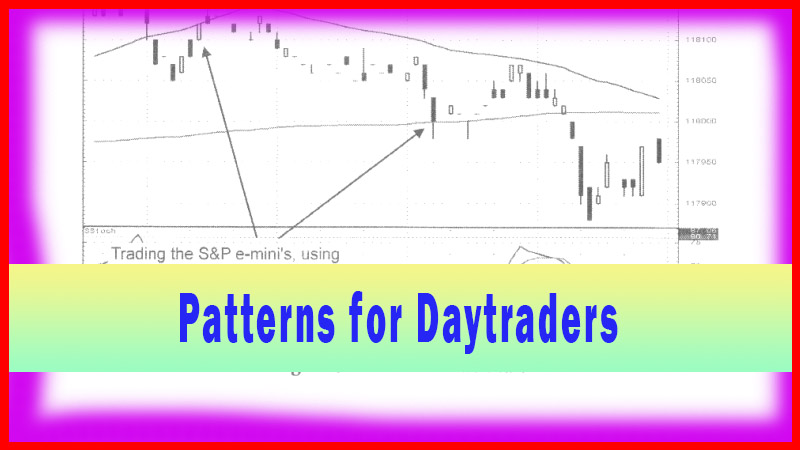

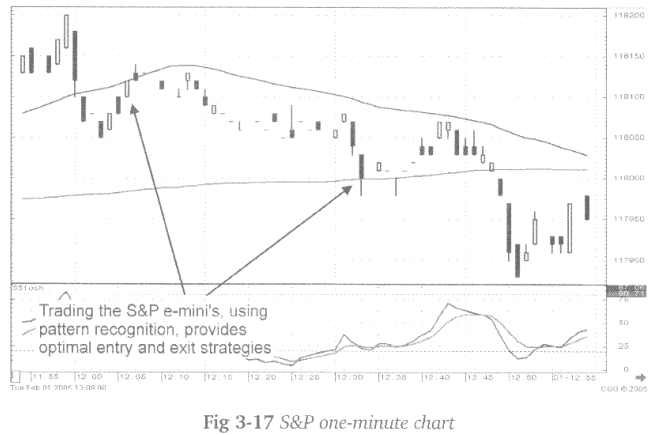

The ability to recognize high probability chart patterns is highly productive for the daytrader. Trading the index futures, which requires much greater accuracy for entering and exiting trades, is better formulated when knowing if a high probability pattern is forming.

Patterns for Daytraders

The

ability to recognize high probability chart patterns is highly productive for the

daytrader. Trading the index futures, which requires much greater accuracy for

entering and exiting trades, is better formulated when knowing if a high

probability pattern is forming. Successful intraday trading can be accomplished

with a few simple analytical steps. Being able to analyze the trend of the

general market provides a bias to the trading, analyzing market direction

should dictate a heavier bias for the long side or the short side during any

given day. That analysis may be formulated when analyzing the daily charts,

then extrapolating that information into the intraday chart analysis.

Simple

logic dictates that the analysis for the market in general is in a downtrend,

then the one-minute, five-minute, and fifteen- minute chart analysis should be

viewed with more emphasis on the moving averages acting as resistance. As

illustrated in the S&P one-minute chart, if a downtrend is the predominant

bias for the day, the candlestick investor’s eyes should be oriented toward

failures at specific moving averages. This is not high-tech analysis. This is

using commonsense and then applying the candlestick signals, along with

stochastics and moving averages, to enhance your entry and exit decisions.

How To make High Profit In Candlestick Patterns : Chapter 2. Moving Averages : Tag: Candlestick Pattern Trading, Forex : pattern day trading rule, Moving Average Best Pattern, Moving Average Signal - Moving Average Patterns