Moving Averages - Basics

Technical indicators, simple moving average (SMA), exponential moving average (EMA), weighted moving aver¬age (WMA),

Course: [ How To make High Profit In Candlestick Patterns : Chapter 2. Moving Averages ]

Moving averages provide important information regarding the direction of a market. They were created to provide directional information, smoothing out the zigs and zags of a trend.

Moving Averages Techniques

“Emotions are your worst enemy in the stock market.”

Moving

averages provide important information regarding the direction of a market.

They were created to provide directional information, smoothing out the zigs

and zags of a trend. Their use has become much more predominant with the

advance of computer software. The automatic calculations for MAs (moving

averages) have greatly simplified their applications. They can now be

calculated and utilized up to the very second/minute in a trading chart. Their

applications, along with candlestick signals, provide a very strong profitable

trading format. As with all other technical indicators, MAs have a relevance

when correlated to price movement. How the moving averages are utilized can

make a big difference between moderate returns and highly profitable returns.

Trading

techniques, using moving averages, provide improved entry and exit strategies.

The most common use is when the relevant moving averages cross. The feasibility

of using MAs “crossing” apparently has some relevance or it would not be widely

known as one of their useful aspects. However, the benefits of moving averages

become greatly diminished if “crossings” are the only application used. The

accuracy of the crossing analysis is moderately successful. However, there are

many technical evaluations that are moderately successful. Applying Candlestick

analysis in relation to the MAs provides a higher function.

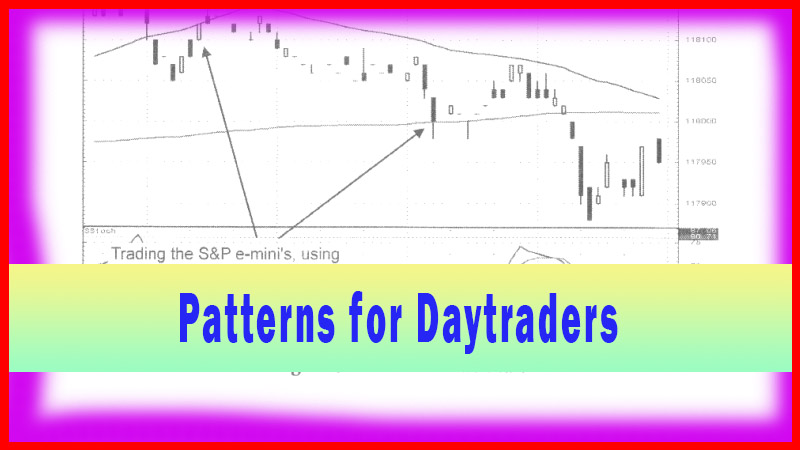

Candlestick

signals, along with the moving averages, create a trading program that

produces highly profitable trades. Using the important moving averages as

support and resistance areas, in conjunction with candlestick analysis,

advances the probabilities of participating in a correct trade. Trades are produced

with a much greater frequency. The point of investing is to find additional

processes for using technical indicators that provide a very high ratio of

successful trades. Fortunately, the use of moving averages is very simple. Once

applied to candlestick charts, it makes the trend analysis, of probable support

or resistance, a very simple, visual process.

The

question always arises whether to use the simple moving average (SMA),

the exponential moving average

(EMA), or the weighted moving average (WMA).

The simple moving average is the easiest to calculate; therefore, the reason it

was well used before the presence of computers. The exponential moving average

has become more popular in recent years due to the quicker calculation’s

computer software provides. It incorporates the latest data in its

calculations, allows the older data to fade out, making the current data more

pertinent. Weighted moving averages put more importance on current data versus

older data. Simple moving averages work very well, providing the information

required to successfully trading candlestick signals. Money managers, as well

as a majority of technical investors, use the simple moving average.

The

moving averages provide a simple visual indicator that shows the direction of a

trend’s slope. When the moving averages are rising, it indicates an uptrend.

When the moving averages are falling, it indicates a downtrend. If the moving

averages are trading sideways, it reveals a sideways market.

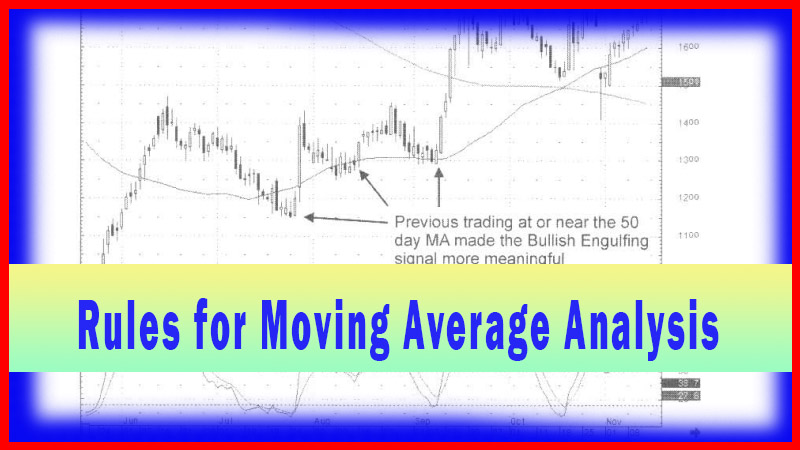

Traders

that use the moving average method for indicating trends follow some very basic

rules.

1.

If the

SMA is trending up, trade the market on the long side. Buy when prices pullback

to, or slightly below, the moving average. After a long position is

established, use the recent low as your stop.

2.

If the

SMA is trending down, trade the market to the short side. Short (sell) when

prices rally to or slightly above, the SMA. Once a short position is

established use the recent high as your stop.

3.

When the

SMA is trading flat or oscillating sideways, it illustrates a sideways market.

Most traders, utilizing the moving average to determine trends, will not trade

in this market.

Simply

stated, traders that use the SMA as a trend go long (buy) when prices are

trending above the moving average. They will go short (sell) when prices are

trending below the moving average. The candlestick trader has an immense

advantage of being able to see what the candlestick signals are telling them at

these important moving average levels.

There

are numerous timeframes that appear to have relevance when using the moving

averages. The 3, 5, 10, 15, 20, 30, 50, 80, 100, 200, 400, 500, 1000 moving

averages are all used. Through extensive studies, theforex7, it has been

revealed that the 50-day moving average and the 200-day moving average are the

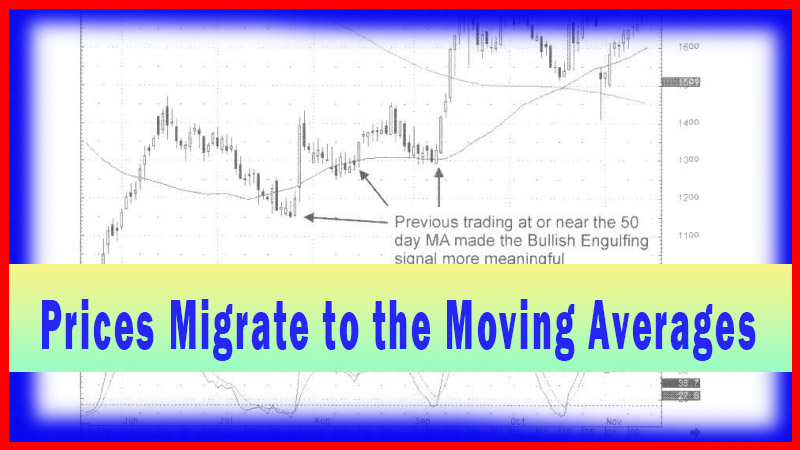

most important moving averages. There seems to be a great tendency for prices

to support or resist at those averages. Therefore, the 50-day and 200-day

moving averages are considered major moving averages. The 20-day and the 80-day

moving average are also important but should be considered secondary moving averages.

Are there other moving averages that work effectively? Probably, but the major

and secondary MAs discussed here seem to have a statistical relevance.

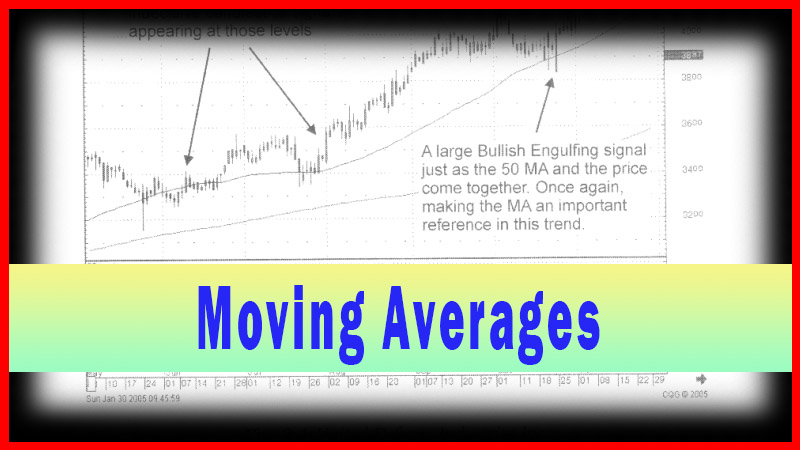

Technical

indicators provide important information. An indicator gains importance because

of the reoccurring significance of major investment considerations happening

at those points. This explanation is put forth so that each investor can become

convinced, in their own minds, that moving averages, especially the ones being

recommended in this chapter, have some relevance. The major moving averages act

like magnets. They attract the price from one moving average to the next moving

average.

Through

the following chart evaluations and one’s own chart studying, the relevance of

these moving averages should become apparent. This does not an investor from

constantly being aware that other moving averages may start gaining importance

in the eyes of other technical investors. The point of using these moving

averages, along with candlestick signals, is that historically many investors

are watching to see what price movements do at these levels. The advantage of

the candlestick signals is that the signals tell you exactly what investors are

doing at those levels.

How To make High Profit In Candlestick Patterns : Chapter 2. Moving Averages : Tag: Candlestick Pattern Trading, Forex : Technical indicators, simple moving average (SMA), exponential moving average (EMA), weighted moving aver¬age (WMA), - Moving Averages - Basics