Moving Averages as Resistance

candlestick signals, Moving average signal, Support And resistance, Bullish signal, Ema, Sma

Course: [ How To make High Profit In Candlestick Patterns : Chapter 2. Moving Averages ]

The same characteristics that are found in an up-trending stock are also found in stocks that are in a downtrend. For example e, a price that breaks down through a major moving average could eventually bounce back up to test that moving average.

Moving Averages as Resistance

The

same characteristics that are found in an up-trending stock are also found in

stocks that are in a downtrend. For example e, a price that breaks down through

a major moving average could eventually bounce back up to test that moving

average. If it fails, then the trend will be taken lower. The continued

downtrend will usually breach the recent low. If the other major moving average

is below the failed moving average, it now becomes the potential target.

Understanding these basic movements in prices, it does not take more than a few

seconds to analyze whether a price will be affected by the moving averages.

A

downtrend in price can be easily monitored when a major moving average is

recognized as being a resistance level. Adding another analytical element,

when analyzing a trend, increases the probabilities of being in a high

probability trade. Logic dictates that if a price does not seem to be able to

push through an observed resistance level, the more often that occurs, the

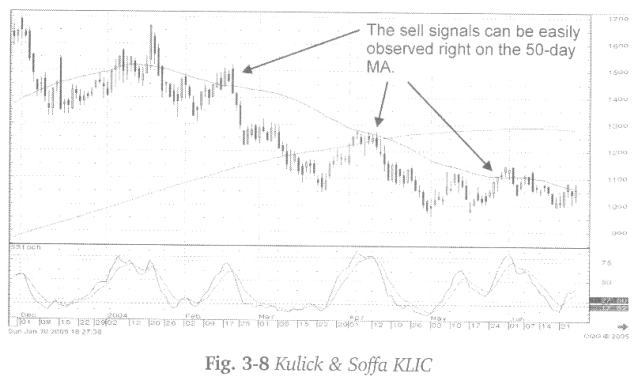

higher the probability that it will continue its downtrend. As can be observed

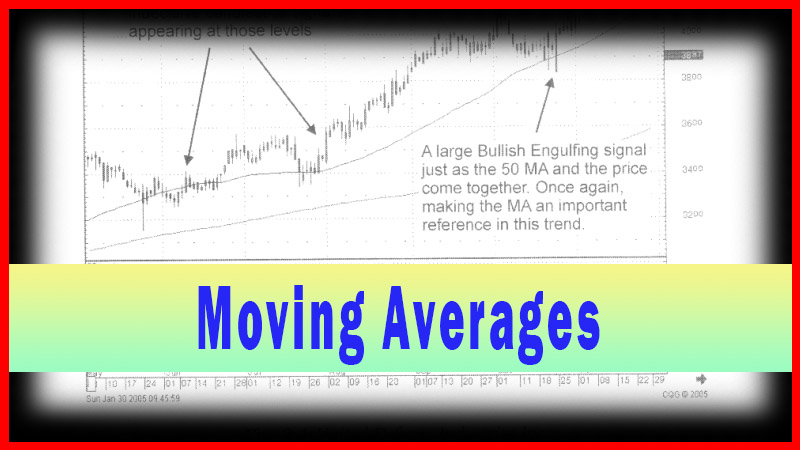

in Fig. 3-8 (opposite), the KLIC chart, from the peak in price in January, of

2004, every time the price climbed up towards the 50-day moving average, sell

signals would appear.

This

observation should not have taken too much analysis. If the stock was bought

when candlestick signals and stochastics dictated, there should be the

preconceived awareness that the uptrend has a high probability of running into

resistance near the 50-day moving average. Being prepared for that occurrence

makes viewing the candlestick sell signals, at those levels, that much more

credible.

Knowing

moving averages are important technical levels for many investors, it becomes

important to understand what is happening at those levels. The candlestick

signals provide that information. If a moving average acts as support, there

should be the anticipation of a candlestick buy signal formation. Conversely,

if the candlestick formations do not reveal any buying strength at those

levels, it becomes apparent that the important support level was not having an

effect on the downtrend. This is just simple logic. Nothing more than analyzing

what is happening at supposedly important technical levels.

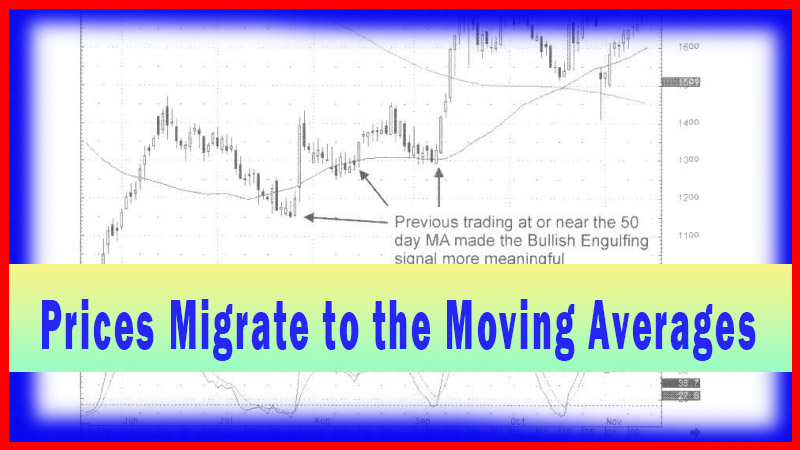

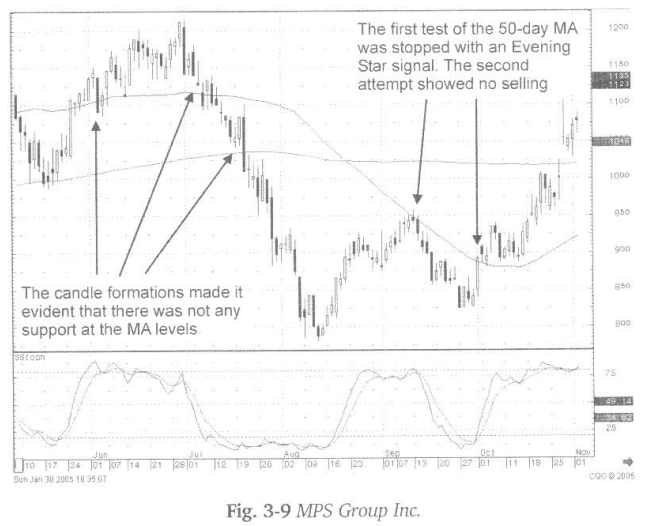

Illustrated

in Fig. 3-9, the MPS Group Inc. chart in late May, spinning tops formed on the

200-day moving average, confirmed with a bullish candle and stochastics.

The

uptrend did not stop at the 50-day moving average. A large bullish candle at

the 50-day moving average indicated this to be a support level until prices

topped out on the first of July. What was the first logical support area? Of

course, the 50-day moving average.

However,

as can be seen, there were no confirmed buy signals at the 50- day moving

average in early July. That should have given the indication the next support

level would be the 200-day moving average. The large dark candle that came down

through the 200-day moving average, in mid-July revealed that the 200-day

moving average was not going to act as a support level either.

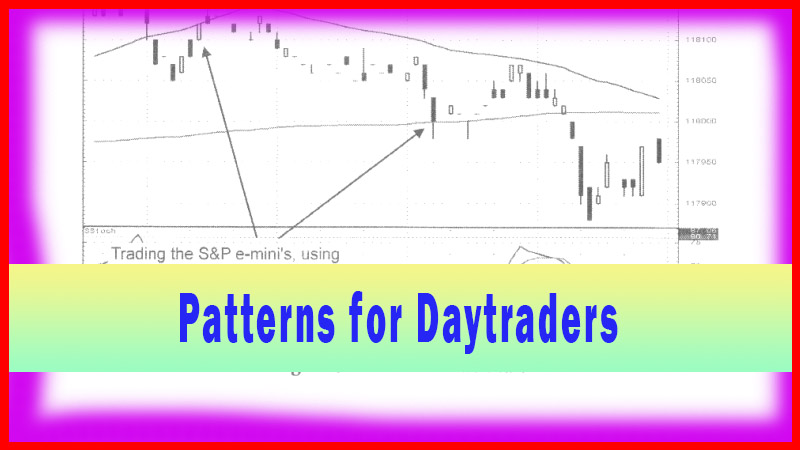

The

failure of the 200-day moving average did not show any confirmed buy signals

until the bullish Harami down in the $8.00 range. If the investor had been

short during this downtrend or an investor was waiting to go long at important

support levels, it became obvious that those support levels were not going to

act as support. Simply stated, if a technical level has the potential of acting

as support, it is logical a candlestick buy signal will confirm that. The lack

of a candlestick buy signal will demonstrate that it is not.

How To make High Profit In Candlestick Patterns : Chapter 2. Moving Averages : Tag: Candlestick Pattern Trading, Forex : candlestick signals, Moving average signal, Support And resistance, Bullish signal, Ema, Sma - Moving Averages as Resistance