Moving Averages as Support

Price trend, Candlestick reversal signal, Candlestick analysis, Support and resistance

Course: [ How To make High Profit In Candlestick Patterns : Chapter 2. Moving Averages ]

Utilizing the 50-day moving average and the 200-day moving average as important support/resistance areas, a target can be established. Being able to evaluate the potential target makes analysis preparation easier. It prepares the investor to anticipate candlestick formations.

Moving Averages as Support

When

witnessing a downtrend, how do we tell when a bottom is getting nearby? As

described in other chapters of this book, it could be witnessing the panic

selling coming into a price trend, as the stochastics are getting toward the

oversold area. That is a helpful alert but does not give us a roadmap to where

panic selling might end. Utilizing the 50-day moving average and the 200-day

moving average as important support/resistance areas, a target can be established.

Being able to evaluate the potential target makes analysis preparation easier.

It prepares the investor to anticipate candlestick formations. For example, if

a sustained downtrend is now showing large dark candles and is approaching one

of the major moving averages, it is evidently indicating the panic bottom may

be near. Panic selling with stochastics approaching the oversold area, at or

near a major moving average, has a probability of a candlestick reversal

signal. This pattern alerts the trader to prepare for a candlestick “buy”

signal.

Do

all charts work well with moving averages? Definitely not! However, a large

majority appear to. The purpose of candlestick analysis is to provide an

advantage for the investor to see what is happening at important technical

levels. The candlestick signals provide that clarity. If a chart is not

providing clear patterns for indicating price movement, then move onto another

chart. There are many from which to choose, especially with the availability of

easy- to-use computer scanning programs.

Combining

technical methods with candlestick signals puts the probabilities in favor of

the investor. How do you discover whether the major moving averages are a

positive correlation when anticipating price moves? Easy! Investigate what has

happened at those moving averages previously in the price trend. This can be

done very quickly. Expand the chart. Take a quick visual analysis of what

happened in the past.

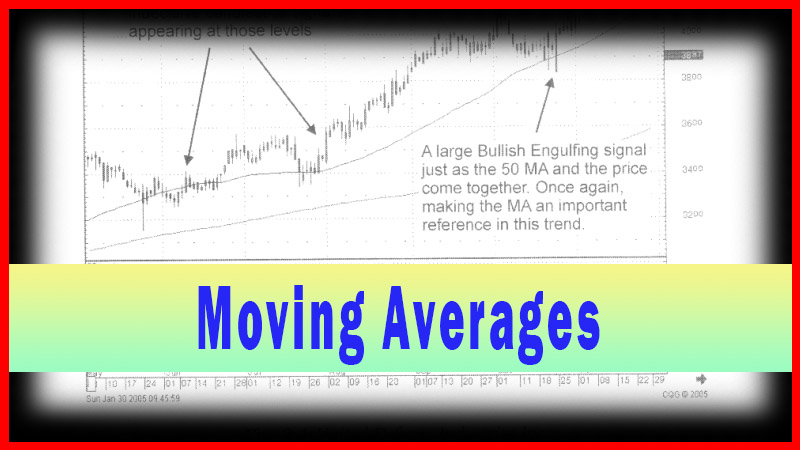

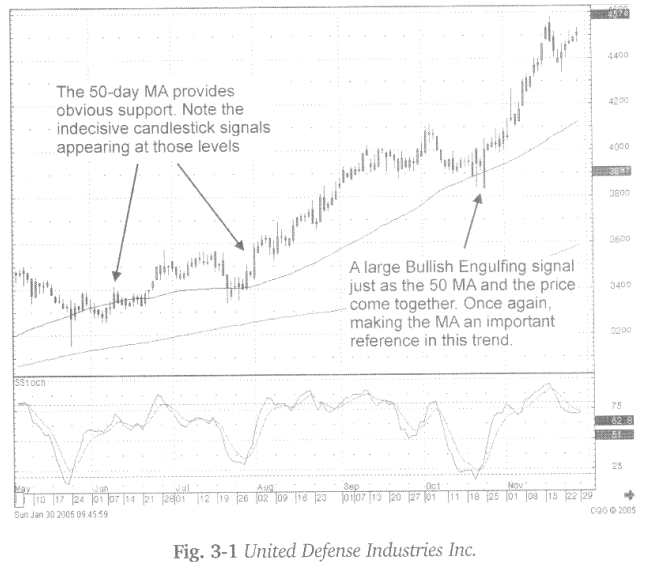

Fig.

3-1, The United Defense Industries Inc. chart illustrates an example of using

past trading patterns to anticipate what might happen. As seen in the chart

illustration, the 50-day moving average seems to have importance during May and

June.

In

addition, the pullback in late July stopped right on the 50-day moving average

with a Meeting Line signal (a secondary candlestick signal), a couple of Doji,

then a Bullish Engulfing Signal that came up off the 50-day moving average.

That started the next strong run up. As it consolidated through September and

October, the 50-day moving average came up to meet the price. Stochastics are

back in the oversold area when a very strong bullish engulfing signal forms

again right on the 50-day moving average.

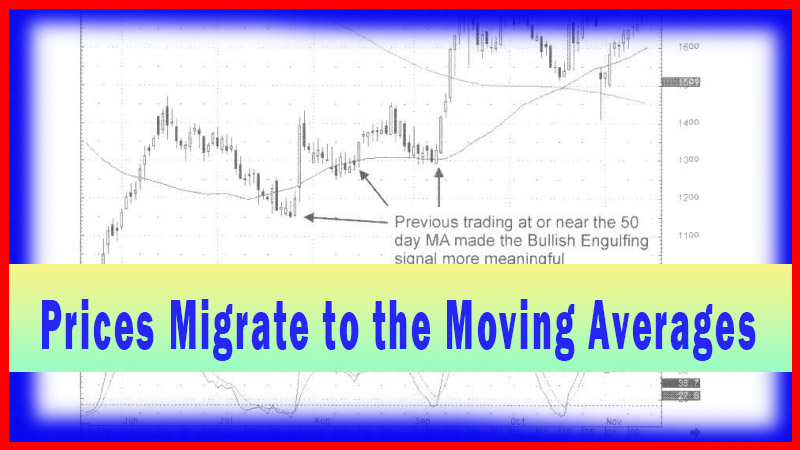

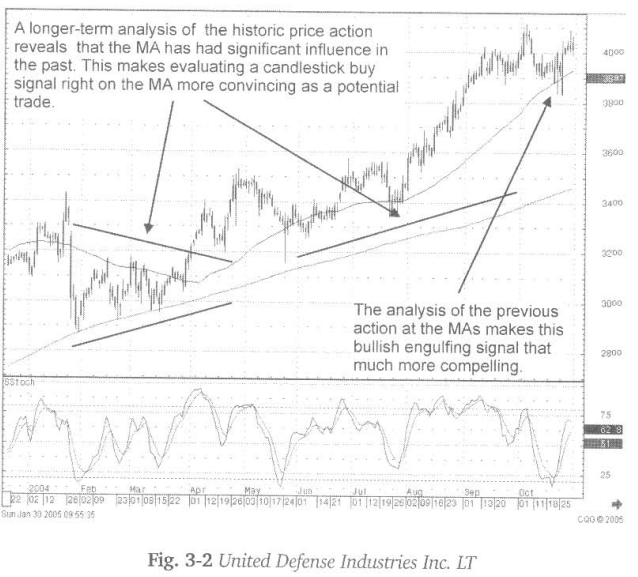

To

further analyze whether the moving averages are important in this stock price

move, the charts can be taken back further. It can be clearly seen that back in

February and March, the 50-day moving average acted as resistance while the

200-day moving average acted as support. Once the price broke out of the

pennant formation from that timeframe, it moved out away from the 50- day

moving average before coming back and finding support on it. Bottom line, even

without all the verbal description of what happened, it only takes an instant

to visually analyze that the price of this stock is greatly influenced by the

major moving averages.

The

decision to buy, upon seeing the Bullish Engulfing pattern, is that much easier

when the signal occurs at the 50-day moving average. This analysis is putting

as many factors as possible into making a trade decision. A Bullish Engulfing

Signal occurring when the stochastics are in the oversold area, starting to

curl up, and doing so right on the 50-day moving average, make a compelling

reason to be buying on strength.

How To make High Profit In Candlestick Patterns : Chapter 2. Moving Averages : Tag: Candlestick Pattern Trading, Forex : Price trend, Candlestick reversal signal, Candlestick analysis, Support and resistance - Moving Averages as Support